Automotive Sealants Market Size 2025-2029

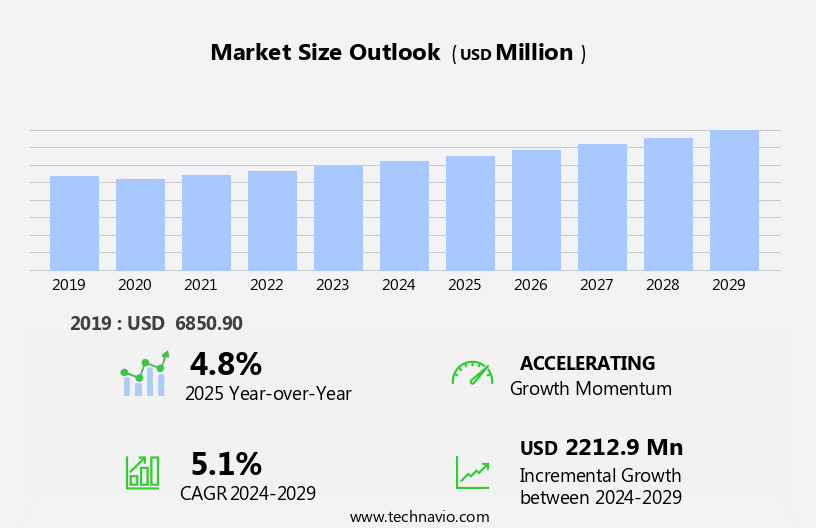

The automotive sealants market size is forecast to increase by USD 2.21 billion at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing automotive production and the introduction of new, advanced sealant technologies. These innovations cater to the evolving demands for improved fuel efficiency, vehicle safety, and durability. However, market expansion is not without challenges. Volatility in raw material prices poses a significant hurdle, as sealant manufacturers grapple with the unpredictability of pricing and availability. Additionally, regulatory requirements, such as stringent emission norms and safety standards, impact adoption and necessitate continuous product development. The market represents a significant advertising medium in the global marketing landscape, particularly in regions with a high prevalence of personal vehicle ownership.

- Navigating these challenges requires strategic planning and agility. Companies must focus on cost optimization, supply chain resilience, and regulatory compliance to capitalize on the market's growth opportunities. By staying abreast of market trends and addressing these challenges effectively, automotive sealant providers can position themselves for long-term success. The market caters to both luxury cars and commercial vehicles, with applications extending to mobile marketing and out-of-home advertising.

What will be the Size of the Automotive Sealants Market during the forecast period?

- The market encompasses a range of products designed to prevent the intrusion of external elements into vehicles. Regulations governing sealant usage continue to evolve, influencing market dynamics. Sealant viscosity and finish are critical factors in ensuring effective application, while warranty and certification play a role in consumer trust. Sealant applicators, cartridges, and dispensers facilitate application methods, with drying time and curing time impacting overall efficiency. Sealant elongation and tensile strength are essential properties, contributing to sealant replacement and repair. Quality control measures, including testing standards and surface preparation, ensure sealant longevity and bond strength. Sealant color, density, and modulus also influence product selection. Unlike traditional static signs and billboards, these mobile marketing tools offer flexibility and mobility

- As market trends lean towards sustainability, eco-friendly sealant options are gaining traction. In the realm of business applications, sealant maintenance and lifespan are crucial considerations for fleet managers and automotive manufacturers. Understanding sealant application methods and replacement schedules can help minimize downtime and maintenance costs. By staying abreast of industry trends and regulations, businesses can optimize their use of sealants and maintain a competitive edge. Electric vehicles and compact family cars are also significant markets for automotive wrap films.

How is this Automotive Sealants Industry segmented?

The automotive sealants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Polyurethane

- Silicone

- Acrylic

- Butyl

- Others

- Technology

- Reactive

- Waterborne

- Hot melt

- Others

- Application

- Passenger car

- LCV

- Commercial vehicles

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Spain

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

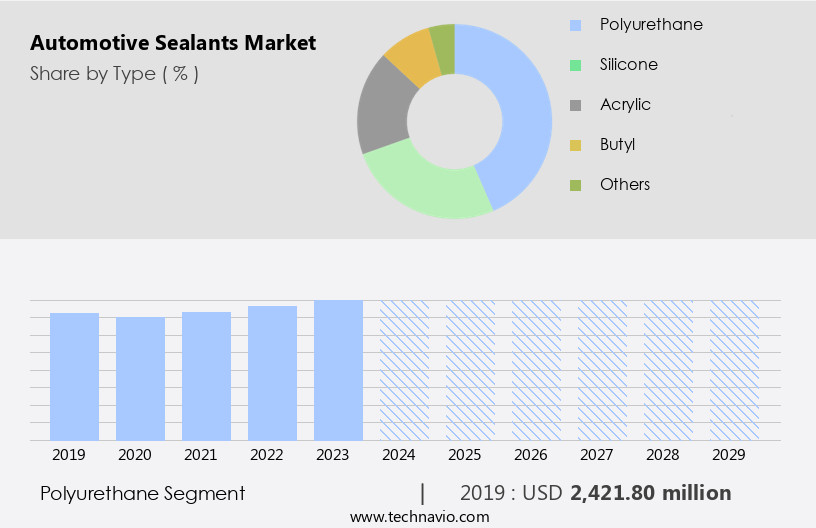

By Type Insights

The polyurethane segment is estimated to witness significant growth during the forecast period. The market encompasses a range of sealant types, with polyurethane sealants holding a prominent position due to their versatile applications and superior performance in the automotive industry. These sealants are extensively used for creating gaskets and seals in various automotive components, such as doors, windshields, rear windows, and tank caps. Their exceptional chemical resistance and flexibility make them ideal for preventing leaks of air, water, and gases, ensuring the integrity and longevity of vehicles. The increasing popularity of luxury vehicles and sports vehicles further boosts market growth. In the realm of auto glass repair, polyurethane sealants are highly valued for their strong adhesion properties and durability. They provide a reliable solution for bonding and sealing glass components, which is crucial for maintaining the safety and functionality of the vehicle.

Sustainable sealants are also gaining traction in the market due to increasing environmental concerns. These eco-friendly alternatives offer similar performance to traditional sealants while reducing the carbon footprint. Butyl sealants, a type of elastomeric sealant, are widely used in the automotive industry for their excellent water resistance and sealing properties. They are commonly found in automotive assembly lines for sealing doors, windows, and other vehicle openings. Automotive manufacturers and repair shops rely on sealants for various applications, from passenger vehicles to commercial vehicles and heavy-duty vehicles. Sealants play a crucial role in automotive design and engineering, ensuring the performance and durability of vehicles. The raw materials used in the production of automotive wrap films primarily consist of polyvinyl chloride (PVC) and other specialty polymers.

Innovative sealant technologies, such as high-performance sealants and advanced sealants, are continuously being developed to meet the evolving needs of the industry. Automotive parts suppliers offer a wide range of sealant products, from acrylic sealants for their ease of use and low VOC content to silicone sealants for their temperature resistance and UV resistance. Chassis sealants and underbody sealants are essential for protecting vehicles from corrosion and water damage. Sealant application methods, such as spray-on and roll-on applications, are continuously evolving to improve efficiency and productivity in automotive assembly lines. Automotive repair shops and service providers utilize sealants for various repair and maintenance applications, from automotive restoration to routine maintenance.

The Polyurethane segment was valued at USD 2.42 billion in 2019 and showed a gradual increase during the forecast period. Sealant durability and resistance to abrasion and sealant resistance are essential factors in the selection of sealants for automotive repair and maintenance. OEM automotive manufacturers rely on sealants for the production of new vehicles, ensuring the quality and performance of their products.The market is a dynamic and evolving industry, driven by the need for superior performance, durability, and sustainability. Polyurethane sealants, butyl sealants, sustainable sealants, and innovative sealant technologies are just a few of the key players in this market, each offering unique benefits and applications. The market is expected to continue growing, driven by advancements in automotive technology, increasing demand for eco-friendly alternatives, and the need for reliable and durable sealant solutions.

Regional Analysis

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. StartFragment The Automotive Sealants Market is witnessing significant growth driven by advancements in vehicle manufacturing and increased demand for durable bonding solutions. The use of sealant gun, sealant applicator, and sealant dispenser ensures precision in applying sealant cartridge and sealant tube, optimizing sealant curing time and sealant drying time for enhanced efficiency. Manufacturers focus on improving sealant bond strength, sealant tensile strength, and sealant modulus to meet stringent safety standards. Factors like sealant density, sealant finish, and sealant gloss contribute to aesthetic appeal and performance. Proper sealant surface preparation is crucial for durability. Rigorous sealant quality control, adherence to sealant testing standards, and acquiring sealant certification ensure compliance with sealant regulations. Offering extended sealant warranty enhances consumer confidence in product reliability.

The market is witnessing significant growth, particularly in the Asia-Pacific (APAC) region, where it is driven by major automotive manufacturers such as Toyota, Honda, Hyundai, and BYD. In 2024, China produced approximately 21 million vehicles, marking a 2% increase year-on-year. Japan experienced a substantial of 17% in car production in 2023, totaling 7.5 million units, while South Korea reported a notable 13.5% increase, producing around 4 million units. India's passenger vehicle sector also saw significant growth, surpassing 4 million units in 2024, reflecting a 4% increase from the previous year. Automotive technology advances continue to influence the market, with a focus on sustainable sealants, chemical resistance, sealant adhesion, and eco-friendly options.

Bio-based sealants and low voc sealants are gaining popularity due to their environmental benefits. Sealant performance is a critical factor, with automotive manufacturers and repair shops demanding high-performance sealants for water resistance, abrasion resistance, and sealant resistance. Automotive design trends include innovative sealants for automotive customization, underbody sealants, chassis sealants, and high-performance sealants for heavy-duty vehicles. Sealant application methods continue to evolve, with sealant flexibility, advanced sealants, and sealant curing becoming essential considerations. UV resistance, temperature resistance, and adhesive sealants are also crucial factors for automotive engineering. Automotive parts suppliers play a vital role in the market, providing a range of sealant options for automotive assembly lines, maintenance, restoration, and repair.

Automotive repair shops and service providers rely on sealants for their durability and resistance to corrosion, gasket seals, and polyurethane sealants. The market for sealants is diverse, catering to the needs of OEM automotive and aftermarket automotive industries. The market is a dynamic and evolving industry, driven by technological advances, automotive production in the APAC region, and the demand for high-performance, sustainable, and eco-friendly sealant options.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Automotive Sealants market drivers leading to the rise in the adoption of Industry?

- The significant expansion of automotive production serves as the primary catalyst for market growth. The market experiences significant growth due to the increasing production of passenger and commercial vehicles. Sealants play a crucial role in the automotive manufacturing process, ensuring durability, safety, and aesthetic appeal through applications such as body sealing, glass bonding, and chassis assembly. With global car manufacturing reaching approximately 75 million units in 2023, a notable increase of around 10% from the previous year, the demand for high-performance sealants with superior adhesion, flexibility, and chemical resistance remains high. Sustainable and eco-friendly sealant options, including butyl and bio-based alternatives, are gaining popularity in the market as automotive technology advances.

- Sealant performance is a critical factor in automotive design, and the industry's focus on enhancing vehicle efficiency and reducing environmental impact further drives the demand for innovative sealant solutions.

What are the Automotive Sealants market trends shaping the Industry?

- The introduction of new products is a current market trend that reflects innovation and progress in various industries. Companies continually strive to meet consumer demands and stay competitive by launching new offerings. The market is experiencing significant growth due to the development of innovative sealant solutions catering to the automotive industry's evolving needs. Companies are focusing on producing advanced sealants that offer superior performance, durability, and environmental benefits. For instance, Henkel introduced Loctite AA 5885, a one-part, UV-curable polyacrylate gasketing sealant, on April 3, 2025. This solution is optimized for automotive electronics applications, such as sealing electronic control units (ECUs), fuse boxes, and sensing systems. Loctite AA 5885 delivers exceptional chemical resistance and can withstand temperatures ranging from -40 degrees Celsius to 150 degrees Celsius.

- Such advancements in sealant technology cater to the increasing demand for water resistance, corrosion resistance, and silicone sealants in automotive assembly lines, automotive manufacturers, automotive repair shops, automotive maintenance, and automotive restoration.

How does Automotive Sealants market faces challenges face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory, necessitating careful cost management and strategic planning. The market experiences volatility due to the influence of raw material prices, particularly those of petrochemical derivatives like silicone, polyurethane, and acrylic polymers. These materials are essential for manufacturing sealants used in automotive repair and maintenance. Fluctuations in crude oil prices and geopolitical events significantly impact the prices of these derivatives, which in turn affect production costs, supply chain stability, and profit margins for automotive sealant manufacturers. For instance, in early 2023, the price of metallurgical-grade silicon, a critical component in silicone sealants, rose by approximately 20% due to reduced output from China, a significant producer, and power rationing.

- Furthermore, disruptions in argon gas exports from Russia and Ukraine added to the supply chain challenges, increasing manufacturing costs. Sealant durability, elasticity, abrasion resistance, and sealant curing are crucial factors that automotive service providers prioritize when selecting sealants for OEM automotive and heavy-duty vehicle applications. Innovative sealant solutions, such as chassis sealants, continue to gain popularity due to their enhanced performance characteristics.

Exclusive Customer Landscape

The automotive sealants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive sealants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive sealants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing a range of advanced automotive sealant solutions, including polyurethane sealant 540 and Scotch-Seal industrial sealant 800.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Arkema

- BASF SE

- Compagnie de Saint-Gobain SA

- DELO Industrie Klebstoffe GmbH and Co. KGaA

- Evonik Industries AG

- General Sealants Inc.

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Huntsman Corp.

- Illinois Tool Works Inc.

- Jowat SE

- KCC SILICONE CORP

- Nan Pao Resins Chemical Co. Ltd.

- PPG Industries Inc.

- Sika AG

- The Dow Chemical Co.

- ThreeBond Holdings Co. Ltd.

- Toagosei Co. Ltd.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Sealants Market

- In February 2024, BASF SE, a leading global chemical producer, introduced a new generation of hot melt adhesive sealants for the automotive industry. These innovative sealants offer improved thermal stability and enhanced bonding performance, addressing the increasing demand for lightweight and fuel-efficient vehicles (BASF press release, 2024).

- In October 2025, Honeywell International Inc. and Magna International, a leading automotive supplier, announced a strategic partnership to develop advanced sealant systems for electric vehicles (EVs). This collaboration aims to address the unique sealing challenges in EVs, such as high-voltage systems and thermal management (Honeywell press release, 2025).

- In May 2024, 3M Company completed the acquisition of Avery Dennison Corporation's Automotive Interiors Business. This acquisition significantly expanded 3M's automotive sealants portfolio, strengthening its position in the market and providing a broader range of solutions for automakers (3M press release, 2024).

- In January 2025, the European Union (EU) introduced new regulations on vehicle emissions, including stricter sealing requirements for automotive manufacturers. These regulations aim to reduce CO2 emissions by 15% by 2025, driving demand for advanced sealant technologies that improve vehicle aerodynamics and reduce weight (European Commission press release, 2020).

Research Analyst Overview

The market continues to evolve, driven by advancements in automotive technology and the diverse requirements of various sectors. Automotive parts suppliers are at the forefront of this dynamic industry, providing low VOC sealants for door seals, windshield sealants for water resistance, and silicone sealants for body panels. These sealants are essential for automotive assembly lines, ensuring the production of high-quality vehicles for both commercial and passenger applications. Automotive manufacturers integrate sealants into their designs for corrosion resistance, gasket sealing, and temperature resistance. In the aftermarket, automotive repair shops and maintenance facilities rely on sealants for restoration projects and routine maintenance. Moreover, the use of advanced technologies, such as nano-ceramic films, self-healing coatings, smart glass, smart films, and switchable films, further enhances the functionality and versatility of automotive wrap films.

Sealant performance is paramount, with factors such as adhesion, chemical resistance, and elasticity critical for long-lasting applications. Innovative sealant solutions continue to emerge, including eco-friendly options made from bio-based materials and those offering enhanced durability and flexibility. The market's ongoing unfolding is shaped by factors like automotive design, sealant application techniques, and the evolving needs of the automotive service providers. Sealants are integral to the industry's progress, with applications ranging from underbody protection to heavy-duty vehicle chassis sealing. Automotive customization and high-performance requirements further push the boundaries of sealant technology. Advanced sealants offer UV resistance, abrasion resistance, and sealant curing properties tailored to specific applications. The market's continuous evolution reflects the dynamic nature of the automotive industry, with ongoing research and development efforts focused on delivering superior sealant solutions for various applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Sealants Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

242 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 2.21 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

China, US, Japan, India, Brazil, Mexico, South Korea, Germany, Spain, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Sealants Market Research and Growth Report?

- CAGR of the Automotive Sealants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive sealants market growth of industry companies

We can help! Our analysts can customize this automotive sealants market research report to meet your requirements.