Luxury Cars Market Size 2025-2029

The luxury cars market size is valued to increase USD 232 billion, at a CAGR of 6.8% from 2024 to 2029. Rising demand for luxury SUVs will drive the luxury cars market.

Major Market Trends & Insights

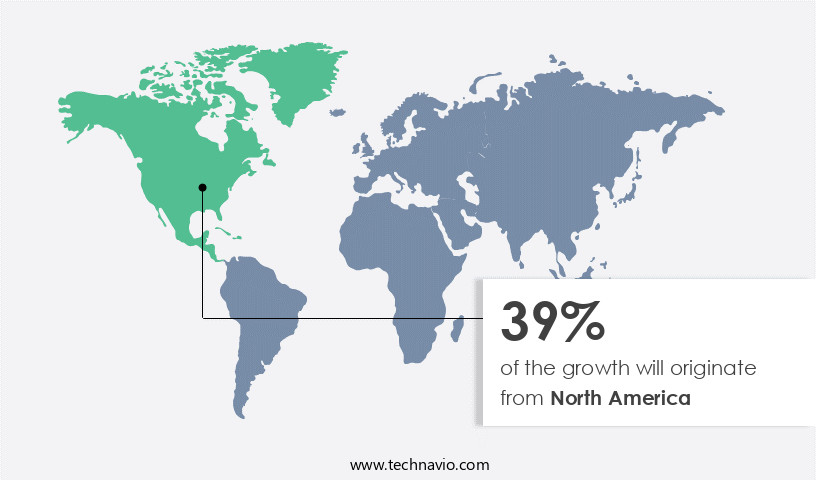

- North America dominated the market and accounted for a 39% growth during the forecast period.

- By Product - Executive luxury car segment was valued at USD 442.00 billion in 2023

- By Propulsion - IC engine-based vehicles segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 63.41 billion

- Market Future Opportunities: USD 232.00 billion

- CAGR from 2024 to 2029 : 6.8%

Market Summary

- In The market, a significant trend emerging is the increasing preference for SUVs, with sales demonstrating a steady upward trajectory. According to the latest market intelligence, the luxury SUV segment accounted for over 30% of the overall market share in 2020. This shift can be attributed to the growing demand for vehicles that offer a blend of comfort, performance, and practicality. Another notable development is the entrance of electric luxury car models, which are gaining traction due to their eco-friendly appeal and advanced technology. The market's evolution is further influenced by various factors, including increasing disposable income, changing consumer preferences, and stringent emission regulations.

- Despite these positive indicators, the market faces challenges such as rising production costs and taxes on high-end vehicles, which can impact profitability. Nevertheless, market players continue to innovate and invest in research and development to cater to evolving consumer needs and expectations. In conclusion, the market is witnessing a dynamic transformation, driven by factors such as the growing popularity of SUVs and the adoption of electric vehicles. These trends, coupled with ongoing challenges, create an intriguing landscape for market participants to navigate and thrive in.

What will be the Size of the Luxury Cars Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Luxury Cars Market Segmented ?

The luxury cars industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Executive luxury car

- Super luxury car

- Propulsion

- IC engine-based vehicles

- Electric vehicles

- Vehicle Type

- Hatchbacks

- Sedans

- Sports Utility Vehicles (SUVs)

- Multi-purpose Vehicles (MPVs)

- Others

- Hatchbacks

- Sedans

- Sports Utility Vehicles (SUVs)

- Multi-purpose Vehicles (MPVs)

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- Switzerland

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The executive luxury car segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with a focus on advanced technologies and innovative design. Three German manufacturers, Audi, BMW, and Mercedes-Benz, dominate the executive luxury car segment, accounting for four out of five global sales. These companies invest heavily in manufacturing automation systems, drivetrain engineering, and chassis engineering, utilizing lightweight materials and high-performance braking systems for improved vehicle dynamics. Powertrain electrification and electric vehicle technology are key areas of investment, with many manufacturers offering hybrid powertrains and fuel efficiency optimization. Exhaust emission control and passive safety systems are also prioritized, ensuring vehicles meet stringent regulations. Ergonomic design principles and infotainment systems integration enhance the driving experience, while automotive cybersecurity measures and vehicle connectivity technology provide added peace of mind.

Aerodynamic optimization techniques and suspension system design contribute to vehicle performance metrics optimization. Rolls-Royce, a BMW brand, represents the pinnacle of super luxury cars. The market is a dynamic and competitive landscape, with ongoing activities in tire performance characteristics, transmission technology, engine performance tuning, and predictive maintenance systems.

The Executive luxury car segment was valued at USD 442.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Luxury Cars Market Demand is Rising in North America Request Free Sample

The market in Europe is experiencing significant growth, with Daimler AG, Audi, and BMW leading the sales of top-tier models. Renowned for their exceptional craftsmanship, European luxury vehicles offer consumers refined finishes, superior build quality, and luxurious interiors. Factors such as these contribute to the market's robust expansion. Furthermore, the rising preference for crossovers with higher ride height, versatility, and cargo space is a notable trend.

This shift in consumer preferences is propelling the growth of the market in Europe, making it an intriguing and dynamic industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth, driven by the increasing demand for vehicles that offer superior performance, safety, and driver experience. One key trend shaping this market is the adoption of lightweight materials, which not only reduce vehicle weight but also enhance performance and fuel efficiency. These materials, such as carbon fiber and aluminum, are increasingly being used in the production of luxury car frames and body components. Another significant trend is the integration of advanced driver assistance systems (ADAS) and safety features. These technologies not only provide enhanced safety but also contribute to a more enjoyable driving experience.

For instance, adaptive cruise control, lane departure warnings, and automatic emergency braking are becoming increasingly common in luxury vehicles. Infotainment integration is another critical factor impacting the luxury car market. The latest vehicles offer advanced infotainment systems, allowing drivers to control various features using voice commands, touchscreens, and other intuitive interfaces. This not only enhances the driver experience but also makes the vehicle more appealing to tech-savvy consumers. High performance braking systems are another essential component of luxury cars. These systems offer shorter stopping distances, ensuring the safety and confidence of drivers during emergency situations.

Additionally, automotive cybersecurity measures are becoming increasingly important to protect sensitive data and prevent unauthorized access to vehicle systems. Ergonomic design plays a significant role in the luxury car market, with manufacturers focusing on providing comfortable interiors that cater to the unique needs of drivers and passengers. Exhaust emission control and regulatory compliance are also crucial considerations, with many manufacturers investing in fuel efficiency optimization engine designs and precision engineering manufacturing processes to meet stringent emissions standards. Vehicle dynamics control and handling performance are other critical factors influencing the luxury car market. Manufacturers are employing advanced technologies, such as adaptive suspension systems and torque vectoring, to deliver exceptional handling and driving experiences.

Powertrain electrification strategies are also gaining popularity, with many manufacturers offering hybrid and electric powertrains to reduce emissions and improve fuel efficiency. Luxury car interior design material selection and exterior styling elements are essential for creating a desirable and distinctive brand image. Manufacturers are investing in manufacturing automation systems and supply chain management to improve production efficiency and reduce manufacturing defects. Predictive maintenance systems are also being employed to minimize downtime and maintenance costs. Vehicle thermal management and aerodynamic optimization are other critical areas of focus for luxury car manufacturers. Advanced cooling systems and aerodynamic optimization techniques, such as active grilles and underbody panels, are being used to improve fuel efficiency and reduce drag coefficient.

Chassis engineering is also a critical area of focus, with manufacturers investing in advanced materials and manufacturing techniques to improve vehicle stability and handling performance. In conclusion, the market is experiencing significant growth, driven by the increasing demand for vehicles that offer superior performance, safety, and driver experience. Manufacturers are investing in various areas, including lightweight materials, advanced driver assistance systems, infotainment integration, high performance braking systems, automotive cybersecurity, ergonomic design, exhaust emission control, fuel efficiency optimization, precision engineering, vehicle dynamics control, powertrain electrification, luxury car interior design, exterior styling elements, manufacturing automation systems, supply chain management, quality control procedures, predictive maintenance systems, vehicle thermal management, and aerodynamic optimization techniques.

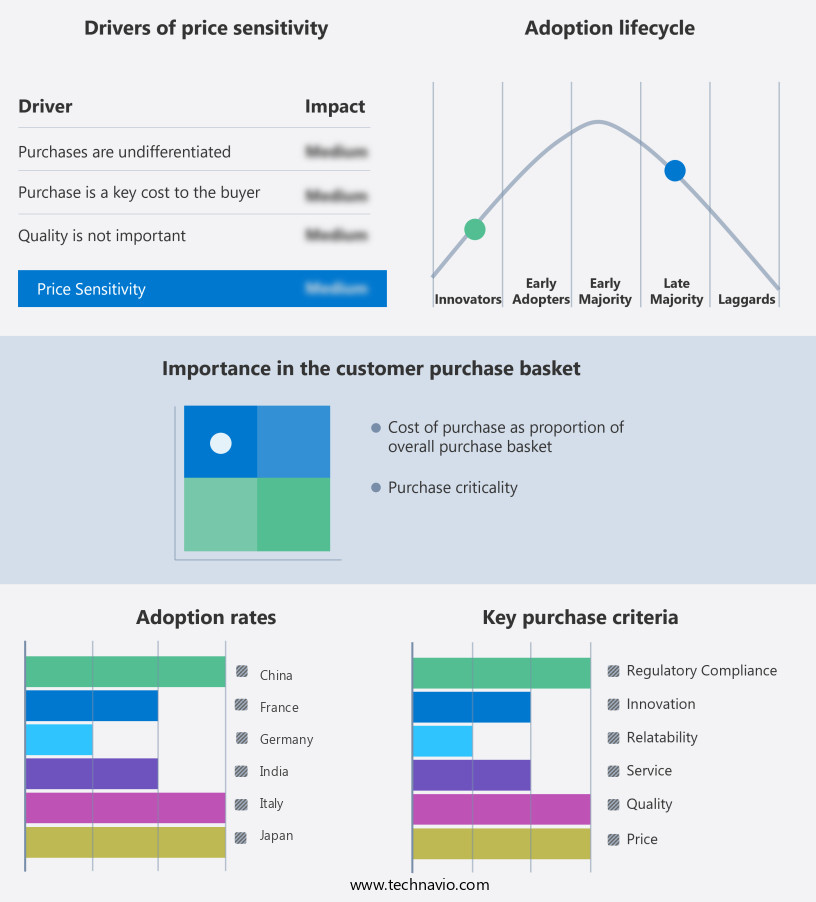

Adoption rates of these technologies and trends vary across different segments and regions, with some regions and segments showing significantly higher adoption rates than others.

What are the key market drivers leading to the rise in the adoption of Luxury Cars Industry?

- The escalating demand for luxury SUVs serves as the primary market driver.

- SUVs, characterized by their elevated seating, increased ground clearance, and enhanced safety features, continue to capture the automotive market's attention. The preference for larger vehicles, accommodating more passengers, is a significant driving factor across entry-level, mid-segment, and luxury SUV segments. The North American market holds a favorable position due to the affordability of credit, low fuel prices, and technological advancements. The price disparity between luxury and mid-segment SUVs has narrowed by approximately 10% over the past decade. This reduction is attributed to the proliferation of mid-segment SUV models and an extensive array of model variants, with a considerable price difference between the basic and top-tier versions of the same SUV model.

- This trend underscores the evolving market dynamics, offering consumers a wider range of choices and price points.

What are the market trends shaping the Luxury Cars Industry?

- The trend in the automotive market is shifting towards the launch of electric luxury car models. A growing number of consumers are expressing interest in these sustainable and high-end vehicle offerings.

- Electric vehicles (EVs) predominantly consist of sedans and hatchbacks due to their energy efficiency. However, the production of electric SUVs and crossovers poses challenges due to their size and power requirements. High power consumption restricts their effective driving range, making them less desirable. Nevertheless, advancements in battery manufacturing processes and the expansion of charging infrastructure, particularly in developed countries, have boosted the confidence of luxury vehicle manufacturers to introduce long-range electric cars.

- Notable luxury brands, including Audi, BMW, and Mercedes-Benz, are increasingly investing in electric vehicle technology. For instance, Mercedes-Benz unveiled plans to launch an electric vehicle in India during 2022. This trend underscores the continuous evolution of the electric vehicle market and its applications across various sectors.

What challenges does the Luxury Cars Industry face during its growth?

- The luxury car industry faces significant growth challenges due to increasing taxes on high-end automobiles.

- In the luxury car market, where advanced technology and high-end features are the norm, price becomes a significant factor for differentiation among competitors. With increasing taxes on luxury cars, the overall cost for consumers continues to rise. Consequently, manufacturers must find ways to maintain a competitive edge. Product innovation and product quality are essential, but price remains a major point of differentiation. However, reducing prices could decrease profit margins, negatively impacting the market's value growth during the forecast period. This challenge is compounded by the fact that luxury car buyers often prioritize prestige and exclusivity, making price a delicate balancing act for manufacturers.

- The luxury car market's continuous evolution requires companies to stay informed about consumer preferences and market trends to effectively price their offerings.

Exclusive Technavio Analysis on Customer Landscape

The luxury cars market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the luxury cars market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Luxury Cars Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, luxury cars market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - The Volvo XC90, available in Onyx Black and Denim Blue, is a premium automobile offering from the company. This luxury vehicle boasts advanced features and sleek designs, catering to discerning consumers seeking superior driving experiences. The XC90's elegant exterior and refined interior reflect the brand's commitment to innovation and quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Aston Martin Lagonda Ltd.

- Bayerische Motoren Werke AG

- BYD Co. Ltd.

- China FAW Group Co. Ltd.

- Dr. Ing. h.c. F. Porsche AG

- Ferrari NV

- Ford Motor Co.

- General Motors Co.

- Honda Motor Co. Ltd.

- Horacio Pagani S p A

- McLaren Group Ltd.

- Mercedes Benz Group AG

- Nissan Motor Co. Ltd.

- Renault SAS

- Stellantis NV

- Tata Sons Pvt. Ltd.

- Tesla Inc.

- Toyota Motor Corp.

- Volkswagen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Luxury Cars Market

- In January 2024, BMW unveiled its new electric luxury sedan, i7, at the Consumer Electronics Show (CES), marking a significant technological advancement in the luxury car market (BMW press release, 2024). In March, Mercedes-Benz and Tesla announced a partnership to collaborate on the development of autonomous driving technology, merging the expertise of two industry leaders (Mercedes-Benz press release, 2024). In April, Rolls-Royce Motor Cars announced a strategic investment of €150 million in its Goodwood plant in the UK, expanding its production capacity and reinforcing its commitment to the British market (Rolls-Royce Motor Cars press release, 2024). In May 2025, Audi secured approval from the European Union for its new electric vehicle battery plant in Brussels, Belgium, marking a major geographic expansion for the German automaker (Audi press release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Luxury Cars Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 232 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, Germany, UK, China, France, Italy, Switzerland, Japan, South Korea, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic world of luxury cars, innovation and evolution are the driving forces behind the industry's continuous progression. Manufacturing automation systems streamline production processes, ensuring meticulous quality control procedures and precision engineering techniques. Powertrain electrification, fueled by advancements in electric vehicle technology, is redefining performance metrics optimization and fuel efficiency. Exhaust emission control and passive safety systems remain paramount, with automakers investing heavily in advanced materials applications and vehicle thermal management. Drivetrain and chassis engineering are refined through tire performance characteristics studies and aerodynamic optimization techniques. Ergonomic design principles and automotive cybersecurity measures are increasingly prioritized to cater to the evolving needs of discerning consumers.

- Lightweight materials and transmission technology enhance vehicle agility and responsiveness, while high-performance braking systems ensure unparalleled stopping power. The market is witnessing a surge in hybrid powertrains, as the industry strives to balance power and sustainability. Infotainment systems integration and exterior styling elements are becoming more sophisticated, reflecting the fusion of technology and aesthetics. Advanced materials applications, such as carbon fiber reinforced polymers, are revolutionizing suspension system design and vehicle connectivity technology. Engine performance tuning and predictive maintenance systems enable proactive vehicle dynamics control, ensuring a seamless driving experience. According to recent studies, electric vehicles accounted for approximately 2.6% of global luxury car sales in 2020.

- This percentage is projected to reach 15% by 2026, underscoring the rapid pace of market transformation. The market is an ever-evolving landscape, where innovation and sustainability converge to redefine the future of personal transportation.

What are the Key Data Covered in this Luxury Cars Market Research and Growth Report?

-

What is the expected growth of the Luxury Cars Market between 2025 and 2029?

-

USD 232 billion, at a CAGR of 6.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Executive luxury car and Super luxury car), Propulsion (IC engine-based vehicles and Electric vehicles), Geography (Europe, North America, APAC, Middle East and Africa, and South America), and Vehicle Type (Hatchbacks, Sedans, Sports Utility Vehicles (SUVs), Multi-purpose Vehicles (MPVs), Others, Hatchbacks, Sedans, Sports Utility Vehicles (SUVs), Multi-purpose Vehicles (MPVs), and Others)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising demand for luxury SUVs, Increase in tax on luxury cars

-

-

Who are the major players in the Luxury Cars Market?

-

AB Volvo, Aston Martin Lagonda Ltd., Bayerische Motoren Werke AG, BYD Co. Ltd., China FAW Group Co. Ltd., Dr. Ing. h.c. F. Porsche AG, Ferrari NV, Ford Motor Co., General Motors Co., Honda Motor Co. Ltd., Horacio Pagani S p A, McLaren Group Ltd., Mercedes Benz Group AG, Nissan Motor Co. Ltd., Renault SAS, Stellantis NV, Tata Sons Pvt. Ltd., Tesla Inc., Toyota Motor Corp., and Volkswagen AG

-

Market Research Insights

- The market continues to evolve, with manufacturers investing significantly in advanced technologies to enhance performance, safety, and comfort. Two key areas of focus are the integration of over-the-air (OTA) updates for powertrain calibration and driver monitoring systems. According to industry estimates, OTA updates will account for over 25% of all software updates in luxury vehicles by 2025, up from just 5% in 2020. Meanwhile, the adoption of driver monitoring systems is projected to reach 70% of luxury cars by 2024. Moreover, aerodynamic drag reduction through high-strength steel applications and materials science automotive innovations, such as magnesium alloy components, are essential in improving engine responsiveness and fuel efficiency.

- Additionally, the integration of adaptive cruise control, lane departure warning, and collision avoidance systems ensures superior vehicle stability control and safety. Exhaust aftertreatment systems and thermal comfort control are other critical features that contribute to the overall luxury experience. The market is also witnessing a shift towards vehicle electrification strategies, with predictive maintenance algorithms and emergency braking systems becoming increasingly common. The integration of automotive telematics, advanced lighting systems, and human-machine interface design further enhances the driving experience.

We can help! Our analysts can customize this luxury cars market research report to meet your requirements.