Bikes And Ride-Ons For Babies And Children Market Size 2025-2029

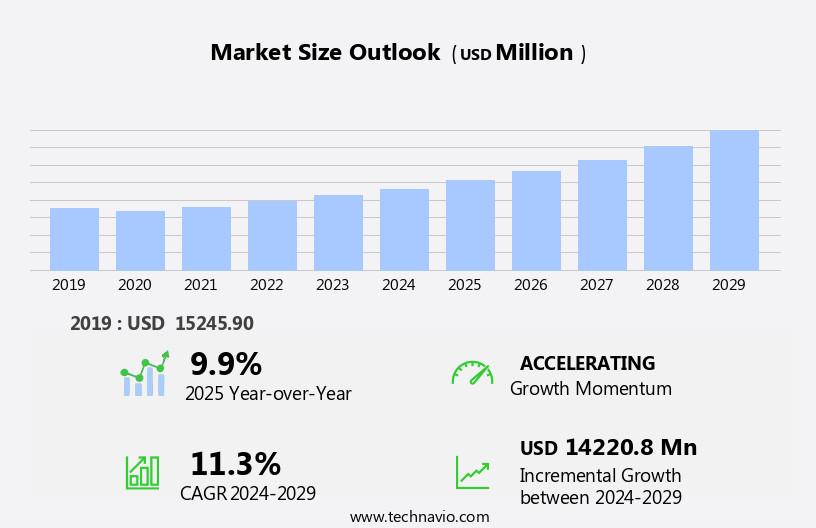

The bikes and ride-ons for babies and children market size is forecast to increase by USD 14.22 billion, at a CAGR of 11.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing trend towards online sales. Parents are increasingly turning to e-commerce platforms to purchase these products, seeking convenience and a wider selection of options. Another key driver is the adoption of multi-channel marketing and promotional strategies by market players. Companies are leveraging various channels to reach their target audience, including social media, influencer marketing, and email campaigns. Furthermore, the popularity of e-games is influencing the market, as children are attracted to interactive and engaging experiences.

- However, challenges persist, including the need for companies to ensure product safety and comply with regulatory requirements. Additionally, the market is becoming increasingly competitive, necessitating continuous innovation and differentiation to stand out from competitors. Companies seeking to capitalize on market opportunities must focus on providing high-quality products, effective marketing strategies, and robust customer service to meet the evolving needs of parents and children.

What will be the Size of the Bikes And Ride-Ons For Babies And Children Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market for bikes and ride-ons for babies and children is a continuously evolving landscape, shaped by various factors that drive innovation and growth. This dynamic industry encompasses a wide range of products, from push bikes and balance bikes to electric ride-ons and ride-on cars, catering to diverse consumer preferences and age groups. Manufacturers are continually exploring new materials, such as eco-friendly options and recycled components, to create sustainable and child-safe products. Innovation in materials, from aluminum frames to non-toxic paints, ensures that these toys not only provide a fun and engaging experience but also prioritize safety and durability.

Consumer feedback, user reviews, and safety testing play a crucial role in shaping market trends. Brands strive for brand loyalty by offering quality control, customer service, and age-appropriate design. Product innovation is a key focus, with features like adjustable handlebars, sound effects, and lighting effects enhancing the overall experience. Training wheels and balance bikes help children develop motor skills and physical activity, while push bikes offer a more traditional riding experience. Remote control options add a new dimension to the play experience, fostering creativity and social interaction. The industry's supply chain management and distribution networks have expanded to include e-commerce platforms and brick-and-mortar stores, catering to the diverse shopping habits of consumers.

Pricing strategies vary, with retail channels offering different price points and product availability. Product recalls and safety concerns have led to stricter child safety standards and increased focus on quality control. Foam padding and protective gear ensure that children remain safe while enjoying their ride-on toys. In conclusion, the market for bikes and ride-ons for babies and children is a dynamic and evolving industry, shaped by ongoing innovation, consumer preferences, and safety concerns. From materials and design to pricing strategies and distribution networks, manufacturers and retailers must stay agile to meet the changing needs of their target audience.

How is this Bikes And Ride-Ons For Babies And Children Industry segmented?

The bikes and ride-ons for babies and children industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- MP and PB and ride-ons

- Battery-operated bikes and ride-ons

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

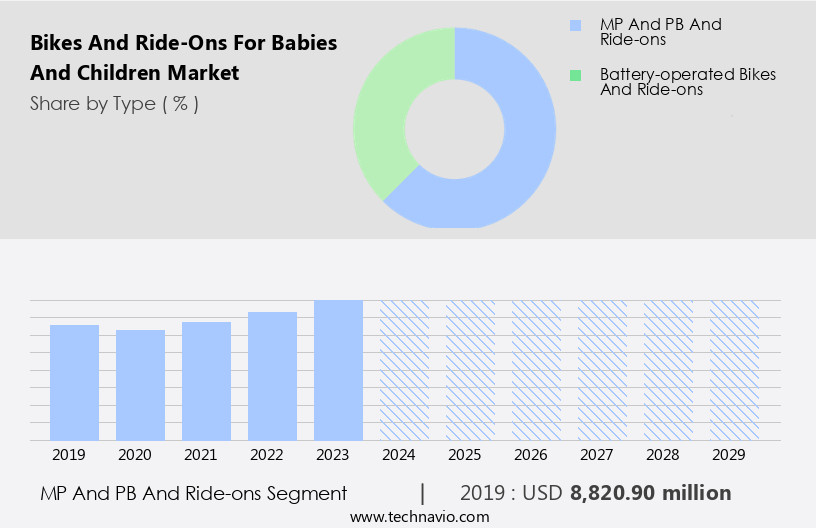

The mp and pb and ride-ons segment is estimated to witness significant growth during the forecast period.

In the realm of children's toys, manual pedal and push bikes, and ride-on products continue to captivate the market with their functional design and engaging features. These toys come in a myriad of color options, catering to children's preferences. Eco-friendly materials and recycled components are increasingly popular choices, reflecting parents' growing consciousness towards sustainability. Aluminum frames ensure durability and lightweight functionality, making these toys suitable for both indoor and outdoor use. Safety testing and non-toxic paints are essential considerations in the manufacturing process, ensuring the well-being of children. Retail channels, including online sales and brick-and-mortar stores, offer diverse pricing strategies to cater to various consumer preferences.

Innovation in materials, such as foam padding and adjustable handlebars, enhances the user experience. Safety features, including training wheels and balance bikes, promote the development of motor skills and cognitive abilities in children. Sound effects and lighting effects add an immersive and harmonious experience to the toys. Electric ride-ons, with their remote control functionality, offer a new level of excitement. Brand loyalty and distribution networks play a significant role in market dynamics. Child safety standards and quality control measures ensure the safety and longevity of these products. Consumer preferences for age-appropriate toys, social interaction, and creative play continue to shape the market trends.

Manufacturing processes prioritize innovation, with an emphasis on design and functionality. Character licensing and aesthetic appeal add to the toys' market appeal. E-commerce platforms and assembly instructions simplify the purchasing and setup experience for parents. In conclusion, the market for manual pedal and push bikes and ride-on products is a vibrant and evolving one, driven by a focus on children's development, safety, and fun. These toys offer a unique blend of physical activity, cognitive development, and creative play, making them a staple in the world of children's toys.

The MP and PB and ride-ons segment was valued at USD 8.82 billion in 2019 and showed a gradual increase during the forecast period.

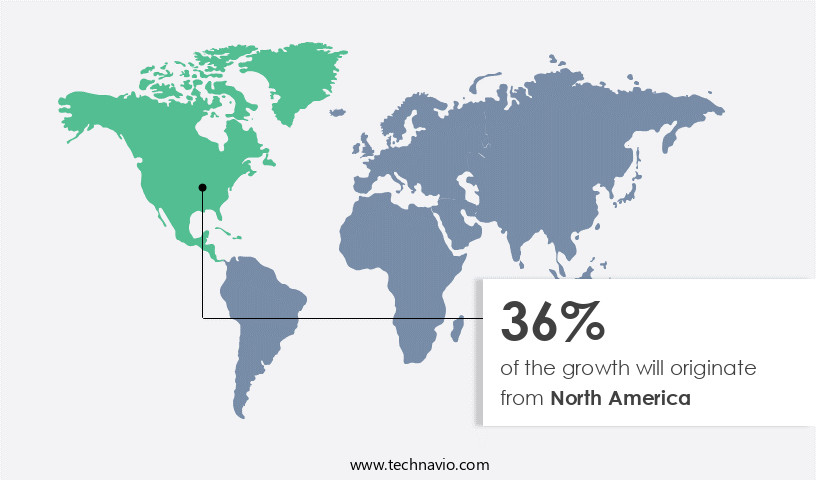

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market for bikes and ride-on toys for babies and children in the US is experiencing significant growth due to increasing parental focus on outdoor activities that promote physical development. Push-and-pull toys, such as bikes and ride-on cars, are gaining popularity as parents seek to combat childhood obesity and encourage early motor skill development. Eco-friendly materials, including recycled components and aluminum frames, are increasingly used in these products to appeal to environmentally-conscious consumers. Consumer preferences for safety and quality are driving manufacturers to prioritize safety testing, non-toxic paints, and adjustable handlebars. Innovation in materials, such as foam padding and sound effects, adds to the aesthetic appeal and creative play value of these products.

Electric ride-ons and balance bikes are also gaining traction, offering features like remote control and training wheels. Retail channels, including both online sales and brick-and-mortar stores, cater to diverse consumer preferences. Supply chain management and quality control ensure the delivery of safe and durable products. Age appropriateness and child safety standards are paramount, with manufacturers continuously innovating to meet these requirements. Despite these trends, the market faces challenges, such as the increasing popularity of indoor activities among children and the availability of affordable plastic components. Brand loyalty, pricing strategies, and distribution networks are crucial factors in maintaining market competitiveness.

Customer service and charging time are also essential considerations for consumers. Manufacturing processes continue to evolve, with a focus on sustainability and the use of character licensing to enhance product appeal. As the market matures, it will be essential for manufacturers to prioritize consumer safety, innovation, and competitive pricing to maintain growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Bikes And Ride-Ons For Babies And Children Industry?

- The significant growth in online sales of bikes and ride-ons for infants and children serves as the primary market catalyst.

- The market for bikes and ride-ons for babies and children online is experiencing significant growth due to the increasing popularity of off-price retailing. With the proliferation of e-commerce platforms, manufacturers can broaden their customer base. Color options and eco-friendly materials, such as aluminum frames, are increasingly in demand for these products. The weight capacity and material composition are essential considerations for parents, with many opting for recycled components. User reviews and safety testing are crucial factors influencing purchasing decisions. Non-toxic paints ensure the safety of children.

- Retail channels, including Amazon and Walmart, dominate the market. Height adjustments cater to children as they grow. Effective supply chain management is essential to meet the increasing demand. Safety features, such as footrests and handgrips, are prioritized to ensure a secure riding experience.

What are the market trends shaping the Bikes And Ride-Ons For Babies And Children Industry?

- Multi-channel marketing and promotional strategies are becoming increasingly popular among companies, representing a significant market trend. This approach allows businesses to engage with customers through various channels, enhancing reach and fostering stronger relationships.

- Companies in the market employ diverse pricing strategies to cater to various consumer segments. Innovation in materials, such as lightweight frames and foam padding, enhances product appeal and differentiates offerings. Training wheels and balance bikes facilitate the transition from ride-on toys to pedal bikes, ensuring a smooth progression in physical activity. Product design incorporates sound effects and lighting effects to create an immersive experience for children. Battery life is a crucial factor for electric or remote-controlled ride-on toys, necessitating quality control measures to ensure customer satisfaction. Companies prioritize quality control to minimize product recalls and maintain brand reputation.

- Digital and social marketing strategies, including Internet marketing campaigns and social media platforms, expand consumer reach. Companies use these channels to engage consumers, promote brand relevance, and direct them to purchasing points. The integration of technology, such as remote control and push bikes, adds value to the products and caters to evolving consumer preferences.

What challenges does the Bikes And Ride-Ons For Babies And Children Industry face during its growth?

- The escalating prevalence of electronic games poses a significant challenge to the expansion of the gaming industry.

- The market for bikes and ride-ons for babies and children faces increasing competition from the growing popularity of electronic games. Children are drawn to the immersive and harmonious experience offered by e-games, which are easily accessible via desktops, consoles, and mobile phones. This shift in consumer preferences poses a significant challenge to the bikes and ride-ons industry. Additionally, the lack of brand loyalty towards traditional ride-on toys and bikes contributes to the trend. Safety standards are a crucial consideration in the production of bikes and ride-ons. Manufacturers prioritize child safety by incorporating plastic components and adjustable handlebars to ensure a comfortable and secure riding experience.

- Consumers can purchase these products through various channels, including online sales and brick-and-mortar stores. Retail prices for bikes and ride-ons vary, offering options for different budgets. Despite the competition from e-games, the cognitive and child development benefits of riding bikes and using ride-ons remain essential. These toys provide children with essential skills, including balance, coordination, and problem-solving abilities. Steel frames ensure durability and longevity, making these products a worthwhile investment for parents. In conclusion, the bikes and ride-ons market for babies and children continues to face competition from the growing popularity of electronic games. However, the importance of child safety standards, cognitive development benefits, and the durability of these products ensure their continued relevance.

- Consumers can purchase these products through various distribution networks, including online sales and brick-and-mortar stores.

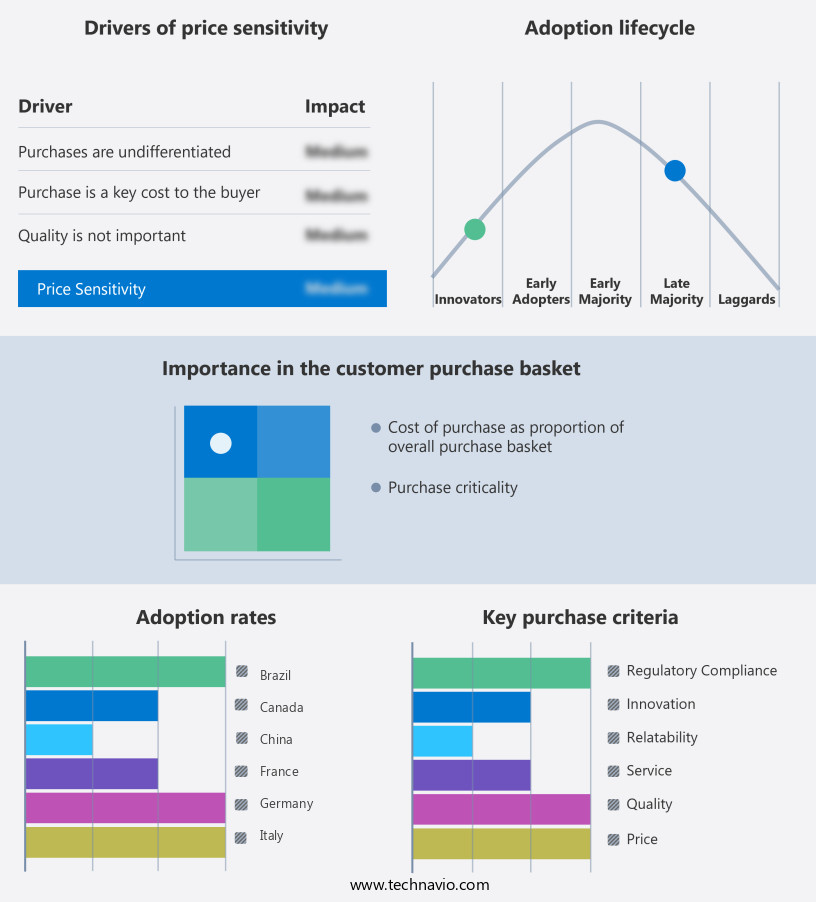

Exclusive Customer Landscape

The bikes and ride-ons for babies and children market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bikes and ride-ons for babies and children market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bikes and ride-ons for babies and children market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Early Rider Ltd - This company specializes in providing a diverse range of high-quality kids' bikes, including the Lite, Classic, Bonsal, Belter, and Seeker models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Early Rider Ltd

- Fuji Bikes

- Funskool India Ltd

- Hasbro Inc.

- JAKKS Pacific Inc.

- Kids2 Inc.

- Mattel Inc

- Mekashi Toys Pvt. Ltd.

- Merida Industry Co. Ltd.

- MGA Entertainment Inc.

- Movetime Technologies Pvt. Ltd.

- Peg Perego

- Razer Inc.

- Simba Dickie Group GmbH

- Toy Quest

- Toyzone Impex Pvt. Ltd.

- Tripple Ess Toys Pvt. Ltd.

- Trunki

- woom GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bikes And Ride-Ons For Babies And Children Market

- In January 2024, Strider Sports International, a leading manufacturer of balance bikes, announced the launch of their new electric-assist balance bike, the Strider ST-4E, catering to the growing demand for eco-friendly and accessible mobility solutions for children (Strider Sports International Press Release, 2024).

- In March 2024, KidTrax, a prominent ride-on toy company, entered into a strategic partnership with Little Tikes, a leading manufacturer of children's toys, to expand their product offerings and reach a broader customer base (KidTrax Press Release, 2024).

- In May 2024, Razor USA, a major player in the ride-on toys market, secured a significant investment of USD50 million in a funding round led by Summit Partners, to support the company's continued growth and innovation (BusinessWire, 2024).

- In April 2025, the European Union passed a new safety regulation for children's ride-on toys, mandating enhanced safety features such as improved stability, braking systems, and age-appropriate warnings (European Commission Press Release, 2025). This regulation is expected to significantly impact the market, with an estimated 30% increase in production costs for affected manufacturers.

Research Analyst Overview

- The market is witnessing significant activity, driven by various marketing strategies and trends. Influencer marketing and online advertising are popular channels for reaching target demographics, while email marketing and content marketing help build brand awareness. Compliance with safety regulations and brand positioning are crucial for consumer trust, leading to marketing campaigns and sales promotions. Maintenance requirements, such as suspension systems and repair services, are essential for product longevity and customer satisfaction. Lightweight designs and foldable features cater to convenience, while inventory management and cost analysis ensure profitability. Brand building through search engine optimization, data analytics, and seasonal demand analysis are essential for staying competitive.

- Parental involvement in purchasing decisions and safety regulations influence import/export regulations and distribution channels. Adjustable seats and steering mechanisms cater to diverse age groups, while complaint handling and safety regulations ensure high return rates. Spare parts availability and compliance with safety standards are vital for customer satisfaction and long-term success. Suspension systems and shock absorbers contribute to the product's lifespan and performance, while safety regulations and compliance standards impact sales. Point-of-sale displays, promotional offers, and storage compartments are effective retail strategies. Brand positioning and marketing campaigns are critical for differentiating offerings, while social media marketing and safety regulations impact profit margins.

- Adjustable seats, safety regulations, and inventory management are essential for catering to seasonal demand. Brand awareness and customer satisfaction are crucial for long-term success, influenced by marketing strategies, maintenance requirements, and safety regulations. Suspension systems, adjustable seats, and repair services contribute to product lifespan and performance. Sales promotions, social media marketing, and inventory management are essential for staying competitive, while compliance with safety regulations and distribution channels impact profitability. Parental involvement and safety regulations influence import/export regulations and customer satisfaction. Marketing campaigns, safety regulations, and brand positioning are crucial for differentiating offerings, while maintenance requirements and inventory management impact product lifespan and profitability.

- Compliance standards and complaint handling are essential for customer satisfaction and long-term success.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bikes And Ride-Ons For Babies And Children Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.3% |

|

Market growth 2025-2029 |

USD 14220.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.9 |

|

Key countries |

US, China, Germany, UK, Mexico, Canada, Brazil, France, Japan, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bikes And Ride-Ons For Babies And Children Market Research and Growth Report?

- CAGR of the Bikes And Ride-Ons For Babies And Children industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bikes and ride-ons for babies and children market growth of industry companies

We can help! Our analysts can customize this bikes and ride-ons for babies and children market research report to meet your requirements.