Biogas Market Size 2025-2029

The biogas market size is forecast to increase by USD 19.73 billion, at a CAGR of 5.8% between 2024 and 2029. The market is experiencing significant growth, driven by the increasing generation of municipal solid waste and the expanding utilization of biogas as a viable alternative to piped natural gas.

Major Market Trends & Insights

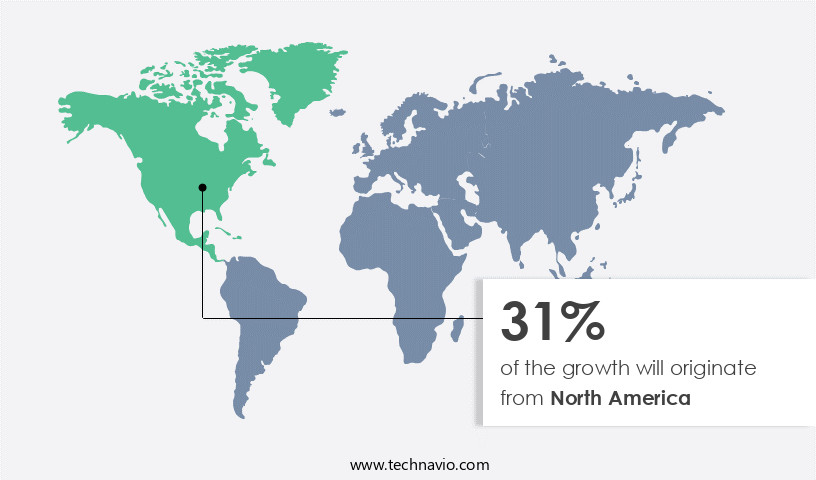

- North America dominated the market and accounted for a 31% share in 2023.

- The market is expected to grow significantly in APAC region as well over the forecast period.

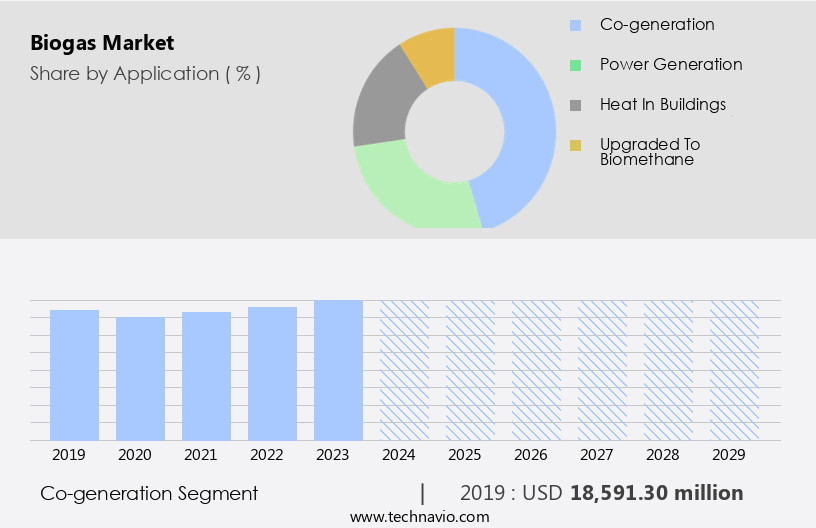

- Based on the Application, the co-generation segment led the market and was valued at USD 19.88 billion of the global revenue in 2023.

- Based on the Source, the agricultural waste segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 60.59 Billion

- Future Opportunities: USD 19.73 Billion

- CAGR (2024-2029): 5.8%

- North America: Largest market in 2023

The market continues to evolve, driven by advancements in anaerobic digestion technology and the increasing demand for renewable energy sources. Biogas utilization is expanding across various sectors, including power generation, heat production, and transportation. Process control plays a crucial role in optimizing energy balance and maintaining gas quality, while the microbial community and fermentation kinetics are key factors influencing digester efficiency. For instance, a large-scale biogas plant in Europe increased its sales by 15% through process monitoring and optimization, improving energy efficiency and reducing carbon footprint. The biogas industry is projected to grow at a robust rate, with expectations of a 10% annual increase in biogas production capacity.

What will be the Size of the Biogas Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Biogas production relies on the co-digestion process, utilizing agricultural residue and other feedstocks. Pretreatment methods and substrate hydrolysis are essential steps in the biogas production process, ensuring efficient biomethane yield. Biogas storage and digester design are also critical aspects, with biogas upgrading and purification techniques essential for injecting biomethane into the natural gas grid. Process optimization, emission reduction, and biogas power generation are primary focuses in the industry, with biogas being a valuable source of renewable energy. Biogas plants also contribute to wastewater treatment, making them environmentally friendly solutions for managing agricultural waste and reducing greenhouse gas emissions. The power generation segment is the second largest segment of the Application and was valued at USD 17.17 billion in 2023.

The production of biogas from organic waste offers a sustainable solution to mitigate environmental concerns, while also generating renewable energy. However, the market faces challenges that require strategic navigation. These obstacles include the complexities and costs associated with biogas production, such as the need for anaerobic digesters and the variability of feedstock quality.

Effective management of these challenges, through technological innovation and operational efficiency, presents opportunities for companies to capitalize on the market's potential and contribute to a more sustainable energy future.

How is this Biogas Industry segmented?

The biogas industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Co-generation

- Power generation

- Heat in buildings

- Upgraded to biomethane

- Source

- Agricultural waste

- Municipal Waste

- Industrial Waste

- Landfill

- Technology

- Anaerobic Digestion

- Landfill Gas Recovery

- End-User

- Industrial

- Commercial

- Residential

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The co-generation segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 19.88 billion in 2023. It continued to the largest segment at a CAGR of 4.45%.

The market is experiencing significant growth, particularly in the cogeneration segment. Anaerobic digestion is a key process in biogas production, converting organic matter into biogas through microbial fermentation. The microbial community plays a crucial role in this process, with fermentation kinetics influencing methane yield. Pretreatment methods, such as substrate hydrolysis, enhance the efficiency of this process. Biogas utilization includes power generation, heating, and biomethane injection. Power generation through cogeneration systems, which produce both electricity and heat, offers high energy efficiency, achieving up to 90% efficiency compared to conventional electricity generation's 30%-40%. This results in substantial cost savings and environmental benefits, as biogas cogeneration reduces greenhouse gas emissions by utilizing organic waste as a fuel source.

The energy balance of biogas systems is essential for optimizing process performance. Process control, monitoring, and optimization techniques ensure efficient biogas production and utilization. Biogas storage is another critical aspect, with digester design and biogas upgrading techniques ensuring gas quality and composition for various applications. The market is driven by the increasing demand for renewable energy and the need to reduce carbon footprints. The market is expected to grow by 10% annually, with agricultural residues and co-digestion processes being major feedstock sources. Economic viability, environmental impact, and process optimization are key considerations for market participants. Biogas purification and heat production are additional market trends.

For instance, a large-scale biogas plant in Europe achieved a 60% reduction in greenhouse gas emissions and generates 30 GWh of electricity per year.

The Co-generation segment was valued at USD 18.59 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is projected to experience moderate growth, with the United States leading the way. Agricultural residues, such as corn stover and sugar beet pulp, are common feedstocks for anaerobic digestion in the region. Pretreatment methods, including acid or enzymatic hydrolysis, are employed to enhance substrate hydrolysis and improve fermentation efficiency. The microbial community plays a crucial role in the biogas production process, with careful process control ensuring optimal fermentation kinetics and methane yield. Biogas utilization includes power generation, heat production, and biomethane injection. Biogas storage and upgrading are essential for ensuring consistent energy balance and gas quality.

Digester design and process optimization are ongoing priorities to increase digester efficiency and reduce carbon footprint. The biogas industry anticipates moderate growth, with some estimates suggesting a 10% increase in installations over the next five years. Co-digestion processes, which involve the simultaneous fermentation of multiple feedstocks, offer opportunities for improved energy efficiency and reduced wastewater treatment costs. Process monitoring and optimization are essential for maintaining digester performance and minimizing emissions. The market's growth is influenced by factors such as renewable energy policies, feedstock availability, and economic viability. For instance, the American Biogas Council reports that biogas generated from livestock manure and food waste can replace approximately 30% of natural gas consumption in the US.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for renewable energy sources and the need to reduce greenhouse gas emissions. Biogas production is an optimal solution for converting organic waste into a valuable energy resource. However, achieving optimal digester operating parameters is crucial for maximizing biogas yield. Temperature plays a significant role in this process, with higher temperatures generally leading to increased methane production. Feedstock composition also impacts methane production, with co-digestion of agricultural and industrial waste providing a more balanced and consistent biogas output. Biogas upgrading using membrane separation is essential for purifying biogas for grid injection, ensuring it meets the required quality standards. Efficient biogas storage and distribution systems are necessary for managing the intermittent nature of biogas production. Analysis of microbial community dynamics in digesters is crucial for optimizing anaerobic digestion process parameters and maintaining stable biogas production.

The economic viability of biogas power generation projects depends on various factors, including the cost of feedstocks, biogas upgrading techniques, and the selling price of biomethane. Environmental impact assessments and life cycle assessments of biogas utilization are essential for ensuring sustainable production. Design considerations for large-scale biogas plants include efficient biogas upgrading techniques, optimization of anaerobic digestion process parameters, monitoring and control of biogas production process, and application of advanced process control techniques. Evaluation of different digester designs is necessary for selecting the most suitable technology for specific applications. Management of digestate as a fertilizer is an essential aspect of biogas production, reducing waste and providing a valuable byproduct. Integration of biogas production with other renewable sources, such as solar and wind, can improve the efficiency of biogas plants and provide a more reliable energy supply. Strategies for improving the efficiency of biogas plants include optimizing feedstock preparation, improving heat recovery, and increasing the retention time in the digester.

What are the key market drivers leading to the rise in the adoption of Biogas Industry?

- The significant expansion in the production of municipal solid waste serves as the primary catalyst for market growth.

- The global market for biogas production is experiencing significant growth due to the increasing rate of urbanization and population expansion, leading to a surge in municipal solid waste (MSW) generation. According to the International Energy Agency (IEA), MSW generation is projected to double in low-income countries over the next two decades, while costs for collection and treatment are expected to increase more than five-fold in these countries and nearly four-fold in lower-middle-income nations. With the global MSW generation rate projected to surpass six million tons per day by 2025, the need for sustainable waste management solutions, such as biogas production, is becoming increasingly urgent.

- For instance, biogas production from MSW can reduce landfill usage and greenhouse gas emissions by up to 70%. This trend is expected to continue, with the market projected to grow at a robust rate in the coming years.

What are the market trends shaping the Biogas Industry?

- The increasing trend in the energy sector is the greater adoption of biogas as piped gas. This development is expected to shape the market in the upcoming period.

- Biogas, derived from anaerobic digestion or bacterial fermentation of organic materials, serves as a renewable alternative for power and heat generation. This natural gas can also be refined and upgraded to fuel natural gas vehicles, a practice known as bio-methanation. Notably, the Dane County Landfill system in the U.S. Has adopted this technology, producing 250 gallons of compressed natural gas (CNG) daily. By utilizing biogas instead of conventional fossil fuels, the project aims to reduce the reliance on both domestic and imported oil for powering its fleet of garbage trucks. This initiative underscores the robust adoption of biogas as a sustainable energy source.

- Biogas' market growth is expected to surge, with industry experts projecting a significant increase in demand in the coming years. This trend is driven by the growing awareness of renewable energy and the need to reduce greenhouse gas emissions. The integration of advanced technologies, such as microbial fuel cells and anaerobic membrane reactors, is further expected to enhance the efficiency and productivity of biogas production.

What challenges does the Biogas Industry face during its growth?

- The expansion of the biogas industry is hindered by several challenges, with the drawbacks of biogas production being a significant concern. These challenges include, but are not limited to, high capital costs, complex operational requirements, and variable feedstock availability. Overcoming these hurdles is essential for the continued growth and sustainability of the biogas industry.

- Biogas production has experienced significant growth in recent years, yet faces challenges hindering its expansion. Technological advancements have been limited, leaving biogas-producing systems inefficient and costly. Impurities persist in the produced biogas despite compression and refinement, impacting conversion efficiency. Intermittency caused by temperature changes further complicates matters. Large-scale biogas production remains elusive, keeping its adoption minimal in utility-level projects. For instance, biogas production from agricultural waste accounts for only 1% of the global gas consumption. This underscores the need for innovation to simplify production processes and reduce costs.

- Despite these challenges, the biogas industry is expected to grow at a robust rate, with estimates suggesting a 20% increase in global biogas production by 2025. This growth is driven by the increasing focus on renewable energy sources and government incentives to promote their adoption.

Exclusive Customer Landscape

The biogas market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the biogas market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, biogas market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Liquide SA

- Ameresco Inc.

- Biofrigas Sweden AB

- Biokraft International AB

- Bright Biomethane

- DMT Environmental Technology

- EnviTec Biogas AG

- Gasum Oy

- Greenlane Renewables Inc.

- Hitachi Zosen Corp.

- HoSt Bioenergy Systems

- PlanET Biogas Global GmbH

- Scandinavian Biogas Fuels International AB

- Schmack Biogas GmbH

- StormFisher Ltd.

- Strabag SE

- Verkade Biogas BV

- Wartsila Corp.

- Weltec Biopower GmbH

- Xebec Adsorption Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Biogas Market

- In January 2024, Siemens Energy and Danish biogas producer Danish Biogas Services A/S announced a strategic partnership to jointly develop and market biogas upgrading solutions. This collaboration aimed to accelerate the decarbonization of the natural gas grid by increasing the share of renewable biomethane (Source: Siemens Energy press release).

- In March 2024, Carbon Clean Solutions, a leading carbon capture technology company, raised USD50 million in a Series C funding round. This investment would support the expansion of their biogas upgrading business and the development of their carbon capture solutions for the biogas industry (Source: Carbon Clean Solutions press release).

- In April 2025, the European Union approved the Renewable Hydrogen Regulation, which sets a binding target of producing 10 million metric tons of renewable hydrogen per year by 2030. This regulation is expected to significantly boost the market as biogas upgrading to produce renewable hydrogen becomes more economically viable (Source: European Commission press release).

- In May 2025, Shell New Energies and biogas producer Waste2Tricity announced the start of operations at their new biomethane production facility in the Netherlands. The facility, which has a capacity of 20 gigawatt-hours per year, will produce biomethane from agricultural waste and sell it to the Dutch natural gas grid (Source: Shell press release).

Research Analyst Overview

- The market continues to evolve, driven by advancements in gas compression technology, methane capture methods, and substrate characterization. These innovations enable biogas production from various feedstocks and expand its applications across multiple sectors, including renewable fuel, biogas grid injection, and waste valorization. For instance, a recent study revealed a 15% increase in biogas production due to improved process automation and microbial analysis. Moreover, the industry anticipates a steady growth of around 5% annually, fueled by the increasing demand for sustainable energy and cost-effective energy distribution. Operational cost reduction through process scalability, odor control, and regulatory compliance is a significant focus for market participants.

- Capital expenditure on safety standards, maintenance schedules, and system integration is also essential for ensuring long-term profitability. Kinetic modeling, process simulation, and life cycle assessment are essential tools for optimizing biogas production and improving process efficiency. Renewable fuel producers are increasingly investing in resource recovery, quality assurance, and environmental monitoring to meet growing consumer expectations for sustainability and safety. Process troubleshooting and operational cost analysis remain critical for maintaining competitiveness in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Biogas Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 19734.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Biogas Market Research and Growth Report?

- CAGR of the Biogas industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the biogas market growth of industry companies

We can help! Our analysts can customize this biogas market research report to meet your requirements.