Bio Polyols Market Size 2025-2029

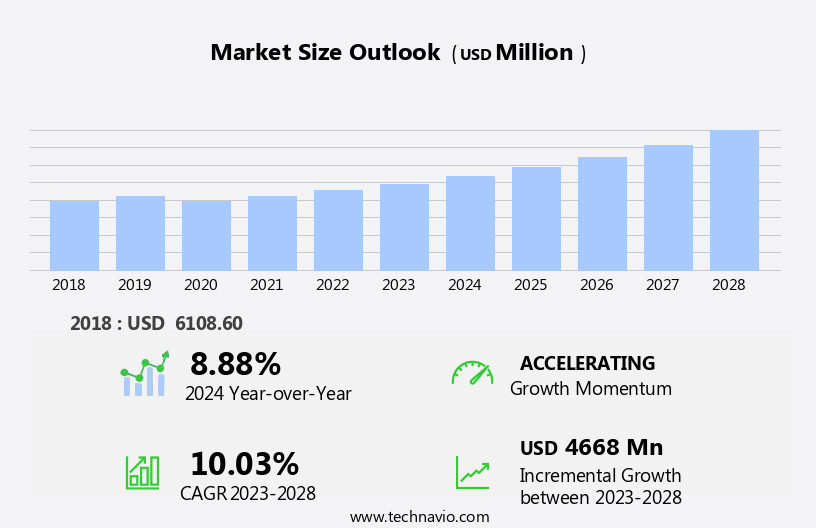

The bio polyols market size is forecast to increase by USD 5.61 billion, at a CAGR of 10.9% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand in the automotive and construction industries. These sectors are adopting bio-based polyols as a sustainable alternative to petroleum-derived counterparts, contributing to the market's expansion. Moreover, innovation in polyurethane foams, which utilize bio polyols as key raw materials, is further fueling market growth. However, the market faces challenges due to the volatile prices of raw materials, which can impact the profitability of manufacturers and hinder market expansion.

- Companies in the market must navigate these price fluctuations and explore strategies to secure a stable supply chain to capitalize on the growing demand and maintain competitiveness.

What will be the Size of the Bio Polyols Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ongoing research and development in green chemistry and sustainable production methods. Polyol manufacturers are increasingly focusing on bio-based and renewable resources to produce these essential building blocks for various industries. The versatile nature of polyols is showcased in their applications across sectors, including flexible and rigid foams, coatings, adhesives, and polyurethane systems. Bio-based polyols, derived from renewable resources, are gaining traction due to their reduced carbon footprint and alignment with the bio-based economy and circular economy principles. Sustainable polyols, which include those with low molecular weight and hydroxyl numbers, are in high demand due to their environmental benefits and improved performance characteristics.

Polyol advancement is a continuous process, with ongoing research focusing on polycarbonate, bio-derived, aliphatic, and polyester polyols. These advancements are shaping the polyol market analysis, with trends toward increased regulation and certification to meet evolving consumer demands and industry standards. Polyol characterization and functionality are crucial factors in determining their suitability for various applications. Regulations and certifications, such as those related to carbon footprint, acid value, and water content, are essential considerations for polyol suppliers and distributors in the competitive landscape. The polyol industry overview reflects the dynamic nature of this market, with ongoing innovation, renewable resource utilization, and life cycle analysis shaping its future.The market size is expected to grow as demand for sustainable and high-performance polyols continues to increase.

How is this Bio Polyols Industry segmented?

The bio polyols industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Foams

- CASE

- Type

- Polyether polyols

- Polyester polyols

- End-user

- Furniture and bedding

- Construction and insulation

- Automotive

- Packaging

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

.

By Application Insights

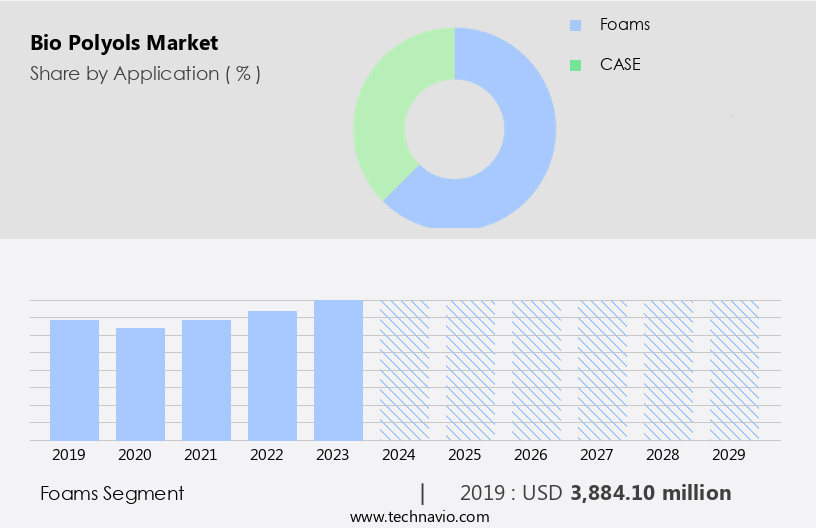

The foams segment is estimated to witness significant growth during the forecast period.

The market encompasses the production and development of polyols, a crucial component in the manufacturing of various foams and other polyurethane products. Polyols are versatile chemicals with distinct properties, including hydroxyl number, molecular weight, and functionality, which determine their application in creating flexible or rigid foams, polyurethane coatings, and adhesives. A significant portion of the market focuses on the production of aromatic and aliphatic polyols, with aromatic polyols derived from non-renewable resources and aliphatic polyols derived from renewable sources, such as plant-based materials. The shift towards sustainable and bio-based polyols, driven by the bio-based economy and circular economy, has led to advancements in polyol research and manufacturing.

Polyol properties, such as viscosity, reactivity, and thermal stability, play a crucial role in determining their application. For instance, low-molecular-weight polyols are used in the production of rigid foams, while high-molecular-weight polyols are used in the creation of flexible foams. Polyol regulations, including those related to carbon footprint and certifications, have become increasingly important in the market. Polyol suppliers and manufacturers are focusing on reducing their carbon footprint through renewable resource utilization and bio-based material production. Additionally, the market is witnessing a trend towards polyol innovation, with companies developing new polyol blends and technologies to cater to various applications.

The flexible foams segment, a major application area for polyols, includes polyurethane flexible foams, which offer excellent cushioning properties and are widely used in bedding, furniture, automotive interiors, and carpet underlay. These foams provide thermal insulation, easy maintenance, and are recyclable, making them an attractive choice for manufacturers. The polyol market is expected to grow significantly due to the increasing demand for sustainable and bio-based materials, advancements in polyol technology, and the growing popularity of polyurethane foams in various industries. Polyol distributors play a vital role in ensuring the availability and accessibility of these essential chemicals to manufacturers. In summary, the market is a dynamic and evolving industry, driven by the demand for sustainable and renewable materials, advancements in polyol technology, and the growing popularity of polyurethane foams in various applications. The market is expected to continue growing, with a focus on reducing carbon footprint, increasing renewable resource utilization, and developing innovative polyol blends and technologies.

The Foams segment was valued at USD 3.88 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

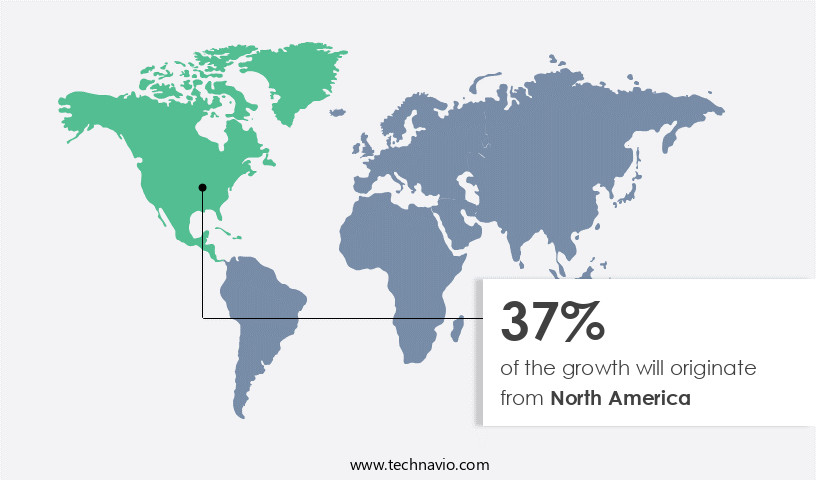

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the US is experiencing significant growth, driven by the increasing demand for bio polyols in various industries, particularly healthcare and consumer goods. The US is the largest consumer of bio polyols in North America, with major manufacturers such as American Foam Products Inc., DuPont de Nemours, Inc, and Huntsman International based in the country. Bio polyols are increasingly used in healthcare applications due to their cost-effectiveness, strength, and durability. They are utilized in the production of disposable medical gloves, catheters, hospital bedding, surgical drapes, and wound dressings. The demand for bio polyols is also driven by their role in the production of flexible foams, which are essential in various industries, including automotive, construction, and furniture.

The market growth is further fueled by advancements in polyol technology, such as the development of plant-based and renewable polyols, which align with the bio-based economy and circular economy trends. Additionally, the focus on reducing carbon footprint and increasing sustainability has led to the growth of the bio-based polyols market. The market is segmented based on molecular weight, hydroxyl number, and polyol type, including aliphatic, aromatic, polyester, polyether, and polycarbonate polyols. The market is also subject to regulations regarding acid value and other quality standards. Bio polyol manufacturers are investing in research and innovation to develop new blends and applications, ensuring the competitiveness of the market.

Bio-derived and sustainable polyols are gaining popularity due to their eco-friendly nature and reduced environmental impact. The market is expected to continue growing as the demand for bio-based materials increases and the focus on sustainability continues.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Bio Polyols Industry?

- The automotive and construction industries' growing requirement for bio polyols serves as the primary market driver.

- Bio polyols play a pivotal role in the production of polyurethane foams, which find extensive applications in various industries such as automotive and construction. These end-use sectors account for significant demand in the market. In particular, the automotive industry's increasing use of polyurethane foams for manufacturing parts like side skirts, wiper cowls, roll pans, and bumpers is driving market growth. Additionally, the construction industry's reliance on polyurethane foams for insulation and other applications further boosts the market's expansion. Green chemistry and polyol development continue to be key focus areas for manufacturers to produce eco-friendly and high-performance polyols.

- Furthermore, research and innovation in plant-based polyols and polyol blends with specific molecular weights cater to the evolving regulatory landscape and diverse application requirements. The market is anticipated to experience moderate growth due to these factors.

What are the market trends shaping the Bio Polyols Industry?

- The trend in the market points towards innovation as the key driver in the polyurethane foams industry.

- The polyol market encompasses a significant role in the production of polyurethanes, which are formed by reacting polyols, alcohols with multiple reactive hydroxyl groups, with diisocyanates or polymeric isocyanates. Recent advancements in the polyol industry include the development of bio-based and sustainable polyols, derived from renewable resources, aligning with the bio-based economy and circular economy trends. These bio-derived polyols, such as aliphatic polyols and polyester polyols, possess a hydroxyl number that meets the requirements for various applications, including polycarbonate polyols.

- Companies are focusing on the incorporation of photo-responsive groups, like coumarin, into the polyurethane foam backbone to create photo cross-linkable polyurethanes. These innovative polyols can be used to manufacture paints and coatings, as they dimerize when exposed to UV light of approximately 340nm and can be cleaved again under reduced light of approximately 250nm. This development adds to the versatility and sustainability of the polyol market.

What challenges does the Bio Polyols Industry face during its growth?

- The volatile pricing of raw materials poses a significant challenge to the industry's growth trajectory. Bio polyols are essential organic compounds characterized by multiple hydroxyl groups. These polyols are classified into two main categories: polyester polyols and polyether polyols. The primary application of polyols is in the production of polyurethane foams, which are formed through the reaction between diisocyanates and polyols. This reaction causes the foam to expand significantly and then harden. Polyol pricing is subject to market dynamics, with fluctuations in raw material prices leading to volatility. In the US market, prices remained stable at approximately USD2,140 per metric ton in Q2 and Q3 2024, signifying consistent demand and a sufficient supply.

- Conversely, in Japan, prices decreased by 8% from USD1,281 per metric ton in Q2 to USD1,230 per metric ton in Q3 2024, primarily due to increased upstream propylene costs and fluctuating crude oil prices. Polyol functionality is crucial in various industries, including rigid foam manufacturing. Sustainability and certifications are essential factors influencing the market. Bio-based polyols, derived from renewable resources, have gained popularity due to their reduced carbon footprint. Polyol standards ensure consistent product quality and safety. Market segmentation includes end-use industries, such as construction, automotive, and packaging. Market trends include the development of new polyol technologies to improve performance and reduce environmental impact.

- Regulations regarding bio-based polyols continue to evolve, impacting market growth. The acid value of polyols is a critical quality indicator, affecting their reactivity and foam properties.

Exclusive Customer Landscape

The bio polyols market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bio polyols market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bio polyols market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alberdingk Boley GmbH - Castor oil-based ALBODUR products from our company deliver a diverse array of surface coating solutions, spanning from flexible to extremely hard formulations. These offerings encompass superior quality decorative finishes. Homogeneous curing enables the application of substantial coating thicknesses, resulting in enhanced chemical resistance and increased hydrophobicity compared to conventional alternatives.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alberdingk Boley GmbH

- Arkema

- BASF SE

- Bio Based Technologies LLC

- Cargill Inc.

- Castor International BV

- Covestro AG

- Croda International Plc

- Emery Oleochemicals Group

- Global Bio chem Technology Group Co. Ltd.

- Huntsman Corp.

- INVISTA Equities, LLC

- Jayant Agro Organics Ltd.

- Mitsui Chemicals Inc.

- Nivapol

- Stahl Holdings B.V.

- Stepan Co.

- The Dow Chemical Co.

- Vertellus Holdings LLC

- Xuchuan Chemical Suzhou Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bio Polyols Market

- In February 2023, BASF SE, a leading global chemical producer, announced the expansion of its bio-based polyols production capacity at its site in Ludwigshafen, Germany. This expansion aims to meet the growing demand for sustainable materials in the polyurethanes industry (BASF press release, 2023).

- In May 2024, Covestro AG, another major player in the polyols market, unveiled its new polyol, Baydur N 1101, which is derived from renewable raw materials. This innovation marks a significant step towards the production of more sustainable polyurethane systems (Covestro press release, 2024).

- In July 2024, DuPont de Nemours, Inc. And BioAmber Inc. Entered into a strategic partnership to develop and commercialize bio-based polyols derived from renewable feedstocks. This collaboration is expected to bring a more sustainable alternative to the market and reduce the dependency on fossil fuels (DuPont de Nemours press release, 2024).

- In December 2024, Lonza Group AG received regulatory approval from the US Environmental Protection Agency (EPA) for its new bio-based polyol production facility in North America. This approval marks a significant milestone in Lonza's commitment to increasing its production capacity and offering more sustainable solutions to its customers (Lonza press release, 2024).

Research Analyst Overview

- The bio-based polyols market encompasses a diverse range of products, including derivatives, additives, and composites, that play a crucial role in various industries. Polyol curing and crosslinking are essential processes in the production of polyurethane and polyester resins, utilizing catalysts and chain extenders for optimal reaction. Performance evaluation and testing are integral to ensuring product quality, with analysis techniques employed for formulation optimization and flame retardant integration.

- The Bio Polyols Market is expanding with advancements in polyol derivatives, polyol modifications, and polyol functionalization aimed at enhancing sustainability and performance. Key innovations include polyol prepolymers, polyol oligomers, and polyol composites tailored for diverse sectors. Formulations are supported by polyol additives, polyol catalysts, polyol stabilizers, polyol crosslinkers, and polyol chain extenders to improve processing and durability. Safety is addressed with polyol flame retardants, while strength is enhanced through polyol reinforcements and polyol fillers. Emphasis on polyol formulation, polyol reaction, polyol testing, polyol analysis, polyol quality control, and polyol performance evaluation ensures high standards. Applications span construction, automotive, furniture, electronics, packaging, insulation, textiles, agriculture, and healthcare, highlighting bio polyols' role in eco-friendly innovation.

- Stabilizers and fillers are commonly used in polyol processing to enhance stability and reduce viscosity. Oligomers and prepolymers serve as building blocks for creating complex structures, while modifications and functionalization offer enhanced properties. Polyol mixing technologies enable efficient production, and reaction conditions are meticulously controlled to maintain consistency and meet market demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bio Polyols Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.9% |

|

Market growth 2025-2029 |

USD 5605.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

US, Canada, UK, Germany, China, France, Italy, The Netherlands, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bio Polyols Market Research and Growth Report?

- CAGR of the Bio Polyols industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bio polyols market growth of industry companies

We can help! Our analysts can customize this bio polyols market research report to meet your requirements.