RNAi Drug Delivery Market Size 2024-2028

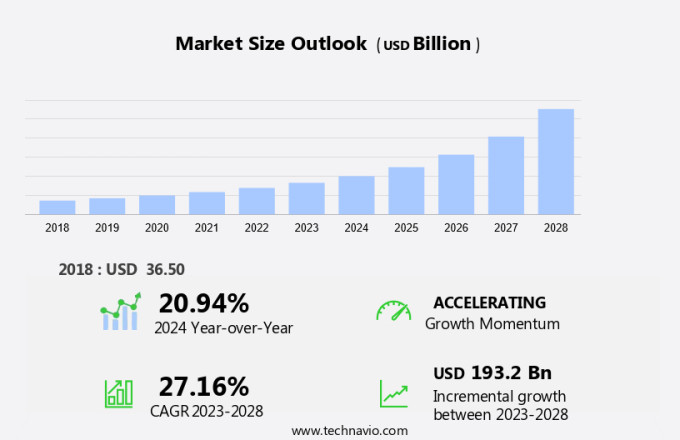

The RNAi drug delivery market size is forecast to increase by USD 193.2 billion at a CAGR of 27.16% between 2023 and 2028.

- The market is experiencing significant growth due to the high target affinity and specificity of RNAi therapeutics. This property makes RNAi drugs an attractive option for treating various diseases, leading to an increase in research and development efforts by market companies. However, the high price of RNAi drugs remains a challenge for the market. Despite this, the potential benefits of RNAi therapy are driving the market forward, with applications in gene therapy, cancer treatment, and infectious diseases. Nanotechnology's role in healthcare infrastructure, molecular diagnostics, and personalized medicines continues to expand, offering promising solutions for altered cellular molecules, metabolites, and various therapeutic areas. The market is expected to grow steadily, with advancements in delivery methods and manufacturing processes helping to reduce costs and improve accessibility.

What will be the Size of the RNAi Drug Delivery Market During the Forecast Period?

- The market encompasses the development and commercialization of technologies for delivering RNAi therapeutics, including siRNA, miRNA, and shRNA, to specific cells or tissues for the treatment of various chronic medical disorders. These disorders span infectious diseases, cardiovascular disorders, neurological disorders, urological disorders, oncological disorders, ophthalmological disorders, and chronic metabolic disorders. RNAi therapeutics function by silencing gene expression through the use of small RNA molecules that target and degrade specific mRNA sequences, thereby inhibiting protein production. Delivery methods for RNAi therapeutics include intravenous, intra-dermal, intraperitoneal, topical, pulmonary, and intracellular approaches, often utilizing nanoparticles or other carriers to enhance efficacy and reduce off-target effects.

- Nucleic acid delivery technologies, such as aptamers, are also employed to facilitate targeted delivery and improve therapeutic efficacy. RNAi therapeutics hold great promise for treating a wide range of diseases, with key therapeutic areas including gene silencing for genetic mutations and RNA aptamers for protein-targeted therapies. Notable examples of approved RNAi therapeutics include Pegaptanib sodium (Macugen) for age-related macular degeneration. The market is expected to grow significantly due to the increasing prevalence of chronic medical disorders and the advancements in RNAi technology and delivery methods.

How is this RNAi Drug Delivery Industry segmented and which is the largest segment?

The RNAi drug delivery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2017-2022 for the following segments.

- Technology

- Nanoparticle drug delivery

- Pulmonary drug delivery

- Nucleic acid drug delivery

- Aptamer drug delivery

- Application

- Infectious diseases

- Oncology

- Cardiology

- Neurology

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Technology Insights

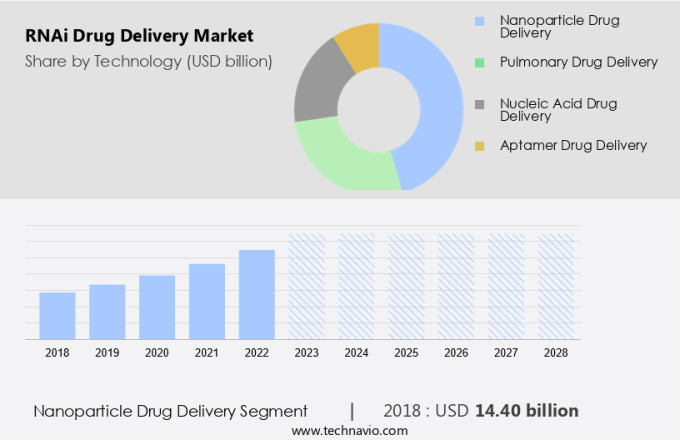

- The nanoparticle drug delivery segment is estimated to witness significant growth during the forecast period.

Nanoparticle drug delivery systems represent a significant advancement in healthcare, utilizing materials at the nanoscale for diagnostic applications and targeted, controlled medication delivery. Leveraging nanotechnology, these systems offer distinct advantages in addressing chronic diseases by precisely administering therapies to intended sites. Notably, RNAi therapeutics have gained traction in various disease treatments due to nanoparticles' unique properties, such as size. These nanoparticle-mediated therapeutics encompass a range of medicines, including chemotherapeutics, biological agents, and immunotherapeutics. The delivery of RNAi therapeutics, including small interfering RNA and RNA aptamers, to specific targets is crucial in treating genetic disorders, cancer, cardiovascular diseases, infectious diseases, and neurological disorders.

Furthermore. technological advancements in synthetic delivery carriers, such as nanocarriers and bio vectors, enable efficient RNAi therapeutic delivery, minimizing potential immunogenicity and RNase degradation. The pipeline for RNAi therapeutics includes drugs and vaccines targeting HIV, rare genetic diseases, and coronavirus disease, among others.

Get a glance at the RNAi Drug Delivery Industry report of share of various segments Request Free Sample

The nanoparticle drug delivery segment was valued at USD 14.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

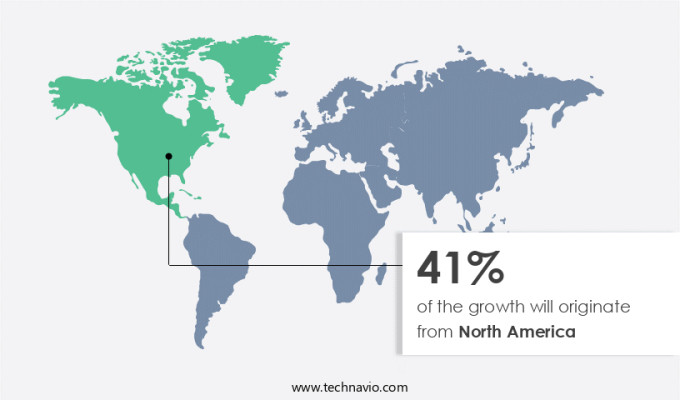

- North America is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the rising incidence of cancer, metabolic disorders, and rare diseases. Advanced healthcare infrastructure and research facilities In the US enable the discovery and development of RNAi therapies. RNAi drug delivery systems, including nanoparticles, intravenous, intra-dermal, intraperitoneal, topical, and pulmonary delivery methods, are utilized for gene silencing in various therapeutic areas such as infectious diseases, cardiovascular disorders, neurological disorders, urological disorders, oncological disorders, ophthalmological disorders, chronic medical disorders, and genetic disorders. Technological advancements in RNAi therapeutics, such as synthetic delivery carriers, bio vectors, nanocarriers, and microRNAs (miRNA), are driving market growth.

Furthermore, key therapeutic areas include antiviral drugs for coronavirus diseases, HIV vaccine trials, and mRNA therapeutics. RNA aptamers, such as Pegaptanib sodium (Macugen), are used for RNA degradation, while nanotechnology, molecular diagnostics, and personalized medicines offer opportunities for market expansion. Despite challenges like RNases, cytoplasmic membrane, and immunogenicity, the market is expected to continue its growth trajectory.

Market Dynamics

Our RNAi drug delivery market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of RNAi Drug Delivery Industry?

High target affinity and specificity of RNAi therapeutics is the key driver of the market.

- RNAi drug delivery has emerged as a promising therapeutic approach for various medical conditions, including gene expression mutations related to infectious diseases, chronic metabolic disorders, cardiovascular disorders, neurological disorders, urological disorders, oncological disorders, ophthalmological disorders, and chronic medical disorders, as well as genetic disorders such as cancer and cardiovascular diseases (CVDs). RNAi therapeutics utilize small interfering RNA (siRNA), RNA aptamers, and microRNAs (miRNA) to silence specific genes or sequences. These therapeutics have a high affinity for their targets due to base pair complementarity in nucleic acids. Technological advancements have led to the development of synthetic delivery carriers, such as nanoparticles, nanocarriers, and bio vectors, which enhance the efficacy and safety of RNAi therapeutics.

- Intravenous, intra-dermal, intraperitoneal, and topical delivery methods have been explored for RNAi drug administration. Nanotechnology plays a crucial role In the development of these delivery systems. Molecular diagnostics and healthcare infrastructure have facilitated the identification and treatment of various diseases with RNAi therapeutics. For example, antiviral drugs targeting viral antigens have shown promise in HIV vaccine trials. RNA synthesis is another critical aspect of RNAi therapeutics, with ongoing research focusing on improving the production and stability of RNAi therapeutics. However, challenges such as RNA degradation by RNases, cytoplasmic membrane penetration, and immunogenicity remain to be addressed. The pipeline for RNAi therapeutics includes numerous products in various stages of development, with drugs and vaccines being the primary focus. The potential applications of RNAi therapeutics are vast, making them a significant area of investment and research In the healthcare industry.

What are the market trends shaping the RNAi Drug Delivery Industry?

Increasing R and D for RNAi therapy by market vendors is the upcoming market trend.

- The market is witnessing significant advancements due to the growing focus on gene expression modulation for various therapeutic areas. RNAi therapy, a form of gene silencing, utilizes small RNA molecules, such as small interfering RNA (siRNA) and RNA aptamers, to target specific messenger RNA (mRNA) sequences and inhibit their translation. This technology holds potential In the treatment of infectious diseases, chronic medical disorders, genetic disorders, and oncological disorders, including cardiovascular diseases (CVDs), neurological disorders, urological disorders, and ophthalmological disorders. Technological advancements in synthetic delivery carriers, such as nanoparticles, nanocarriers, and bio vectors, have facilitated intravenous, intra-dermal, intraperitoneal, topical, pulmonary, and intravitreal delivery methods.

- These advancements enable RNAi therapeutics to target altered cellular molecules, metabolites, and viral antigens, such as those associated with coronavirus disease. Nanotechnology plays a crucial role in enhancing the stability and specificity of RNAi therapeutics, reducing immunogenicity, and improving RNA degradation resistance. Key therapeutic areas include gene silencing for cancer, CVDs, HIV vaccine trials, and rare genetic diseases. Pharmaceutical companies, such as Alnylam and Novo Nordisk, are investing in R&D to expand their offerings, with recent advancements including Alnylam's C16 conjugate technology for extrahepatic tissue targeting and Novo Nordisk's acquisition of Dicerna Pharmaceuticals for its RNAi platform. MicroRNAs (miRNA) and RNA aptamers are emerging as promising therapeutic agents in personalized medicines.

What challenges does the RNAi Drug Delivery Industry face during its growth?

The high price of RNAi drugs is a key challenge affecting the industry growth.

- The market encompasses the development and commercialization of RNA interference (RNAi) therapeutics for the treatment of various genetic and chronic disorders, including infectious diseases, cardiovascular disorders, neurological disorders, urological disorders, oncological disorders, ophthalmological disorders, and chronic medical disorders. These therapies work by silencing specific gene expressions through the use of small interfering RNA (siRNA), aptamers, or microRNAs (miRNA). Delivery methods include intravenous, intra-dermal, intraperitoneal, topical, pulmonary, and intracellular. Technological advancements have led to the development of synthetic delivery carriers, such as nanoparticles, nanocarriers, and bio vectors, to enhance the efficacy and stability of RNAi drugs. The high cost of manufacturing and scaling-up facilities, as well as the requirement for a highly skilled workforce, contribute to the exorbitant prices of these drugs.

- RNAi drugs have shown promise in treating gene mutations and altered cellular molecules, such as viral antigens and metabolites, associated with various diseases. Key therapeutic areas include antiviral drugs for infectious diseases, gene silencing for genetic disorders, and mRNA therapeutics for rare genetic diseases. The healthcare infrastructure continues to invest in molecular diagnostics and personalized medicines to improve patient outcomes. Despite the high cost, the market is expected to grow significantly due to the potential benefits of these therapies. However, challenges such as RNA degradation by RNases and immunogenicity remain. Pipeline products In the form of drugs and vaccines are under development to address these challenges. The use of RNAi technology In the treatment of cancer, cardiovascular diseases (CVDs), and the geriatric population, particularly In the context of coronavirus disease, is a focus area for research.

Exclusive Customer Landscape

The RNAi drug delivery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the RNAi drug delivery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, RNAi drug delivery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alnylam Pharmaceuticals Inc.

- Arbutus Biopharma Corp.

- Arrowhead Pharmaceuticals Inc.

- Bayer AG

- Benitec Biopharma Inc.

- BioNTech SE

- Bristol Myers Squibb Co.

- CureVac AG

- e therapeutics plc

- F. Hoffmann La Roche Ltd.

- Novartis AG

- Novo Nordisk AS

- Phio Pharmaceuticals

- Sanofi SA

- Silence Therapeutics plc

- Silenseed Inc.

- siRNAgen Therapeutics Corp.

- Sirnaomics Inc.

- Sylentis S.A.

- Thermo Fisher Scientific Inc.

- TransCode Therapeutics Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

RNAi drug delivery represents a promising avenue for the development of novel therapeutics, particularly In the realm of gene expression modulation. This approach leverages the natural process of RNA interference (RNAi) to silence specific genes, thereby offering potential treatments for a wide range of diseases. RNAi drug delivery systems employ various methods for introducing therapeutic nucleic acids into cells. These include intravenous, intra-dermal, intraperitoneal, topical, and pulmonary delivery, among others. Nanoparticles, nanocarriers, and bio vectors are commonly utilized as synthetic delivery carriers to enhance the efficacy and stability of RNAi therapeutics. Technological advancements in RNAi drug delivery have led to the development of innovative solutions for addressing challenges such as nucleic acid stability, cytoplasmic membrane penetration, and immunogenicity.

For instance, nanotechnology has played a crucial role In the creation of more effective and targeted delivery systems. RNAi therapeutics hold significant potential in various key therapeutic areas, including infectious diseases, chronic metabolic disorders, cardiovascular disorders, neurological disorders, urological disorders, oncological disorders, ophthalmological disorders, and chronic medical disorders, among others. Furthermore, RNAi technology has the potential to revolutionize the treatment landscape for genetic disorders, including rare diseases and cancer. The development of RNAi therapeutics is driven by the growing demand for personalized medicines and altered cellular molecules as alternatives to traditional small molecule drugs and antibiotics. This trend is particularly evident In the context of antiviral drugs, where RNAi therapeutics offer a potential solution to the growing threat of drug-resistant viruses.

Furthermore, molecular diagnostics and healthcare infrastructure play a crucial role In the successful implementation of RNAi therapeutics. The ability to accurately diagnose and identify the underlying genetic causes of diseases is essential for the effective targeting of RNAi therapeutics. Moreover, a strong healthcare infrastructure is necessary to ensure the efficient and widespread delivery of these novel therapies. RNAi drug delivery is a rapidly evolving field, with numerous pipeline products under development. These include RNA aptamers, small interfering RNAs (siRNAs), and mRNA therapeutics. The potential applications of these therapies are vast, ranging from the treatment of infectious diseases such as coronavirus disease, to the development of vaccines for CVDS and cancer.

|

RNAi Drug Delivery Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 27.16% |

|

Market Growth 2024-2028 |

USD 193.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

20.94 |

|

Key countries |

US, UK, China, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this RNAi Drug Delivery Market Research and Growth Report?

- CAGR of the RNAi Drug Delivery industry during the forecast period

- Detailed information on factors that will drive the RNAi Drug Delivery market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rnai drug delivery market growth of industry companies

We can help! Our analysts can customize this rnai drug delivery market research report to meet your requirements.