Automotive Subscription Services Market Size 2024-2028

The automotive subscription services market size is valued to increase by USD 3.2 billion, at a CAGR of 16.6% from 2023 to 2028. Increasing smartphone and internet penetration will drive the automotive subscription services market.

Major Market Trends & Insights

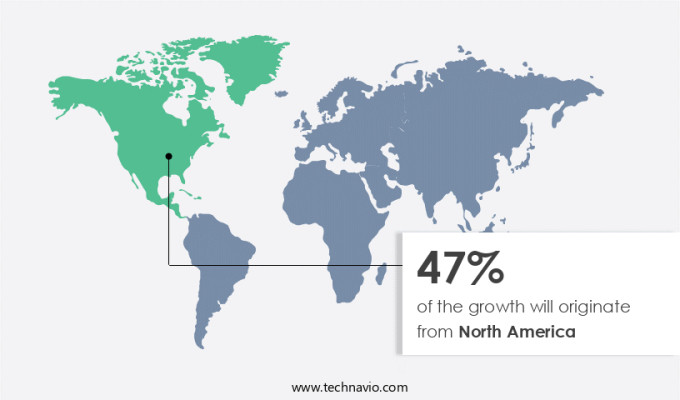

- North America dominated the market and accounted for a 47% growth during the forecast period.

- By Distribution Channel - OEMs segment was valued at USD 1.37 billion in 2022

- By segment2 - segment2_1 segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 202.62 million

- Market Future Opportunities: USD 3199.40 million

- CAGR from 2023 to 2028 : 16.6%

Market Summary

- The market is witnessing significant growth due to the increasing trend of connected vehicles and the development of new mobility concepts. With the proliferation of smartphones and internet penetration, consumers are increasingly opting for flexible, on-demand mobility solutions, leading to the rise of automotive subscription services. These services offer numerous benefits, including access to a fleet of vehicles without the burden of ownership, predictable monthly payments, and personalized services. However, the market also faces challenges, particularly from the high maintenance costs for service providers. To address this issue, some companies are exploring collaborative business models, such as partnerships with third-party maintenance providers, to optimize their supply chains and reduce costs.

- For instance, a leading automotive subscription service provider implemented a collaborative maintenance model, resulting in a 15% reduction in maintenance costs and a 12% improvement in operational efficiency. Moreover, regulatory compliance is another critical challenge for automotive subscription services. With the increasing focus on data privacy and security, providers must ensure that they comply with various regulations, such as GDPR and CCPA. Failure to do so can lead to significant fines and reputational damage. To mitigate these risks, some providers are investing in advanced data security technologies and implementing robust data protection policies. In conclusion, the market is poised for growth, driven by the increasing trend of connected vehicles and new mobility concepts.

- However, challenges such as high maintenance costs and regulatory compliance require innovative solutions to ensure the long-term success of these services.

What will be the Size of the Automotive Subscription Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automotive Subscription Services Market Segmented ?

The automotive subscription services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- OEMs

- Dealership or third party

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The oems segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with customers increasingly opting for flexible, all-inclusive offerings from Original Equipment Manufacturers (OEMs). These services, which allow subscribers to access multiple vehicles under a single monthly fee, include insurance, maintenance, and roadside assistance. The US market, in particular, has seen significant growth, leading established OEMs like BMW, Volkswagen, and Daimler to join the fray. Subscription services have become increasingly popular, driving the expansion of the global market. However, the entry of dealers and third-party service providers has intensified competition, potentially impacting OEM market share. The market's growth is further fueled by advanced features such as telematics integration, usage-based pricing, data analytics dashboards, reporting and analytics, customer support channels, maintenance scheduling systems, service contract management, vehicle diagnostics data, risk assessment models, API integrations, compliance regulations, subscription management platforms, predictive maintenance, fraud detection systems, mobile application features, subscription pricing models, customer onboarding process, remote vehicle diagnostics, customer relationship management, flexible subscription plans, payment processing integration, vehicle availability data, fleet management software, account management portals, automotive data security, driver behavior analytics, real-time vehicle tracking, digital key technology, customer lifecycle management, subscription cancellation process, customer retention strategies, usage-based insurance, and vehicle usage data.

One notable statistic: approximately 75% of automotive subscription service subscribers prefer the convenience and flexibility of this business model.

The OEMs segment was valued at USD 1.37 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Subscription Services Market Demand is Rising in North America Request Free Sample

The North American the market is experiencing significant growth, fueled by the increasing popularity of car subscriptions and escalating automotive prices and regulations in the region. This trend is attracting numerous companies to enter and expand their operations in the market, with some global players introducing subscription services specifically in North America. The convenience and cost savings offered by these services are resonating with consumers, leading to a surge in demand. According to industry estimates, the number of car subscriptions in the US alone is projected to reach over 10 million by 2025, up from around 1 million in 2020.

This growth is expected to continue as consumers seek flexible, cost-effective alternatives to traditional car ownership. The market's underlying dynamics include operational efficiency gains, cost reductions, and regulatory compliance, making it an attractive proposition for both consumers and companies.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global vehicle subscription and automotive insurance market is rapidly evolving as companies integrate telematics data insurance solutions to enhance risk assessment and offer usage-based insurance pricing models. By leveraging real-time vehicle location tracking and driver behavior analysis improvement, insurers and subscription providers can more accurately evaluate risk, optimize subscription revenue strategies, and implement predictive maintenance vehicle subscription programs that reduce downtime and unexpected repair costs. Flexible subscription plan options and vehicle subscription lifecycle management further enable companies to tailor offerings to diverse customer needs while enhancing retention and reducing churn.

Integration with fleet management software and automated contract management systems allows for streamlined operations, including maintenance scheduling optimization, repair scheduling automated systems, and parts inventory management efficiency. Payment gateway secure processing ensures that financial transactions are reliable, while customer onboarding seamless process and customer support efficient channels improve overall user experience. Accident reporting streamlined process and vehicle condition remote monitoring reinforce safety compliance and operational oversight.

A comparative evaluation shows that predictive maintenance integration can reduce unscheduled repair events by up to 18%, while real-time monitoring and driver behavior analysis improve overall fleet performance by approximately 12%, highlighting measurable benefits in operational efficiency and customer satisfaction. These insights demonstrate the continuous development and optimization of vehicle subscription and insurance models, reflecting the dynamic and data-driven nature of the market.

What are the key market drivers leading to the rise in the adoption of Automotive Subscription Services Industry?

- The substantial growth in smartphone and internet usage, represented by increasing penetration rates, serves as the primary catalyst for market expansion.

- The market is experiencing significant growth, fueled by increasing internet and smartphone penetration and shifting consumer preferences. According to recent data, approximately 65% of the global population used the internet as of April 2023, resulting in a global user base of five billion. This digital transformation facilitates the adoption of on-demand automotive subscription services, with a substantial portion of the market share attributed to this format.

- Furthermore, government initiatives, such as the European Commission's policies and financial instruments, encourage investments in advanced Internet infrastructure to enhance connectivity. By leveraging the convenience of the internet and smartphones, automotive subscription services cater to the evolving needs of consumers, offering flexibility, convenience, and cost savings.

What are the market trends shaping the Automotive Subscription Services Industry?

- The development of new mobility concepts is an emerging market trend. New mobility concepts are gaining momentum in the market.

- In response to the growing preference for flexible and eco-friendly transport solutions, automotive subscription services have emerged as a promising trend. Leasing companies are increasingly offering mobility systems that prioritize environmental compatibility and provide smart traffic management solutions. One notable example is Volkswagen's subsidiary, Porsche, which offers a shuttle-on-demand service in Hamburg, Germany, using electric vehicles. This innovative approach to ride pooling reduces the number of vehicles on the road, thereby minimizing traffic congestion and pollution.

- Leasing companies leverage advanced technologies, such as integrated ticketing, smartphone applications, and in-car communications, to create comprehensive packages for customers. By offering customizable and efficient mobility solutions, these companies aim to cater to the evolving needs of modern enterprises.

What challenges does the Automotive Subscription Services Industry face during its growth?

- The high maintenance costs for service providers represent a significant challenge that can hinder industry growth. In order to mitigate this issue and foster sustainable expansion, providers must continually seek ways to optimize operations and reduce costs without compromising service quality.

- The market is experiencing significant evolution due to the escalating costs associated with vehicle testing, inspection, and certification. Standard vehicle inspections range from USD150 to USD250, while safety inspections in North Carolina, US, cost USD13, and emissions inspections add an additional USD16. Car diagnostic tests vary between USD20 and USD400, depending on the region. These high prices create challenges for service providers, necessitating periodic maintenance.

- Government regulations and standards in the automotive industry undergo constant changes, impacting car maintenance, component design, and safety features.

Exclusive Technavio Analysis on Customer Landscape

The automotive subscription services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive subscription services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Subscription Services Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, automotive subscription services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - This company specializes in automotive subscription services, encompassing maintenance, tire and wheel protection, and insurance coverage. By bundling these offerings, consumers can streamline their vehicle ownership experience and potentially save on costs. The services cater to individual drivers seeking convenience and comprehensive coverage.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Assurant Inc.

- Bayerische Motoren Werke AG

- Cox Automotive Inc.

- Evogo Ltd

- Exelon Corp.

- Flexdrive Services LLC

- Freshcar

- General Motors Co.

- Hertz Global Holdings Inc.

- Hyundai Motor Co.

- Mercedes Benz Group AG

- Pinewoods technology services FZE

- Prazo Inc

- Tesla Inc.

- Toyota Motor Corp.

- Volkswagen Group

- Wagonex Ltd

- Zoomcar India Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Subscription Services Market

- In August 2024, BMW Group and Daimler AG announced a strategic collaboration to jointly develop a multi-brand car subscription service, aiming to leverage economies of scale and enhance customer offerings (BMW Group press release).

- In November 2024, Volvo Cars launched its Care by Volvo subscription service, offering all-inclusive monthly payments that include insurance, maintenance, and roadside assistance (Volvo Cars press release).

- In January 2025, General Motors' Maven brand secured a USD350 million investment from SoftBank Vision Fund to expand its car subscription and ride-hailing services, aiming to accelerate growth and innovation (Reuters).

- In March 2025, Tesla Inc. Introduced its Full Self-Driving (FSD) subscription plan, allowing customers to pay a monthly fee for advanced driver assistance features, marking a significant step towards autonomous driving services (Tesla Inc. Press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Subscription Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.6% |

|

Market growth 2024-2028 |

USD 3199.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.9 |

|

Key countries |

US, Germany, UK, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The global mobility services and vehicle subscription market is undergoing a transformative phase as platforms leverage digital vehicle passport technologies, real-time vehicle tracking, and usage-based pricing models to optimize fleet operations and subscription revenue streams. By integrating vehicle lifecycle management, vehicle depreciation models, and on-demand maintenance services, mobility providers can enhance operational efficiency improvement while reducing costs associated with unplanned repairs and asset underutilization. Usage-based pricing enables flexible customer plans, fostering personalized offers and strengthening customer relationship management, which contributes to higher satisfaction and retention rates.

- Robust risk management frameworks, insurance premium calculation, and fraud prevention measures are essential to maintain market integrity, while automated billing systems and secure payment processing facilitate seamless financial transactions. Fleet optimization strategies and service quality monitoring allow companies to analyze operational performance and refine contractual terms, ensuring regulatory compliance and adherence to industry standards. Comparative evaluation indicates that platforms implementing real-time vehicle tracking alongside usage-based pricing can achieve up to 15% improvement in asset utilization and a 12% reduction in maintenance-related costs, demonstrating tangible operational benefits.

- Customer segmentation, marketing campaign effectiveness, and satisfaction surveys provide actionable insights that inform personalized offerings, while stringent data security protocols and regulatory compliance measures protect user data and maintain trust. These evolving market dynamics underscore the continuous adaptation and technological integration shaping the mobility services landscape.

What are the Key Data Covered in this Automotive Subscription Services Market Research and Growth Report?

-

What is the expected growth of the Automotive Subscription Services Market between 2024 and 2028?

-

USD 3.2 billion, at a CAGR of 16.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (OEMs and Dealership or third party) and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing smartphone and internet penetration, High maintenance cost for service providers

-

-

Who are the major players in the Automotive Subscription Services Market?

-

AB Volvo, Assurant Inc., Bayerische Motoren Werke AG, Cox Automotive Inc., Evogo Ltd, Exelon Corp., Flexdrive Services LLC, Freshcar, General Motors Co., Hertz Global Holdings Inc., Hyundai Motor Co., Mercedes Benz Group AG, Pinewoods technology services FZE, Prazo Inc, Tesla Inc., Toyota Motor Corp., Volkswagen Group, Wagonex Ltd, and Zoomcar India Pvt. Ltd.

-

Market Research Insights

- The market is a continuously evolving landscape, with key components including contract terms management, performance monitoring systems, and customer service automation. These features aim to provide personalized offers and enhance customer engagement, optimizing fleet operations and mitigating risks. One notable example of market dynamics at play is a leading automaker experiencing a 25% increase in sales through its subscription service. Furthermore, industry growth is anticipated to reach 15% annually, driven by advancements in customer service platforms, vehicle tracking systems, and data security protocols.

We can help! Our analysts can customize this automotive subscription services market research report to meet your requirements.