Biopolymers And Bioplastic Market Size 2024-2028

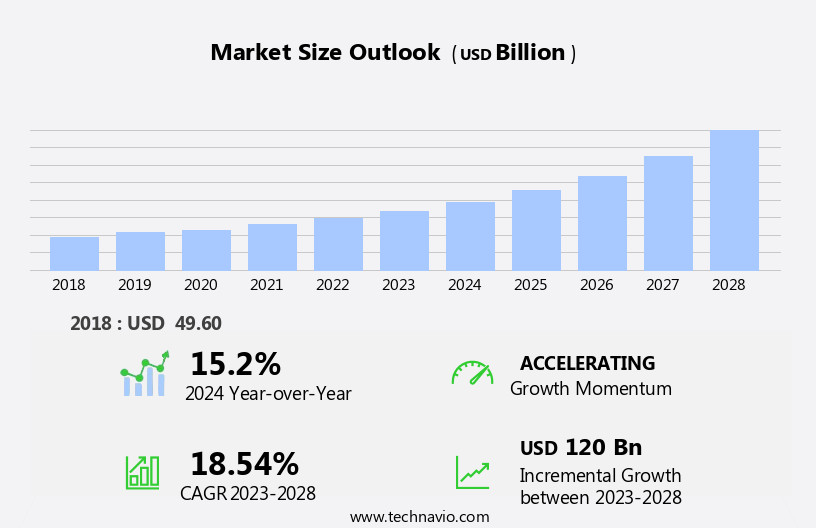

The biopolymers and bioplastic market size is forecast to increase by USD 120 billion at a CAGR of 18.54% between 2023 and 2028.

- The Biopolymers and Bioplastics Market is witnessing significant growth, driven by the increasing demand for sustainable and eco-friendly alternatives to conventional plastics. The emergence of bio-based and renewable raw materials is a key trend propelling market expansion. However, regulatory hurdles impact adoption, as stringent regulations regarding the use and disposal of biopolymers and bioplastics vary across regions. Additionally, supply chain inconsistencies temper growth potential due to the complex production process and limited availability of raw materials. Despite these challenges, cost-effective production methods are being developed, which could help bridge the price gap between biopolymers and conventional plastics.

- Companies seeking to capitalize on market opportunities should focus on improving production efficiency, collaborating with raw material suppliers, and addressing regulatory compliance to navigate these challenges effectively. The strategic landscape of the Biopolymers and Bioplastics Market presents both challenges and opportunities for businesses, requiring a balanced approach to innovation, sustainability, and cost-effectiveness.

What will be the Size of the Biopolymers And Bioplastic Market during the forecast period?

- The bioplastics market encompasses a range of bio-based polymers, including bio-based resins and biodegradable plastics, which are gaining traction due to their sustainability advantages. Bioplastic certification schemes ensure transparency and trust in the market, addressing consumer concerns about bioplastic traceability and labeling. Bio-based oligomers and bioplastic sustainability assessments contribute to the development of eco-friendly bioplastic products. Market segmentation reveals opportunities in various sectors, such as bio-based coatings, bioplastic aerobic digestion, bio-based foams, bioplastic thermal and mechanical properties, and bioplastic anaerobic digestion. Bioplastic market challenges include biodegradation rate inconsistencies and cost competitiveness with fossil fuel-based plastics.

- Chitin-based polymers, lignin-based polymers, and microbial polymers offer potential solutions, along with bio-based feedstocks and industry analysis. Bioplastic modification, reinforcement, and functionalization enhance performance, while bioplastic blends and bio-based films expand applications. Bio-based adhesives and barrier properties are crucial considerations for the market. Biodegradable plastics' optical properties, bacterial cellulose, and cost analysis are also significant factors. The bioplastic industry continues to innovate, with opportunities in bio-based construction materials, bio-based electronics, and bio-based textiles. Polybutylene succinate (PBS) and bioplastic migration are essential topics in the evolving bioplastic landscape.

How is this Biopolymers And Bioplastic Industry segmented?

The biopolymers and bioplastic industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Packaging

- Consumer goods

- Others

- Type

- Bio-PE

- Bio-PET

- PLA

- Biodegradable starch blends

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

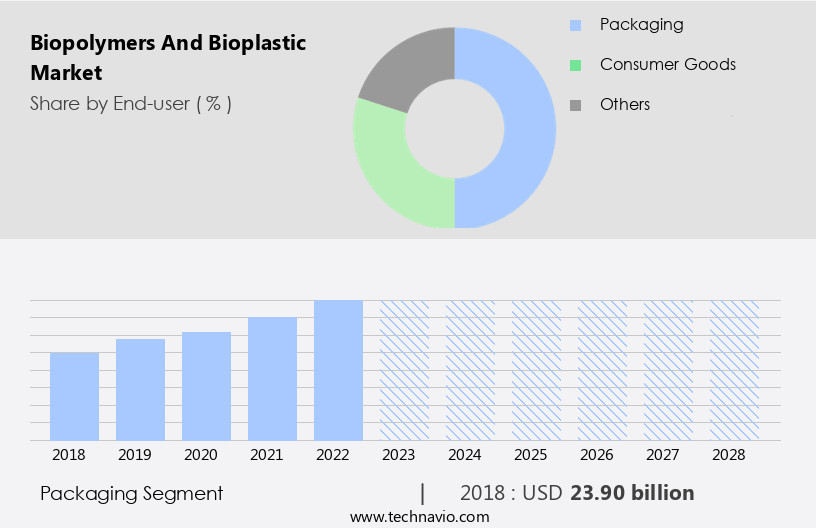

The packaging segment is estimated to witness significant growth during the forecast period.

Bioplastics, derived from renewable resources, have gained significant attention in various industries due to their eco-friendly nature and sustainable production. The packaging sector is the largest consumer of bioplastics, accounting for over 60% of its usage. These bioplastics are utilized in the production of rigid and flexible packaging, including bottles, cups, pots, films, and coatings. Applications span from fresh food packaging to premium and branded products with specific requirements. Biodegradable plastics, such as cellulose-based polymers and polyhydroxyalkanoates (PHAs), offer advantages like biocompatibility, oxygen and moisture resistance, and biodegradability. In food packaging, bioplastics provide a longer shelf life, reducing food waste and greenhouse gas emissions.

Bioplastics are also used in medical devices, biodegradable coatings, and bioplastic fibers. The bioplastics industry is committed to sustainable development, ensuring bioplastic performance matches or exceeds that of conventional plastics. The production of bioplastics involves biopolymer synthesis through chemical engineering and microbial processes. Bioplastic properties, including heat resistance, flexibility, and strength, are continually improving to meet diverse industry needs. The circular economy concept is driving the development of bioplastic recycling and biodegradation technologies. Bioplastic regulations ensure safety, biocompatibility, and environmental impact assessment. The biopolymers market continues to grow, driven by consumer demand for sustainable packaging and eco-friendly alternatives.

The Packaging segment was valued at USD 23.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

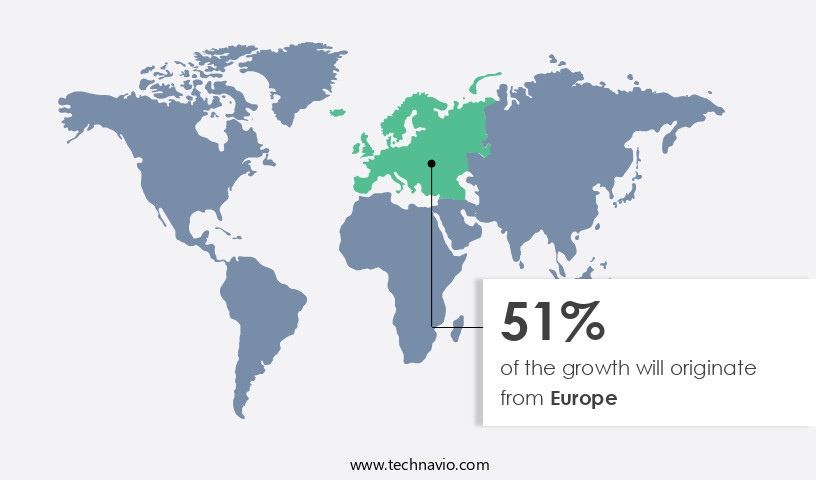

Europe is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Bioplastics have been a significant part of the European market for over two decades, making it a mature market in the global biopolymers and bioplastics industry. The European market's primary offerings include compostable bio-based waste bags and loose-fill packaging. The European governments' legal framework and strategies offer subsidies for bioplastic use, contributing to the market's expansion. In terms of consumption, Europe held the largest share of the global biopolymers and bioplastics market in 2023. This significant market presence is due to the high demand for biodegradable packaging materials from consumers. The bioplastics market encompasses various entities, including agricultural films, bioplastic shelf life, greenhouse gas emissions, cellulose-based polymers, medical devices, biodegradable coatings, bioplastic transparency, sustainable development, bio-based polymers, bioplastic biocompatibility, bioplastic grease barrier, food packaging, compostable materials, life cycle assessment, circular economy, biopolymer synthesis, bioplastic oxygen barrier, bioplastic degradation, biopolymer production, chemical engineering, bioplastic moisture resistance, environmental impact, consumer goods, bioplastic performance, renewable resources, bioplastic heat resistance, polymer science, bioplastic resins, polyhydroxyalkanoates (PHAs), bioplastic compostability, material science, bioplastic barriers, carbon footprint, bioplastic regulations, biopolymer characterization, bio-based additives, bioplastic standards, bioplastic fibers, bioplastic processing, bioplastic cold resistance, bioplastic flexibility, microbial synthesis, polylactic acid (PLA), bioplastic certification, bioplastic safety, bioplastic cost, biodegradable plastics, bioplastic aroma barrier, biopolymers market, bio-based chemicals, bioplastics industry, and sustainable packaging.

Biodegradable plastics, such as bioplastics, offer numerous advantages over traditional plastics, including reduced greenhouse gas emissions, improved biocompatibility, and biodegradability. These factors contribute to the growing demand for bioplastics in various industries, including agriculture, medical, and consumer goods. The bioplastics industry's growth is driven by the increasing focus on sustainable development, the availability of renewable resources, and the need to reduce environmental impact. Biopolymers and bioplastics are produced through various methods, including biopolymer synthesis, chemical engineering, and microbial synthesis. These processes result in a wide range of bioplastic properties, including biodegradability, biocompatibility, chemical resistance, heat resistance, flexibility, and strength.

Bioplastics are used in various applications, such as food packaging, agricultural films, medical devices, and biodegradable coatings. The biopolymers and bioplastics market is expected to continue growing due to the increasing demand for sustainable materials and the availability of renewable resources. The market's growth is also driven by advancements in biopolymer synthesis, bioplastic processing, and bioplastic characterization. The market's evolution is shaped by various factors, including regulatory requirements, consumer preferences, and technological advancements. In conclusion, the biopolymers and bioplastics market is a dynamic and evolving industry that offers numerous opportunities for growth. The market's expansion is driven by the increasing demand for sustainable materials, the availability of renewable resources, and advancements in biopolymer synthesis, bioplastic processing, and biopolymer characterization.

The market's growth is shaped by various factors, including regulatory requirements, consumer preferences, and technological advancements. The European market, with its mature market dynamics and high demand for biodegradable packaging materials, is expected to continue leading the global biopolymers and bioplastics market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Biopolymers And Bioplastic market drivers leading to the rise in the adoption of Industry?

- The emergence of bio-based and renewable raw materials serves as the primary catalyst for market growth.

- The market is experiencing growth due to the adoption of bio-based raw materials, such as starch and vegetable crop derivatives. Bioplastics are increasingly being used in various applications, including sustainable packaging and domestic goods, as a viable alternative to petroleum-based plastics. However, the depletion of fossil fuel resources within the next few decades poses a challenge. To mitigate this, there is a focus on developing new bio-based products that reduce greenhouse gas emissions while being time- and cost-effective. The bioplastics industry faces hurdles in achieving these requirements, as well as ensuring comparable bioplastic properties, such as chemical resistance, oil barrier, durability, and strength, to their petroleum counterparts.

- Additionally, bioplastic recycling and addressing potential toxicity concerns are crucial for market expansion. The establishment of advanced integrated bio-refineries can help address these challenges and provide a sustainable solution for industries reliant on petroleum.

What are the Biopolymers And Bioplastic market trends shaping the Industry?

- Focusing on sustainable production is an essential trend in today's market. It is mandatory for businesses to prioritize sustainable practices in order to remain competitive and meet consumer demand for eco-friendly products.

- The market is experiencing notable growth due to the increasing focus on sustainable development and favorable government regulations for green procurement. Biodegradable polymers, including cellulose-based polymers and biodegradable coatings, are gaining popularity in various industries, particularly consumer goods and packaging. Biodegradable films, such as those used for agricultural purposes, offer extended shelf life while reducing greenhouse gas emissions. In the medical sector, biocompatible bioplastics are being used for medical devices and implants. The demand for biodegradable materials in food packaging is also on the rise, as they offer superior biodegradability and compostability compared to traditional plastics.

- Biodegradable bags, for instance, can improve the composting process and compost quality by reducing the amount of organic waste in landfills. Bioplastics are also being used in the production of trays, dishes, and other food-catering equipment due to their transparency, biodegradability, and excellent grease barrier properties. The circular economy is driving the demand for biodegradable materials, as they offer a more sustainable alternative to traditional plastics. Life cycle assessment studies indicate that biodegradable polymers have a lower carbon footprint compared to conventional plastics. Biopolymer synthesis is an active area of research, with ongoing efforts to improve the efficiency and cost-effectiveness of production processes.

- Despite the challenges faced by smaller manufacturers in keeping up with the competition, the market is expected to continue its growth trajectory in the coming years.

How does Biopolymers And Bioplastic market faces challenges face during its growth?

- The cost-effectiveness of conventional plastic versus biopolymers poses a significant challenge to the growth of the industry, as businesses must carefully weigh the economic advantages and environmental considerations when making material selection decisions.

- Biopolymers and bioplastics, derived from renewable resources, are gaining traction in the market due to their potential to reduce the environmental impact of traditional plastics. However, the production of biopolymers comes with challenges, including high polymerization costs leading to a price premium compared to conventionally produced polymers. The bioplastics market faces supply-chain complexities and technological hurdles in optimizing the production of biopolymers from diverse raw materials. Bioplastic resins, such as polyhydroxyalkanoates (PHAs), offer desirable properties like biodegradability, moisture resistance, and heat resistance. However, their oxygen barrier properties and bioplastic degradation rates require further improvement for them to fully compete with conventional plastics.

- The bioplastics market offers a range of products catering to various industries, including consumer goods. The price of bioplastics, which ranges from USD2.65 to USD6.68 per kilogram, is currently higher than that of conventional plastics at USD1.65 per kilogram. This price parity exists due to the relatively shorter commercial availability of biodegradable polymers compared to their commodity counterparts. Material scientists and chemical engineers continue to innovate in the field of biopolymers and bioplastics, striving to enhance their performance and reduce production costs. Bioplastic barriers and biodegradability are key areas of focus for research and development in this field.

Exclusive Customer Landscape

The biopolymers and bioplastic market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the biopolymers and bioplastic market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, biopolymers and bioplastic market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGRANA Beteiligungs AG - The company specializes in the production and supply of biopolymers and bioplastics, including Bioplastic Agenacomp. These innovative materials offer sustainable alternatives to traditional plastics, contributing to reduced carbon emissions and waste. Biopolymers and bioplastics are derived from renewable resources, making them an eco-friendly solution for various industries. By utilizing advanced technology and research, the company ensures the production of high-quality, functional materials that meet the evolving needs of the market. The adoption of bioplastics is gaining momentum as more businesses seek to minimize their environmental footprint and align with consumer preferences for sustainable products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGRANA Beteiligungs AG

- AKRO PLASTIC GmbH

- Arkema SA

- BASF SE

- Biome Bioplastics Ltd.

- Biotec GmbH Co. and KG

- Braskem SA

- Carbiolice

- Cardia Bioplastics

- Cargill Inc.

- Fkur Kunststoff GmbH

- Futerro SA

- Green Dot Bioplastics Inc.

- Ingevity Corp.

- Mitsubishi Chemical Group Corp.

- Novamont S.p.A.

- Plantic Technologies Ltd.

- TianAn Biologic Materials Co. Ltd.

- Toray Industries Inc.

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Biopolymers And Bioplastic Market

- In February 2023, BASF SE, a leading global chemical producer, announced the expansion of its biopolymer production capacity at its site in Ludwigshafen, Germany. This development will enable the company to produce up to 100,000 metric tons of biopolymers annually, strengthening its position in the bioplastics market (BASF Press Release, 2023).

- In May 2024, Danish biotech company Novozymes and American chemical company DuPont announced a strategic collaboration to develop a new biodegradable polymer. This partnership combines Novozymes' expertise in enzymes for bioplastics production with DuPont's experience in materials science, aiming to create a more sustainable alternative to traditional plastics (DuPont Press Release, 2024).

- In August 2024, LyondellBasell Industries, a leading plastics, chemicals, and refining company, completed the acquisition of the European bioplastics business of Braskem SA. This acquisition will significantly expand LyondellBasell's biopolymers portfolio and enhance its position in the European bioplastics market (LyondellBasell Press Release, 2024).

- In December 2025, the European Commission approved the use of biodegradable plastics in food packaging. This decision is expected to boost the demand for biopolymers and bioplastics in Europe, as these materials offer a more sustainable alternative to traditional fossil fuel-based plastics (European Commission Press Release, 2025).

- These significant developments in the biopolymers and bioplastics market include capacity expansions, strategic collaborations, and regulatory approvals, demonstrating the growing importance and momentum of this sector in the transition towards more sustainable materials.

Research Analyst Overview

The bioplastics market continues to evolve, driven by the relentless pursuit of sustainable alternatives to traditional fossil fuel-derived plastics. Bioplastics, derived from renewable resources, offer a more eco-friendly solution with reduced greenhouse gas emissions during production compared to their conventional counterparts. This shift is reflected in various sectors, from agricultural films that protect crops while minimizing environmental impact, to biodegradable coatings enhancing the shelf life of consumer goods. Cellulose-based polymers and biodegradable plastics are at the forefront of this revolution. In medical devices, biocompatible bioplastics ensure safety and efficiency, while bioplastic transparency aligns with aesthetic demands. Sustainable development is further emphasized through the use of bio-based polymers in packaging, particularly in food applications where biodegradability and compostability are crucial.

The circular economy is gaining momentum, with bioplastics playing a pivotal role in reducing waste and minimizing carbon footprint. Bioplastic processing and biopolymer synthesis, including chemical engineering and microbial synthesis, continue to advance, improving performance and durability. Bioplastic properties such as heat resistance, flexibility, and moisture resistance are being fine-tuned to meet diverse industry needs. Bioplastic regulations and certifications ensure safety and standards, while bioplastic testing and characterization provide valuable insights into their properties and degradation. Bioplastics are not limited to films and packaging; they also find applications in fibers, resins, and additives, expanding their reach across various industries.

The ongoing research and development in biopolymer science and technology underline the continuous dynamism of this evolving market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Biopolymers And Bioplastic Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.54% |

|

Market growth 2024-2028 |

USD 120 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.2 |

|

Key countries |

Germany, US, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Biopolymers And Bioplastic Market Research and Growth Report?

- CAGR of the Biopolymers And Bioplastic industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the biopolymers and bioplastic market growth of industry companies

We can help! Our analysts can customize this biopolymers and bioplastic market research report to meet your requirements.