Biomaterial Wound Dressing Market Size 2024-2028

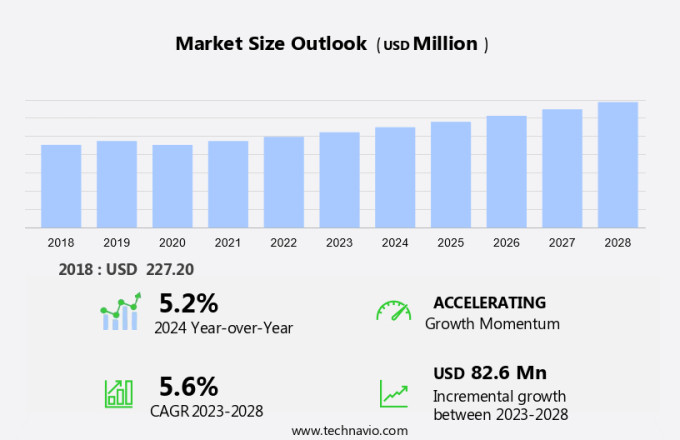

The biomaterial wound dressing market size is forecast to increase by USD 82.6 million at a CAGR of 5.6% between 2023 and 2028.

- The market is experiencing notable growth due to the increasing demand for efficient and safe treatments for chronic wounds. The geriatric population segment is a significant contributor to this market's expansion, given the higher prevalence of chronic wounds among older adults. However, regulatory scrutiny remains a critical challenge for market participants, as stringent regulations for biomaterial wound dressings necessitate rigorous compliance. Bioactive compounds, such as silver and alginate, are increasingly being incorporated into wound dressings to enhance their therapeutic properties. Silver dressings, for instance, offer antibacterial benefits, making them suitable for managing infected wounds. Film dressings and hydrogel wound dressings are other popular types, catering to various wound types and sizes. Pressure ulcers and diabetic wounds are primary applications driving the market's growth. The demand for advanced wound care solutions, particularly in hospitals and home healthcare settings, is also on the rise. Antibacterial bio-additives are increasingly being integrated into wound dressings to address the issue of antibiotic resistance.

What will be the Size of the Market During the Forecast Period?

- The market holds significant potential in catering to the demands of chronic wound patients in the US. Chronic wounds, such as diabetic foot ulcers, pressure ulcers, venous ulcers, and wounds resulting from accidents, pose a challenge to the healthcare system due to their prolonged healing time and high incidence among certain populations, including Medicare beneficiaries with diabetes, obesity, and vascular diseases. Biomaterial wound dressings, which include collagen matrix, alginate, and chitosan-based products, offer advanced wound care solutions by promoting tissue regeneration and maintaining a moist wound environment. The hydrophilic nature of these biomaterials facilitates moisture management, which is crucial for the healing process.

- Chronic diseases, such as diabetes and heart disease, are leading causes of chronic wounds in the US. Diabetes, in particular, affects over 30 million Americans and increases the risk of developing foot ulcers by up to 25%. Obesity, another prevalent lifestyle disorder, also contributes to the high incidence of chronic wounds. Biomaterial wound dressings with antimicrobial activity are gaining popularity in the US healthcare market due to their ability to prevent infections and enhance the healing process. These dressings can be particularly beneficial for patients with chronic wounds, as they are susceptible to infection and often require extended hospital services. The US market for biomaterial wound dressings is expected to grow due to the increasing number of chronic wound patients and the need for advanced wound care solutions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Antimicrobial dressings

- Bio-engineered skin and skin substitutes

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- Rest of World (ROW)

- North America

By Type Insights

- The antimicrobial dressings segment is estimated to witness significant growth during the forecast period.

Antimicrobial wound dressings are essential in preventing bacterial growth and infection in various types of wounds. These dressings incorporate antimicrobial agents, such as silver, iodine, honey, and zinc, into a range of commercially available moist wound dressings, including alginate, hydrogel, hydrocolloid, and foam dressings, as well as traditional gauze dressings. The use of antimicrobial dressings extends to the treatment of localized wound infections in conjunction with systemic antibiotic therapy. Moreover, they are suitable for managing partial and full-thickness burns and burns of indeterminable depth during their initial stages. Antimicrobial dressings come in different forms, including silver dressings, iodine dressings, honey-based dressings, and zinc dressings.

Additionally, regulatory scrutiny plays a crucial role in the development and approval of these products to ensure their safety and efficacy. Hospitals and home healthcare settings are significant markets for antimicrobial wound dressings, particularly for pressure ulcers and diabetic wounds. In the US, the demand for antimicrobial wound dressings is expected to grow due to the increasing prevalence of chronic wounds and the aging population.

Get a glance at the market report of share of various segments Request Free Sample

The antimicrobial dressings segment was valued at USD 161.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market holds a prominent position in the global biomaterial wound dressing industry, accounting for the largest revenue share in 2023. The US, in particular, is a significant contributor to this market's growth. Key players, such as 3M Company, Johnson & Johnson, Integra LifeSciences Corporation, and Cardinal Health, are headquartered in the US and are actively launching advanced biomaterial wound dressings to cater to specific requirements, including water resistance, flexibility, and transparency. Hospitals and ambulatory care centers in North America are major consumers of biomaterial wound dressings due to the increasing prevalence of chronic wounds, such as Diabetic Foot Ulcers and Venous Leg Ulcers, in the aging population.

Further, the demand for these products is driven by their ability to enhance moisture retention, promote angiogenesis, and prevent infection. Biomaterials used in wound dressings include natural materials like alginate, collagen, and chitosan, as well as synthetic materials like Carboxymethyl Cellulose (CMC). The market's growth is expected to continue as companies focus on innovation and product development to meet the evolving needs of the healthcare industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Biomaterial Wound Dressing Market ?

Demand for fast and safe treatment for chronic wounds is the key driver of the market.

- The market in the United States is experiencing substantial growth due to the escalating need for efficient and secure treatment solutions for chronic wounds. Chronic wounds, including diabetic ulcers, pressure ulcers, and venous leg ulcers, necessitate effective and timely management to mitigate complications and enhance patient recovery. Biomaterial wound dressings, renowned for their superior properties such as heightened moisture retention, antimicrobial properties, and biocompatibility, represent an attractive alternative for addressing these requirements. The burgeoning prevalence of chronic diseases, an aging population, and heightened awareness of advanced wound care products are fueling market expansion. Furthermore, the healthcare sector's emphasis on shortening hospital stays and preventing infections aligns with the advantages offered by biomaterial wound dressings, which facilitate faster healing and minimize infection risks.

- Hydrophilic nature dressings, such as hydrogels and electrospun scaffolds, are gaining popularity in various settings, including ambulatory surgical centers and home care settings, for their ability to promote optimal wound healing. The increasing incidence of lifestyle disorders, like heart disease, further underscores the importance of advanced wound care solutions. By addressing the unique challenges posed by chronic wounds, biomaterial wound dressings are poised to revolutionize the healthcare landscape.

What are the market trends shaping the Biomaterial Wound Dressing Market?

Significant demand from geriatric population is the upcoming trend in the market.

- The elderly population in the United States and globally are at a higher risk for falls, resulting in unintentional injuries. Approximately 25-35% of fall incidents occur in individuals aged 65 and above. In countries with a larger elderly population, such as the UK, Canada, and Australia, hospital admission rates for falls among the elderly range from 1-3 per 10,000 population. Chronic diseases like diabetes and venous insufficiency are common among the elderly, leading to a significant demand for advanced wound care solutions, including biomaterial wound dressings. By 2024, it's estimated that around 30% of Americans aged 65 and older will have diabetes, a condition that often results in chronic wounds.

- Biomaterial wound dressings, such as collagen matrix, play a crucial role in promoting wound healing and reducing the risk of infection in chronic wounds. Advanced wound care solutions, including antimicrobial wound gels and nanotechnology, offer additional benefits in managing these wounds effectively. Hospitals and healthcare services provide essential treatment for chronic wounds, making the market a vital sector in healthcare.

What challenges does Biomaterial Wound Dressing Market face during the growth?

Strict regulatory compliances for biomaterial wound dressings is a key challenge affecting the market growth.

- Biomaterial wound dressings play a crucial role in promoting the healing process of various types of wounds, including amputation sites, pressure injuries, and burn injuries. The importance of these dressings lies in their direct contact with the affected area, making it essential to maintain sterility and quality to prevent any adverse effects on human health. Compliance with regulatory requirements and standards set by international and local regulatory authorities, such as the Food and Drug Administration (FDA), the European Medicine Agency (EMA), and the American Society for Testing and Materials (ASTM) International, is mandatory for commercial wound care products. However, variations in regulatory approvals and compliances across countries can create confusion among manufacturers and pose challenges in managing international business.

- In the US, biomaterial wound dressings are extensively used in home healthcare and healthcare infrastructure settings for managing surgical wounds and traumatic injuries. The market for these products is growing due to the increasing prevalence of chronic wounds and the rising awareness of advanced wound care solutions. Effective wound care is essential to reduce wound-related mortality and improve patient outcomes. In summary, biomaterial wound dressings play a vital role in wound care by promoting healing and preventing infection. Compliance with regulatory requirements and standards is crucial to ensure the safety and effectiveness of these products. The market for wound care products in the US is growing due to the increasing prevalence of chronic wounds and the rising awareness of advanced wound care solutions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AdvaCare Pharma

- B.Braun SE

- Baxter International Inc.

- Cardinal Health Inc.

- Coloplast AS

- ConvaTec Group Plc

- DermaRite Industries LLC

- Hollister Inc.

- Informa Plc

- Integra LifeSciences Holdings Corp.

- Johnson and Johnson Inc.

- Medline Industries LP

- Molnlycke Health Care AB

- Nidhi Surgicals Pvt. Ltd.

- Paul Hartmann AG

- Scapa Group Plc

- Smith and Nephew plc

- URGO Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Biomaterial wound dressings have gained significant attention in the healthcare industry due to their effectiveness in managing various types of wounds. These advanced wound care solutions offer numerous benefits, including promoting tissue regeneration, enhancing moisture management, and exhibiting antimicrobial activity. Chronic diseases such as diabetes, obesity, and vascular diseases are prevalent causes of chronic wounds, including diabetic foot ulcers, pressure ulcers, and venous leg ulcers. Biomaterial wound dressings, made from natural materials like collagen matrix or synthetic materials such as alginate, chitosan, and carboxymethyl cellulose (CMC), play a crucial role in the healing process. They are used in hospitals, ambulatory surgical centers, home healthcare settings, and even in the management of acute wounds from accidents.

Further, regulatory scrutiny ensures the safety and efficacy of these wound dressing products, which come in various forms like film dressings, hydrogel wound dressings, and antimicrobial bio-additives. Silver dressings and alginate dressings are popular choices for their antimicrobial properties, while hydrophilic nature of hydrogels and electrospun scaffolds facilitates moisture retention and angiogenesis. Biomaterial wound dressings are essential in reducing wound-related mortality, particularly in cases of severe burn injuries, pressure injuries, and diabetic foot ulcers, which may lead to amputation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market Growth 2024-2028 |

USD 82.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.2 |

|

Key countries |

US, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch