Automotive Seatbelts Market Size 2024-2028

The automotive seatbelts market size is forecast to increase by USD 2.24 billion, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing use of electronic components in vehicles. Seatbelt reminder systems with visual or audible alarms for rear seats are becoming increasingly common, enhancing safety features and consumer convenience. Another trend includes an increasing emphasis on road safety and the integration of advanced safety features in passenger cars, light commercial vehicles, and trucks. However, this market faces challenges as well. The gradual increase in the cost of automobiles poses a significant obstacle for both manufacturers and consumers, potentially limiting market expansion. Despite this, opportunities remain for companies that can effectively address these challenges by offering cost-effective solutions while maintaining high safety standards.

- The integration of advanced technologies, such as sensors and connectivity, into seatbelt systems could provide a competitive edge, catering to consumer demand for enhanced safety and convenience features. Companies must navigate these market dynamics to capitalize on opportunities and remain competitive in the evolving automotive landscape.

What will be the Size of the Automotive Seatbelts Market during the forecast period?

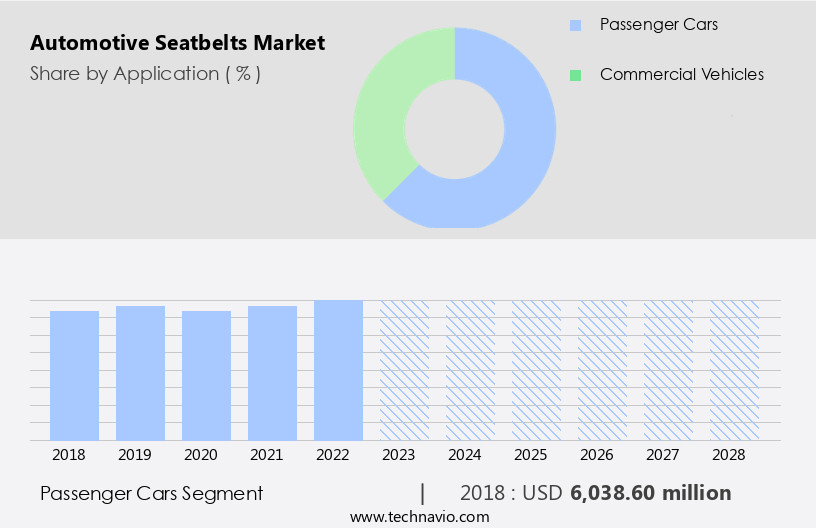

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in safety technology and increasing regulatory requirements. Energy absorbing retractors and automatic locking retractors are becoming standard features, ensuring optimal safety during accidents. Durability testing methods are rigorous to ensure the longevity of seatbelts, with automatic emergency locking retractors and pretensioner systems designed for child seat compatibility. Inertial reel mechanisms and pyrotechnic pretensioners are integral parts of pre-safe systems, enhancing occupant protection. Seatbelts undergo extensive testing, including structural integrity checks, sensor-based deployment, and material tensile strength assessments. Buckle latch assemblies are designed with wear and abrasion resistance, while seatbelt anchor points are subjected to fatigue strength testing.

Seatbelts are integrated with secondary restraint systems, featuring load limiter mechanisms and impact absorption technology, to minimize injuries during accidents. The market growth is robust, with industry experts anticipating a steady expansion of over 5% annually. For instance, a leading automaker reported a 10% increase in sales due to the integration of advanced seatbelt technologies. The ongoing development of three-point harness systems, seatbelt buckle designs, and child restraint anchorage further underscores the continuous unfolding of market activities. Manufacturing processes are continually refined to optimize seatbelt performance, ensuring compliance with testing standards and enhancing safety features. Seatbelts are subjected to rigorous compliance testing, including seatbelt webbing strength and crash sensor deployment assessments.

The integration of pre-safe systems and lateral impact protection further bolsters the market's evolution.

How is this Automotive Seatbelts Industry segmented?

The automotive seatbelts industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by the increasing sales volume of passenger vehicles and the rising popularity of larger utility vehicles such as SUVs, CUVs, and MPVs. This trend is expected to persist during the forecast period. Furthermore, the penetration rate of seatbelts in rear seats is acting as a market catalyst. The market is characterized by various dynamics, including the adoption of advanced technologies such as energy absorbing retractors, automatic and emergency locking retractors, inertial reel mechanisms, pretensioner system designs, and sensor-based deployment. These innovations enhance safety and comfort, making seatbelts an essential component of occupant restraint systems.

Manufacturers prioritize durability, ensuring seatbelts undergo rigorous testing methods, including material tensile strength, fatigue strength, wear resistance, and abrasion resistance tests. Compliance with stringent safety standards is also crucial. For instance, the National Highway Traffic Safety Administration (NHTSA) mandates seatbelts in all seating positions. Moreover, the integration of pre-safe systems, pre-tensioners, load limiters, and impact absorption technology further enhances seatbelts' functionality. Child seat compatibility, structural integrity checks, and buckle latch assembly are other essential considerations. The market's future growth is expected to be around 5% annually, as per recent industry reports. This growth is attributed to ongoing advancements in seatbelt technology and the increasing demand for enhanced safety features in vehicles.

The Passenger cars segment was valued at USD 6.04 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 60% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific is experiencing steady growth, driven by the increasing sales of automobiles in countries like China, Japan, India, Indonesia, South Korea, Thailand, and Australia. This trend is influenced by the stringent traffic regulations, heightened focus on vehicular safety from automakers, and rising consumer awareness regarding seatbelts' benefits. Developing road infrastructure in the region has also boosted the usage of road transportation, further fueling the market's expansion. Seatbelts' essential components, such as energy absorbing retractors, automatic locking and emergency locking retractors, inertial reel mechanisms, pretensioner systems, and buckle latch assemblies, undergo rigorous durability testing methods to ensure safety and reliability.

Advanced technologies like sensor-based deployment, pre-safe system integration, and load limiter mechanisms are integrated into seatbelts to enhance their functionality and effectiveness. The market's growth is expected to reach approximately 10% over the next five years, as per industry estimates. This expansion is attributed to the increasing demand for three-point harness systems, child seat compatibility, and secondary restraint systems, which provide enhanced safety features for vehicle occupants. Manufacturers employ various manufacturing processes, including wear resistance testing, abrasion resistance tests, and crash sensor deployment, to ensure the seatbelts' structural integrity and material tensile strength. Incorporating impact absorption technology and fatigue strength testing into seatbelts' design further enhances their performance during collisions.

The market's growth is also influenced by the integration of pyrotechnic pretensioners, lateral impact protection, and adjustable height mechanisms, which cater to the diverse needs of consumers. Compliance with stringent testing standards, such as seatbelt webbing strength and child restraint anchorage, ensures the occupant restraint system's overall effectiveness.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to increasing regulatory norms and consumer awareness towards road safety. Seatbelts are a crucial safety feature in vehicles, and their performance under various conditions is of utmost importance. Seatbelt webbing tensile strength is crucial for ensuring passenger safety during accidents. Laboratories employ various testing methods to evaluate this property. Pretensioner system deployment time analysis is another essential aspect, as quick deployment can save lives. The force reduction effectiveness of load limiters is also evaluated to minimize passenger injuries. Buckle latch mechanisms undergo rigorous reliability testing procedures to ensure smooth functionality. Child restraint anchorage points are validated through strength tests to secure child safety seats effectively. Impact absorption technology is a key focus area, with energy dissipation efficiency being a critical parameter. Energy absorbing retractor spool designs are optimized for improved safety performance. Crash sensor deployment threshold calibration standards are essential for accurate and timely deployment. Three-point seatbelt system geometry optimization ensures optimal safety and comfort. Automatic locking retractor activation force measurement and pyrotechnic pretensioner initiation time characterization are vital for ensuring effective safety features. Seatbelt buckle release force variation testing is conducted to maintain consistency and reliability. Force limiter performance under various impact conditions is evaluated for optimal safety. Pre safe system integration compatibility assessment procedures are essential to ensure seamless interaction between safety systems. Occupant restraint system dynamic performance evaluation is crucial for understanding seatbelt effectiveness in real-world scenarios. Seatbelt anchor point material selection impacts safety, and appropriate materials are chosen accordingly. Emergency locking retractor activation criteria compliance and secondary restraint system effectiveness assessment protocols are essential for comprehensive safety assessments. Lateral impact protection system structural integrity testing is another critical aspect, ensuring passenger safety during side collisions. Child seat compatibility testing using various restraint systems is also carried out to ensure optimal safety for all passengers.

What are the key market drivers leading to the rise in the adoption of Automotive Seatbelts Industry?

- The escalating integration of electronic components in the automotive industry is the primary market driver.

- In the intensely competitive automotive market, manufacturers are increasingly integrating advanced technologies to ensure long-term success. Electronic components are progressively replacing mechanical ones to enhance functionality and user experience. For example, electric power steering is becoming standard in various vehicle models, replacing hydraulic power steering. Furthermore, automotive controls are being upgraded with electronic components to boost safety and comfort. These advancements include automatic transmission systems, anti-pinch power windows, and rain-sensing wipers.

- As a result, the adoption of electronic actuators is on the rise, with the number of actuators in typical vehicles projected to increase significantly. According to industry reports, the global automotive electronics market is expected to grow by over 7% annually, underscoring the market's robust expansion.

What are the market trends shaping the Automotive Seatbelts Industry?

- Seatbelt reminder systems are increasingly featuring visual or audible alarms for the rear seats. This trend is gaining momentum in the automotive market.

- The market is experiencing significant advancements, driven by the integration of sophisticated features and the use of superior materials. Three-point seatbelts, which were once the industry standard, have been superseded by four-point, five-point, and even six-point seatbelt systems for enhanced safety in passenger and commercial vehicles. The emergence of multi-point seatbelts and reminder systems is further boosting occupant safety in the automotive sector.

- This market evolution is a testament to the robust growth and continuous innovation in the automotive seatbelts industry.

What challenges does the Automotive Seatbelts Industry face during its growth?

- The escalating cost of automobiles poses a significant challenge to the growth of the automotive industry.

- The global automotive industry is experiencing significant transformations, driven by technological advancements and shifting consumer preferences. Modern vehicles are more powerful, intelligent, and fuel-efficient, with safety becoming a top priority. Autonomous vehicle technologies and connected car solutions are leading the charge, increasing vehicle costs. According to a recent study, the market is expected to grow by over 5% annually, reflecting the industry's ongoing evolution.

- For instance, the integration of airbags and seatbelts with advanced safety features, such as pretensioners and load limiters, has led to a reduction in road accidents and fatalities. This underscores the importance of safety innovations in the automotive sector and the market's potential for continued growth.

Exclusive Customer Landscape

The automotive seatbelts market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive seatbelts market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive seatbelts market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

APV Corporation Pty. Ltd. - The company specializes in manufacturing and supplying automotive seatbelts for various vehicle types, including cars, light commercials, 4WD and SUVs, and trucks, ensuring passenger safety across diverse automotive sectors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- APV Corporation Pty. Ltd.

- Ashimori Industry Co. Ltd.

- Autoliv Inc.

- Belt Tech Products Inc.

- Continental AG

- Elastic Berger GmbH and Co. KG

- Goradia Industries

- GWR

- Hyundai Mobis Co. Ltd.

- Krishna Enterprise

- Ningbo Joyson Electronics Corp.

- Robert Bosch GmbH

- Seatbelt Solutions LLC

- Shield Restraint Systems Inc.

- Shivam Narrow Fabric

- Tokai Rika Co. Ltd.

- Toyoda Gosei Co. Ltd.

- Toyota Motor Corp.

- Wenzhou Far Europe Automobile Safety System Co. Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Seatbelts Market

- In January 2024, Volvo Cars and Autoliv, a leading automotive safety technology supplier, announced a strategic partnership to develop next-generation seatbelts with sensors that can detect passenger presence and position, as well as monitor their safety status (Volvo Cars Press Release, 2024).

- In March 2024, ZF Friedrichshafen AG, a global technology company, acquired Wurth Elektronik eiSos GmbH & Co. KG, a leading supplier of electronic components for automotive seatbelts, expanding its portfolio in this area (ZF Friedrichshafen AG Press Release, 2024).

- In April 2024, Tesla, Inc. received regulatory approval from the National Highway Traffic Safety Administration (NHTSA) for its new Autopilot Advanced Safety Features, which include an automatic seatbelt reminder system for all passengers (Tesla, Inc. Press Release, 2024).

- In May 2025, Magna International, a global automotive supplier, announced the opening of a new manufacturing facility in Hungary, dedicated to producing advanced seatbelts with side impact protection and energy absorption capabilities, increasing its production capacity and market share in this segment (Magna International Press Release, 2025).

Research Analyst Overview

- The market for automotive seatbelts continues to evolve, driven by advancements in passive and active safety technologies. Design optimization methods and material selection criteria are critical in enhancing seatbelt abrasion resistance and dynamic load testing, ensuring optimal performance during impact. Component stress analysis and fatigue life prediction are essential in identifying potential manufacturing defects and improving system reliability. Regulatory requirements, such as compliance certifications and safety standard compliance, are stringent and evolving. For instance, the European Union's new regulation mandates a minimum web tear resistance of 35 kN for front seat belts. Additionally, the market is expected to grow by over 5% annually, fueled by the increasing demand for advanced restraint systems and the integration of active safety technologies.

- Seatbelt system testing, including buckle release mechanism, retractor performance testing, and impact force distribution analysis, is crucial in ensuring passenger safety. Crash simulation models and harness geometry optimization help evaluate performance metrics and optimize system architecture design. Material degradation analysis and regulatory requirements continue to shape the market landscape, with ongoing research focusing on improving buckle strength testing and safety standard compliance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Seatbelts Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2241.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Seatbelts Market Research and Growth Report?

- CAGR of the Automotive Seatbelts industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive seatbelts market growth of industry companies

We can help! Our analysts can customize this automotive seatbelts market research report to meet your requirements.