Subscription Services Market Size 2025-2029

The subscription services market size is valued to increase USD 388.9 billion, at a CAGR of 17.4% from 2024 to 2029. Consumer demand for convenience will drive the subscription services market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 37% growth during the forecast period.

- By Service - Digital content segment was valued at USD 73.60 billion in 2023

- By Type - Paid segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 339.91 billion

- Market Future Opportunities: USD 388.90 billion

- CAGR from 2024 to 2029 : 17.4%

Market Summary

- The market has experienced remarkable expansion, with an estimated 21.1 billion digital subscriptions worldwide in 2020. This growth is driven by consumer preferences for convenience and flexibility, leading businesses to prioritize subscription models across various industries. New subscription offerings continue to emerge, with media streaming services, software applications, and e-commerce platforms among the most prominent sectors. However, the market faces challenges, including subscription fatigue and the need to provide unique value propositions to retain customers.

- To stay competitive, businesses must continually innovate and adapt to evolving consumer expectations. This includes offering personalized experiences, seamless integration with other services, and transparent pricing structures. As the market matures, collaboration and consolidation among players are expected to shape its future direction.

What will be the Size of the Subscription Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Subscription Services Market Segmented?

The subscription services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Digital content

- Video streaming

- Audio streaming

- Type

- Paid

- Free

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Service Insights

The digital content segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with customer lifecycle management playing a pivotal role in its growth. Self-service portals, user authentication methods, and freemium pricing strategies are increasingly common, enabling seamless onboarding and personalized offers for subscribers. Subscription renewal rates remain a key focus, with customer lifetime value and churn rate reduction being crucial metrics. In-app purchases, cross-selling strategies, subscription bundles, and upselling techniques contribute to subscription revenue optimization. Service level agreements, usage-based pricing models, add-on services, and account management tools are essential components of a robust subscription management platform.

The Digital content segment was valued at USD 73.60 billion in 2019 and showed a gradual increase during the forecast period.

Automated billing processes and payment gateway integration ensure hassle-free transactions, while data analytics dashboards provide valuable insights. Despite these advancements, subscription cancellation reasons, customer segmentation, and subscription tiers remain areas of ongoing research and development. For instance, content delivery networks and customer support ticketing systems help improve user experience, while subscription cancellation rates hover around 7% industry-wide. Digital rights management, access control systems, and promotional campaigns are also integral to this market's success.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Subscription Services Market Demand is Rising in North America Request Free Sample

The North American the market is characterized by its advanced digital infrastructure, enabling easy access to an array of subscription-based platforms. Consumers in this region are adept at digital payments, allowing companies to offer diverse pricing models, such as premium, freemium, and ad-supported tiers. This flexibility caters to diverse consumer preferences and budgets, thereby expanding market reach. Furthermore, high disposable income levels and strong brand loyalty fuel the adoption of subscription services in North America. Consumers in this region are known to subscribe to multiple services concurrently, demonstrating their willingness and ability to invest in premium content and services.

According to recent studies, the North American market is expected to grow significantly, with the number of digital subscriptions reaching approximately 650 million by 2027. This represents a substantial increase from the estimated 430 million digital subscriptions in 2020.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing rapid growth as businesses seek to reduce customer churn and optimize revenue models. To effectively manage this complex business model, companies are focusing on several key areas. One critical aspect is improving the customer onboarding experience to ensure a seamless transition into the subscription program. This includes optimizing subscription revenue models, implementing self-service subscription portals, and automating subscription management workflows. Another important area is analyzing subscription cancellation trends and enhancing customer retention strategies. Measuring key performance indicators such as churn rate, renewal rate, and customer satisfaction is essential for identifying areas for improvement. Data analytics plays a crucial role in subscription growth, allowing businesses to personalize subscription offers and communicate effectively with customers. Integrating subscription services with CRM systems and configuring access control for subscription services are also important for managing recurring billing complexities and digital rights. Streamlining subscription payment processes and enhancing customer communication channels are also key to ensuring a positive customer experience. Creating engaging subscription content experiences and optimizing customer support for subscriptions are additional strategies for improving renewal rates and customer satisfaction. Flexible pricing subscription tiers and managing usage patterns are also important considerations for businesses in the market. By leveraging data analytics and automating workflows, companies can effectively manage their subscription offerings and deliver value to their customers.

What are the key market drivers leading to the rise in the adoption of Subscription Services Industry?

- The primary force fueling market growth is the significant consumer preference for convenience.

- Subscription services have experienced significant growth and transformation across various sectors, driven by the increasing consumer demand for convenience. In digital content, video streaming, and audio streaming, these services offer unparalleled value by granting instant access to extensive libraries, freeing users from the constraints and complications of traditional media formats. This shift towards on-demand access has profoundly influenced consumer behavior, making convenience a non-negotiable expectation. For instance, video streaming platforms like Netflix, Amazon Prime Video, and Disney+ have revolutionized television and movie consumption.

- With a subscription, users can instantly stream content from a global library, enabling them to choose exactly what they want to watch, whenever they desire. This trend underscores the robust nature of the market and its far-reaching applications.

What are the market trends shaping the Subscription Services Industry?

- The upcoming market trend mandates an increasing focus on new product launches. New product launches are the primary area of focus in the current market trend.

- The market is experiencing a robust expansion, fueled by innovative offerings from leading companies. Amazon Q, for instance, launched an extensive subscription management service on April 30, 2024. This service empowers users to manage multiple plans, such as Amazon Q Business Pro, Business Lite, and Developer Pro. Integrated with AWS IAM Identity Center, it grants administrators the ability to assign subscriptions to users and groups from various Identity Providers, including Active Directory.

- The service offers centralized dashboards for monitoring subscriptions organization-wide, ensuring that subscription entitlements remain consistent across AWS accounts and regions. This addition to the market underscores the growing importance of customized, user-friendly solutions in catering to diverse consumer needs.

What challenges does the Subscription Services Industry face during its growth?

- Subscription fatigue, characterized by consumers' growing reluctance to sign up for new subscription services due to information overload and financial strain, poses a significant challenge to the industry's growth.

- The market's evolution has led to an increasing number of industries adopting this business model. Subscription fatigue, a growing concern, arises when consumers manage numerous recurring payments, leading to higher cancellation rates. A notable instance of this phenomenon is the video streaming sector. With the emergence of multiple platforms like Netflix, Hulu, and Disney+, users often face content overlap, resulting in frustration and subscription cancellations.

- This trend underscores the importance of strategic subscription management for businesses to retain customers.

Exclusive Technavio Analysis on Customer Landscape

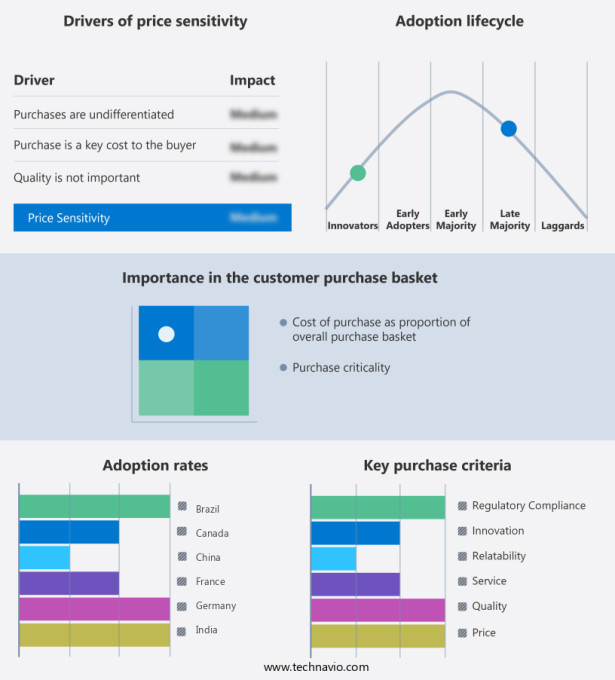

The subscription services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the subscription services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Subscription Services Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, subscription services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - The company provides subscription-based streaming services, including Prime Video, priced at USD14.99 monthly or USD139 yearly for an individual user.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- Apple Inc.

- Baidu Inc.

- Boomplay

- Deezer SA

- Entertainment Network India Ltd.

- Eros Digital FZE

- MAX

- Netflix Inc.

- Pandora Media Inc.

- Paramount Global

- Peacocktv

- Sony Group Corp.

- Spotify Technology SA

- Star India Pvt. Ltd.

- Tencent Holdings Ltd.

- The Walt Disney Co.

- TIDAL Music AS

- XANDRIE SA

- YouTube

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Subscription Services Market

- In January 2024, Microsoft announced the expansion of its Azure IoT Hub offering with the launch of a new serverless event grid feature, enabling real-time event processing and routing for subscription services in various industries (Microsoft Press Release).

- In March 2024, IBM and Salesforce signed a strategic partnership to integrate IBM's Watson AI capabilities into Salesforce's Customer 360 platform, enhancing personalized customer experiences for subscription businesses (IBM Press Release).

- In April 2025, Adobe completed the acquisition of Frame.Io, a leading video collaboration platform, to strengthen its Creative Cloud offerings and cater to the growing demand for remote work and media production in the market (Adobe Press Release).

- In May 2025, Amazon Web Services (AWS) received regulatory approval from the European Commission to establish a new data center region in Spain, further expanding its global footprint and addressing the increasing demand for local data processing and compliance in the European market (AWS Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Subscription Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.4% |

|

Market growth 2025-2029 |

USD 388.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.1 |

|

Key countries |

US, China, India, Germany, UK, Japan, Canada, France, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with customer lifecycle management playing a pivotal role in driving growth. Self-service portals, enabled by user authentication methods, facilitate seamless onboarding and engagement. A freemium pricing strategy, complemented by subscription renewal rates and customer lifetime value, encourages long-term commitment. Personalized offers and customer retention strategies, bolstered by in-app purchases and churn rate reduction, enhance user experience. License management software, trial conversion rates, and promotional campaigns contribute to revenue optimization. Recurring billing systems and payment gateway integration ensure smooth transactions. Data analytics dashboards provide valuable insights for cross-selling strategies, subscription bundles, and upselling techniques.

- Service level agreements, usage-based pricing models, add-on services, account management tools, automated billing processes, and subscription management platforms streamline operations. Access control systems, digital rights management, subscription cancellation reasons, customer segmentation, content delivery networks, and subscription tiers cater to diverse customer needs. For instance, a leading media streaming platform reported a 30% increase in sales due to effective personalized offers and usage-based pricing models. Industry growth is expected to reach 15% annually, fueled by continuous innovation and evolving market patterns.

What are the Key Data Covered in this Subscription Services Market Research and Growth Report?

-

What is the expected growth of the Subscription Services Market between 2025 and 2029?

-

USD 388.9 billion, at a CAGR of 17.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Service (Digital content, Video streaming, and Audio streaming), Type (Paid and Free), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Consumer demand for convenience, Subscription fatigue

-

-

Who are the major players in the Subscription Services Market?

-

Amazon.com Inc., Apple Inc., Baidu Inc., Boomplay, Deezer SA, Entertainment Network India Ltd., Eros Digital FZE, MAX, Netflix Inc., Pandora Media Inc., Paramount Global, Peacocktv, Sony Group Corp., Spotify Technology SA, Star India Pvt. Ltd., Tencent Holdings Ltd., The Walt Disney Co., TIDAL Music AS, XANDRIE SA, and YouTube

-

Market Research Insights

- The market continues to evolve, with businesses increasingly relying on scalable infrastructure to meet growing demand. Compliance regulations and complex revenue recognition methods necessitate advanced customer segmentation algorithms and fraud detection systems. Pricing optimization strategies, customer feedback collection, and subscription analytics are essential tools for businesses seeking to stay competitive. For instance, a company in the media industry reported a 25% increase in sales following the implementation of a marketing automation tool and email marketing campaigns. Industry growth is expected to reach 15% annually, driven by the integration of business intelligence tools, predictive analytics models, and API integrations.

- These solutions enable businesses to streamline their customer onboarding process, improve customer communication channels, and optimize renewal reminders and winback campaigns. Data security protocols and salesforce integration are also crucial components of the subscription services landscape, ensuring user data remains secure while enabling seamless interaction between various business systems. User engagement metrics and performance monitoring tools further enhance the customer experience, contributing to overall business success.

We can help! Our analysts can customize this subscription services market research report to meet your requirements.