Automotive Rental And Leasing Market Size 2024-2028

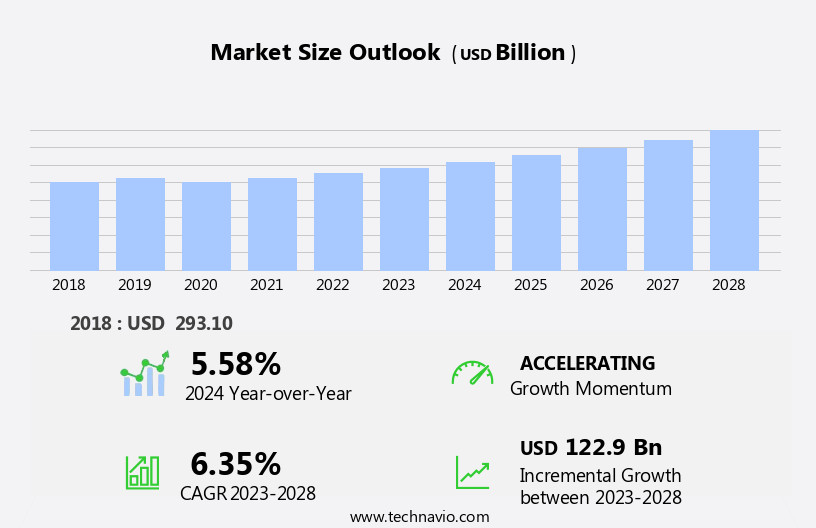

The automotive rental and leasing market size is forecast to increase by USD 122.9 billion at a CAGR of 6.35% between 2023 and 2028.

What will be the Size of the Automotive Rental And Leasing Market during the forecast period?

How is this Automotive Rental And Leasing Industry segmented and which is the largest segment?

The automotive rental and leasing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Passenger car rental

- Truck utility trailer

- Recreational vehicle rental and leasing

- Passenger car lease

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Type Insights

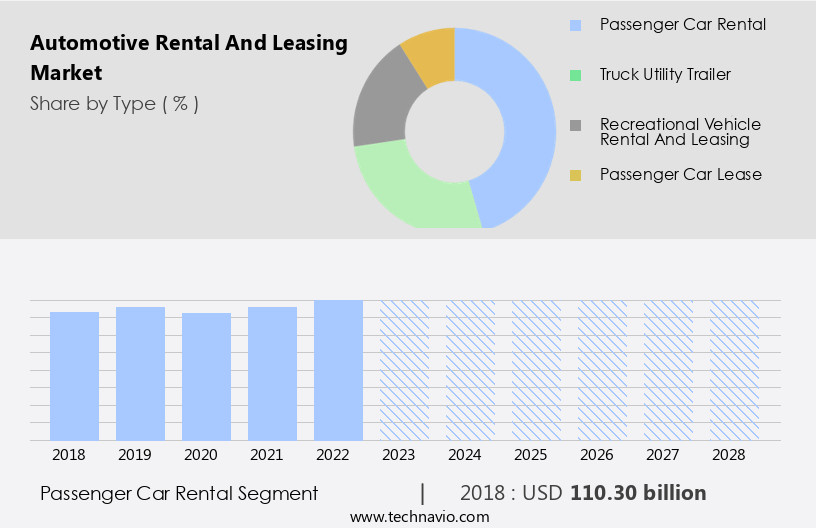

- The passenger car rental segment is estimated to witness significant growth during the forecast period.

The market has experienced notable growth, particularly In the passenger car rental sector. This trend is driven by various factors, including the need for economic mobility solutions and the aging of existing vehicles. Automakers have responded by offering attractive leasing programs, enabling small businesses to expand their fleets without substantial financial burden. The passenger car rental industry is further influenced by the increasing acceptance of this mobility concept worldwide and the evolving transportation requirements of businesses. Additionally, emerging trends such as e-commerce, big data, blockchain, and on-demand taxi services are transforming the industry landscape. The rental and leasing segments encompass a wide range of vehicles, including cars, trucks, vans, utility trailers, recreational vehicles, and electric vehicles.

These offerings cater to diverse customer needs, from compact city hopping to long-distance driving and off-road trips. The rental agreement, lease agreement, and insurance details are crucial aspects of this market, with lenders, dealerships, and rental companies playing significant roles In the transaction process. The integration of smart cities initiatives, urbanization, and public transportation systems further underscores the importance of the market In the modern transportation landscape.

Get a glance at the market report of share of various segments Request Free Sample

The Passenger car rental segment was valued at USD 110.30 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

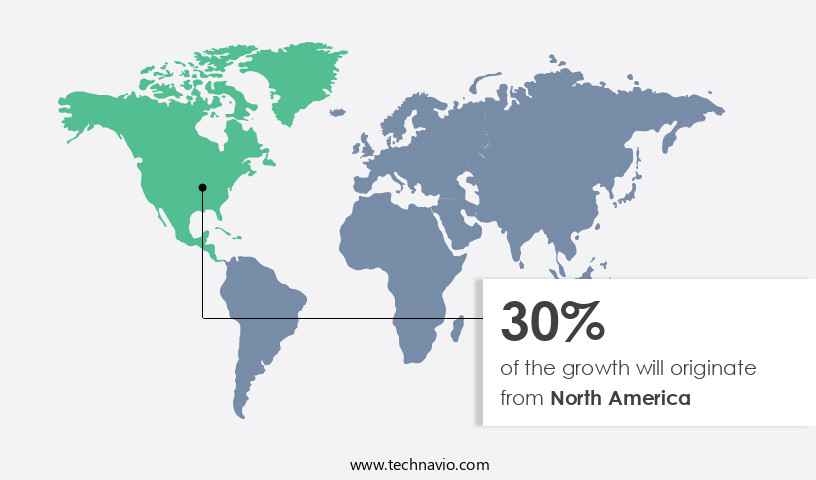

- North America is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market holds a significant share In the global industry and is expected to lead during the forecast period. Factors contributing to this growth include the rise in leisure and business travel within and outside the region, as well as the increasing preference for rental services. Notable market participants, such as Avis Budget Group and Enterprise Rent-a-Car, are based in North America and are expanding their services in various locations. The trend toward rental services is expected to boost revenue generation. Key sectors, including e-commerce, tourism, and urbanization, are integrating automotive rental and leasing services into their operations, further fueling market growth.

Additionally, the adoption of technologies like big data, blockchain, and on-demand taxi services is transforming the industry. The market encompasses various vehicle types, including cars, trucks, vans, utility trailers, recreational vehicles, electric vehicles, and more. Lease and rental agreements, lender arrangements, repairs, maintenance, insurance, and payment details are integral components of this market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Rental And Leasing Industry?

Growing urbanization and industrialization boost market growth is the key driver of the market.

What are the market trends shaping the Automotive Rental And Leasing Industry?

Robust growth of travel and tourism industry is the upcoming market trend.

What challenges does the Automotive Rental And Leasing Industry face during its growth?

Lack of awareness in tier two cities is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The automotive rental and leasing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive rental and leasing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive rental and leasing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Al Futtaim Group Co. - The company provides automotive rental and leasing solutions through its subsidiaries, including Hertz, Al Futtaim Vehicle Rentals, Firefly, and Thrifty. These brands offer comprehensive vehicle rental services to customers, ensuring a seamless experience and enhancing search engine visibility for the company. Our professional approach aligns with the company's commitment to delivering quality services In the transportation industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Al Futtaim Group Co.

- Aspark Holidays Pvt. Ltd.

- Avis Budget Group Inc.

- Carzonrent India Pvt. Ltd.

- Centauro Rent a Car S.L.U.

- DriiveMe Ltd.

- Drivezy India Travels Pvt. Ltd.

- Enterprise Holdings Inc.

- Europcar Mobility Group SA

- Expedia Group Inc.

- Getaround Inc.

- Green Motion International

- Hertz Global Holdings Inc.

- Localiza Rent a Car SA

- Mercedes Benz Group AG

- Turismo Gargo SAÂ de CV

- Movida Participacoes SA

- OK Group

- SIXT SE

- Zoomcar India Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the provision of short-term and long-term mobility solutions for various types of vehicles, including cars, trucks, vans, utility trailers, recreational vehicles, and electric vehicles. This industry caters to diverse customer needs, ranging from e-commerce businesses requiring delivery vehicles to tourists seeking travel convenience. The automotive rental and leasing sector is influenced by several market dynamics. The advent of e-commerce has led to an increase in demand for delivery vehicles, particularly during peak seasons. Big data and blockchain technology are revolutionizing the industry by streamlining processes, enhancing customer service, and ensuring transparency in transactions. The rise of on-demand taxi services and the tourism industry have also contributed to the growth of the market.

However, revenue losses due to shutdowns and social distancing measures imposed in response to the global health crisis have presented challenges. The shift towards working from home and urbanization have led to a decline in public transportation usage, making personal vehicles a more attractive option for many consumers. Smart cities initiatives and the development of public transportation systems are expected to influence the market dynamics In the coming years. A vehicle lease agreement is a contractual arrangement between a lender and a renter, outlining the terms and conditions of the lease. The agreement covers aspects such as repairs, maintenance, insurance, and payment details.

The type of vehicle, duration of the lease, and monthly fee are essential factors influencing the lease agreement. Renting a vehicle offers flexibility and convenience for various purposes, including compact city hopping, long-distance driving, and off-road trips. The choice between renting and leasing depends on individual needs, preferences, and financial considerations. The market is a dynamic and evolving industry, shaped by various factors, including technological advancements, changing consumer preferences, and economic conditions. As the market continues to grow and adapt, it presents numerous opportunities for businesses and investors. In summary, the market offers mobility solutions for various types of vehicles, catering to diverse customer needs.

The industry is influenced by several market dynamics, including e-commerce, technology, and urbanization, among others. The choice between renting and leasing depends on individual needs and preferences. The lease agreement outlines the terms and conditions of the lease, covering aspects such as repairs, maintenance, insurance, and payment details.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.35% |

|

Market growth 2024-2028 |

USD 122.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.58 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Rental And Leasing Market Research and Growth Report?

- CAGR of the Automotive Rental And Leasing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive rental and leasing market growth of industry companies

We can help! Our analysts can customize this automotive rental and leasing market research report to meet your requirements.