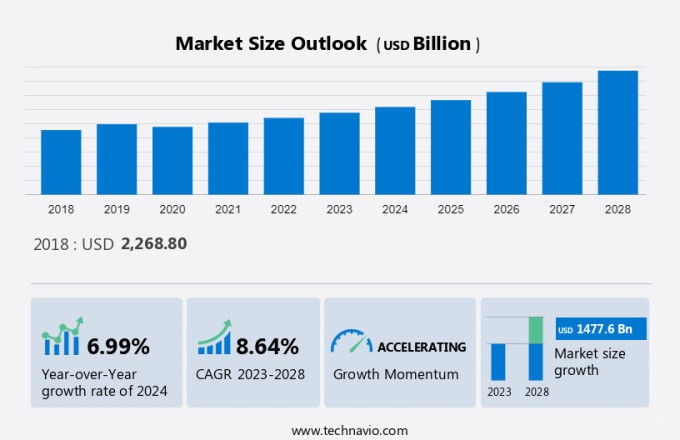

Motor Vehicles Market Size 2024-2028

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamics and Customer Landscape

The market is evolving rapidly driven by various factors. Electrification is gaining momentum, with a shift towards electric motors and hybrid electric vehicle, fueled by the growing demand for sustainable transportation solutions amid concerns over climate change. Premium vehicles continue to attract consumers seeking luxury and performance. Safety systems such as ABS and ESC are becoming standard features, enhancing vehicle safety. However, challenges persist, including the impact of the pandemic on production and supply chains, as well as the need for infrastructure development to support the widespread adoption of electric vehicles. The market encompasses a range of products including ICE vehicles, plugin hybrids, motorbikes, and autocycles. Key components like brake assist motors, compact pedal adjuster motors, and steel pushbelt are essential, along with electrical power steering systems and intelligent cockpit domain controllers for land vehicles including sedans, utility vehicles, and light commercial vehicles.

Key Market Driver

The growing urban population is notably driving the market growth. The world is rapidly urbanizing, with more people moving to cities in search of better opportunities and a higher quality of life. According to the World Bank Group, the urban population (percentage of the total population) was 54% in 2015 and is trending to 56% in 2021. This trend is particularly pronounced in developing countries such as India with rapid economic growth and large-scale urbanization. According to the World Bank Group, India's urban population (percentage of the total population) was 33% in 2015 and is trending toward 35% in 2021. With increasing urbanization, the demand for automobiles is correspondingly increasing. As people move to cities, there is a growing demand for transportation infrastructure such as roads, highways, bridges, and public transit systems. This infrastructure often supports the use of automobiles, a convenient and efficient means of transportation within cities. In addition, modern automobiles are equipped with advanced features such as air conditioning, entertainment systems, and satellite navigation, making them attractive to city dwellers.

Urban areas are often densely populated, resulting in more traffic congestion, slower public transport, and longer commute times for residents. In this scenario, owning a car-like automobile becomes a necessity for many. Moreover, the rising disposable income of the population, especially in emerging countries such as India, is driving the demand for passenger cars. Therefore, as the urban population grows and incomes rise, more people are expected to be able to afford cars. This will further increase the demand and propel the growth of the market during the forecast period.

Significant Market Trends

Technological advances in EVs are a key trend influencing the market growth. The growing adoption of EVs is increasingly witnessing new opportunities for different stakeholders, such as system integrators, vehicle manufacturers, engine manufacturer, and component providers. As more consumers become aware and start understanding the benefits of EVs, along with the government supporting the trend with incentives, the companies will have to cater to this increasing demand and provide better options. The major challenges associated with the adoption of EVs are the high cost and limited range of these vehicles. In order to eliminate these, the companies are expected to invest more time and energy in R&D and come up with better models of EVs. Most of the stakeholders in the automotive technology industry are expecting the year 2025 to be an inflection point, after which not only the overall prices for EVs are expected to reduce, but the necessary infrastructure will also be in place to fulfill the growing demand for EVs.

Moreover, automobile manufacturers are looking to lessen their environmental impact by using sustainable materials in their EVs. In addition, significant advancements have been made in developing efficient, high-capacity batteries for EVs. Top companies such as Tesla, BMW, and Nissan have invested heavily in developing batteries that can offer longer ranges and faster charging times. Such technological advancements are revolutionizing the EV industry, making EVs more efficient, affordable, and environmentally friendly, contributing to the growth of the market during the forecast period.

Major Market Challenge

The environmental concerns associated with vehicle emissions are challenging the market growth. One of the biggest challenges the market is facing is environmental issues. Environmental concerns are becoming more and more important, with stakeholders demanding that automakers produce sustainable, environmentally friendly, low-emission vehicles. Customers are becoming more conscious of their carbon footprint and choosing vehicles with a lower environmental impact. Governments around the world are also cracking down on vehicle emissions, creating regulations, and imposing penalties for violations.

Vehicles emit large amounts of carbon monoxide, nitrogen oxides, and particulate matter. Cars release toxic compounds into the atmosphere with a range of negative effects on human health and the environment. About 80-90% of a car's environmental impact comes from fuel consumption, air pollution, and greenhouse gas emissions. Governments around the world set stringent fuel economy and emission standards that vehicle manufacturers must meet during vehicle production. Therefore, such standards are expected to hinder the adoption of ICE-based vehicles, which could restrain the growth of the market during the forecast period.

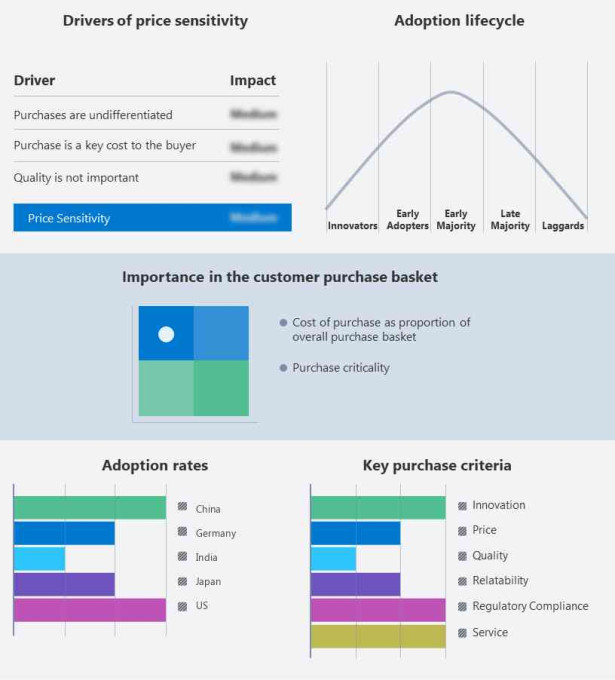

Customer Landscape

The market research report includes the adoption lifecycle of the market research and growth, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bayerische Motoren Werke AG: The company offers various motor vehicles such as the BMW Turbo, BMW 7 Series, and other extensive ranges of automobiles, including the premium compact class, the premium mid-size, the luxury class, and the ultra-luxury class.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Beijing Automotive Group Co. Ltd.

- BYD Co. Ltd.

- Dongfeng Motor Group Co. Ltd.

- Ford Motor Co.

- Guangzhou Automobile Group Co. Ltd.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Mahindra and Mahindra Ltd.

- Mercedes Benz Group AG

- Porsche Automobil Holding SE

- Renault SAS

- SAIC Motor Corp. Ltd.

- Stellantis NV

- Tata Motors Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

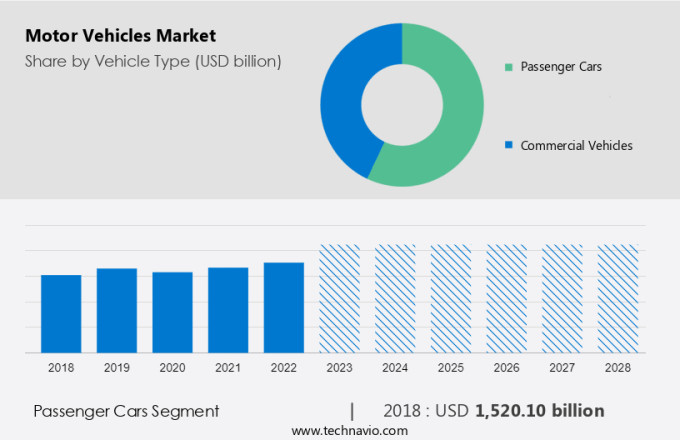

What is the Fastest-Growing Segments in the Market?

The market share growth by the Passenger Cars segment will be significant during the forecast period. The global motor vehicles market encompasses various types of automobiles, including motorcycles, bicycles, passenger cars, and commercial vehicles. Motorcycles and scooters are popular modes of transportation in many regions, while passenger cars come in various classes such as hatchbacks, sedans, and utility vehicles. Commercial vehicles include light commercial vehicles and heavy trucks, as well as buses and coaches. Internal combustion engines (ICEs), which use gasoline and diesel as fuel, dominate the market. IC engines have been the primary power source for motor vehicles due to their affordability and availability. An internal combustion engine (ICE) is a type of power source that powers a variety of automobiles by burning oil or natural gas to produce heat and produce electricity, which is used to propel the vehicle in which it is installed. Most of the market is dominated by diesel and gasoline engines.

Get a glance at the market contribution of various segments View the PDF Sample

The Passenger Cars segment was valued at 1.52 billion in 2018. Economic growth is the primary growth driver for the ICE segment. As the world's population continues to grow, the demand for ICE-dependent transport is increasing. This includes cars, trucks, buses, and other commercial vehicles. As emerging countries like India continue to develop, demand for ICE-based vehicles is likely to increase, which is expected to drive the growth of the ICE segment during the forecast period.

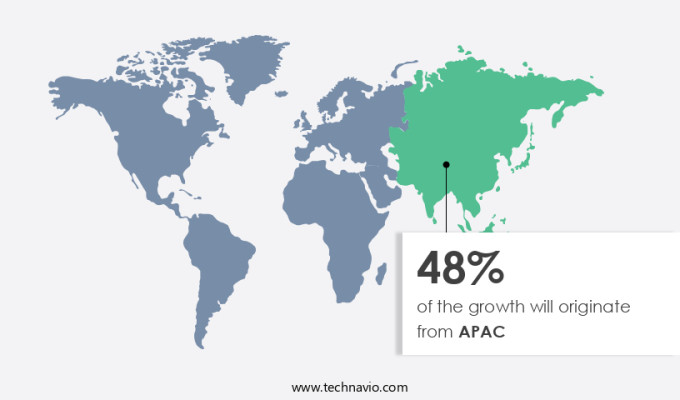

Which are the Key Regions for the Market?

For more insights on the market share of various regions Download PDF Sample now!

APAC is estimated to contribute 48% to the growth of the market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. APAC is an important and rapidly growing automotive market. This region alone accounts for 46% of global car production in 2020. This market is driven by factors such as rising wealth and urbanization of the population, expanding export opportunities, and government policies promoting sustainable transportation. China, India, Japan, and South Korea are the main markets in the APAC region and account for the majority of vehicle sales.

In addition, APAC may have the highest number of first-time commercial vehicle buyers, which has also led to increased sales of pickup and light trucks in the region. With rapid economic growth in the Asia-Pacific region, per capita income has risen dramatically in recent years, increasing consumer purchasing power and resulting in increased sales of automobiles, especially passenger cars and light commercial vehicles. Moreover, technological advancements in the automotive industry, especially the development of powertrain technology, are expected to contribute to the growth of the market.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Propulsion Outlook

- ICE

- Electric

- Hybrid

- Vehicle Type Outlook

- Passenger cars

- Commercial vehicles

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The market is characterized by continuous innovation and technological advancements aimed at enhancing driver control, comfort, and safety. Advanced features like autonomous emergency braking and occupant monitoring systems contribute to improved safety standards. Components such as ECUs, engine motor systems, and thermal management systems optimize vehicle performance and efficiency. With increasing emphasis on environmental sustainability, manufacturers are focusing on hybrid electric vehicles and environmental norms compliance. From motorcycles to heavy trucks, the market offers a diverse range of vehicles catering to various needs. Emerging technologies like e-axle and intelligent cockpit domain controllers are reshaping the automotive landscape, while innovations in braking systems and steering by wire systems are enhancing driving experiences.

Further, active safety features like active window displays, braking system and millimeter wave radar enhance vehicle safety, while components such as ECU, power electronic controller, and thermal management system optimize performance. The shift towards hybrid electric vehicles and electric motor vehicle reflects a growing focus on environmental sustainability and reducing emissions. From compact hatchback to heavy-duty buses and coaches, diverse vehicle types cater to different consumer needs and preferences. Emerging technologies like e-axles and intelligent cockpit domain controllers promise to revolutionize driving experiences, while innovations in electrical power steering systems and steering by wire systems pave the way for enhanced vehicle control and maneuverability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.64% |

|

Market Growth 2024-2028 |

USD 1,477.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.99 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 48% |

|

Key countries |

China, US, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Bayerische Motoren Werke AG, Beijing Automotive Group Co. Ltd., BYD Co. Ltd., China FAW Group Co. Ltd., Dongfeng Motor Group Co. Ltd, Ford Motor Co., General Motors Co., Guangzhou Automobile Group Co. Ltd, Honda Motor Co. Ltd., Hyundai Motor Co., Mahindra and Mahindra Ltd., Mercedes Benz Group AG, Porsche Automobil Holding SE, Renault SAS, SAIC Motor Corp. Ltd., Stellantis NV, Tata Motors Ltd., Tesla Inc., Toyota Motor Corp., and Zhejiang Geely Holding Group Co. Ltd. |

|

Market dynamics |

Parent market growth analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch