Automotive Fuse Market Size 2024-2028

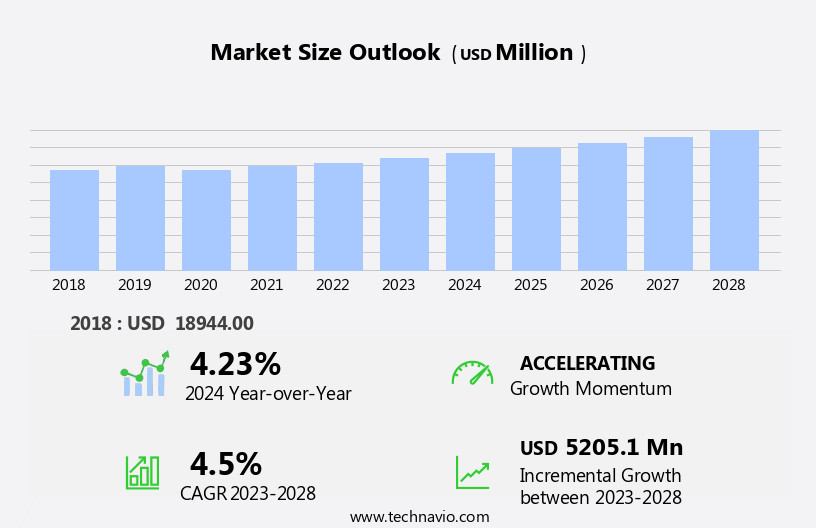

The automotive fuse market size is forecast to increase by USD 5.21 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs), which require an extensive network of fuses to protect their expensive components. This trend is driving the development of fuses specifically designed for EVs and HEVs, presenting a lucrative opportunity for market participants. However, the lack of infrastructure in potential markets, particularly in developing countries, poses a significant challenge to the market's expansion. This infrastructure gap hinders the widespread adoption of EVs and HEVs, ultimately affecting the demand for automotive fuses. Companies in the market must navigate this challenge by exploring alternative strategies, such as expanding their product offerings to include fuses for conventional internal combustion engine vehicles or entering new markets where infrastructure is being developed.

- By capitalizing on the growing demand for EV and HEV fuses while addressing the infrastructure challenge, market players can effectively position themselves for long-term success.

What will be the Size of the Automotive Fuse Market during the forecast period?

- The market continues to evolve in response to the dynamic nature of the automotive industry. Hybrid cars, driven by the increasing middle-class population and environmental concerns, are leading the charge towards electrification. Macroeconomic factors, including fuel prices and energy policies, significantly impact the demand for fuse units in the automotive sector. Raw material availability and pricing play a crucial role in the manufacturing of fuse units for various vehicle applications, from internal combustion engines to hybrid electric and electric vehicles. The evolving power systems in these vehicles require advanced electronics and safety features, further increasing the demand for fuse units.

- Fleet management and comfort features are also driving the need for reliable fuse systems in the automotive industry. The ongoing electrification of the automotive sector, with major automakers like General Motors investing in zero emission vehicles, is expected to significantly impact the demand for fuse units in the coming years. The market is a critical component of the power system in vehicles, ensuring the safe and efficient operation of various electrical components. As the automotive industry continues to innovate and adapt to changing market dynamics, the demand for advanced fuse units will remain a constant.

How is this Automotive Fuse Industry segmented?

The automotive fuse industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger vehicle

- Commercial vehicle

- Type

- Blade Fuses

- Glass Tube Fuses

- Semiconductor Fuses

- Application

- Battery Management

- Lighting Systems

- Infotainment Systems

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Vehicle Type Insights

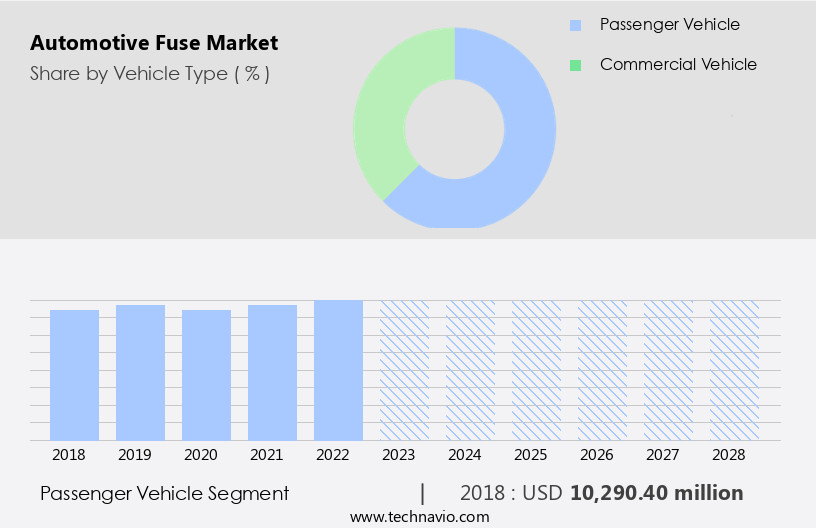

The passenger vehicle segment is estimated to witness significant growth during the forecast period.

The market in the passenger vehicles segment is experiencing significant growth due to the rising sales of vehicles, particularly entry-level cars and larger utility vehicles. New car registrations in Europe increased by approximately 17.8% between June 2022 and June 2023, reflecting this trend. The demand for comfort features, electrification, engineering advancements, and safety systems in vehicles is driving the need for more fuses. The electrification of the automotive industry, with the increasing adoption of hybrid electric and electric vehicles, is a major factor fueling market growth. Macroeconomic factors, such as fuel prices and environmental concerns, are also influencing the shift towards electric vehicles.

The automotive sector is witnessing a surge in the adoption of advanced electronics, including infotainment systems, which require numerous fuses for proper functioning. General Motors and major automakers are investing heavily in the development of zero-emission vehicles, further boosting the demand for automotive fuses. The raw materials used in manufacturing fuses, such as battery materials, are also experiencing increased demand due to the growth of the electric vehicle industry. The market is expected to continue its expansion as the demand for more advanced power systems in vehicles persists.

The Passenger vehicle segment was valued at USD 10.29 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

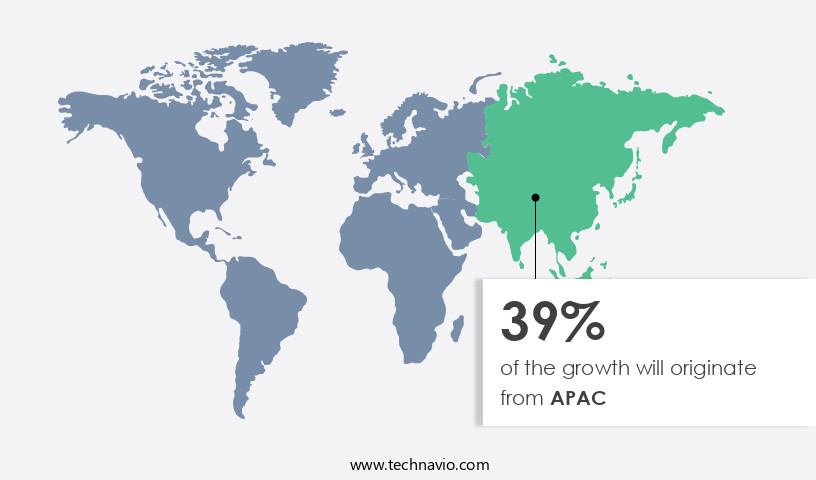

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the increasing production and sales of electric and hybrid vehicles in countries like China, Japan, South Korea, India, and Hong Kong. China, being the largest market for electric vehicles, is driving the demand for automotive fuses as the production and sales of EVs and their related components increase. Major companies in the region, including General Motors and other major automakers, are contributing to this trend by introducing more hybrid and electric models. The penetration of comfort features, advanced electronics, safety systems, and infotainment systems in these vehicles also necessitates the use of more fuses to manage the increased power requirements.

Macroeconomic factors, such as fuel prices and environmental concerns, are further boosting the adoption of electric and hybrid vehicles, leading to a surge in demand for automotive fuses. The use of battery electric and hybrid electric vehicles in the automotive sector is expected to continue, with the demand for automotive fuses remaining a crucial component in the power systems of these vehicles.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Fuse Industry?

- The necessity of incorporating fuses to protect costly components in electric vehicles (EVs) and hybrid electric vehicles (HEVs) serves as the primary market driver.

- The market is experiencing significant growth due to the increasing focus on safety and power management in the electric vehicle (EV) and hybrid electric vehicle (HEV) segments of the automotive sector. As EVs and HEVs become more prevalent, ensuring the proper functioning of expensive components, such as electric motors and batteries, is essential. Automotive fuses play a crucial role in protecting these components from power surges and faults. Moreover, the trend toward vehicle electrification is increasing the complexity of fuse selection, as high power, speed, and long-range requirements become more common in BEVs and HEVs.

- OEMs face design challenges in meeting these demands while maintaining safety and reliability. In summary, the market is experiencing growth due to the increasing importance of safety and power management in the electric vehicle and hybrid electric vehicle segments of the automotive sector. The need to protect expensive components from power surges and faults, coupled with the complexity of fuse selection in electric vehicles, is driving market demand.

What are the market trends shaping the Automotive Fuse Industry?

- The development of specialized fuses for electric vehicles (EVs) and hybrid electric vehicles (HEVs) is a growing market trend. This focus on creating fuses tailored to the unique requirements of EVs and HEVs is essential to ensure optimal performance and safety in these advanced vehicles.

- Automotive fuses play a crucial role in safeguarding electrical systems in vehicles, including those of electric vehicles (EVs) and hybrid electric vehicles (HEVs). Eaton, a leading fuse manufacturer, has introduced specialized fuses for EV applications. These advanced fuses protect sensitive equipment, such as high voltage, high capacity batteries, power conversion systems, contactors, cabling, and other auxiliary circuits. Eaton Bussmann fuses offer protection at up to 135% of the rated current, addressing a wide range of overcurrent conditions without causing damages due to cycling fatigue. These fuses require 48% less space and 50% less weight than traditional fuses, making them ideal for EVs and HEVs.

- Additionally, they have an 11% higher voltage rating than the Japanese Automotive Standards Organization (JASO) D622 specification, eliminating the need for circuit redesign as battery systems are optimized for higher voltages. Fuel prices and environmental concerns continue to drive the adoption of EVs and HEVs, making the development of efficient and reliable power systems a priority. Infotainment systems in vehicles also require robust protection, further increasing the demand for advanced automotive fuses.

What challenges does the Automotive Fuse Industry face during its growth?

- The absence of adequate infrastructure in potential markets poses a significant challenge to the expansion and growth of the industry.

- The market is significantly influenced by the adoption of hybrid vehicles, particularly among the middle-class population. Macroeconomic factors, such as increasing energy prices and a growing focus on reducing carbon emissions, are driving the demand for more fuel-efficient vehicles. However, the lack of an adequate charging infrastructure for electric vehicles (EVs) poses a challenge to the market growth. In countries like India, the absence of a comprehensive charging network is hindering the large-scale adoption of EVs, impacting the sales of automotive fuses.

- The need for a reliable and easily accessible charging infrastructure is crucial for the growth of the EV market and, consequently, the market. The demand for comfort features in vehicles, including advanced safety systems and climate control, also contributes to the market growth. The raw material costs and fleet management are other key factors that influence the market dynamics.

Exclusive Customer Landscape

The automotive fuse market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive fuse market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive fuse market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AEM Components USA Inc. - The company specializes in the production and distribution of advanced automotive fusing solutions. Our product line includes AirMatrix air fuses and SolidMatrix solid body fuses, engineered for enhanced performance and reliability. AirMatrix fuses utilize a matrix-type design for improved air flow, reducing the risk of arcing and potential damage to electrical components. SolidMatrix fuses feature a solid body construction, ensuring optimal current flow and minimizing the likelihood of failure. By prioritizing innovation and quality, we cater to the evolving demands of the global automotive industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AEM Components USA Inc.

- Blue Sea Systems

- Dongguan Better Electronics Technology Co. Ltd.

- Eaton Corp. Plc

- ETA Elektrotechnische Apparate GmbH

- Fuzetec Technology Co. Ltd.

- GLOSO TECH Inc.

- Halfords Group Plc

- Littelfuse Inc.

- Mersen Corporate Services SAS

- MTA Spa

- ON Semiconductor Corp.

- OptiFuse

- Pacific Engineering Corp.

- Protectron Electromech Pvt. Ltd.

- Rainbow Power Co. Ltd.

- SCHURTER Holding AG

- Sensata Technologies Inc.

- SIBA GmbH

- Ultra Wiring Connectivity System Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Fuse Market

- In February 2024, Bosch, a leading global technology company, introduced its new generation of automotive fuses with iFuses technology. This innovation offers improved safety and reliability by enabling real-time monitoring of the fuse status and automatically replacing faulty fuses (Bosch press release, 2024).

- In July 2025, Cummins Power Generation, a power solutions provider, announced a strategic partnership with Magneti Marelli, a global automotive technology leader. This collaboration aimed to develop advanced automotive fuse systems for electric and hybrid vehicles, expanding Cummins' presence in the automotive sector (Cummins Power Generation press release, 2025).

- In October 2024, Panasonic Automotive and TDK Corporation, two major components suppliers, joined forces to establish a new company, named Panasonic-TDK Automotive Electronics. This joint venture focused on producing automotive fuses and other electronic components, aiming to strengthen their market position and enhance their competitiveness (Panasonic press release, 2024).

- In December 2025, the European Union introduced new regulations on vehicle safety, including the requirement for advanced automotive fuses in all new passenger cars. These fuses must meet higher safety standards and support advanced driver assistance systems (EU Commission press release, 2025). This regulatory change is expected to significantly boost the demand for advanced automotive fuses in Europe.

Research Analyst Overview

The market experiences significant growth as major automakers, including General Motors, prioritize electrification in response to environmental concerns and increasing fuel prices. MERSEN Electric, a leading supplier of electrical power solutions, capitalizes on this trend by manufacturing fuse units for hybrid cars, hybrid electric vehicles (HEVs), and electric vehicles (EVs) under the Fame Scheme for zero emission vehicles. Battery materials and engineering advancements enable the production of more comfortable and powerful EVs, driving demand for specialized fuse units to ensure vehicle safety.

The ev industry's shift towards electric power sources necessitates the development of innovative fuse solutions to accommodate the unique requirements of these vehicles. Fuel prices remain a critical factor influencing consumer preferences, further boosting the demand for efficient and cost-effective fuse solutions in the automotive sector.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Fuse Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 5205.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, Canada, Brazil, UAE, Australia, Rest of World (ROW), Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Fuse Market Research and Growth Report?

- CAGR of the Automotive Fuse industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive fuse market growth of industry companies

We can help! Our analysts can customize this automotive fuse market research report to meet your requirements.