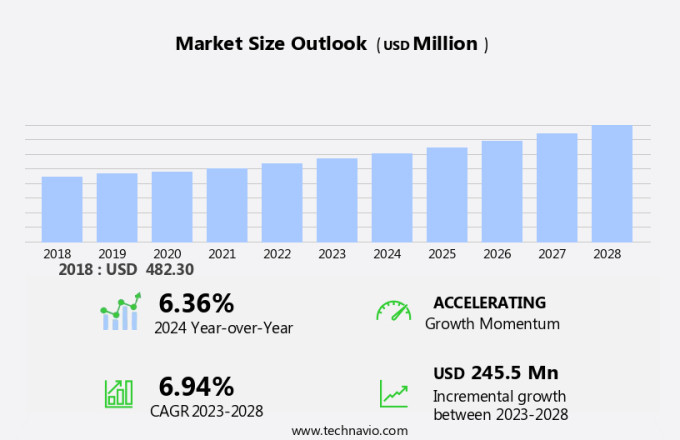

Benzoic Acid Market Size 2024-2028

The benzoic acid market size is forecast to increase by USD 245.5 million at a CAGR of 6.94% between 2023 and 2028.

- The market is experiencing significant growth due to the high demand for this preservative In the food and beverage industry. With the increasing consumption of processed and packaged food in North America, the need for effective preservatives is on the rise. However, the market is also facing challenges due to health and environmental concerns. Benzoic acid has been linked to health hazards such as allergic reactions and hyperactivity in children. Benzoic acid also finds applications In the paper industries as a preservative and In the production of nonphthalate plasticizers. Additionally, its production and disposal have negative environmental impacts. These factors are likely to influence the market dynamics and may lead to the development of alternative preservatives or stricter regulations. Overall, the market is expected to continue its growth trajectory, driven by the food industry, but with a focus on addressing the associated health and environmental concerns.

What will be the Size of the Benzoic Acid Market During the Forecast Period?

- The market encompasses the production and consumption of this microbiological preservative in various industries, including food preservation and the chemical sector. It is a widely used food additive, extending the shelf life of instant food and packaged products for consumers and food producers.

- Moreover, its applications span beyond food, extending to toothpaste and mouthwash, ointments for fungal skin diseases, anti-aging products, and even burn treatments. In the food industry, it is particularly relevant to processed foods, beverage products, snacks, fruit juices, and processed meat snacks. The middleclass population's growing demand for convenient, ready-to-eat meals further fuels market growth. The chemical sector's evolution towards safer alternatives to phthalate plasticizers is expected to impact market dynamics.

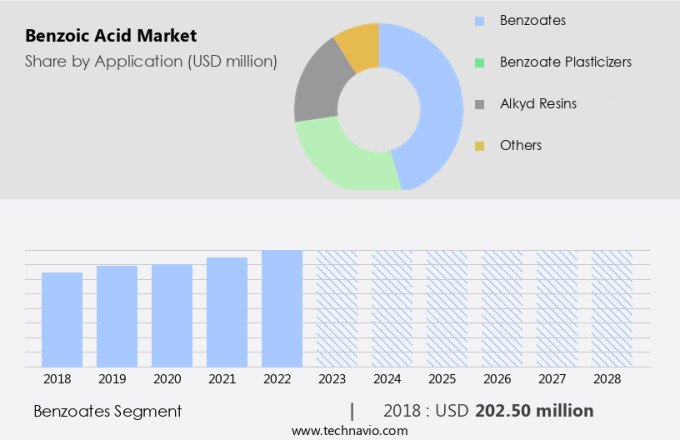

How is this Benzoic Acid Industry segmented and which is the largest segment?

The benzoic acid industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Benzoates

- Benzoate plasticizers

- Alkyd resins

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Application Insights

- The benzoates segment is estimated to witness significant growth during the forecast period.

Benzoic acid is a significant chemical compound utilized in various industries, primarily In the production of benzoates, such as sodium and potassium benzoate. These derivatives, derived are widely employed In the food and beverage, cosmetic, and pharmaceutical sectors. Benzoic acid is also the base ingredient for the production of benzyl esters, which are integral to the flavors and fragrances industry. In the food and beverage industry, potassium benzoate, the potassium salt of benzoic acid, is extensively used as a preservative, particularly in soft drinks and energy drinks. It effectively inhibits microbial growth, preserving food freshness, color, and taste.

Get a glance at the Benzoic Acid Industry report of share of various segments Request Free Sample

The benzoates segment was valued at USD 202.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 62% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Benzoic acid and its derivatives hold a significant market share In the APAC region due to the expansion of industries such as food and beverage, chemical, paints and coatings, and building and construction. The strong economic growth in APAC, particularly in China, Japan, India, Indonesia, and Vietnam, has led to increased usage in various applications. The food and beverage industry's growing demand for food preservatives and the rising preference for packaged and processed foods and drinks contribute to consumption. Additionally, the building and construction industry's expansion in APAC, particularly In the use of non-phthalate plasticizers (benzoate plasticizers) in coatings, adhesives, sealants, and PVC, is driving market growth.

Market Dynamics

Our benzoic acid market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Benzoic Acid Industry?

High demand for benzoic acid from food and beverage industry is the key driver of the market.

- Benzoic acid is a significant preservative In the food and beverage industry, renowned for its anti-fungal properties and excellent solubility. Food producers extensively use it and its derivatives, such as potassium benzoate and sodium benzoate, to preserve acidic food products and beverages, including jams, fruit juices, and carbonated drinks. These preservatives do not alter the taste of the food and beverages, making them an ideal choice for consumers seeking freshness, safety, and taste. The increasing consumption of instant and packaged food products in developed and developing regions, driven by the middleclass population and working women, has driven the demand for food preservatives.

- Furthermore, potassium benzoate and sodium benzoate inhibit bacterial growth and are used in antimicrobial packaging to enhance the shelf life of processed food and beverage products. In the beverage industry, potassium benzoate is used as a preservative in soft or energy drinks. The demand and its derivatives is not limited to the food and beverage sector; they are also used in toothpaste and mouthwash, ointments for fungal skin diseases, anti-aging products, and burn treatments. The paper industries use as a chemical intermediate. The global food additives market is projected to grow significantly due to health, wellness trends, clean labels, and innovative product launches.

What are the market trends shaping the Benzoic Acid Industry?

Rising demand for processed and packaged food is the upcoming market trend.

- The demand for preservatives In the food industry has surged due to the increasing consumption of processed and packaged food products in both developed and developing regions. It is a common preservative, is widely used in food preservation to enhance shelf life and ensure food safety. This trend is driven by various factors, including the growing middleclass population, especially in developing regions, and the increasing preference for convenience foods among working women. In the food and beverage industry, it is used in a wide range of products, including instant food, packaged food products, salad dressings, pickles, sauces, condiments, carbonated drinks, and fruit juices.

- In addition, it is used in non-food applications such as toothpaste and mouthwash, ointments for fungal skin diseases, anti-aging products, and burn treatments. The chemical sector also utilizes a chemical intermediate In the production of phthalate plasticizers and nonphthalate plasticizers, as well as In the paper industries. The use of benzoic acid as a microbiological preservative in processed foods and beverage products helps maintain freshness, safety, taste, appearance, and texture. The Food and Drug Administration (FDA) has approved the use of sodium benzoate as a food additive, making it a popular choice among food producers. The market is expected to grow further due to increasing health and wellness trends, clean label initiatives, and innovative product launches In the food and beverage industry.

What challenges does the Benzoic Acid Industry face during its growth?

Health hazards and environmental effects of benzoic acid is a key challenge affecting the industry growth.

- Benzoic acid, a preservative widely used in food preservation, plays a significant role in extending the shelf life of various packaged food products and instant food items. Consumers and food producers rely on this microbiological preservative, derived from phenols, to ensure the freshness, safety, taste, appearance, and texture of processed foods, beverage products, snacks, fruit juices, processed meat snacks, frozen meals, and RTE breakfast items. The chemical sector also utilizes benzoic acid in toothpaste and mouthwash, ointments for fungal skin diseases, anti-aging, and burn treatments. Despite its benefits, the use of benzoic acid raises concerns regarding potential health risks.

- In addition, when combined with vitamin C in drinks, it can release or form benzene, a carcinogen. High concentrations of sodium benzoate in food can be toxic. In case of a fire at a sodium benzoate production site, toxic gases are released into the air. Moreover, the combination of sodium benzoate with strong oxidizers can result in a flash powder explosion. Consumption of highly concentrated benzoic acid can lead to irritation and damage to the eyes, lungs, and digestive tract. The middleclass population in developed and developing regions increasingly demands clean label and organic food products, leading to innovative product launches In the food and beverage industries.

Exclusive Customer Landscape

The benzoic acid market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the benzoic acid market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, benzoic acid market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aarti Industries Ltd.

- Chemcrux Enterprises Ltd.

- Eastman Chemical Co.

- FUSHIMI Pharmaceutical Co. Ltd.

- Ganesh Benzoplast Ltd.

- GFS Chemicals Inc.

- Hemadri Chemicals

- IG Petrochemicals Ltd.

- Merck and Co. Inc.

- MP Biomedicals Inc.

- Navyug Pharmachem Pvt. Ltd.

- Pat Impex

- Premier Group Of Industries

- Shri Hari Chemicals

- Smart Chemicals Group Co. Ltd.

- Swastik Industries

- The Chemical Co.

- Thermo Fisher Scientific Inc.

- Tianjin Dongda Chemical Group Co. Ltd

- Velsicol Chemical LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Benzoic acid, a phenolic compound, is a widely used preservative in various industries, including food and beverage production. Its role in food preservation is significant, as it helps extend the shelf life of numerous products by inhibiting the growth of microorganisms. The demand is driven by several factors. The increasing consumption of instant and packaged food products, particularly in developed regions, has led to an increase in demand for food additives. Consumers In these regions are increasingly focused on convenience and freshness, leading food producers to turn to preservatives to ensure the longevity of their offerings.

Moreover, in the food industry, it is used in a wide range of products, from processed meats and snacks to fruit juices and beverages. Its application In the beverage industry is particularly noteworthy, as it is used in carbonated drinks, salad dressings, pickles, sauces, and condiments to prevent spoilage. The chemical sector also utilizes this acid, primarily In the production of toothpaste and mouthwash. In addition, it is used In the paper industries for the manufacture of coatings and adhesives. It also finds applications In the pharmaceutical industry, where it is used In the production of ointments for the treatment of fungal skin diseases, anti-aging products, and burn treatments.

Furthermore, the demand is not limited to developed regions. Developing regions, particularly in Latin America, are experiencing significant growth In the consumption of processed food and beverage products. The Mexican market, for instance, has seen an increase in demand for processed food and beverages, driven by the growing middleclass population and increasing health and wellness trends. The trend towards clean labels and organic products has led to an increase In the demand for non-phthalate plasticizers. Consumers are increasingly concerned about the safety and health implications of the chemicals used in food and beverage production, leading to a shift towards natural preservatives.

In addition, innovative product launches In the food and beverage industry are also driving the demand. Functional and organic food and beverage products, which often have a shorter shelf life than their conventional counterparts, require effective preservatives to ensure their freshness and safety. The food packaging industry is also a significant consumer. The focus on extending the shelf life of food and beverage products, while maintaining their taste, appearance, and texture, has led to the widespread use as a preservative. Therefore, the demand is driven by several factors, including the increasing consumption of processed food and beverage products, health and wellness trends, and the need for effective preservatives in various industries. The trend towards clean labels and organic products is also expected to drive the demand, as it is considered a natural preservative.

|

Benzoic Acid Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.94% |

|

Market growth 2024-2028 |

USD 245.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.36 |

|

Key countries |

China, US, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Benzoic Acid Market Research and Growth Report?

- CAGR of the Benzoic Acid industry during the forecast period

- Detailed information on factors that will drive the Benzoic Acid growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the benzoic acid market growth of industry companies

We can help! Our analysts can customize this benzoic acid market research report to meet your requirements.