Binders Excipients Market Size 2024-2028

The binders excipients market size is forecast to increase by USD 354.5 million at a CAGR of 4.5% between 2023 and 2028.

What will be the Size of the Binders Excipients Market During the Forecast Period?

How is this Binders Excipients Industry segmented and which is the largest segment?

The binders excipients industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

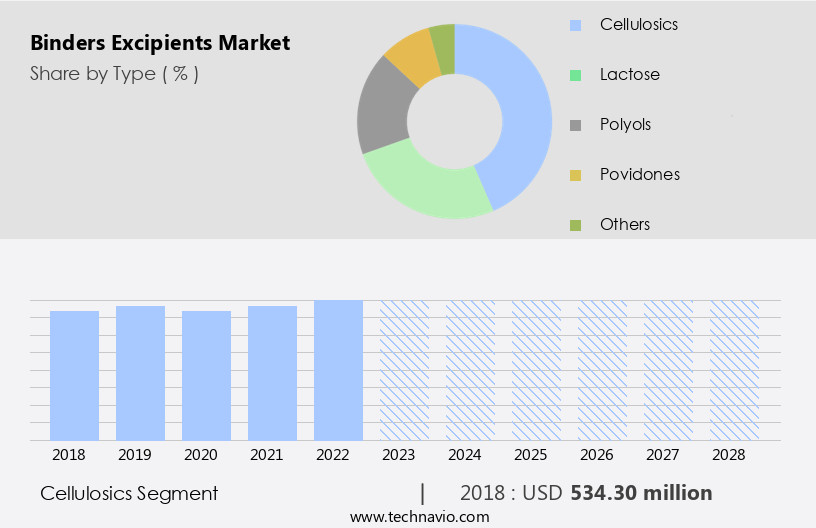

- Type

- Cellulosics

- Lactose

- Polyols

- Povidones

- Others

- Application

- Tablets or capsules

- Solution-based

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Type Insights

- The cellulosics segment is estimated to witness significant growth during the forecast period.

Cellulose derivatives, particularly hydroxypropyl methylcellulose (HPMC), hydroxypropylmethylcellulose acetate (HPMCAS), and microcrystallic cellulose (MCC), dominated the binder excipients market in 2023. HPMC, a chemically modified cellulose polymer, is a popular choice due to its vegetarian source and physical similarities to gelatin and gluten. It is commonly used as a binder and bioadhesive in pharmaceuticals, acting as a compression aid and coating agent for tablets. HPMC's demand continues to rise globally, driving market expansion. In pharmaceutical formulations, tablets, and capsules, binders play a crucial role in ensuring consistency, compressibility, and accurate dosing. Other excipients include starches, sugars, natural and synthetic polymers, and various additives like fillers, diluents, disintegrants, lubricants, coloring agents, and co-processed excipients.

These materials impact tablets and capsules' mechanical properties, drug delivery characteristics, and therapeutic effect. The market for binders and excipients is expected to grow significantly due to the increasing demand for oral medicines, nutraceuticals, and dietary supplements, as well as the development of innovative therapies and modified-release tablets.

Get a glance at the Binders Excipients Industry report of share of various segments Request Free Sample

The Cellulosics segment was valued at USD 534.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The pharmaceutical industry in Asia, particularly in countries like China and India, is projected to experience substantial growth due to rising health consciousness among consumers, an aging population, and increasing prevalence of diseases such as diabetes, cancer, and age-related health issues. According to the European Federation of Pharmaceutical Industries and Associations, China and Japan accounted for over 15% of global pharmaceutical sales revenue in 2020. Consequently, the demand for binder excipients is anticipated to increase in this region. Binder excipients, such as starch, polyvinylpyrrolidone (PVP), and cellulose derivatives, play crucial roles in pharmaceutical formulations like tablets and capsules. They ensure the required compressibility, dose consistency, and flow characteristics, enabling accurate dosing and therapeutic effects.

Natural and synthetic polymers, sugars, starches, and other excipients are used to enhance the stability, consistency, and drug delivery characteristics of oral medicines. The development of modified-release tablets, nutraceuticals, and dietary supplements further boosts the market for binder excipients. Key players in this market include major pharmaceutical companies and excipient manufacturers, who continuously innovate and introduce novel excipients and co-processed excipients to cater to the evolving needs of the industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Binders Excipients Industry?

Increasing demand for cellulose-based binders is the key driver of the market.

What are the market trends shaping the Binders Excipients Industry?

Demand for new excipients to develop easily consumable drugs is the upcoming market trend.

What challenges does the Binders Excipients Industry face during its growth?

Loss of patents and patent expiry is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The binders excipients market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the binders excipients market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, binders excipients market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Asahi Kasei Corp. - The company specializes in providing binder excipients, specifically Ceolus, to the pharmaceutical industry. Binder excipients play a crucial role In the manufacturing process of tablets and capsules by binding active pharmaceutical ingredients and other excipients together. This results in a cohesive and stable dosage form. Ceolus, as a binder excipient, offers advantages such as improved binding efficiency, enhanced compressibility, and excellent flow properties. Its use contributes to the production of high-quality pharmaceutical products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asahi Kasei Corp.

- Ashland Inc.

- BASF SE

- Beneo GmbH

- CD Formulation

- Colorcon Inc.

- DFE Pharma GmbH and Co. KG

- Dow Chemical Co.

- DuPont de Nemours Inc.

- Evonik Industries AG

- Fuji Chemical Industries Co. Ltd.

- Ingredion Inc.

- JRS PHARMA GmbH and Co. KG

- Kerry Group Plc

- Merck KGaA

- Roquette Freres SA

- Scope Ingredients Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Binders In the context of pharmaceutical formulations play a crucial role in holding the various components of tablets and capsules together. These excipients, as they are called In the industry, contribute significantly to the stability, consistency, and overall performance of oral medicines. Hydrophilic molecules, such as starches and natural polymers, are commonly used as binders due to their ability to absorb water and form a cohesive mass. Cellulose derivatives, synthetic polymers, and sugars are other classes of binders that provide different properties and benefits. The choice of binder depends on several factors, including intermolecular interactions, compressibility, dose, and flow characteristics.

The therapeutic effect of medicinal drugs is also influenced by the binder's ability to affect the release profile and mechanical properties. Binders are essential in various types of pharmaceutical formulations, including tablets, capsules, and modified-release tablets. They are also used in nutraceuticals and dietary supplements to enhance health benefits and ensure accurate dosing. Innovative therapies and novel excipients continue to emerge In the market, offering improved drug delivery characteristics and enhanced patient convenience. Co-processed excipients, for instance, offer the advantage of reducing the number of processing steps and improving the overall quality of the final product. Binders can be used in both dry form and solvent applications, depending on the specific requirements of the formulation.

The research methodology for studying binders involves subject-related expert advice, estimates, and laboratory experiments to evaluate their compatibility, release profile, and other critical properties. The market for binders is diverse and dynamic, with a wide range of applications and end-users. The demand for binders is driven by the growing need for accurate dosing, improved patient convenience, and the development of innovative therapies. In summary, binders are essential excipients in pharmaceutical formulations that play a critical role in ensuring stability, consistency, and performance. The choice of binder depends on various factors, including the formulation's composition, therapeutic effect, and manufacturing process.

The market for binders is diverse and dynamic, driven by the growing demand for accurate dosing, improved patient convenience, and the development of innovative therapies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 354.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Japan, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Binders Excipients Market Research and Growth Report?

- CAGR of the Binders Excipients industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the binders excipients market growth of industry companies

We can help! Our analysts can customize this binders excipients market research report to meet your requirements.