Mouthwash Market Size 2024-2028

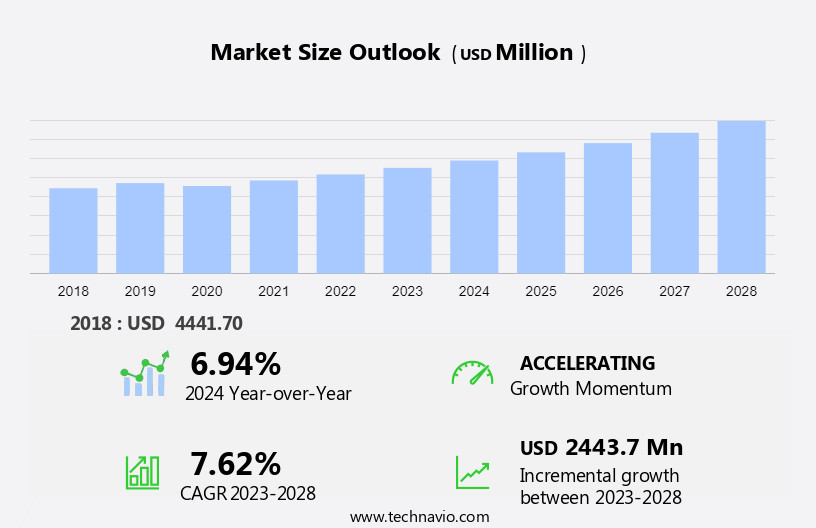

The mouthwash market size is forecast to increase by USD 2.44 billion at a CAGR of 7.62% between 2023 and 2028.

- The market is witnessing significant growth due to various factors. Innovation and portfolio expansion are key drivers propelling market growth. The increasing preference for natural and synthetic mouthwashes, based on individual preferences, is fueling market demand. Moreover, the rise in meat consumption, which can lead to oral health issues, is creating opportunities for mouthwash manufacturers. In terms of trends, the growing popularity of private-label brands is impacting the market positively. However, the availability of counterfeit products is degrading brand value and posing a challenge to market growth. E-commerce platforms and retail stores are major distribution channels, offering convenience and accessibility to consumers. In the US market, the focus on diabetic risk reduction and cosmetic benefits of mouthwashes is gaining traction, further boosting market demand. To stay competitive, companies are investing in research and development to launch innovative products and expand their offerings.

What will be the Mouthwash Market Size During the Forecast Period?

- The market for dental care products in the United States continues to hold significance in the overall toiletry industry. Oral hygiene remains a crucial aspect of maintaining overall health and well-being. This market caters to various dental health issues, including cavities, bacterial infections, gum diseases, mouth ulcers, dry mouth, and dental caries. Fresh breath is a primary concern for consumers, driving the demand for mouthwash and other oral care solutions. Halitosis, or bad breath, can be caused by various medical conditions, such as gum diseases, dental caries, and systemic diseases. Mouthwash is an essential component of home-based oral care routines, providing an additional layer of protection against oral diseases. Dental plaque and tooth decay are common dental health problems that can lead to tooth loss if left untreated. Regular dental care, including brushing, flossing, and using mouthwash, can help prevent these issues. Dental practitioners recommend using mouthwash as part of a comprehensive oral care regimen.

- Moroever, periodontal diseases, such as gingivitis and periodontitis, affect the gums and supporting structures of the teeth. These conditions can lead to tooth loss and other health complications. Chlorhexidine, a common antimicrobial agent used in mouthwash, is effective against the bacteria that cause periodontal diseases. Children's dental care is an essential segment of the dental care products market. Proper oral hygiene habits are crucial for children to prevent dental caries and other oral health issues. Fluoride toothpaste and mouthwash are commonly used in children's dental care due to their cavity-preventing properties. Tooth loss due to dental health problems can lead to various complications, including nutritional deficiencies, speech impairments, and social issues. Preventing tooth loss through regular dental care and using mouthwash as part of an oral care routine is essential.

- In conclusion, dental care products, including mouthwash, are not only used by individuals for personal use but are also provided in hotels and other establishments to ensure guests maintain good oral hygiene. Cosmetics companies also offer mouthwash as part of their product lines, catering to consumers seeking both oral health and cosmetic benefits. In conclusion, the market for dental care products, particularly mouthwash, continues to grow due to the importance of maintaining good oral health. Fresh breath, prevention of dental diseases, and children's dental care are key drivers for this market. Consumers, dental practitioners, and various industries rely on mouthwash as part of their oral care routines to ensure optimal dental health.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Alcohol-based mouthwash

- Alcohol-free mouthwash

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

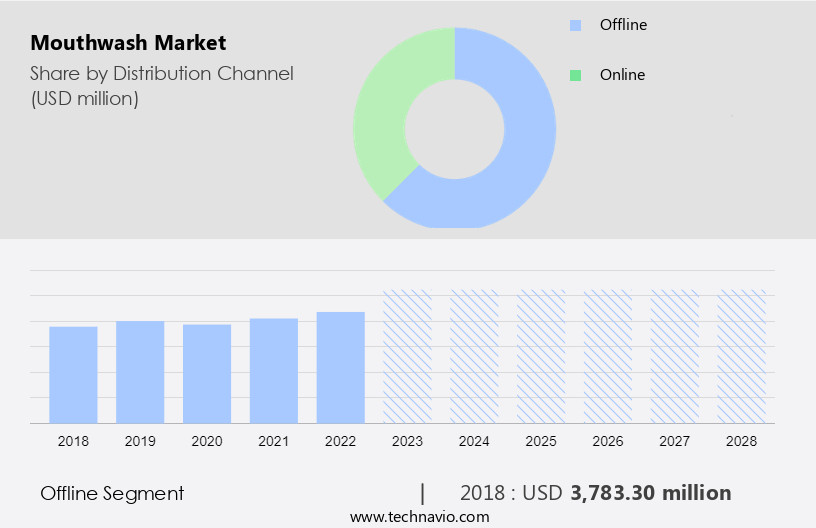

- The offline segment is estimated to witness significant growth during the forecast period.

Mouthwash is a common oral hygiene product used to freshen breath, reduce plaque and germs, and alleviate symptoms of dry mouth. Two primary categories of mouthwash are cosmetics, which focus on freshness and taste, and therapeutic, which contain active ingredients such as Fluoride, Antiseptics, and Oral gels. Dry mouth, a condition characterized by decreased saliva flow, is a significant driver of mouthwash sales due to its association with bad breath and oral health issues. Manufacturers offer a range of flavors, including Mint and Natural Lemon, to cater to consumer preferences. Herbs and natural ingredients are also gaining popularity in mouthwash formulations. The expansion of retail activities and the presence of major retailers like Walmart, Costco Wholesale, Target, and Tesco, have boosted sales in these retail formats. However, the increasing preference for online shopping has led to a gradual decline in offline sales revenue.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 3.78 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

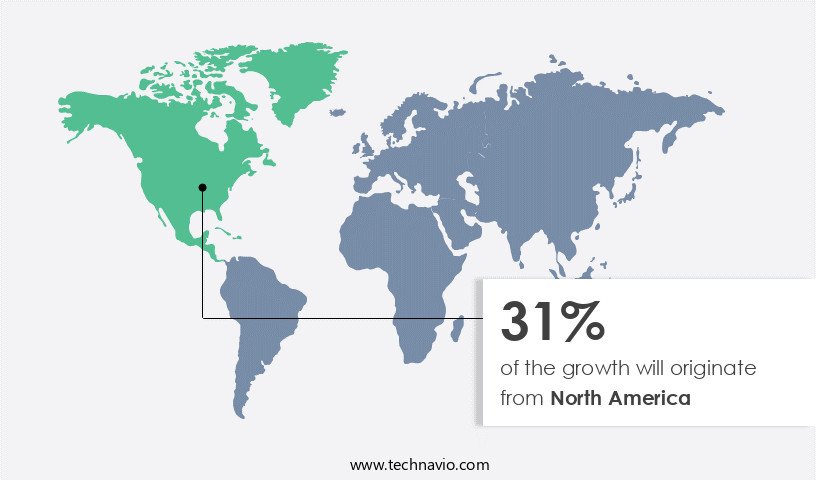

- North America is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the United States, the market for mouthwash products holds a significant position due to the high prevalence of dental issues such as tooth decay and periodontal diseases. Dental practitioners increasingly recommend using mouthwash as part of home-based oral care routines, contributing to the market's expansion. The US population is health-conscious and seeks multi-benefit oral care solutions, leading companies to introduce multi-purpose mouthwash products. Private labels, like Walgreens, are gaining traction in the market, offering affordable alternatives to consumers. The North American market, comprising the US, Mexico, and Canada, is a major contributor to the global mouthwash industry. Key oral health issues, such as tooth loss and dental plaque, continue to drive demand for effective mouthwash solutions. Commonly used antimicrobial agents, such as Cetylpyridinium chloride and Chlorhexidine digluconate, are widely used in mouthwash formulations to combat these issues.

Market Dynamics

Our mouthwash market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Mouthwash Market?

Innovation and portfolio expansion are the key drivers of the market.

- The market is experiencing growth due to new product introductions and portfolio expansions by manufacturers. Companies such as Johnson & Johnson Services are leading this trend with innovative mouthwash offerings. Their brand, Listerine, provides a range of products including Original Listerine Antiseptic Mouthwash, Listerine Ultraclean Fresh Citrus Mouthwash, and Listerine Naturals with Fluoride Herbal Mint Anticavity Mouthwash. Despite limited innovation opportunities, companies continue investing in research and development to launch new product variants. For example, in April 2024, Johnson & Johnson Services introduced the OCH-TUNE brand, allowing consumers to personalize their oral care choices based on individual style. Mouthwash is widely used for bad breath control and dental care, with additional benefits for those with medical conditions. In the US, mouthwash is commonly found in hotels and is increasingly popular for children's dental care. Sodium saccharin and mint flavor are popular choices for mouthwash, while some manufacturers are introducing probiotic and Fly Mouthwash options.

What are the market trends shaping the Mouthwash Market?

The growing popularity of private-label brands is the upcoming trend in the market.

- The market is witnessing a notable trend towards the adoption of private-label mouthwash products. Retailers are increasingly focusing on these offerings to enhance their profitability and address consumer preferences for affordable alternatives. Major retailers, including Walgreens Co. And Alibaba, are expanding their private-label mouthwash product lines, capitalizing on the escalating demand for mouthwash solutions.

- Moreover, the market expansion for mouthwash is anticipated to witness substantial growth in the upcoming years. This growth can be attributed to the rising consumer preference for mouthwashes with natural ingredients and alcohol-free options. Furthermore, the increasing awareness regarding oral health and the requirement for customized oral care solutions are contributing factors to this market growth.

What challenges does Mouthwash Market face during the growth?

Availability of counterfeit products degrading brand value is a key challenge affecting the market growth.

- In the expansive the market, numerous domestic and international entities operate, providing an array of advanced and effective mouthwash solutions. However, the proliferation of counterfeit products poses a significant challenge to market expansion. These imitation items, which include both toothpaste and mouthwash, can be found in various retail channels such as e-commerce platforms and supermarkets.

- Moreover, consumers may find it challenging to discern between authentic and counterfeit products due to identical packaging. The labels on counterfeit mouthwash often lack essential safety guidelines and quality checks, increasing the risk for diabetic individuals and undermining the reputation and customer base of genuine manufacturers.

Exclusive Customer Landscape

The mouthwash market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The mouthwash market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amway Corp.

- Bio Botanica Inc.

- Church and Dwight Co. Inc.

- Colgate Palmolive Co.

- Dabur India Ltd.

- Dr Organic Ltd.

- GlaxoSmithKline Plc

- Henkel AG and Co. KGaA

- Johnson and Johnson Services Inc.

- Kao Corp.

- Lion Corp.

- Oral Essentials Inc.

- PerrigPlco Co.

- Raw Essentials Living Foods LLC

- Sanofi SA

- SmartMouth Oral Health Laboratories

- The Himalaya Drug Co.

- The Procter and Gamble Co.

- Uncle Harrys Natural Products

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Maintaining optimal oral hygiene is essential for preventing dental health issues and ensuring fresh breath. Cavities, gum diseases like gingivitis and periodontitis, mouth ulcers, and bacterial infections such as halitosis can be mitigated through regular dental care. Dental care products, including mouthwashes, play a crucial role in this process. Mouthwashes offer various benefits, from fighting plaque and tooth decay to reducing bad breath and providing a refreshing minty taste. Modern trade outlets like drugstores, pharmacies, hypermarkets, and convenience stores stock a wide range of mouthwashes, catering to diverse preferences. Choose from antiseptic mouthwashes containing active ingredients like chlorhexidine, fluoride, or cetylpyridinium chloride, or opt for herbal alternatives with natural extracts of mint fresh tea, lemon, or various herbs.

Moreover, synthetic and natural options are available, catering to both cosmetic and therapeutic needs. Mouthwashes can help combat dental diseases, including dental caries and gum diseases like periodontal diseases, which may lead to tooth loss. They also contribute to addressing medical conditions like bacterial endocarditis and atherosclerosis. For children, specific mouthwash formulations are available to ensure their dental health. Alcohol-containing mouthwashes are not recommended for children due to their potential health risks. Incorporating mouthwash into your home-based oral care routine can significantly improve your dental health and overall well-being.

|

Mouthwash Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.62% |

|

Market growth 2024-2028 |

USD 2.44 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.94 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch