Biologic Therapeutics Market Size 2024-2028

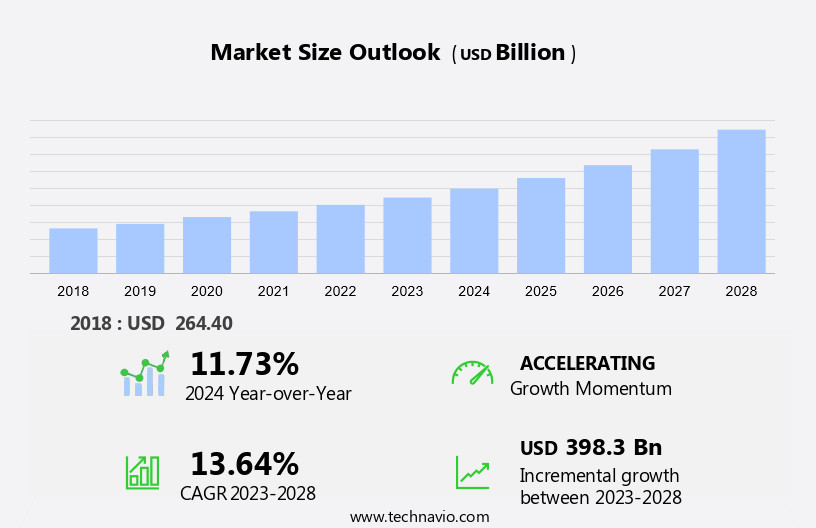

The biologic therapeutics market size is forecast to increase by USD 398.3 billion at a CAGR of 13.64% between 2023 and 2028.

- The biologics market is experiencing significant growth, driven by the rising prevalence of chronic diseases such as cancer, genetic disorders, and autoimmune conditions. The approval of numerous disease-modifying biologics, coupled with advancements in personalized medicine and the development of companion diagnostics, is further accelerating market expansion. These advancements enable more targeted and effective treatments, ultimately increasing the demand for these sophisticated therapies.

- This report analyzes the competitive landscape, including key 20 players including AbbVie Inc., Amgen Inc., Apogenix AG, AstraZeneca Plc, Aurobindo Pharma Ltd., Baxter International Inc., Biocon Ltd., BioMarin Pharmaceutical Inc., Celltrion Healthcare Co. Ltd., Eli Lilly and Co., GangaGen Biotechnologies Pvt Ltd., GlaxoSmithKline Plc, Johnson and Johnson Services Inc., Merck and Co. Inc., Novartis AG, Pfizer Inc., Precision Biologics Inc., Samsung Electronics Co. Ltd., Sanofi SA, and Tubulis GmbH

What will be the Size of the Biologic Therapeutics Market During the Forecast Period?

- The market encompasses a range of innovative treatments for various diseases, including genetic disorders and autoimmune conditions. Personalized medicine, facilitated by companion diagnostics, plays a pivotal role in this sector. Globally, the prevalence of non-communicable diseases (NCDs), such as Alzheimer's disease, Parkinson's disease, breast cancer, and lung cancer, fuels market growth. Strict regulatory processes, overseen by regulatory bodies like the FDA, ensure the safety and efficacy of biologic therapies. These include monoclonal antibodies (MAbs), vaccines, recombinant proteins, antisense, RNAi, molecular therapy, and diagnostics. Notable developments include Leqembi (lecanemab-irmb) for Alzheimer's disease and Tezepelumab for chronic diseases. The market is further propelled by advancements in biologic production methods, such as microbial-based production and mRNA-based vaccines.

How is this Biologic Therapeutics Industry segmented and which is the largest segment?

The biologic therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Cancer

- Infectious diseases

- Autoimmune diseases

- Others

- Product

- Antibody therapeutics

- Vaccines

- Cell therapy

- Gene therapy

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- Spain

- Asia

- China

- Japan

- India

- Rest of World (ROW)

- North America

By Application Insights

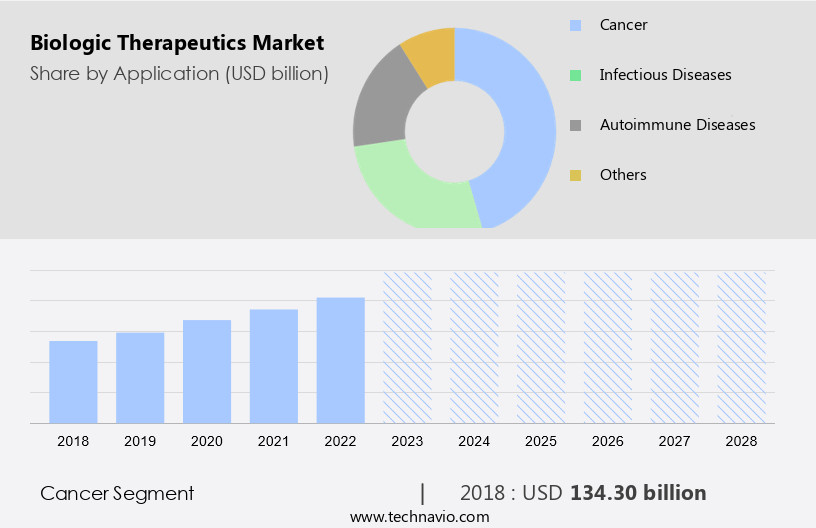

- The cancer segment is estimated to witness significant growth during the forecast period.

Biologic therapeutics have emerged as a significant advancement In the field of oncology, offering targeted treatments for various types of cancer, including colorectal and prostate cancer. These therapies, which include mRNA-1273, monoclonal antibodies (MAbs), vaccines, recombinant proteins, antisense, RNAi, and molecular therapy, differ from chemotherapeutic agents In their mode of action. While chemotherapeutics act indiscriminately on both cancer and normal cells, leading to side effects such as alopecia, nausea, and fatigue, biologics are designed to interact specifically with cancer cells. Biologics exhibit two primary mechanisms of action: direct and indirect. Direct action involves the killing of cancer cells, while indirect action stimulates the immune system to eliminate cancer cells.

The first biologic for oncology, approved by the US FDA, was the microbial-based biologic production, bacillus Calmette-Guerin (BCG) vaccine. Monoclonal antibodies, such as Remicade, Humira, Herceptin, Avastin, Rituxan/MabThera, and Enbrel, are a type of biologic that have revolutionized cancer treatment. They are produced using biotechnology and biomedical science techniques, such as protein purification, cell lines, and adjuvants. These therapies can be murine, chimeric, humanized, or nanobodies, and they function by targeting specific proteins on cancer cells, thereby inhibiting their growth and proliferation. Synthetic vaccines, fusion proteins, soluble receptors, immunoconjugates, and immunotherapeutics are other types of biologics that have shown promise in cancer treatment.

These therapies leverage the power of the immune system to fight cancer, making them highly effective and minimally toxic compared to chemotherapeutics. Biologics have also found applications In the treatment of infectious diseases, such as HIV and hepatitis, by targeting specific viral proteins. They have the potential to revolutionize the way we approach disease treatment and management, offering targeted, effective, and minimally toxic solutions. In conclusion, biologic therapeutics represent a significant advancement In the field of oncology and beyond, offering targeted, effective, and minimally toxic solutions for various diseases, including cancer and infectious diseases. These therapies, which include mRNA-1273, monoclonal antibodies, vaccines, recombinant proteins, antisense, RNAi, molecular therapy, diagnostics, therapy, protein purification, murine, chimeric, humanized, nanobodies, rDNA, synthetic vaccines,cancer diagnostics fusion proteins, soluble receptors, immunoconjugates, immunotherapeutics, and biosimilars, are the future of disease treatment and management.

Get a glance at the Biologic Therapeutics Industry report of share of various segments Request Free Sample

The Cancer segment was valued at USD 134.30 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

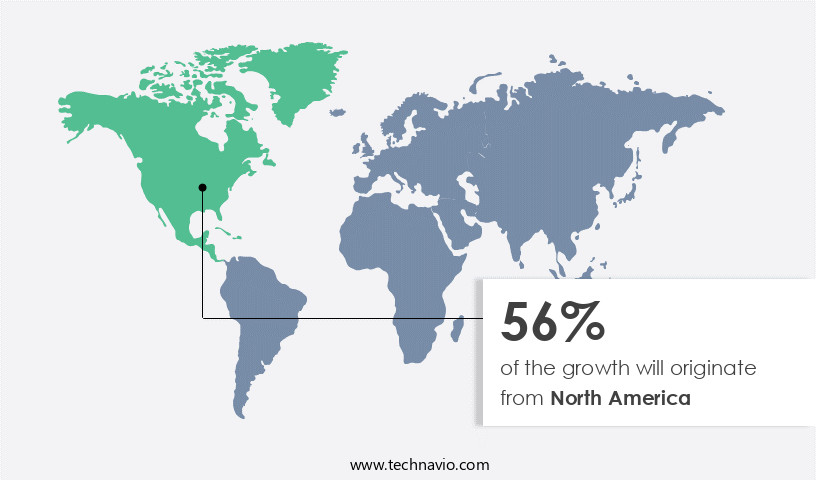

- North America is estimated to contribute 56% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is characterized by advancements in various fields, including colorectal and prostate cancer treatments. Key players, such as AbbVie, Eli Lilly, Merck, Pfizer, and Amgen, are based In the region and offer a diverse range of products. These include monoclonal antibodies (MAbs) like mRNA-1273, microbial-based biologic production, recombinant proteins, antisense RNA, RNAi, molecular therapy, and vaccines. The increasing prevalence of chronic diseases, such as cancer, drives market growth. Biotechnology and biomedical science techniques have led to the development of innovative therapies. These include immunotherapeutics, such as Adjuvants, Nanosystems, and immunoconjugates. Protein purification techniques have enabled the production of murine, chimeric, humanized, and nanobody-based therapeutics.

Fusion proteins and soluble receptors are also significant contributions to the market. The market encompasses various applications, including the treatment of infectious diseases and modulation of the immune system. Key products include Remicade, Humira, Herceptin, Avastin, Rituxan/MabThera, and Enbrel. Antithymocyte Globulin (ATG) is another important therapeutic used in immunosuppression. The market for biologic therapeutics is continually evolving, with advancements in synthetic vaccines, biosimilars, and mRNA therapeutics. These developments offer new opportunities for market growth and improved patient outcomes.

Market Dynamics

Our biologic therapeutics market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Biologic Therapeutics Industry?

Introduction of biosimilars is the key driver of the market.

- Biologic therapeutics, comprised of anti-cytokine therapies and biologic response modifiers, have revolutionized the treatment landscape for various diseases, including cancers. These advanced medicines are derived from mammalian cell lines and microbial populations, yielding complex structures such as proteins, monoclonal antibodies, and recombinant interferon. The mechanism of action for these therapeutics often involves modulating biological processes, like inhibiting platelet-derived growth factor, to induce therapeutic effects. The introduction of biosimilars, highly similar biological products, has significantly impacted the market. Developed using distinct cell lines, manufacturing processes, or formulations, these biosimilars offer no clinically meaningful differences in terms of safety, purity, and potency compared to their original counterparts.

- By increasing competition and reducing treatment costs, biosimilars expand access to life-saving medications for patients, particularly those facing financial barriers. Moreover, the cost reduction brought about by biosimilars is crucial as healthcare spending continues to escalate.

What are the market trends shaping the Biologic Therapeutics Industry?

Strong research and development pipeline is the upcoming market trend.

- The biologics market encompasses a range of therapeutic agents, including anti-cytokine therapies and biologic response modifiers, which have demonstrated significant efficacy in addressing severe infections, malignancies, and immunological and hormonal disorders. Monoclonal antibodies, derived from mammalian cell lines, represent a rapidly expanding segment within biological therapies. As of now, 153 monoclonal antibodies have been approved or are under review for various indications In the EU and the US. Some notable examples include TZIELD, BRIUMVI, and ELAHERE. Furthermore, biologics utilized as vaccines and therapeutic proteins are also experiencing substantial advancements. Key industry players, such as AbbVie and Amgen, are actively engaged in research and development of novel biologics.

- Microbial populations and platelet-derived growth factor are among the targets for new biologic interventions. Recombinant interferon, another type of biologic, holds promise In the treatment of various cancers and viral infections.

What challenges does the Biologic Therapeutics Industry face during its growth?

High cost of biologics is a key challenge affecting the industry growth.

- Biologic therapeutics, including anti-cytokine therapies and biologic response modifiers, hold significant promise In the treatment of various malignancies, hormonal imbalances, and autoimmune conditions. However, the high manufacturing costs associated with these therapies, driven by the expenses related to clinical trials and the use of mammalian cell lines and microbial populations, limit their accessibility to economically underprivileged individuals. The production of therapeutic agents such as monoclonal antibodies and vaccines involves the handling of animals, leading to increased costs due to immunization procedures and other related production processes. For instance, the production of recombinant interferon, a type of biologic response modifier, involves the use of platelet-derived growth factor to stimulate the growth of cells in culture.

- These complex production processes contribute to the overall high cost of biologic therapeutics.

Exclusive Customer Landscape

The biologic therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the biologic therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, biologic therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Amgen Inc.

- Apogenix AG

- AstraZeneca Plc

- Aurobindo Pharma Ltd.

- Baxter International Inc.

- Biocon Ltd.

- BioMarin Pharmaceutical Inc.

- Celltrion Healthcare Co. Ltd.

- Eli Lilly and Co.

- GangaGen Biotechnologies Pvt Ltd.

- GlaxoSmithKline Plc

- Johnson and Johnson Services Inc.

- Merck and Co. Inc.

- Novartis AG

- Pfizer Inc.

- Precision Biologics Inc.

- Samsung Electronics Co. Ltd.

- Sanofi SA

- Tubulis GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Developments

- In January 2024: Amgen and Novartis announced a strategic collaboration to develop and commercialize innovative therapies for cancer. This partnership leverages the strengths of both companies in oncology research and development, with a focus on cell and gene therapies.

- In March 2023: Merck & Co. acquired Acceleron Pharma, a biopharmaceutical company focused on the development of therapies for rare diseases. This acquisition expanded Merck's portfolio of rare disease treatments, particularly in the areas of hematology and oncology.

- In July 2022: Regeneron Pharmaceuticals and Sanofi entered into a global collaboration to develop and commercialize a new class of bispecific antibodies for the treatment of cancer. This partnership aims to leverage the expertise of both companies in antibody engineering and drug development.

- In November 2021: Roche acquired Spark Therapeutics, a leading gene therapy company. This acquisition strengthened Roche's position in the gene therapy market and expanded its portfolio of innovative therapies for rare diseases.

Research Analyst Overview

The market encompasses a significant segment of the healthcare industry. Disenses and diseases are the primary drivers for the growth of this market. The development of advanced technologies and techniques for the production of biologics has led to an increase In their usage. Proteins, monoclonal antibodies, and gene therapies are the major types of biologic therapeutics. The market for these therapeutics is driven by the rising prevalence of chronic diseases, increasing healthcare expenditure, and growing awareness about the benefits of biologic therapies. Additionally, the market is fueled by regulatory approvals for new biologic therapies and collaborations between industry players and academic institutions.

The market for biologic therapeutics is diverse and complex, with various players, including pharmaceutical companies, biotechnology firms, and academic institutions, contributing to its growth. The market is also characterized by its global nature, with players operating in various regions and targeting diverse patient populations. The market for biologic therapeutics is expected to continue its growth trajectory In the coming years, driven by the increasing demand for effective treatments for chronic diseases and the ongoing research and development efforts in this field. The market is also expected to be influenced by regulatory developments and pricing pressures. In conclusion, the market is a dynamic and evolving industry, driven by the need for effective treatments for chronic diseases and the ongoing advancements in biotechnology.

The market is characterized by its diversity, complexity, and global nature, and is expected to continue its growth trajectory In the coming years.

|

Biologic Therapeutics Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.64% |

|

Market growth 2024-2028 |

USD 398.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.73 |

|

Key countries |

US, China, Germany, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Biologic Therapeutics Market Research and Growth Report?

- CAGR of the Biologic Therapeutics industry during the forecast period

- Detailed information on factors that will drive the Biologic Therapeutics growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the biologic therapeutics market growth of industry companies

We can help! Our analysts can customize this biologic therapeutics market research report to meet your requirements.