Automotive Pedestrian Protection System Market Size 2024-2028

The automotive pedestrian protection system market size is forecast to increase by USD 653.5 million at a CAGR of 6.1% between 2023 and 2028.

- The Automotive Pedestrian Protection System (PPS) market is experiencing significant growth due to the increasing number of pedestrian accidents worldwide. According to the World Health Organization, approximately 27,000 pedestrians are killed annually, accounting for 24% of all road traffic fatalities. This alarming trend is driving automotive manufacturers to invest in advanced PPS technologies, such as pedestrian airbags, to mitigate the risk of injuries and fatalities. However, the market growth is not without challenges. One of the major challenges is the high degree of inaccuracy in current PPS systems. These systems often fail to detect small or unexpected pedestrian impacts, leading to less adoption and skepticism from consumers.

- Moreover, the integration of these systems into existing vehicle structures can be complex and costly. Despite these challenges, the future of PPS looks promising. The era of active front panels is upon us, with manufacturers exploring the use of sensors and advanced materials to create more accurate and effective systems. As technology advances, we can expect to see more precise detection and response capabilities, leading to a reduction in pedestrian accidents and fatalities. Companies seeking to capitalize on this market opportunity must focus on developing accurate and cost-effective PPS solutions while navigating the complex regulatory landscape and addressing consumer concerns.

What will be the Size of the Automotive Pedestrian Protection System Market during the forecast period?

- The market in the United States is experiencing significant growth, driven by the increasing prioritization of traffic safety and the integration of advanced driver assistance systems (ADAS) into vehicle design and engineering. These systems, which include pedestrian detection, emergency braking, and limb protection, are becoming increasingly important as urban mobility evolves and the adoption rate of automated driving systems rises. The market is also influenced by vehicle safety standards, regulations, and research, which continue to push for innovation in vehicle safety technology. Commercial vehicles and electric vehicles are also adopting these systems to enhance vehicle security and ensure pedestrian safety.

- The future of transportation is characterized by a focus on accident prevention and the development of autonomous driving systems, which will further drive demand for pedestrian protection technologies. Safety technology trends include blind spot monitoring, lane departure warning, collision avoidance systems, and pedestrian awareness systems. Vehicle safety testing and vehicle safety innovations are ongoing areas of investment and research in the market.

How is this Automotive Pedestrian Protection System Industry segmented?

The automotive pedestrian protection system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Passive

- Active

- Geography

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- South America

- Middle East and Africa

- Europe

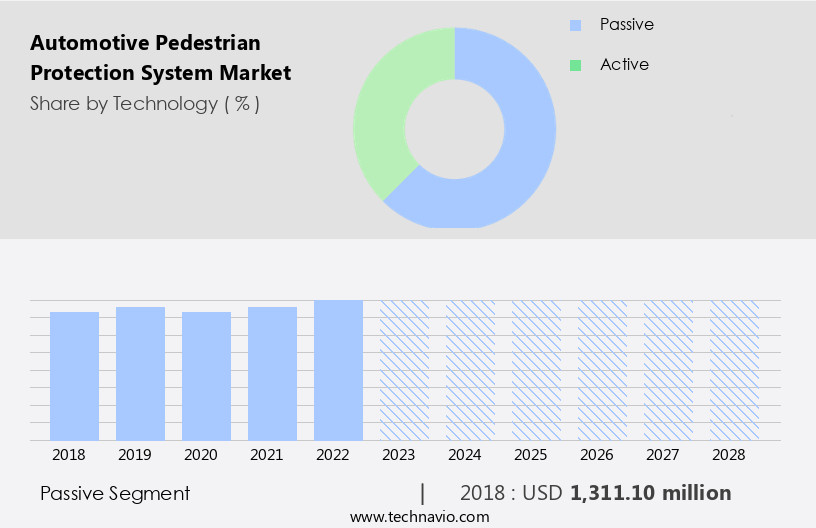

By Technology Insights

The passive segment is estimated to witness significant growth during the forecast period.

The market primarily consists of passive and active systems. Passive systems, which include external airbags and engine hood designs, are cost-effective and are widely used due to their lower price point compared to active systems. These passive systems are essential components of automobile safety features, enhancing overall safety for both vehicle occupants and pedestrians. The passenger car industry plays a significant role in assessing a country's economic growth, as the demand for passenger cars is directly linked to the population's disposable income. Among various applications, the passenger car segment dominates the global automotive industry in terms of both volume and revenue.

This trend is expected to continue due to the increasing sales in emerging economies. Advanced safety systems, such as collision avoidance sensors, lane departure warnings, and radar systems, are becoming increasingly common in both passenger cars and commercial vehicles. These systems utilize various detection technologies, including cameras, sensors, and machine learning algorithms, to identify obstacles and potential collisions. Electronic stability control, traction control, and electronic brake-force distribution are other essential safety features that contribute to the overall safety of vehicles. Moreover, technological advancements, such as human machine interfaces, actuators, and electronic control units, have significantly improved the functionality and convenience of pedestrian protection systems.

These advancements have led to the development of collision avoidance systems, which can detect pedestrians and issue warnings to prevent accidents. Additionally, electric and hybrid vehicles, as well as autonomous vehicles, are increasingly incorporating pedestrian protection systems to enhance safety and meet stringent safety regulations. Pedestrian safety ratings have become crucial for vehicle manufacturers, as consumers demand safer vehicles. The aftermarket for pedestrian protection systems is also growing, with parking assistance and tire pressure monitors being popular additions. Large commercial vehicles, such as trucks and buses, are also implementing pedestrian protection systems to prevent accidents and improve road safety. Investments in research and development, as well as the integration of telematics and ADAS, are driving the growth of the market.

These systems not only help prevent accidents but also contribute to reducing automotive emissions and improving overall driving situations. The future of automotive pedestrian protection systems lies in the integration of advanced safety systems, machine learning algorithms, and convenient features that enhance the driving experience while ensuring the safety of all road users.

Get a glance at the market report of share of various segments Request Free Sample

The Passive segment was valued at USD 1311.10 million in 2018 and showed a gradual increase during the forecast period.

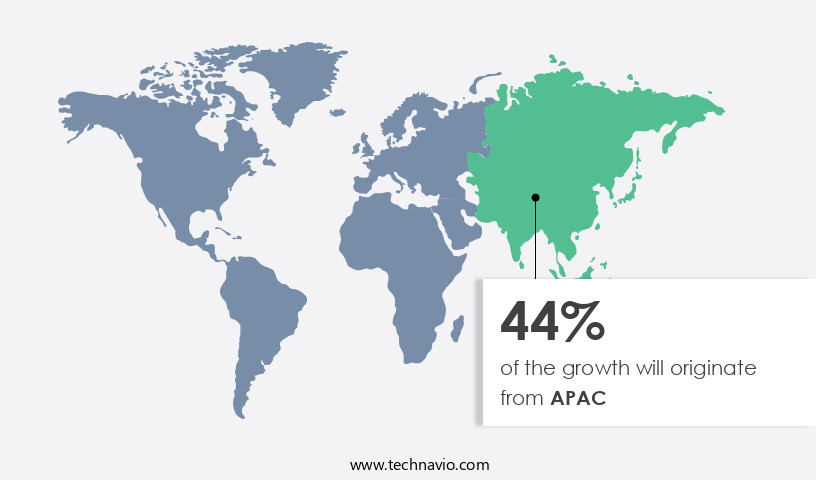

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European automotive market plays a significant role in the global pedestrian protection system industry. Strict safety and emission regulations in Europe have driven the demand for advanced safety systems, including Pedestrian Protection Systems (PPS), in vehicles. Despite a threefold increase in European road traffic over the past three decades, road safety has significantly improved. This can be attributed to the mandatory installation of certain levels of Advanced Driver-Assistance Systems (ADAS), such as PPS, in all vehicles. European governments prioritize safety and emission norms, making the region a key market for pedestrian protection technology. Pedestrian safety is a critical concern, as accidents caused by driver negligence are common.

PPS is designed to mitigate these accidents by detecting and alerting drivers to potential collisions with pedestrians. The system utilizes various technologies like cameras, sensors, radar, and machine learning to identify pedestrians and assess the risk of a collision. The integration of PPS with other automotive systems, such as traction control, electronic stability control, and airbags, enhances overall vehicle safety. The adoption of PPS is not limited to passenger cars; it is also gaining popularity in electric and hybrid vehicles, as well as commercial vehicles. The advantages of PPS extend beyond collision avoidance, as it also includes features like parking assistance, lane departure warnings, and tire pressure monitors.

Investments in technological advancements, such as machine learning and human-machine interface, further enhance the functionality and convenience of PPS. The future of pedestrian protection lies in the integration of active systems, such as active hoods and collision avoidance sensors, which can actively protect pedestrians in the event of an accident. The European automotive industry's focus on safety and regulatory compliance makes it a prime market for pedestrian protection systems. The industry's continuous efforts to improve safety features and reduce road traffic injuries further bolster the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Pedestrian Protection System Industry?

- Rising number of pedestrian accidents helping growth of PPS is the key driver of the market.

- Pedestrian accidents can result in various injuries, with the lower or upper leg being the most common areas affected in low-velocity impacts. These injuries are primarily due to the impact with the vehicle or surrounding obstacles. In high-velocity accidents, the risk of secondary impacts with the upper bonnet, windscreen, or windscreen surround increases, potentially leading to head injuries. Additionally, there is a risk of tertiary impacts on the ground, resulting in multiple topples and hits. These incidents can be severe and may even lead to fatalities. The automotive industry recognizes the importance of pedestrian protection systems to mitigate these risks and ensure passenger and pedestrian safety.

- Market research firms like , , and provide insights into the market dynamics and trends of these systems. These studies highlight the increasing demand for advanced safety features, stringent regulations, and technological advancements as key factors driving the growth of the market.

What are the market trends shaping the Automotive Pedestrian Protection System Industry?

- Pedestrian protection airbags: Era of active front panel is the upcoming market trend.

- The market focuses on the implementation of technologies that ensure the safety of pedestrians in case of a collision with a vehicle. Inactive front panel systems, a common feature in this market, utilize the front panel of the vehicle as a cowcatcher to prevent pedestrians from being pulled under the truck. This is accomplished through airbag technology that pushes out the front panel, creating a clearance between the panel and the grille and other rigid structures. However, in instances where adequate cushioning is lacking, the head of a pedestrian may collide with the front panel at a velocity that exceeds its safe limit.

- To address such cases, innovations like outside airbags are employed to provide the necessary cushioning. These systems play a crucial role in minimizing the severity of injuries or fatalities resulting from pedestrian-vehicle collisions.

What challenges does the Automotive Pedestrian Protection System Industry face during its growth?

- High degree of inaccuracy in PPS leading to less adoption is a key challenge affecting the industry growth.

- The current Automotive Pedestrian Protection Systems (PPS) in the market, aside from automatic emergency braking, share a common limitation. These systems, evaluated through live tests, employ a crash dummy to assess their efficiency. During trials at varying speeds, the test vehicles successfully halted with a safe distance between the dummy and the vehicle. However, unfortunate incidents have occurred where the dummy was left devastatingly impacted on the ground due to the PPS's miscalculation of the necessary stopping distance. As a professional and knowledgeable assistant, it's crucial to acknowledge the challenges faced by these systems and the need for continuous improvement.

- Ensuring the safety of pedestrians remains a top priority in the automotive industry, and addressing the inaccuracies of current PPS offerings is essential for advancing pedestrian safety technology.

Exclusive Customer Landscape

The automotive pedestrian protection system market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive pedestrian protection system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive pedestrian protection system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aptiv Plc - The company specializes in advanced automotive safety technologies, including V2X systems. These systems enhance vehicle safety, comfort, and convenience by facilitating real-time communication between vehicles and their surroundings. By leveraging vehicle-to-everything (V2X) connectivity, these systems can detect and respond to potential hazards, improving overall road safety. Additionally, they offer seamless integration with smart city infrastructure, enabling vehicles to adapt to changing traffic conditions and optimize travel routes. This innovative approach to automotive safety aligns with our commitment to pushing the boundaries of technology and delivering superior solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aptiv Plc

- Autoliv Inc.

- BorgWarner Inc.

- Continental AG

- DENSO Corp.

- Ford Motor Co.

- Hitachi Ltd.

- Honda Motor Co. Ltd.

- Magna International Inc.

- Marelli Holdings Co. Ltd.

- Mobileye Technologies Ltd.

- Porsche Automobil Holding SE

- Renault SAS

- Robert Bosch GmbH

- Stellantis NV

- SUBARU Corp.

- Toyota Motor Corp.

- Valeo SA

- Volvo Car Corp.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive industry continues to prioritize pedestrian protection as a critical safety feature in passenger cars and commercial vehicles. Pedestrian protection systems have evolved significantly over the years, integrating various technologies to enhance safety and minimize the risk of accidents. One of the key components of these systems are sensors and cameras, which enable early detection of pedestrians and other obstacles. These sensors utilize Doppler velocity technology to assess the distance and velocity of pedestrians, allowing for timely warning signals or even automatic braking. The integration of machine learning algorithms further enhances the functionality of these sensors, improving their ability to accurately detect and respond to various driving situations.

Pedestrian protection systems also include external passive systems, such as airbags and external airbags, designed to absorb the impact of a collision and protect pedestrians from serious injury. These systems have been shown to be effective in reducing road traffic injuries and fatalities. Hybrid and electric vehicles have also adopted pedestrian protection systems, with traction control and electronic stability control being essential components. These systems ensure optimal capacity utilization, enabling vehicles to respond effectively to unexpected pedestrian encounters. Telematics and connectivity features, such as lane departure warnings and blind spot crashes, have become increasingly popular in automotive production.

These systems provide real-time information to drivers, allowing them to make informed decisions and avoid potential accidents. Safety regulations continue to drive investments in advanced safety systems, including collision avoidance sensors and active systems like active hoods and EBD. These active systems offer advantages over passive pedestrian protection, providing a more proactive approach to safety. Autonomous vehicles represent the future of automotive safety, with collision avoidance systems and human-machine interfaces playing a crucial role in ensuring safe and convenient transportation. These systems utilize radar systems and electronic control units to assess driving situations and respond accordingly. Despite the technological advancements, pedestrian protection remains a complex issue, with various factors influencing the effectiveness of these systems.

The driving situation, vehicle design, and user behavior all play a role in the overall safety of pedestrian protection systems. In , the automotive industry continues to invest in pedestrian protection systems, integrating various technologies to enhance safety and minimize the risk of accidents. From sensors and cameras to active systems and connectivity features, these systems represent a significant advancement in automotive safety. However, ongoing research and development are necessary to address the complexities of pedestrian protection and ensure the continued effectiveness of these systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2024-2028 |

USD 653.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.7 |

|

Key countries |

US, China, Germany, UK, Japan, Canada, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Pedestrian Protection System Market Research and Growth Report?

- CAGR of the Automotive Pedestrian Protection System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive pedestrian protection system market growth of industry companies

We can help! Our analysts can customize this automotive pedestrian protection system market research report to meet your requirements.