Automotive Fleet Leasing Market Size 2024-2028

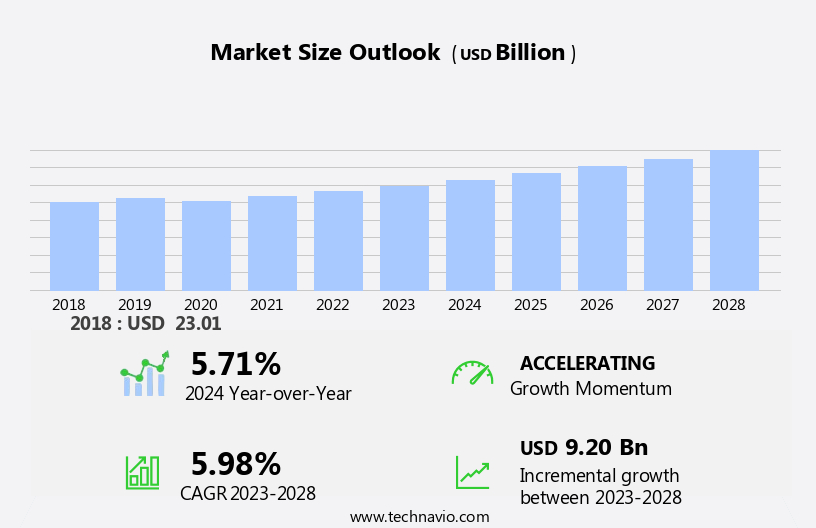

The automotive fleet leasing market size is forecast to increase by USD 9.20 billion at a CAGR of 5.98% between 2023 and 2028. The market is experiencing significant growth due to the increasing emphasis on cost-effective logistics and transportation solutions. The adoption of advanced technologies, such as GPS vehicle tracking and telematics, is enabling fleet managers to optimize routes, reduce idle time, and enhance fleet performance. These technologies also facilitate asset tracking and maintenance scheduling, leading to improved employee efficiency and customer satisfaction. Furthermore, the rise of electric and autonomous vehicles in the automotive fleet leasing industry is revolutionizing the way businesses manage their fleets. However, challenges remain, including limited customer awareness and acceptance in semi-urban and rural areas. To stay competitive, fleet leasing companies must continuously innovate and adapt to these trends and challenges.

What will be the Size of the Market During the Forecast Period?

The market is a significant sector within the transportation industry, catering to the needs of various businesses for motorized assets. This market encompasses a diverse range of vehicle types, including semi-tractors with trailers, small vehicles, medium-sized vehicles, and more. Businesses rely on fleet leasing to manage their daily transport activities, such as cargo transportation, service vans, rental cars, taxicabs, and even heavy machinery like bulldozers, backhoes, and skid-steer loaders. The choice of fuel type, such as gas, diesel, or aviation fuel, depends on the specific requirements of the business and the nature of the vehicles.

Furthermore, Fleet management plays a crucial role in this market, with businesses seeking efficient ways to manage their fleet operations. Fuel costs are a significant consideration, and fleet managers must ensure compliance with safety standards and various regulations. Preliminary steps in entering the fleet leasing market include analyzing business needs, considering the types of vehicles required, and evaluating the total cost of ownership. This includes not only the initial cost of the vehicle but also ongoing expenses like fuel, maintenance, and insurance. Businesses may require various types of vehicles for their operations, such as SUVs, pickup trucks, passenger vans, buses, and box trucks.

Moreover, the horsepower and other specifications of these vehicles will depend on the intended use. Fleet leasing companies offer flexible lease terms and customizable solutions to cater to the unique needs of businesses. They may also provide additional services, such as maintenance and repair, to ensure the smooth operation of their clients' fleets. In conclusion, the market offers businesses a cost-effective and efficient solution for managing their motorized assets. By carefully considering their business needs and evaluating the total cost of ownership, businesses can make informed decisions when choosing a fleet leasing provider.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Type

- Open ended

- Close ended

- Geography

- APAC

- China

- Europe

- Germany

- UK

- France

- North America

- US

- Middle East and Africa

- South America

- APAC

By Vehicle Type Insights

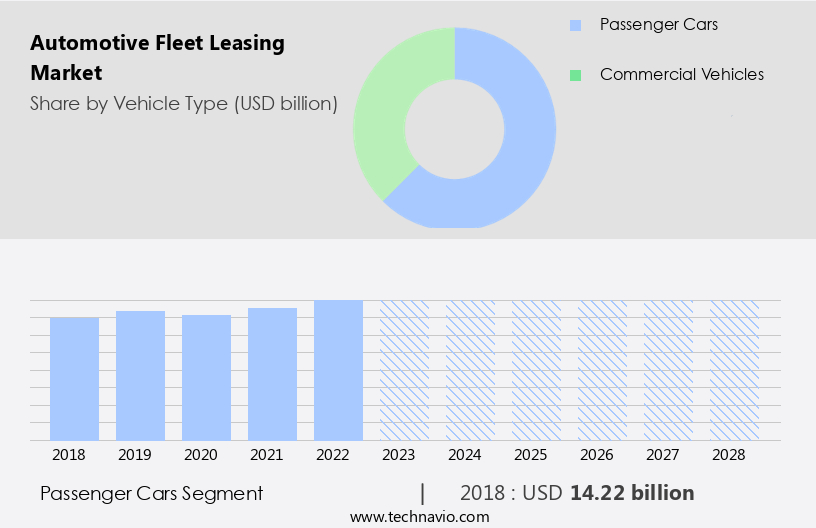

The passenger cars segment is estimated to witness significant growth during the forecast period. The passenger car segment is a crucial part of The market, serving diverse business needs and mirroring the shifting preferences of corporate vehicle users. This segment includes sedans, SUVs, and compact cars, making up a significant portion of the fleet leasing industry's offerings. Its versatility lies in its ability to cater to the transportation needs of businesses across various sectors, from corporations to transportation service providers. In recent times, there has been a notable trend towards incorporating eco-friendly and technologically advanced vehicles in the passenger cars segment. Service vans, rental cars, taxis, and construction equipment such as bulldozers, backhoes, and skid-steer loaders also constitute essential components of the market.

Furthermore, the fuel types used in these vehicles vary, with some relying on gas, while others prefer diesel or aviation fuel. The fleet leasing industry offers customized solutions to meet the unique requirements of each business, ensuring optimal efficiency and cost savings. The market caters to a diverse range of industries and applications, from passenger cars for corporate transportation to heavy-duty vehicles for construction and industrial projects. The market's growth is driven by factors such as the need for cost savings, operational efficiency, and the increasing popularity of eco-friendly and technologically advanced vehicles. The flexibility and convenience offered by fleet leasing solutions continue to make them an attractive option for businesses looking to manage their transportation needs effectively.

Get a glance at the market share of various segments Request Free Sample

The passenger cars segment accounted for USD 14.22 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

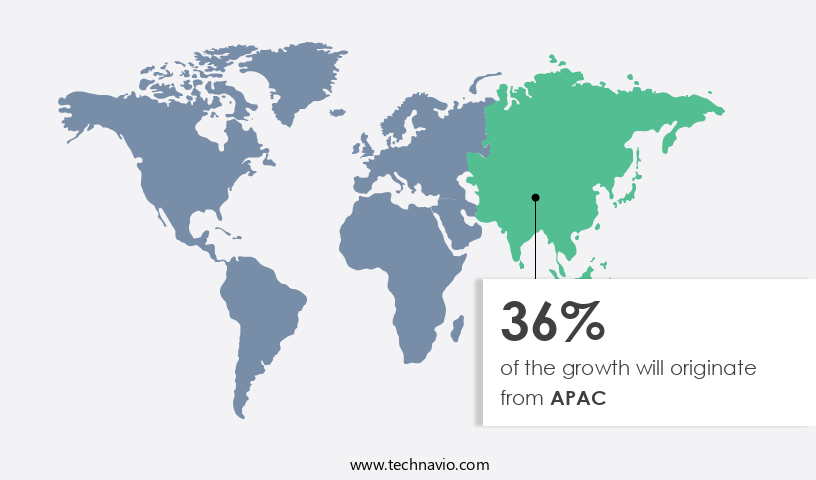

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth due to its cost-effective advantages. While fleet purchases remain popular, leasing is becoming an increasingly attractive option for businesses seeking to enhance productivity and manage tasks more efficiently. In 2023, China, India, Australia, South Korea, Japan, and Indonesia were the leading markets for automotive fleet leasing in APAC, accounting for a substantial portion of the global leasing volume. The region's large automotive production, growing population, and increasing spending power create a favorable environment for the expansion of automotive leasing. Despite the prevalence of fleet ownership in APAC, leasing offers numerous benefits, including fuel management, driver safety, and risk minimization. Technology and software solutions are driving innovation in the market, making it easier for businesses to manage their fleets and optimize operations. The potential for growth in the APAC market is substantial, making it an area of interest for businesses seeking to streamline their transportation needs.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rise in focus on cost-effective solutions in logistics and transportation sector is the key driver of the market. The market is witnessing growing demand due to the financial advantages it provides to businesses. Companies across various industries are adopting fleet leasing as an efficient strategy for managing their vehicle needs. Preventive maintenance is a crucial aspect of fleet leasing, ensuring minimal downtime and maximizing vehicle utilization. Leasing companies offer real-time visibility into fleet operations, enabling data-driven decisions that enhance profitability.

Fuel savings are another significant benefit, as leasing companies often have economies of scale that result in lower fuel costs. Customer service is a priority in fleet leasing, with leasing companies providing comprehensive support to ensure optimal fleet performance. By choosing fleet leasing over vehicle ownership, businesses can streamline their processes, reduce upfront costs, and make informed decisions based on accurate data. This approach allows companies to allocate resources effectively and mitigate financial risk.

Market Trends

The rise in the adoption of electric and autonomous vehicles in automotive fleet leasing industry is the upcoming trend in the market. The market in the United States is witnessing a notable trend towards the adoption of electric and autonomous vehicles. This shift is driven by a combination of factors, including technological innovations, corporate sustainability initiatives, and the pursuit of operational efficiencies.

The growing preference for electric vehicles (EVs) in fleet leasing reflects the industry's commitment to environmental sustainability and regulatory compliance. Businesses across various sectors are capitalizing on the benefits of EVs to reduce their carbon footprint and meet sustainability targets. The automotive fleet leasing industry is evolving, with a focus on safety education programs and fuel price volatility management to ensure the optimal utilization of resources.

Market Challenge

Limited customer awareness and acceptance in semi-urban and rural areas is a key challenge affecting the market growth. Automotive fleet leasing has been a popular business model in urban areas for over a decade, yet its reach remains limited in semi-urban and rural regions. The complexity of leasing terminology, such as money factor, residual value, and capitalized costs, can deter potential customers in these areas. However, the integration of advanced technologies like GPS vehicle tracking and telematics in fleet management is transforming the industry. These technologies enable fleet managers to optimize routes, reduce idle time, and enhance asset tracking, leading to improved fleet performance and employee efficiency.

Moreover, real-time data analysis helps in proactive maintenance, ensuring vehicle reliability and reducing downtime. By leveraging these benefits, fleet leasing companies can boost customer satisfaction and expand their market reach beyond urban areas. Incorporating these technologies into fleet management solutions can help demystify leasing terminology and make the business model more accessible to a wider audience.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ALD SA - The company offers automotive fleet leasing, including maintenance, roadside assistance, relief cars, scheduling services, and repairs through an approved network of franchised dealers.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avis Leasing

- Donlen Corp.

- Element Fleet Management Corp.

- Emkay Inc.

- Enterprise Holdings Inc.

- Flex Fleet Rental

- Hertz Global Holdings Inc.

- Holman Inc.

- Inchcape Plc

- Mercedes Benz Group AG

- Merchants Fleet

- Milestone Equipment Holdings LLC

- Nissan Motor Co. Ltd.

- Ryder System Inc.

- SG fleet Group

- SIXT SE

- Solera Holdings LLC

- TomTom NV

- Union Leasing Inc.

- Wheels Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to businesses requiring motorized assets for their daily operations. This market includes various types of vehicles such as semi-trucks with trailers, medium-sized buses, SUVs, pickup trucks, passenger vans, and box trucks. These vehicles are utilized for transporting cargo, providing passenger services, and operating heavy machinery like bulldozers, backhoes, and skid-steer loaders. Businesses face numerous challenges in managing their fleet, including fuel costs, safety standards, and compliance laws. Preliminary steps include analyzing business needs, budget constraints, and vehicle specifications such as horsepower, passenger capacity, payload capacity, and towing capacity. Fleet management involves controlling costs, increasing productivity, and optimizing efficiency.

Furthermore, solutions include fuel management, driver safety programs, preventive maintenance, and real-time visibility through GPS vehicle tracking and telematics. Minimizing risk, downtime, and idle time, as well as optimizing routes, are essential for fleet performance and profitability. Customer service, employee efficiency, and customer satisfaction are crucial factors. Fuel price volatility necessitates data-driven decisions and fuel savings strategies. Additionally, safety education programs ensure regulatory compliance and reduce risks. Fleet management software solutions streamline processes, enhance productivity, and provide valuable insights for businesses.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.98% |

|

Market growth 2024-2028 |

USD 9.20 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.71 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 36% |

|

Key countries |

US, China, UK, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ALD SA, Avis Leasing, Donlen Corp., Element Fleet Management Corp., Emkay Inc., Enterprise Holdings Inc., Flex Fleet Rental, Hertz Global Holdings Inc., Holman Inc., Inchcape Plc, Mercedes Benz Group AG, Merchants Fleet, Milestone Equipment Holdings LLC, Nissan Motor Co. Ltd., Ryder System Inc., SG fleet Group, SIXT SE, Solera Holdings LLC, TomTom NV, Union Leasing Inc., and Wheels Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch