Juices Market Size 2025-2029

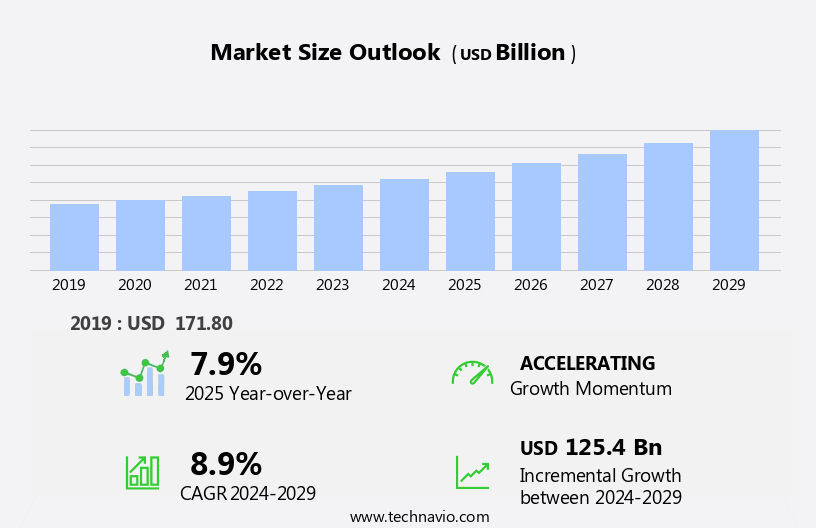

The juices market size is forecast to increase by USD 125.4 billion, at a CAGR of 8.9% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the rising preference for healthier beverage options and the increasing prominence of private-label brands. Cold-pressed juice, with its perceived health benefits, is gaining traction over traditional juice due to its minimal processing and preservation of nutrients. However, this trend poses challenges for manufacturers as the fluctuating prices of raw materials, such as fruits and vegetables, can significantly impact profitability.

- Moreover, the intensifying competition from private-label brands, which often offer lower prices, puts pressure on established brands to innovate and differentiate their offerings. To capitalize on the market's opportunities, companies must focus on product innovation, sustainability, and effective supply chain management to maintain competitiveness and cater to evolving consumer preferences.

What will be the Size of the Juices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic trends shaping its landscape. Health-conscious consumers are driving the demand for low-sugar and sugar-free juice options, as well as those made from ethically sourced and fair trade fruits. Innovation in the sector is ongoing, with the introduction of plant-based juices, probiotic juices, and functional juices. Juice machines, from home models to commercial ones, facilitate the production of these beverages. Pasteurization and clean label are key considerations for juice manufacturers. Tetra Pak and aseptic packaging offer solutions for juice preservation and convenience. Juice filtration and juice processing technologies ensure consistent nutritional value and high-quality juice.

Functional juices, energy boosters, and collagen juices cater to specific consumer needs. Cold-pressed juices and vegetable juices offer unique health benefits. Juice blends, juice cocktails, and juice recipes add variety to the market. Concentrated juices and juice bases provide convenience for food service and wholesale distribution. The market is not limited to retail sales. E-commerce platforms and food service establishments contribute significantly to its growth. Juice consumption is a continuous activity, with consumers seeking new and exciting flavors and combinations. The market's evolution is a reflection of the industry's commitment to meeting the ever-changing needs and preferences of health-conscious consumers.

How is this Juices Industry segmented?

The juices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Fruit juices

- Vegetable juices

- Others

- Distribution Channel

- Offline

- Online

- Type

- 100 percent fruit juice

- Nectars

- Juice drinks

- Concentrates

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

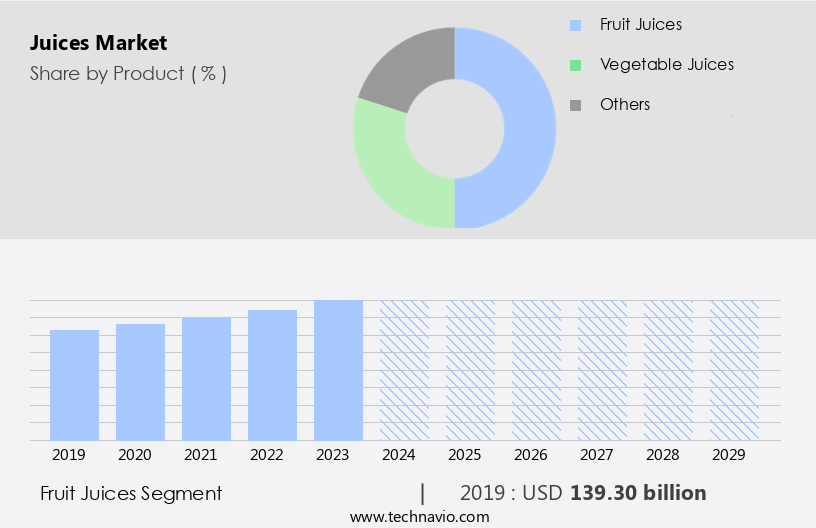

By Product Insights

The fruit juices segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, fruit juices hold the largest share due to rising consumption of processed food and increasing health consciousness. Companies innovate by introducing new, delicious, and economical flavors to attract consumers. Regulatory bodies enforce stricter regulations to ensure juice safety and high nutritional value. Low-sugar and sugar-free juices gain popularity as consumers focus on health. Juice homogenization and pasteurization techniques ensure consistency and longer shelf life. Convenience stores and health food stores are significant distribution channels. Plant-based juices, including superfood and probiotic blends, cater to ethical sourcing and clean label preferences. Juice bars and juice machines offer customizable and fresh options.

Juice filtration and juice presses ensure juice purity. Juice combinations, recipes, and concentrates cater to various consumer needs. Wholesale distribution, e-commerce sales, and food service expand market reach. Aseptic packaging and juice preservation technologies maintain juice freshness. Vegan and non-GMO juices cater to diverse dietary needs. Energy-boosting and high-pulp juices provide health benefits. Commercial juicers and home juicers cater to different consumer segments. Overall, the market continues to evolve, driven by consumer preferences and regulatory requirements.

The Fruit juices segment was valued at USD 139.30 billion in 2019 and showed a gradual increase during the forecast period.

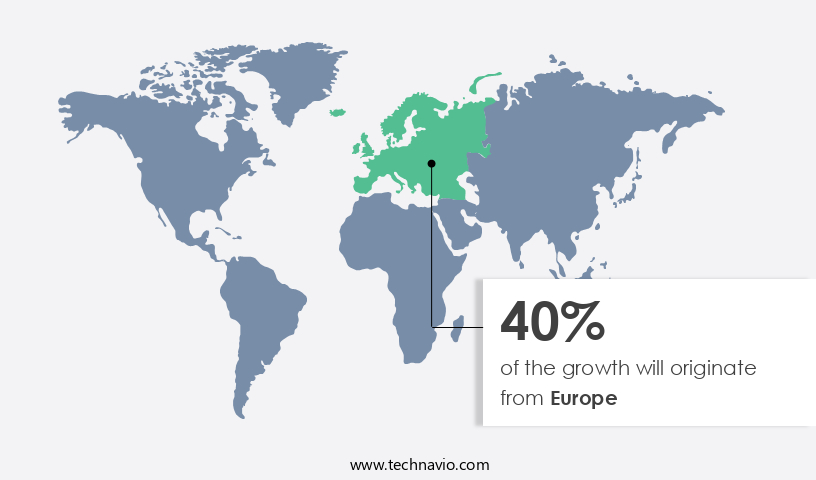

Regional Analysis

Europe is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market experiences steady growth, driven by the increasing preference for healthier and more natural food and beverage options. Low-sugar and sugar-free juices are popular choices, with innovation in plant-based, probiotic, and functional juices fueling market expansion. Convenience plays a significant role, with convenience stores and health food stores stocking an array of juices, from cold-pressed and high-pulp to fruit purees and juice blends. Ethical sourcing and fair trade practices are essential to consumers, leading to a rise in demand for organic and non-GMO juices. Juice machines and home juicers enable consumers to make their juices, while commercial juicers cater to food service and wholesale distribution.

Tetra Pak and aseptic packaging ensure juice preservation and convenience, making ready-to-drink juices a popular choice. Vegetable juices, energy boosters, and collagen juices cater to diverse health needs, and vegan juices meet the demands of ethical consumers. Juice filtration, pasteurization, and juice processing technologies are continually evolving to meet the market's demands for clean label, nutritious, and high-quality juices.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Juices Industry?

- The primary factor fueling the market's growth is the advantages of cold-pressed juice over conventional juicing methods. Cold-pressed juice production preserves more nutrients and natural flavors by minimally processing the fruits or vegetables, resulting in a higher-quality, healthier beverage compared to traditionally extracted juices.

- Cold-pressed juices have gained popularity in the health food market due to their superior nutritional value compared to traditionally prepared juices. These juices are extracted using a hydraulic press, which preserves the natural nutrients and enzymes found in fruits and vegetables. Superfood juices, made from organic produce, are a popular subcategory of cold-pressed juices. They contain a high concentration of vitamins, minerals, and antioxidants, making them an excellent addition to a healthy diet. Juice filtration and juice presses are essential tools for producing cold-pressed juices. Juice blenders and juice cocktails offer consumers various juice combinations and unique flavors. Collagen juices are another trend in the market, providing additional health benefits by promoting skin health and joint mobility.

- Health food stores and online retailers offer a wide range of juice blends and juice recipes for consumers. Concentrated juices are also available, allowing for longer shelf life and easier storage. Nutritional value is a significant factor in the choice of juices, with consumers seeking out juices that provide the most health benefits. High-pulp juices are preferred by some consumers for their added fiber content and texture. Juice trends continue to evolve, with new combinations and innovative methods of juice production emerging regularly. Overall, cold-pressed juices offer a delicious and nutritious way to incorporate more fruits and vegetables into one's diet.

What are the market trends shaping the Juices Industry?

- The rising prevalence of private-label brands represents a significant market trend. This trend signifies a growing preference among consumers for cost-effective and high-quality alternatives to well-known brands.

- The market is witnessing significant growth due to the increasing popularity of private-label fruit and vegetable juices among consumers. Retailers are capitalizing on this trend by introducing their own brands, which include organic fruit juices and functional vegetable juices. In the last decade, the private-label segment has expanded, with major retailers such as Target Corp. Offering a range of options under their brands, like Simply Balanced Organic Apple Juice. Consumers are drawn to these juices due to their perceived health benefits and clean label appeal. Additionally, functional juices with added vitamins and energy-boosting ingredients are gaining traction. Juice packaging, whether for home use or commercial production, plays a crucial role in maintaining the freshness and quality of the product.

- Pasteurized juices and cold-pressed juices, including those made from vegetables, have different production methods and appeal to various consumer preferences. Gluten-free juices are also in demand for those with dietary restrictions. Overall, the market is driven by consumer preferences for healthier, convenient, and functional beverage options.

What challenges does the Juices Industry face during its growth?

- The volatile pricing of raw materials poses a significant challenge to the industry's growth trajectory.

- Juice production involves the use of raw materials such as fruits, vegetables, sugar, and other ingredients. However, the rising costs of these materials pose a challenge for juice manufacturers. The increase in production costs, coupled with unforeseen events like adverse weather conditions, national emergencies, natural disasters, and supply shortages, can significantly impact the juice industry. These factors make it difficult for manufacturers to introduce new product varieties and maintain consistent product quality. Moreover, the increase in product prices can influence consumer purchasing decisions. This trend can impact the overall market performance of juice manufacturers. To mitigate these challenges, juice manufacturers are turning to various strategies such as juice preservation techniques, including juice pasteurization and aseptic packaging, to extend the shelf life of their products.

- Additionally, the demand for healthy and vegan juices, as well as non-GMO juices, is on the rise in the food service and e-commerce sectors. These trends are expected to drive the growth of the juice market. Juice processing and distribution also play a crucial role in maintaining product quality and ensuring timely delivery to consumers. Wholesale distribution channels and efficient supply chain management are essential for juice manufacturers to meet the growing demand for their products. Overall, the juice industry faces several challenges, but the growing demand for healthy and convenient beverage options, along with advancements in juice preservation technologies, provide opportunities for growth.

Exclusive Customer Landscape

The juices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the juices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, juices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Daniels Midland Co. - The company specializes in producing a range of high-quality, single fruit juices and juice blends, utilizing only ripe and fresh fruits.

- Archer Daniels Midland Co.

- Binghatti Holding Ltd.

- Bostan Juice

- Campbell Soup Co.

- Citrus World Inc.

- Dabur India Ltd.

- Eckes Granini Group GmbH

- Keurig Dr Pepper Inc.

- Motts LLP

- National Beverage Corp.

- Nestle SA

- NutriAsia Inc.

- Ocean Spray Cranberries Inc.

- PepsiCo Inc.

- Suntory Beverage and Food Ltd.

- The Coca Cola Co.

- Vilore Foods Co. Inc.

- WILD Flavors and Specialty Ingredients USA Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Juices Market

- In January 2024, PepsiCo, a leading beverage company, announced the launch of a new line of organic and cold-pressed juices under its Tropicana brand. The new product line, named Trop50 Organic, was introduced in response to growing consumer demand for healthier and more natural beverage options (Source: Business Wire).

- In March 2024, Coca-Cola and Nestle entered into a strategic partnership to jointly produce and distribute ready-to-drink coffee and juice beverages. The collaboration aimed to leverage each company's strengths in their respective categories and expand their product portfolios (Source: Reuters).

- In April 2025, Danone, a leading player in the market, completed the acquisition of a major stake in a Brazilian fruit juice company, Frutarom. The acquisition was valued at approximately â¬1.7 billion and marked Danone's entry into the Brazilian market, strengthening its global presence (Source: Danone Press Release).

- In May 2025, the European Union approved new regulations on the use of plastic packaging for beverages, including juices. The regulations set strict guidelines for the recyclability and biodegradability of plastic packaging, aiming to reduce plastic waste and promote more sustainable packaging solutions (Source: European Commission Press Release).

Research Analyst Overview

- The juice market analysis reveals a dynamic industry shaped by various trends and regulations. Automation in juice production streamlines processes and enhances efficiency, while safety standards ensure product quality and consumer trust. Regulatory compliance is a priority, shaping the competitive landscape with innovation as a key differentiator. Loyalty programs and delivery services cater to evolving consumer preferences, driving sales growth. Sustainability is a significant trend, with waste reduction and recycling initiatives gaining traction. Marketing efforts focus on lifestyle and culture, emphasizing health benefits and flavorful options. Consumer trends favor natural, organic, and functional juices, leading to an increase in concentration and clarification technologies.

- Juice technology advances, such as improved labeling and advertising, enable better consumer engagement and brand recognition. Flavoring and advertising strategies cater to diverse tastes and preferences, while quality control and shelf life management ensure product consistency. Subscription services offer convenience and flexibility, further expanding market reach. Overall, the juice industry remains a vibrant and evolving sector, shaped by consumer trends, technological advancements, and regulatory requirements.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Juices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.9% |

|

Market growth 2025-2029 |

USD 125.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Juices Market Research and Growth Report?

- CAGR of the Juices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the juices market growth of industry companies

We can help! Our analysts can customize this juices market research report to meet your requirements.