Avocado Market Size 2025-2029

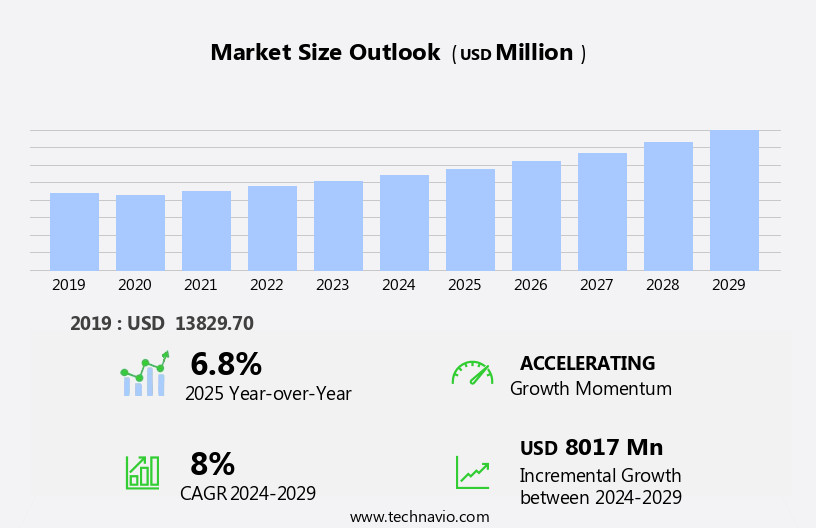

The avocado market size is forecast to increase by USD 8.02 billion, at a CAGR of 8% between 2024 and 2029.

- The market is driven by the increasing recognition of avocados' health benefits, with their rich nutritional content fueling consumer demand. This trend is particularly strong in regions where a health-conscious population seeks out fresh produce for their diets. However, the market faces challenges related to the perishable nature of avocados, necessitating the adoption of advanced technologies to extend their shelf life. One such technology is controlled atmospheric storage, which maintains optimal temperature and humidity levels to preserve avocados' freshness. Another challenge for the market is the relatively low popularity of avocado oil compared to other edible oils.

- Despite its high monounsaturated fat content and potential health benefits, avocado oil has not yet gained widespread acceptance in the culinary world. To capitalize on this opportunity, companies could focus on increasing consumer awareness and education about the unique properties and uses of avocado oil. By addressing these challenges and leveraging the growing demand for healthier food options, market participants can effectively position themselves to capitalize on the market's promising potential.

What will be the Size of the Avocado Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic trends shaping its various sectors. Avocado mayonnaise and spreads are gaining popularity as healthier alternatives to traditional condiments, while avocado recipes expand beyond salads and guacamole. Avocado derivatives, such as oil, seed, and butter, are finding applications in food processing and cosmetics industries. Farming innovations and sustainability practices influence avocado cultivation, with an increasing focus on optimizing yield and reducing water usage. Avocado plantations adapt to meet consumer demands, implementing advanced storage solutions and processing techniques to ensure consistent supply and quality. Market trends indicate a growing interest in avocado's nutritional benefits, including its rich mineral content, phytonutrients, and healthy fats.

This has led to a surge in demand for avocado-based products, from sauces and dressings to mash, paste, and puree. The market size continues to expand, driven by increasing global trade and consumer preferences for fresh, flavorful produce. Regulations and standards play a crucial role in ensuring food safety and quality, while avocado's versatility and health advantages fuel its ongoing growth. Avocado's applications extend beyond the kitchen, with potential in various industries, from pharmaceuticals to cosmetics. As market activities unfold, the avocado industry remains a vibrant and evolving sector, reflecting the ongoing demand for nutritious, delicious, and sustainable produce.

How is this Avocado Industry segmented?

The avocado industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Conventional

- Organic

- Distribution Channel

- Offline

- Online

- End-user

- Food and beverage

- Retail

- Cosmetics and personal care

- Others

- Type

- Raw

- Processed

- Geography

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Chile

- Colombia

- Peru

- Rest of World (ROW)

- North America

.

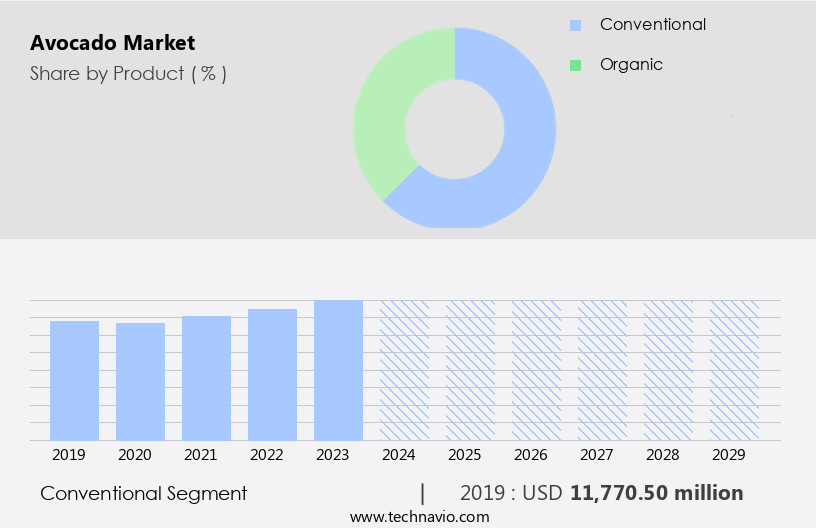

By Product Insights

The conventional segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing demand for this nutrient-dense fruit. Avocado's rich mineral content, including potassium, vitamin K, and folate, contributes to its popularity as a health food. The fruit's versatility in culinary uses, from avocado toast and salads to sauces, dips, and spreads, further boosts its market potential. Avocado exports and imports have been on the rise, with major producing countries like Mexico and Peru supplying a significant portion of the global demand. However, the ripening process is crucial in maintaining the fruit's quality and shelf life, requiring careful handling and transportation.

Regulations play a vital role in the market, ensuring food safety and sustainable farming practices. Avocado cultivars, such as the Hass avocado, are widely cultivated due to their superior taste and texture. Avocado farming involves careful harvesting techniques to ensure optimal ripeness and minimize damage to the fruit. Avocado's phytonutrient content, including carotenoids and polyphenols, offers numerous health benefits. Its high monounsaturated fat content makes it a popular choice for consumers seeking heart-healthy options. However, allergens in avocados can pose a challenge for some individuals. The market for avocado-based products, including seed oil, mash, smoothie, puree, and derivatives, is expanding rapidly.

Avocado's antioxidant properties and its role in various food applications contribute to its market growth. The market size is expected to continue expanding, driven by increasing consumption and innovation in avocado products. Sustainability and ethical farming practices are becoming increasingly important to consumers, leading to a growing demand for organic and fair trade avocados. Avocado orchards and plantations must adhere to strict standards to meet this demand, ensuring a responsible and sustainable supply chain. The market's dynamics are influenced by various factors, including weather conditions, consumer preferences, and regulations. Avocado's versatility and health benefits make it a staple in many diets, and its popularity continues to grow.

The Conventional segment was valued at USD 11.77 billion in 2019 and showed a gradual increase during the forecast period.

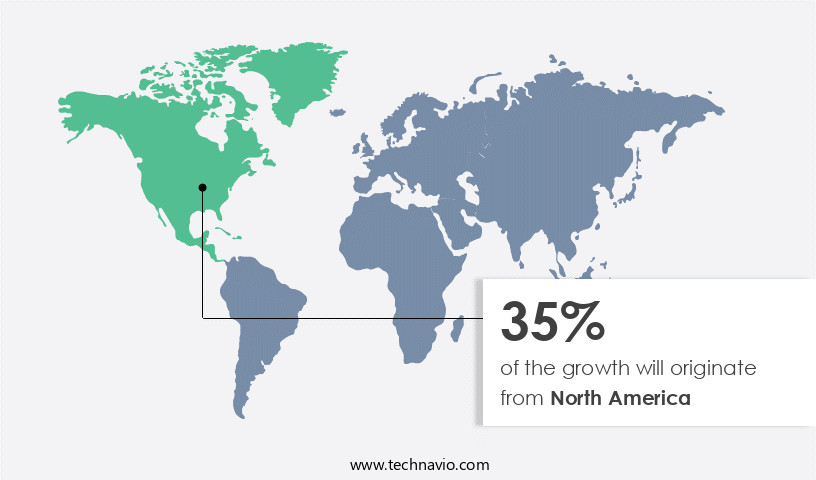

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to rising consumer awareness about the fruit's health benefits and the increasing number of new product launches. Avocado varieties, such as Hass, are gaining popularity, leading to an increase in demand. California, with over 3,000 avocado growers farming on more than 50,000 acres, is the largest avocado-producing state in the US. This surge in raw avocado production contributes to the market's growth in terms of both revenue and volume. Avocado ripening techniques have also advanced, ensuring a consistent supply throughout the year. Sustainability is a key focus in avocado cultivation, with companies implementing eco-friendly farming practices and using renewable energy sources.

Avocado's nutrient-rich content, including minerals, phytonutrients, and healthy fats, makes it a staple in various culinary uses, such as salads, toast, sauces, and spreads. Despite some allergens, avocado's health benefits outweigh the risks. The market size is expected to grow as consumers continue to seek out avocado-based products, such as mash, smoothies, and purees, for their antioxidant properties. The market's growth is further driven by the development of new avocado derivatives, including seed oil, butter, and dressing. Regulations and standards ensure the quality and safety of avocado products, while advancements in packaging and storage technologies maintain their freshness.

The market's future looks promising, with ongoing research focusing on improving cultivars, harvesting techniques, and processing methods.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Avocado Industry?

- The significant health benefits associated with avocados serve as the primary driver for the market's growth.

- The market is experiencing significant growth due to increasing consumer awareness and appreciation for the health benefits of this fruit. Avocados are rich in essential vitamins, including C, E, K, and B-6, as well as nutrients such as riboflavin, niacin, folate, pantothenic acid, magnesium, potassium, lutein, and omega-3 fatty acids. The fruit also contains a natural plant sterol called beta-sitosterol, which contributes to heart health by maintaining healthy cholesterol levels. Moreover, avocados are beneficial for eye health due to their lutein and zeaxanthin content, which offer antioxidant protection. Avocados are available in various forms, including fresh, packaged, and processed.

- Hass avocados are a popular variety, known for their creamy texture and rich flavor. Avocado orchards produce the fruit, which is then processed into various products such as avocado sauce, cubes, and pit removal. The market growth can be attributed to the increasing demand for healthy food options and the versatility of avocados in various dishes. The distribution channels for avocados have expanded, ensuring their availability in various retail outlets and supermarkets. The market adheres to stringent standards to maintain the quality and safety of the fruit. Despite the increasing price, consumers continue to purchase avocados due to their numerous health benefits.

What are the market trends shaping the Avocado Industry?

- The adoption of innovative technologies is a significant market trend, extending the shelf life of avocados and ensuring their freshness for longer periods. This development is crucial for the avocado industry, enhancing its competitiveness and sustainability.

- The market is experiencing significant growth due to advancements in technology and innovation in avocado processing and storage solutions. Companies are developing new technologies to extend the shelf life of avocado products, enhancing their market value and consumer appeal. For instance, Smart Ripe by ILIP Srl is a smart packaging system for avocados that uses RFID tags to provide real-time information on the fruit's ripeness, ensuring optimal freshness and reducing waste. Additionally, coatings like Naturcover from DECCO IBERICA POST-COSECHA S.A.U.

- Help preserve avocados by reducing dehydration and acting as a carrier for fungicides. Avocado derivatives, such as avocado mayonnaise, avocado spread, avocado dip, avocado oil, avocado seed oil, avocado butter, and avocado dressing, are gaining popularity in various food applications, driving market demand. The versatility of avocados in the food industry, coupled with their nutritional benefits, makes them an attractive option for consumers and businesses alike.

What challenges does the Avocado Industry face during its growth?

- The low popularity of avocado oil presents a significant challenge to the industry's growth trajectory. With consumer preferences shifting towards healthier cooking alternatives, the avocado oil industry faces the daunting task of increasing market penetration and awareness to realize its full potential.

- Avocado oil is a lesser-known yet valuable addition to the global edible oil market. Although avocado products, such as fresh avocados and guacamole, are widely consumed, avocado oil often goes unnoticed. The demand for avocado oil lags behind more established oils like olive oil, coconut oil, soybean oil, and canola oil due to their wider availability and lower prices. For instance, the average selling price of avocado oil in New Zealand and Australia is approximately USD5 for a 250 ml bottle, whereas olive oil prices range from USD 2 to USD 10 for the same quantity, depending on its country of origin.

- Avocado oil's market dynamics are influenced by several factors, including supply and demand, ripening techniques, and regulations. Avocado cultivars, such as Hass and Fuerte, are grown in various regions worldwide, contributing to the global avocado supply. Avocado ripening is a critical aspect of the market, with proper handling and storage ensuring optimal quality and shelf life. Regulations play a significant role in the avocado oil market, with various countries implementing import and export restrictions to maintain food safety and quality standards. Avocado oil's nutritional benefits, including its rich mineral content and phytonutrients, contribute to its growing popularity.

- The oil's skin and pulp are rich sources of these nutrients, making it a valuable addition to a healthy diet. Sustainability is another essential factor driving the growth of the avocado oil market. Avocado cultivation practices are increasingly focused on reducing water usage and minimizing the environmental impact, making it an attractive option for health-conscious consumers. Overall, the avocado oil market is poised for growth, with increasing consumer awareness and demand for healthy, sustainable food options.

Exclusive Customer Landscape

The avocado market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the avocado market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, avocado market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Brooks Tropicals LLC - The company specializes in avocado products, featuring the tropical SlimCado variety. T

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Brooks Tropicals LLC

- Calavo Growers Inc.

- Costa Group Holdings Ltd.

- Del Monte Foods Inc.

- Del Rey Avocado Co. Inc.

- Fresca Group Ltd.

- Greenyard NV

- Henry Avocado Corp.

- Index Fresh Inc.

- JBR Avocados

- McDaniel Fruit Co.

- Melissas World Variety Produce Inc.

- MHAIAs

- Natures Touch Frozen Foods Inc.

- Propal

- Rincon Farms Produce

- Salud Foodgroup Europe BV

- Tesco Plc

- West Pak Avocado Inc.

- Westfalia Fruit Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Avocado Market

- In February 2023, California-based avocado growers and distributors, Calavo Growers, Inc., announced a strategic partnership with Mexican avocado producer, Grupo Agrofruttal, to expand their avocado supply chain in Mexico. This collaboration aims to strengthen Calavo's position in the market by increasing their access to high-quality Mexican avocados (Calavo Growers, Inc. Press release).

- In May 2024, Whole Foods Market, an Amazon company, launched a new avocado ripening facility in California, using advanced technology to ensure optimal ripening and a consistent supply of fresh avocados. This investment in technology is expected to reduce waste and improve the overall customer experience (Whole Foods Market press release).

- In October 2024, Chilean avocado exporter, Agroamerica, secured a USD 50 million investment from the International Finance Corporation (IFC) to expand its avocado production and processing capacity. This funding will support the company's growth plans and help it meet the increasing global demand for avocados (International Finance Corporation press release).

- In January 2025, the European Union (EU) approved a new regulation allowing the import of Mexican avocados without fumigation, making it easier for Mexican producers to export their avocados to the EU market. This regulatory change is expected to boost Mexican avocado exports to Europe and strengthen the global avocado supply chain (European Commission press release).

Research Analyst Overview

- The market exhibits dynamic trends and evolving consumer preferences, with online sales experiencing significant growth. Food safety remains a top priority, driving innovation in avocado packaging materials and pasteurization techniques. Investment opportunities abound in areas such as organic farming, culinary innovation, and technology trends. Market segmentation reveals distinct preferences for avocado varieties and applications, from retail sales to foodservice demand. Avocado industry analysis indicates a focus on sustainability practices and fair trade, as consumers demand transparency and ethical production methods. Nutritional analysis continues to highlight the health benefits of avocados, fueling innovation in oil extraction and butter production.

- Traceability and pricing strategies are crucial in maintaining brand loyalty and navigating market competition. Food trends favor avocado's versatility and nutritional value, while innovation in shelf life extension and culinary applications expand market reach. The organic farming sector responds to consumer demand for sustainable and healthier food options. The avocado industry remains a vibrant landscape, with ongoing research in health benefits, production methods, and technological advancements shaping its future.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Avocado Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market growth 2025-2029 |

USD 8017 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, Brazil, Argentina, Canada, China, Chile, Colombia, Japan, India, and Peru |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Avocado Market Research and Growth Report?

- CAGR of the Avocado industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, South America, APAC, Middle East and Africa, and Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the avocado market growth of industry companies

We can help! Our analysts can customize this avocado market research report to meet your requirements.