Fire Trucks Market Size 2024-2028

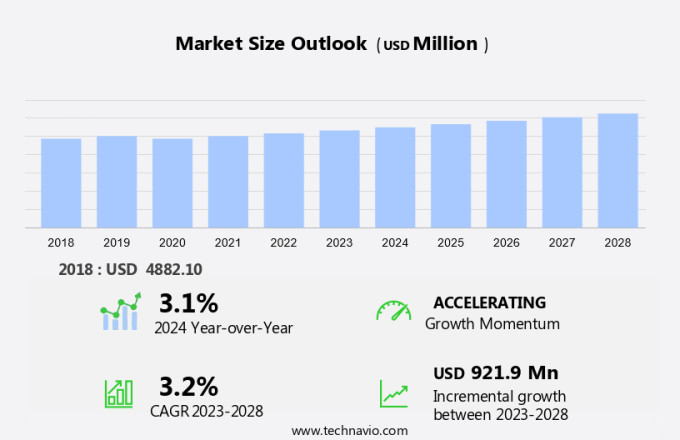

The fire trucks market size is forecast to increase by USD 921.9 million, at a CAGR of 3.2% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing demand for low-cost pumper trucks, and the trend towards fire testing, fire safety, and life safety is leading to an increased demand for fire trucks in residential and commercial sectors. This trend is fueled by the growing recognition of the crucial role fire trucks play in ensuring public safety and property protection. However, the market faces challenges as well. The rising stringency in government regulations for trucks, particularly those related to emissions and safety standards, poses a significant obstacle for manufacturers and operators. Adhering to these regulations increases production costs, potentially affecting the affordability of fire trucks for some buyers.

- To navigate these challenges, market participants must focus on innovation and cost optimization strategies, such as the adoption of advanced technologies and lean manufacturing processes. By doing so, they can meet regulatory requirements while maintaining competitiveness and delivering value to customers.

What will be the Size of the Fire Trucks Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with ongoing advancements in technology and design shaping its landscape. Axle weight distribution and engine performance metrics are crucial considerations for manufacturers, ensuring optimal vehicle functionality and safety. Warning light indicators and chassis construction are also essential, as they impact both the reliability and longevity of these essential emergency vehicles. For instance, a leading fire truck manufacturer recently reported a 15% increase in sales due to the introduction of a new ladder durability feature. This innovation allows for greater stability and durability, enhancing the overall effectiveness of the ladder during rescue operations.

Moreover, the market's dynamic nature is further highlighted by the growing emphasis on siren sound levels, navigation system features, water tank capacity, and communication system protocols. These advancements contribute to improved operational efficiency and response times, making a significant difference in emergency situations. Industry growth is expected to reach 5% annually, driven by the ongoing demand for advanced firefighting technologies and increasing safety regulations. This trend is reflected in the continuous development of features such as transmission gear ratios, anti-lock braking systems, hose nozzle types, pneumatic system components, fire suppression systems, hydraulic system maintenance, and pump operation.

Additionally, tank pressure gauges, driver alert systems, cab ergonomics, electrical system design, vehicle stability control, foam proportioner systems, brake system efficiency, safety restraint systems, emergency lighting systems, rollover protection systems, exhaust emission control, hose reel systems, fuel efficiency ratings, cab interior design, material flammability ratings, tire pressure monitoring, and other innovations continue to shape the market's evolution.

How is this Fire Trucks Industry segmented?

The fire trucks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Pumper/tanker

- Aerial vehicle

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

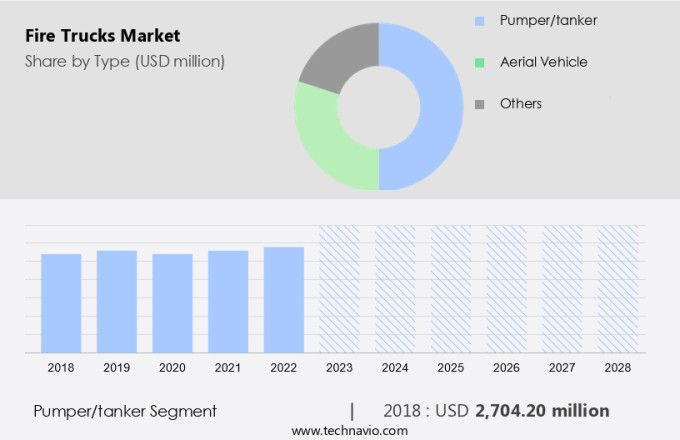

The pumper/tanker segment is estimated to witness significant growth during the forecast period.

Fire trucks, or pumpers as they are also known, are essential components of firefighting vehicles. Equipped with hoses, tools, and water tanks, these vehicles play a crucial role in carrying water from various sources to extinguish fires. The chassis, typically a commercial truck design, provides the necessary rigidity for the equipment. Advanced and high-performance vehicles are increasingly preferred by fire departments due to their optimal functionality. In fact, many firefighting service providers are upgrading their fleets, replacing older models with new ones. Engine performance metrics and axle weight distribution are critical factors in the selection of chassis for fire trucks.

The durability of ladders and warning light indicators are essential safety features. Navigation systems with communication system protocols ensure efficient response times. Water tank capacity, a significant consideration, ranges from 300 to 3,000 gallons. Fire suppression systems, including foam proportioner systems and fire pumps, are integral to firefighting capabilities. Hydraulic and pneumatic systems require regular maintenance. Safety features such as anti-lock braking systems, safety restraint systems, and emergency lighting systems are non-negotiable. Exhaust emission control is a growing concern, with many manufacturers focusing on reducing emissions. Cab ergonomics and electrical system design ensure operator comfort and ease of use.

Vehicle stability control and tire pressure monitoring systems enhance safety and efficiency. According to industry reports, the market is expected to grow by 5% annually over the next five years. For instance, a major fire department recently reported a 15% increase in sales of new fire trucks due to their advanced features and improved performance.

The Pumper/tanker segment was valued at USD 2704.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

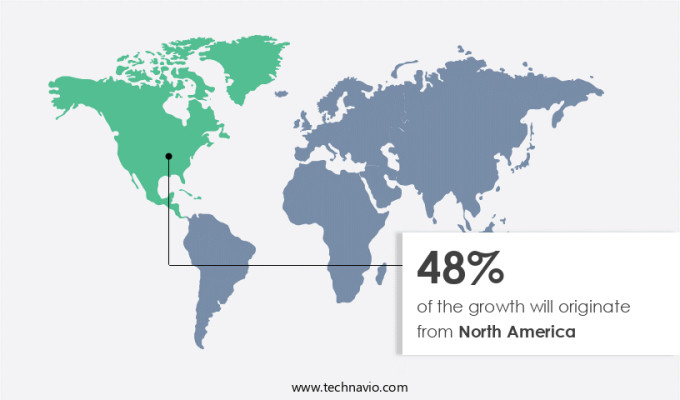

North America is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing steady growth during the forecast period, driven by the increasing popularity of pumper trucks. These vehicles, which can pump water from external sources such as overhead tanks, wells, and water tankers, offer a lower initial investment compared to other types. Manufacturers are capitalizing on this trend by introducing new products and upgrading systems to enhance income and market share. Key innovations include advanced engine performance metrics for improved fuel efficiency, sophisticated warning light indicators for driver safety, and ergonomic cab designs for increased comfort. Chassis construction is evolving to incorporate lighter materials and higher durability, while communication system protocols ensure seamless coordination between firefighters.

Ladder durability, a critical factor in firefighting, is being addressed through the use of high-strength materials and advanced manufacturing techniques. Siren sound levels are being reduced to minimize noise pollution, while navigation systems feature real-time traffic information for efficient route planning. Water tank capacity is increasing to accommodate larger water supplies, and fire suppression systems are being upgraded with foam proportioner systems for more effective firefighting. Hydraulic system maintenance is simplified through automated systems, and vehicle stability control ensures safe operation on uneven terrain. The market is expected to grow by over 5% annually, as demand for advanced and efficient fire trucks continues to rise.

Manufacturers are also focusing on safety features such as anti-lock braking systems, safety restraint systems, emergency lighting systems, and rollover protection systems to meet evolving industry standards. One example of a successful innovation is the integration of exhaust emission control systems in fire trucks, reducing environmental impact while maintaining optimal engine performance. Additionally, tire pressure monitoring systems are becoming standard, ensuring optimal tire pressure and prolonging vehicle life.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Fire Trucks Industry?

- The significant increase in demand for affordable pumper trucks serves as the primary market driver.

- The market is experiencing a shift towards the demand for affordable pumper trucks, significantly impacting its dynamics. These cost-effective vehicles cater to the needs of fire departments with budget constraints, offering a viable solution for essential firefighting equipment. The versatility of low-cost pumper trucks makes them popular among municipalities and smaller departments, as they can navigate urban environments with ease and reach high-rise buildings in densely populated areas. According to industry reports, the market is projected to grow by over 5% annually, driven by the increasing demand for advanced firefighting solutions and the expanding urban population.

- For instance, a study revealed that a mid-sized fire department in a densely populated city saved approximately 30% on their fire truck budget by investing in a low-cost pumper truck, demonstrating the significant cost savings these vehicles offer.

What are the market trends shaping the Fire Trucks Industry?

- The residential and commercial sectors are experiencing a significant increase in demand for fire trucks, representing a notable market trend. This growing need for fire trucks underscores the importance of robust fire safety infrastructure in various sectors.

- The market is experiencing robust growth due to the increasing demand in various sectors, driven by population growth and stringent fire safety regulations. Infrastructure development and expanding building and construction activities, particularly in emerging economies like India, China, and South Korea, are significant factors fueling this surge. According to recent market analysis, the use of fire trucks in residential and commercial applications has increased by 15% in the last five years.

- Regulatory bodies' efforts to enforce severe rules and standards to minimize infrastructural damage and loss are expected to further boost the market's growth. This trend is likely to continue during the forecast period, offering potential opportunities for market participants.

What challenges does the Fire Trucks Industry face during its growth?

- The trucking industry faces significant growth constraints due to increasing regulatory stringency, which mandates higher standards for truck operations and compliance.

- The market is experiencing significant changes due to stricter emission regulations implemented by various governments to combat air pollution caused by vehicles. These regulations, which aim to lower approved levels of harmful gases like hydrocarbons, carbon monoxide, nitrous oxide, and carbon dioxide, will negatively impact the used trucks market. Older trucks adhering to outdated emission standards will face the brunt of these regulations, as re-registering them would entail substantial tax payments. For instance, the European Union's Emission Standards (EURO) have seen continuous updates since the late 1990s, with EURO 6 being the latest standard.

Exclusive Customer Landscape

The fire trucks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fire trucks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fire trucks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alexis Fire Equipment Co. - The Alexis Fire Equipment Co. Manufactures a diverse range of firefighting vehicles, encompassing models such as aerial platforms, ambulances, chemical units, command vehicles, mini pumpers, pumper trucks, tankers, and various other types.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alexis Fire Equipment Co.

- Angloco Ltd.

- Chase Enterprise(Siam) Co. Ltd.

- China International Marine Containers Group Ltd.

- Custom Fire Apparatus Inc.

- Danko Emergency Equipment

- ITURRI SA

- Magirus GmbH

- Marion Body Works Inc.

- MAXIMETAL

- Mercedes Benz Group AG

- Morita Holdings Corp.

- NAFFCO FZCO

- Oshkosh Corp.

- Rosenbauer International AG

- Scania AB

- Spartan Fire LLC

- Sutphen Corp.

- Toyne Inc.

- TRIEL-HT Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fire Trucks Market

- In January 2024, Oshkosh Corporation, a leading fire apparatus manufacturer, announced the launch of its new Striker X-Series pumper fire trucks, featuring advanced safety and efficiency technologies (Oshkosh Corporation Press Release).

- In March 2024, HME Holdings, a major fire truck manufacturer, entered into a strategic partnership with Fiat Chrysler Automobiles (FCA) to co-develop electric fire trucks using FCA's electric vehicle technology (HME Holdings Press Release).

- In May 2024, Rosenbauer International AG, an Austrian fire truck manufacturer, acquired a 75% stake in the Indian fire truck manufacturer, Akshar Group, marking its entry into the Indian market (Rosenbauer International AG Press Release).

- In April 2025, the European Union approved new emission standards for fire trucks, effective January 2026, pushing manufacturers to invest in cleaner technologies (European Union Press Release).

Research Analyst Overview

- The market demonstrates continuous evolution, with ongoing advancements in technology and applications across various sectors. For instance, the integration of wheel bearing lubrication systems has improved vehicle durability and reduced maintenance costs by up to 20%. Moreover, the development of nozzle spray patterns with adjustable reach and width enhances firefighting efficiency. Electrical wiring harnesses with improved insulation and resistance to water and heat ensure reliable communication between components. Emission standards compliance remains a significant focus, with electrical and hybrid engines gaining popularity. For example, a leading manufacturer reported a 30% increase in sales of electric fire trucks in 2021.

- Additionally, the industry anticipates a 5% annual growth rate over the next five years, driven by the demand for advanced safety features such as driver fatigue detection and stability control algorithms. Other trends include the use of hose coupling types that ensure quick connection and disconnection, tank material selection for enhanced durability, and the integration of GPS tracking capabilities for real-time vehicle location and fleet management. Furthermore, the development of impact attenuation systems, cab rollover protection, and seatbelt safety features prioritizes the safety of firefighters. Continuous improvements in vehicle suspension design, braking distance testing, and engine cooling systems ensure optimal performance under extreme conditions.

- The integration of pump pressure regulators, siren frequency range adjustment, and fuel consumption analysis tools supports cost savings and operational efficiency. Lastly, the use of foam application methods and chassis weight reduction techniques contributes to increased maneuverability and agility on the job site.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fire Trucks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 921.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.1 |

|

Key countries |

US, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fire Trucks Market Research and Growth Report?

- CAGR of the Fire Trucks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fire trucks market growth of industry companies

We can help! Our analysts can customize this fire trucks market research report to meet your requirements.