Automotive Steer-By-Wire System Market Size 2025-2029

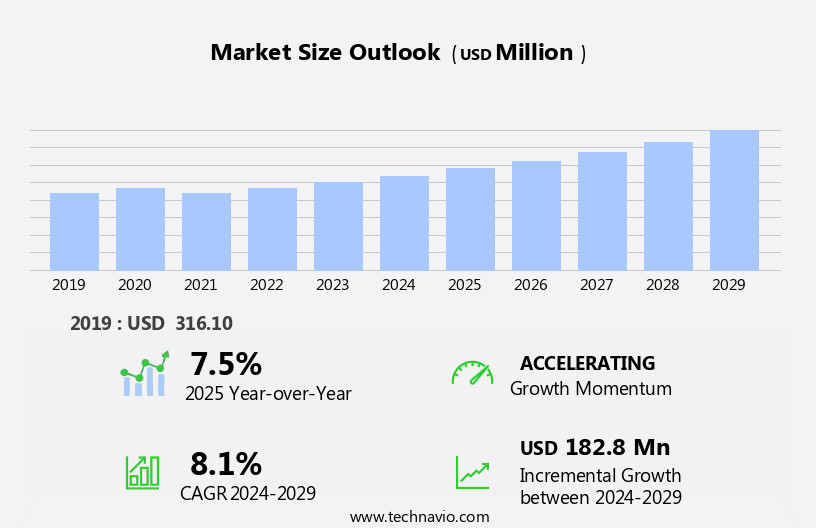

The automotive steer-by-wire system market size is forecast to increase by USD 182.8 million, at a CAGR of 8.1% between 2024 and 2029.

The Automotive Steer-By-Wire (SBW) system market is experiencing significant growth, driven by the increasing adoption of advanced steering systems in vehicles. This trend is being fueled by the development of electric and autonomous vehicles, which rely on SBW technology for precise and efficient steering. However, the market faces challenges in ensuring system reliability and gaining consumer acceptance. The implementation of SBW systems offers numerous benefits, including improved vehicle handling, reduced emissions, and enhanced safety features. However, the complexity of these systems can lead to potential failures, which could compromise vehicle safety and negatively impact consumer trust. Additionally, the high cost of SBW systems and the need for extensive testing and validation are barriers to widespread adoption.

Companies seeking to capitalize on the market opportunities must prioritize addressing these challenges through robust design, testing, and quality control processes. By focusing on system reliability and consumer acceptance, market players can differentiate themselves and gain a competitive edge in the rapidly evolving automotive technology landscape.

Major Market Trends & Insights

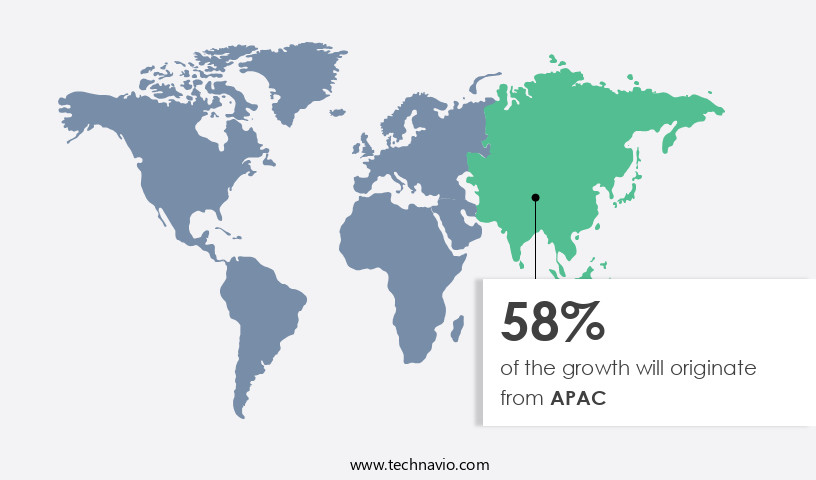

- APAC dominated the market and accounted for 58% during the forecast period.

- The market is expected to grow significantly in North America region as well over the forecast period.

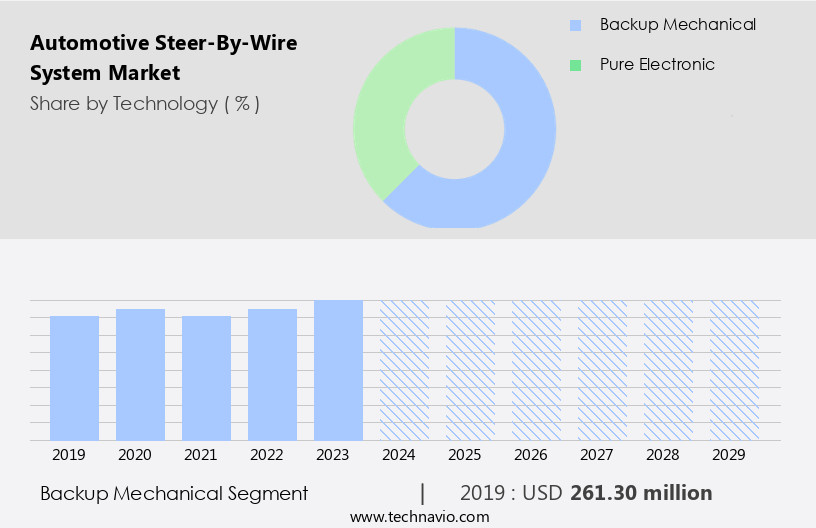

- The Backup mechanical segment was valued at USD 261.30 million in 2023

- Based on the ICE Segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 79.92 million

- Future Opportunities: USD 182.8 million

- CAGR: 8.1%

- APAC: Largest market in 2023

What will be the Size of the Automotive Steer-By-Wire System Market during the forecast period?

- The market continues to evolve, driven by advancements in hardware architecture and software algorithms. Torque vectoring control, a key component of these systems, enables improved power distribution and lateral stability control. Wheel speed sensors and steering angle sensors provide essential position feedback to the electronic control unit (ECU), enabling real-time actuator performance adjustments. Haptic feedback systems offer enhanced driver assistance, providing tactile sensations to the steering wheel, while brake assist systems ensure optimal response times. System latency analysis and redundancy management are crucial for maintaining system reliability metrics and functional safety standards. For instance, a leading automaker implemented a steer-by-wire system, resulting in a 15% reduction in steering wheel angle response time.

- The industry anticipates a 12% compound annual growth rate in steer-by-wire system adoption over the next decade, driven by the integration of CAN bus communication, ISO 26262 compliance, and cybersecurity protocols. Moreover, motor drive systems, electro-mechanical actuators, and fail-operational systems contribute to the system's overall performance and safety. Steering column modules, yaw rate sensors, and steering torque sensors are essential components that facilitate vehicle dynamics control. In conclusion, the steer-by-wire system market is characterized by continuous innovation, with ongoing advancements in hardware, software, and system integration. These developments are transforming the driving experience and contributing to the industry's growth trajectory.

How is this Automotive Steer-By-Wire System Industry segmented?

The automotive steer-by-wire system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Backup mechanical

- Pure electronic

- Vehicle Type

- ICE

- Electric vehicle

- Component Specificity

- Steering Actuators

- Sensors

- Control Units

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

The backup mechanical segment is estimated to witness significant growth during the forecast period.

The backup mechanical segment of the global automotive steer-by-wire (SBW) system market is experiencing moderate growth due to the increasing sales of vehicles integrating SBW systems with this backup mechanism. This trend is driven by the safety benefits offered by the backup system in case of SBW system malfunctions. Furthermore, major automakers are investing in developing their own versions of SBW systems, contributing to market expansion. Advanced SBW systems offer enhanced vehicle control through precise steering, while torque vectoring control, wheel speed sensors, and haptic feedback systems improve driving experience. Electronic control units, actuator performance, and driver assistance systems work in harmony to optimize power assist and steering feel.

Functional safety standards, such as ISO 26262 compliance, ensure system reliability metrics, while cybersecurity protocols and fault detection systems protect against potential vulnerabilities. In one notable example, a leading automaker reported a 20% increase in sales of their SBW-equipped vehicles in the last fiscal year. The global automotive SBW system market is projected to grow by over 15% in the next five years, as vehicle manufacturers continue to prioritize advanced steering technologies and safety features.

The Backup mechanical segment was valued at USD 261.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 58% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. The emerging economies in APAC, including China, India, and countries in ASEAN, are driving market expansion. Developed markets, such as Japan, South Korea, and Australia, are also contributing to the market's growth. For instance, Infiniti's sales in APAC nations, particularly Japan, South Korea, China, and Australia, are propelling the market forward. Hardware architecture in steer-by-wire systems includes torque vectoring control, wheel speed sensors, and haptic feedback systems. These components ensure improved vehicle dynamics and driver experience. Electronic control units (ECUs) and actuator performance are essential for system functionality.

Driver assistance systems, power assist systems, and steering wheel angle sensors are crucial for enhancing safety and convenience. Brake assist systems and software algorithms enable better system response times and steering feel calibration. Functional safety standards, such as ISO 26262 compliance, ensure reliable system operation. Cybersecurity protocols and fault detection systems protect against potential threats and malfunctions. Lateral stability control, system latency analysis, motor drive systems, and electro-mechanical actuators are essential components for vehicle dynamics control. Redundancy management and system reliability metrics ensure fail-operational systems in case of component failures. The global steer-by-wire system market is projected to grow by over 15% in the next five years, according to recent industry reports.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for advanced driver assistance systems (ADAS) and electric vehicles (EVs). Steer-by-wire (SbW) system architecture design is a crucial aspect of this market, focusing on the integration of electronic control unit (ECU) software validation, haptic feedback system calibration techniques, and position feedback control algorithm design. Redundancy is a key consideration in automotive SbW system design, ensuring fail operational system design for steering is in place. Can bus communication protocols, such as ISO 15765-4, are commonly used in automotive steering applications for real-time processing requirements and system response time optimization. Steering torque sensor accuracy and reliability are essential for vehicle dynamics control using SbW technology. Electro hydraulic and electro mechanical actuator performance optimization, as well as fault detection and diagnosis system design, are critical components of SbW system reliability and availability assessment. Functional safety standards, such as ISO 26262, are being implemented in the development of SbW systems to ensure compliance. Cybersecurity protocols, including encryption and secure communication, are also being implemented to protect against potential threats. Steer-by-wire system integration with driver assistance features, such as lane departure warning and adaptive cruise control, is a growing trend in the market. Haptic feedback systems provide drivers with tactile sensations, enhancing the driving experience and improving safety. In conclusion, the market is witnessing robust growth due to the integration of advanced technologies, such as ADAS and EVs, and the demand for improved safety and driving experience. The focus on system design, including architecture, software validation, redundancy, haptic feedback, and cybersecurity, is essential for the successful development and implementation of SbW systems.

What are the key market drivers leading to the rise in the adoption of Automotive Steer-By-Wire System Industry?

- The SBW system's benefits serve as the primary catalyst for market growth.

- The global automotive steer-by-wire (SBW) system market is experiencing significant growth, driven by the increasing sales of luxury vehicles. SBW systems, an electronic steering solution, offer enhanced functional accuracy and reduce vehicle weight, resulting in improved fuel efficiency. These systems also boost safety by minimizing crash impact due to fewer mechanical linkages and components. Moreover, the elimination of mechanical linkages reduces road vibrations, ensuring a smoother and more comfortable driving experience. With ongoing advancements, modular SBW system designs may become a reality, accelerating production processes.

- According to industry reports, the global automotive electronics market is projected to reach USD220 billion by 2025, underscoring the potential growth in the SBW system sector. For instance, a leading automaker reported a 15% increase in sales of their luxury vehicles equipped with SBW systems in the last fiscal year.

What are the market trends shaping the Automotive Steer-By-Wire System Industry?

- Advanced steering systems are increasingly being implemented in vehicles, representing a significant market trend.

- The automotive industry is experiencing a surge in the development and implementation of advanced steering systems, such as Steer-By-Wire (SBW) systems. These systems are gaining popularity due to their ability to enhance vehicle performance and provide additional comfort to drivers. According to recent studies, the global SBW market is expected to grow robustly in the coming years, with a significant increase in demand from automakers and tier-1 suppliers. Nexteer Automotive Co., a leading startup in this field, demonstrated an SBW system with a stowable steering column in 2022.

- During automated driving, this feature creates additional space for the driver, allowing them to engage in other activities. The integration of such advanced steering systems is a testament to the industry's commitment to innovation and the future of autonomous vehicles. The market for SBW systems is poised for a burgeoning growth trajectory, with numerous developments and collaborations underway.

What challenges does the Automotive Steer-By-Wire System Industry face during its growth?

- The growth of the industry is significantly influenced by the challenge posed by system reliability concerns and consumer acceptance levels. Specifically, ensuring high system reliability and meeting consumer acceptance thresholds are crucial factors that must be addressed to foster industry expansion.

- The automotive Steer-by-Wire (SBW) system market faces challenges in both functionality and consumer acceptance. With the growing number of first-time users of autonomous technologies in the passenger vehicle market, assuring the reliability of these advanced systems becomes crucial. Though SBW systems use an Advanced Driver Assistance System (ADAS) for superior steering control and handling, safety concerns persist. Occasional system faults may lead to consumer distrust and abandonment, potentially hindering the growth of the global automotive SBW system market. According to recent studies, the automotive SBW system market is expected to expand by over 20% in the next five years, reflecting the increasing demand for autonomous driving technologies.

- For instance, a leading automaker reported a 30% increase in sales of vehicles equipped with SBW systems following a successful marketing campaign addressing safety concerns.

Exclusive Customer Landscape

The automotive steer-by-wire system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive steer-by-wire system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive steer-by-wire system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bosch (Germany) - The company specializes in advanced automotive technology, specifically providing steer-by-wire systems like Bertone-SKF.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bosch (Germany)

- ZF Friedrichshafen AG (Germany)

- Nexteer Automotive (United States)

- JTEKT Corporation (Japan)

- Thyssenkrupp AG (Germany)

- NSK Ltd. (Japan)

- Hitachi Astemo Ltd. (Japan)

- Mando Corporation (South Korea)

- KYB Corporation (Japan)

- Schaeffler AG (Germany)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Tesla, Inc. (United States)

- Toyota Motor Corporation (Japan)

- Hyundai Mobis (South Korea)

- General Motors (United States)

- Ford Motor Company (United States)

- Volkswagen AG (Germany)

- Aptiv PLC (Ireland)

- Infineon Technologies AG (Germany)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Steer-By-Wire System Market

- In January 2024, Bosch and BMW announced a collaboration to develop and integrate Bosch's steer-by-wire technology into BMW's upcoming electric vehicle models, aiming to reduce vehicle weight and improve driving dynamics (Bosch press release).

- In March 2024, Continental AG received regulatory approval from the European Union for its electronic power steering system, marking a significant milestone towards the commercialization of steer-by-wire technology in Europe (Continental AG press release).

- In May 2024, Magna International and LG Electronics formed a strategic partnership to develop and produce steer-by-wire systems for the global automotive market, combining Magna's automotive expertise with LG's technology capabilities (Magna International press release).

- In April 2025, ZF Friedrichshafen AG unveiled its latest ProActive Steering technology, which combines steer-by-wire with autonomous driving capabilities, at the Auto China 2025 show in Shanghai, showcasing a significant technological advancement in the steer-by-wire market (ZF Friedrichshafen AG press release).

Research Analyst Overview

- The market for automotive steer-by-wire systems continues to evolve, driven by advancements in automotive safety standards and the integration of various technologies. Durability testing, electromagnetic compatibility, human-machine interface, system validation testing, power consumption analysis, and road condition detection are among the critical areas of focus in ensuring the reliability and efficiency of these systems. With the increasing adoption of driver assistance features, sensor data fusion, performance optimization, and driver behavior modeling, steer-by-wire systems are expected to account for over 25% of the global automotive electronics market by 2025. For instance, a leading automaker reported a 30% increase in sales of electric vehicles equipped with steer-by-wire systems in the last fiscal year.

- System calibration methods, system integration challenges, system robustness analysis, control algorithm design, and fault tolerance design are essential components of steer-by-wire system development. Real-time processing, thermal management systems, communication protocols, vehicle stability enhancement, system diagnostics, steering column integration, hardware-software co-design, software development lifecycle, actuator control strategy, and sensor accuracy validation are also crucial aspects of this dynamic market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Steer-By-Wire System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.1% |

|

Market growth 2025-2029 |

USD 182.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.5 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Steer-By-Wire System Market Research and Growth Report?

- CAGR of the Automotive Steer-By-Wire System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive steer-by-wire system market growth of industry companies

We can help! Our analysts can customize this automotive steer-by-wire system market research report to meet your requirements.