Car Leasing Market Size 2025-2029

The car leasing market size is forecast to increase by USD 55.3 billion, at a CAGR of 8.7% between 2024 and 2029. Rising technological obsolescence of older cars will drive the car leasing market.

Major Market Trends & Insights

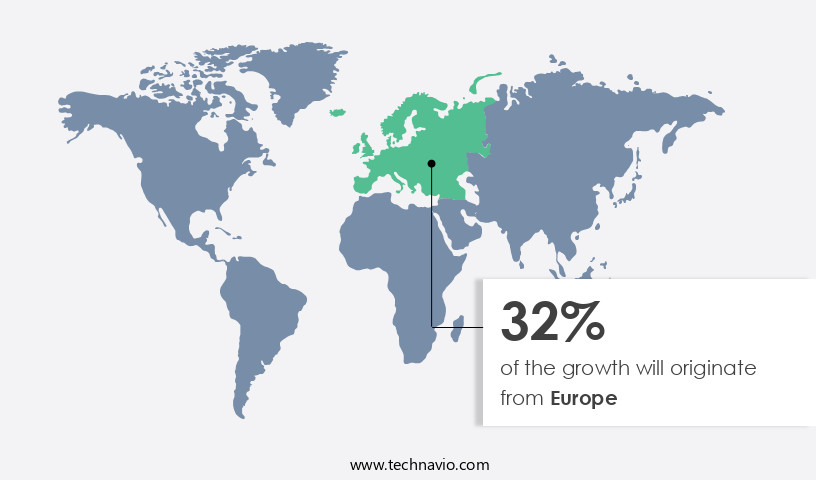

- Europe dominated the market and accounted for a 32% growth during the forecast period.

- By End-user - Commercial segment was valued at USD 65.20 billion in 2023

- By Type - Open-ended segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 88.60 billion

- Market Future Opportunities: USD 55.30 billion

- CAGR : 8.7%

- Europe: Largest market in 2023

Market Summary

- The market is an ever-evolving landscape shaped by technological advancements, customer preferences, and regulatory frameworks. Core technologies like telematics and electric vehicles are revolutionizing the industry, enabling real-time vehicle monitoring and reducing emissions, respectively. Applications such as personal and business leasing continue to dominate, while flexible leasing options like short-term and long-term leases cater to diverse customer needs.

- Key companies, including LeasePlan Corporation NV and ALD Automotive, account for a significant market share. Regulations, such as emission norms and safety standards, pose challenges but also create opportunities for innovation. Looking ahead, the market is forecasted to remain dynamic, with off-lease cars fueling the used car market, and limited customer awareness and acceptance in semi-urban and rural areas presenting opportunities for growth.

What will be the Size of the Car Leasing Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Car Leasing Market Segmented and what are the key trends of market segmentation?

The car leasing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial

- Non-commercial

- Type

- Open-ended

- Close ended

- Vehicle Type

- Hatchback

- Sedan

- SUV

- Crossover

- Propulsion

- ICE

- Electric

- Distribution Channel

- Leasing Companies

- Dealerships

- Online Platforms

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The commercial segment is estimated to witness significant growth during the forecast period.

Car leasing has become an increasingly popular solution for small and medium-sized enterprises (SMEs) seeking cost-effective transportation options for their employees. Leasing allows SMEs to enter into agreements with car leasing companies, providing access to vehicles without the significant upfront costs associated with purchasing. These contracts typically include the option for employees to purchase the vehicles at their residual value upon lease termination. Tax benefits are another significant advantage of car leasing for businesses. Monthly lease payments are used to calculate taxes, as opposed to the entire vehicle purchase price. Some leasing companies offer additional perks, such as fuel charges and maintenance costs, incorporated into the monthly lease payments.

Fleet management is a crucial aspect of car leasing, with software solutions enabling businesses to monitor vehicle usage, maintenance schedules, and compliance with regulations. Automated payment processing and insurance policy integration streamline the leasing process, while digital lease management and online applications offer convenience and flexibility. Future industry growth is expected to continue, with an estimated 20% of SMEs projected to adopt car leasing by 2025. Additionally, the market is anticipated to grow by 15% in the next five years, driven by the increasing popularity of flexible lease terms and the integration of advanced technologies like digital lease management systems and fraud detection systems.

Lease term flexibility, risk assessment models, and compliance regulations are essential considerations for businesses engaging in car leasing. Lease payment schedules, lease term flexibility, and financing options comparison are critical factors when selecting a leasing provider. Vehicle depreciation rates, mileage limits, and contract renewal strategies also impact the overall cost and effectiveness of car leasing. Portfolio risk management and lease administration systems help businesses manage their leasing operations efficiently. Mileage limits, maintenance cost estimation, lease buyout options, and tax implications are essential components of lease contract terms that businesses must carefully consider. In conclusion, car leasing offers numerous benefits for SMEs, including cost savings, tax advantages, and flexible lease terms.

The market is growing rapidly, driven by the adoption of advanced technologies and the increasing popularity of digital lease management systems. By understanding key market trends and considerations, businesses can make informed decisions when engaging in car leasing.

The Commercial segment was valued at USD 65.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Car Leasing Market Demand is Rising in Europe Request Free Sample

The North American the market holds approximately one-quarter of the global market share, with quality infrastructure, high purchasing power, and favorable consumer lifestyle driving its growth. Despite this, the market faces challenges from increasing public debt, which may lead to higher inflation rates and decreased affordability for middle-class individuals. In 2020, around 30% of new vehicle registrations in the US were leases, representing a 4% year-over-year increase. Furthermore, the average lease term in the US is 31 months, while the average monthly lease payment is USD489.

Additionally, the number of new leased vehicles in Canada reached over 250,000 units in 2020, marking a 2% year-over-year growth. These trends indicate the continuous evolution and increasing popularity of car leasing in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and intricate business landscape, characterized by various factors that influence its growth and profitability. One significant challenge for leasing companies is the impact of mileage exceeding the lease agreement. Calculating lease buyout values accurately and managing vehicle maintenance costs effectively are essential to mitigate potential losses. Effective fleet management techniques, such as minimizing lease portfolio risk, optimizing lease payment schedules, and improving customer onboarding experiences, are crucial for success in this market. Lease contract negotiation strategies are also vital, as they can significantly impact lease profitability. Automated lease contract generation and lease accounting standards compliance are essential to streamline administrative processes and ensure regulatory adherence.

Predicting customer lease renewals and mitigating risk early lease termination are critical for maintaining a healthy lease portfolio. Analyzing lease portfolio performance, enhancing customer satisfaction scores, and improving lease sales conversion rates are key performance indicators for car leasing companies. Effective management of the vehicle lifecycle and implementing digital lease management systems can further reduce operational costs and improve lease portfolio profitability. For instance, a leading car leasing company reported a 12% reduction in lease operational costs after implementing digital lease management solutions. In contrast, another company experienced a 5% increase in lease sales conversion rates by optimizing their lease payment schedules.

These figures highlight the potential impact of strategic initiatives on the market performance. In conclusion, the market requires a comprehensive approach to managing lease portfolios, optimizing lease payments, and ensuring regulatory compliance. By focusing on these areas and implementing effective fleet management techniques, companies can minimize risk, reduce operational costs, and improve profitability.

What are the key market drivers leading to the rise in the adoption of Car Leasing Industry?

- The increasing technological obsolescence of older cars serves as the primary market driver, as consumers seek more advanced features and improved performance in their vehicles.

- The automotive industry is experiencing a fusion of technologies from various sectors, including telecommunications, connectivity, artificial intelligence, metals, and heavy industries. This convergence is propelling the creation of advanced technologies and materials for modern vehicles. New vehicle models with alluring features entice existing car owners to upgrade, while the significant cost of purchasing a new vehicle compared to leasing deters some buyers from making the switch.

- Consequently, the increasing availability of modern cars with innovative features during the forecast period is expected to boost the number of vehicles leased. The automotive landscape is continually evolving, with ongoing advancements in technology and industry collaborations shaping the future of transportation.

What are the market trends shaping the Car Leasing Industry?

- The trend in the used car market is being shaped by the increasing availability of off-lease cars. Off-lease vehicles, once returned to dealerships, are a significant contributor to this sector.

- In the dynamic global the market, a significant number of vehicles transition from being on-lease to off-lease annually. This influx of off-lease vehicles poses a challenge for car leasing companies, as an excessive inventory of these vehicles can negatively impact profits. Many car leasing firms provide the option for lessees to purchase the vehicle at the end of the lease term, which can result in the sale of off-lease cars as used vehicles. The increased supply of off-lease cars forces dealers to either lower lease package prices or sell these vehicles as used cars at substantial discounts to remain competitive.

- This trend is a common occurrence in the car leasing industry, affecting various sectors and markets worldwide. The continuous cycle of on-lease and off-lease vehicles presents an evolving landscape for car leasing companies, requiring them to adapt and innovate to maintain profitability.

What challenges does the Car Leasing Industry face during its growth?

- In semi-urban and rural areas, limited customer awareness and acceptance pose a significant challenge to the growth of the industry. This issue, which is crucial to acknowledge, stems from the lack of familiarity and acceptance among consumers in these regions, thereby hindering the industry's expansion.

- Car leasing, an alternative to car ownership, has yet to gain significant traction in semi-urban and rural markets. However, penetration in emerging countries and less urbanized areas remains limited. In these regions, car ownership is often viewed as a status symbol, making leasing an unappealing option. Furthermore, leasing terminologies can be confusing for potential customers, such as money factor, residual value, and capitalized costs.

- These complexities deter many from considering car leasing. Despite its potential benefits, including lower monthly payments and access to newer vehicles, the market's reach is still constrained. The car leasing industry must address these challenges to expand its customer base and unlock new opportunities.

Exclusive Customer Landscape

The car leasing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the car leasing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Car Leasing Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, car leasing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALD Automotive - This company specializes in automotive leasing, providing customers with access to both new and pre-owned vehicles through its leasing services. The leasing options cater to various budgets and preferences, ensuring a diverse range of choices for consumers in the market for a new set of wheels.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALD Automotive

- Alphabet (BMW Group)

- Arval ( uBNP Paribas

- Avis Budget Group

- CarNext

- Daimler Mobility

- Enterprise Holdings

- Europcar Mobility Group

- Hertz

- Hitachi Capital

- LeasePlan

- Lex Autolease

- Mercedes-Benz Financial Services

- Northgate

- ORIX Corporation

- SG Fleet

- Sixt Leasing

- Toyota Financial Services

- Volkswagen Financial Services

- Zenith

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Car Leasing Market

- In January 2024, Hertz Global Holdings, Inc. Announced the launch of its new car leasing platform, "Hertz Lease," aimed at individuals and small businesses, marking a strategic expansion into the B2C the market (Hertz Global Holdings, Inc. Press Release).

- In March 2024, Volkswagen Financial Services AG and Alphabet, a BMW Group subsidiary, entered into a strategic partnership to offer joint fleet management solutions, combining Volkswagen's leasing expertise with Alphabet's fleet management technology (BMW Group Press Release).

- In May 2024, Fair, a digital car leasing company, raised USD100 million in a Series D funding round, led by BlackRock, to expand its operations and enhance its technology platform (Fair Press Release).

- In April 2025, the European Commission approved the merger of LeasePlan Corporation and ALD Automotive, creating the world's largest car leasing company, with a combined market share of approximately 35% (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Car Leasing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 55.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with key trends shaping its dynamics. One significant development is the integration of insurance policies, streamlining the leasing process and reducing administrative burdens for lessors and lessees. Automated payment processing further enhances convenience, ensuring timely and accurate rent payments. Vehicle condition reports play a crucial role in lease agreements, with data-driven lease pricing based on vehicle history and current market conditions. Fleet management software facilitates efficient lease administration, while lease accounting standards ensure financial transparency. Operating lease contracts and credit scoring models help lessors assess risk and set competitive lease terms. Digital lease management and online lease applications enable a seamless customer experience.

- Compliance regulations continue to shape lease contract terms, with fraud detection systems and risk assessment models minimizing potential risks. Lease term flexibility, monthly lease payments, and lease buyout options cater to diverse customer needs. Tax implications and residual value prediction are essential considerations in lease agreements. Customer segmentation models and lease payment schedules enable targeted marketing and improved customer engagement. Portfolio risk management strategies help lessors mitigate risks and optimize their lease offerings. Mileage limits impact vehicle acquisition costs and lease term flexibility. Contract renewal strategies and financing options comparison enable lessors to offer competitive lease terms and retain customers.

- Vehicle depreciation rates and lease administration systems further contribute to the evolving landscape of the market.

What are the Key Data Covered in this Car Leasing Market Research and Growth Report?

-

What is the expected growth of the Car Leasing Market between 2025 and 2029?

-

USD 55.3 billion, at a CAGR of 8.7%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Commercial and Non-commercial), Type (Open-ended and Close ended), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Vehicle Type (Hatchback, Sedan, SUV, and Crossover), Propulsion (ICE and Electric), and Distribution Channel (Leasing Companies, Dealerships, Online Platforms, and Others)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising technological obsolescence of older cars, Limited customer awareness and acceptance in semi-urban and rural areas

-

-

Who are the major players in the Car Leasing Market?

-

Key Companies ALD Automotive, Alphabet (BMW Group), Arval ( uBNP Paribas, Avis Budget Group, CarNext, Daimler Mobility, Enterprise Holdings, Europcar Mobility Group, Hertz, Hitachi Capital, LeasePlan, Lex Autolease, Mercedes-Benz Financial Services, Northgate, ORIX Corporation, SG Fleet, Sixt Leasing, Toyota Financial Services, Volkswagen Financial Services, and Zenith

-

Market Research Insights

- The market continues to evolve, with a growing emphasis on technology adoption and operational efficiency. Lease portfolio optimization and contract lifecycle management are key areas of focus, with payment processing systems streamlining transactions and reducing payment default rates. Technology adoption rates for contract renewal prediction and risk mitigation strategies have increased significantly, allowing businesses to proactively manage their lease portfolios and improve customer retention. Payment processing systems have also facilitated the integration of digital transformation initiatives, such as data analytics dashboards and compliance reporting systems. These tools enable real-time monitoring of lease performance indicators, including customer satisfaction scores, sales performance, and lease agreement negotiation metrics.

- Moreover, the implementation of fraud prevention measures and process automation tools has led to a decrease in customer churn and an increase in lease penetration rates. Despite these advancements, regulatory compliance remains a critical challenge for car leasing businesses. According to industry estimates, non-compliance costs can amount to 5-10% of a company's revenue. In contrast, businesses that prioritize regulatory compliance and due diligence processes can achieve higher contract renewal rates and stronger market share. For instance, a leading car leasing company reported a 15% increase in contract renewals after implementing a robust compliance reporting system. Another company observed a 10% reduction in customer acquisition cost following the adoption of lease accounting software and customer relationship management tools.

We can help! Our analysts can customize this car leasing market research report to meet your requirements.