Automotive Occupant Sensing System Market Size 2024-2028

The automotive occupant sensing system market size is forecast to increase by USD 533.6 billion at a CAGR of 4.02% between 2023 and 2028. The market is experiencing significant growth due to the increasing prioritization of occupant safety in the automotive industry. Advanced safety features, such as airbag activation and seatbelt pre-tensioning, are becoming standard in modern vehicles. However, the high costs associated with installing these systems remain a challenge for market growth. To address this, there is a trend toward using sensor accuracy improvements and real-world driving condition simulations to optimize system performance and reduce costs.

Additionally, the use of bio-based plastics and recyclable components in the production of occupant sensing systems is gaining popularity as a sustainable solution, aligning with consumer demand for eco-friendly products. Despite these advancements, ensuring sensor accuracy in various driving scenarios remains a key challenge for market players.

Automotive occupant sensing systems have become an integral part of modern vehicles, ensuring the safety of drivers and passengers during collisions and accidents. These systems utilize sophisticated sensors to detect the presence and weight of occupants in both the driver's seat and passenger's seats. By employing pressure sensors that monitor inflation and deflation, these structures can effectively determine the severity of a collision and trigger airbag activation accordingly. In today's world, where self-reliant cars and smart technologies are taking center stage, occupant sensing systems have gained significant importance.

Furthermore, these systems play a crucial role in enhancing vehicle safety features for compact cars and premium car segments alike. With the increasing focus on reducing road crashes, sensor technologies have been integrated into onboard systems to ensure optimal safety in electric vehicles and autonomous vehicles. Occupant sensing systems are designed to adapt to various driving conditions and vehicle types. They continuously monitor the vehicle's environment and adjust accordingly to ensure the best possible protection for all occupants. By continuously evolving with the latest safety guidelines and advancements in technology, these systems are set to revolutionize the future of vehicle safety.

Market Segmentation

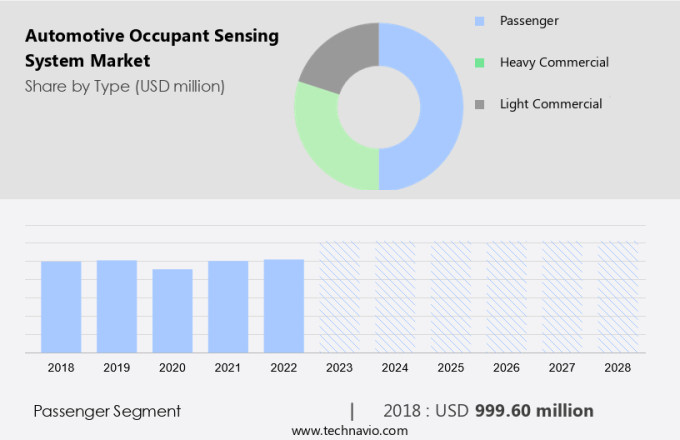

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Passenger

- Heavy commercial

- Light commercial

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

The passenger segment is estimated to witness significant growth during the forecast period. The market is poised for significant expansion due to the increasing penetration of passenger cars and the integration of these systems for enhanced safety and comfort. Weight sensors, capacitive sensors, and ultrasonic sensors are among the key technologies driving market growth. Passenger cars are expected to dominate the market, with mid-sized and luxury passenger cars leading the adoption. The shift towards electrification in passenger cars has fueled the adoption of advanced technologies, making occupant sensing systems a standard feature. Initially, these systems were exclusive to luxury vehicles, but they have now permeated mid-segment cars, leading to increased market volume. The rising popularity of premium vehicles is a crucial factor for market growth due to their high revenue potential, driven by the adoption of advanced safety features.

Get a glance at the market share of various segments Request Free Sample

The passenger segment was valued at USD 999.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The automotive industry in developed regions like Europe and the US is witnessing a heightened focus on safety features due to increasing consumer awareness. In contrast, emerging markets in Asia Pacific, particularly China, are demonstrating significant advancements in adopting standard safety technologies in vehicles. Previously, the Chinese market prioritized fuel efficiency, low maintenance costs, and affordability.

However, the growing importance of safety is expected to positively impact the automotive occupant sensing systems market in the long term. Sensors, such as weight sensors, capacitive sensors, and ultrasonic sensors, play a crucial role in these systems. Software integration is also essential for accurate occupancy detection and airbag deployment. As the largest automotive market in the world, China's commitment to safety will significantly influence the market's growth trajectory.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growth of the automotive industry is notably driving market growth. Occupant sensing systems play a crucial role in enhancing passenger safety in automobiles. These systems, which include airbag activation and seatbelt pre-tensioning, are designed to detect the presence and weight of occupants in a vehicle and respond accordingly during accidents. Sensor accuracy is paramount in ensuring effective system performance under real-world driving conditions. Bio-based plastics and recyclable components are increasingly being adopted in the manufacturing of these sensors to reduce environmental impact.

Further, the market for occupant sensing systems is growing rapidly, driven by the increasing demand for passenger safety features in passenger vehicles. Middle-class populations in emerging economies are a significant consumer base for this technology. Sensor suppliers and technology firms are investing heavily in research and development to improve sensor accuracy and functionality. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

Improvising occupant safety across the value chain is the key trend in the market. Automotive occupant sensing systems play a crucial role in enhancing passenger safety during accidents. These systems, which include airbag structures, rely on sensors to detect the presence and weight of occupants, as well as their seating position. Sensor accuracy is essential in real-world driving conditions, making it a priority for sensor suppliers and technology firms.

Moreover, the increasing demand for passenger safety features, particularly among the middle-class population, is driving market growth. Bio-based plastics and recyclable components are being increasingly used in the production of these sensors to reduce environmental impact. The automotive occupant sensing system market is expected to expand significantly due to the increasing production of passenger vehicles worldwide. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

High costs associated with the installation of occupant sensing systems is the major challenge that affects the growth of the market. Automotive occupant sensing systems play a crucial role in enhancing passenger safety during accidents. These systems, which include airbag activation and seatbelt pre-tensioning, rely on sensors to detect the presence and weight of occupants in a vehicle. Sensor accuracy is paramount in real-world driving conditions to ensure optimal safety performance.

However, with a growing focus on sustainability, sensor suppliers and technology firms are increasingly using bio-based plastics and recyclable components in the production of these systems. The middle-class population's increasing demand for passenger vehicles is driving market growth. Shortly, we can expect further advancements in occupant sensing technology, ensuring even greater safety and efficiency. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AB Volvo - The company offers automotive occupant sensing system such as airbags, seat belts, and many more.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Aptiv Plc

- Autoliv Inc.

- Continental AG

- DENSO Corp.

- Flexpoint Sensor Systems Inc.

- Furukawa Electric Co. Ltd.

- Hamamatsu Photonics KK

- IEE International Electronics and Engineering S.A.

- Joyson Safety Systems Aschaffenburg GmbH

- Lear Corp.

- LeddarTech Inc.

- Robert Bosch GmbH

- Schneider Electric SE

- Texas Instruments Inc.

- Valeo SA

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to increasing safety guidelines and the integration of smart technologies in passenger cars. Occupant sensing structures, including pressure sensors, image sensors, weight sensors, capacitive sensors, and ultrasonic sensors, play a crucial role in ensuring vehicle safety. The premium seat car segment increasingly incorporates advanced safety features like seat belt tension sensors and airbag activator control system, making it essential for families using rear facing child seats to stay informed about gasoline prices. These sensors detect the presence and weight of occupants in the drivers and passengers seats, enabling airbag structures to activate appropriately during collisions or accidents.

Furthermore, self-reliant cars are becoming the norm, with software programs and onboard systems relying heavily on sensor technologies for real-world driving conditions. Passenger cars, mid-sized passenger cars, luxury passenger cars, premium passenger cars, compact passenger cars, light commercial vehicles, and heavy commercial vehicles all benefit from these advanced safety features. Automotive manufacturers are standardizing safety policies, integrating seatbelts, airbags, and other vehicle safety features to meet evolving safety guidelines. The integration of digital cameras and bio-based plastics, along with recyclable components, further enhances the sustainability of these systems. With the rise of electric vehicles, autonomous vehicles, and the middle-class population's increasing demand for safety, the occupant sensing system market is poised for continued growth. Sensor suppliers and technology firms are at the forefront of this innovation, driving advancements in sensor accuracy and integration.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.02% |

|

Market growth 2024-2028 |

USD 533.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.81 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 49% |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AB Volvo, Aptiv Plc, Autoliv Inc., Continental AG, DENSO Corp., Flexpoint Sensor Systems Inc., Furukawa Electric Co. Ltd., Hamamatsu Photonics KK, IEE International Electronics and Engineering S.A., Joyson Safety Systems Aschaffenburg GmbH, Lear Corp., LeddarTech Inc., Robert Bosch GmbH, Schneider Electric SE, Texas Instruments Inc., Valeo SA, and ZF Friedrichshafen AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch