Bladder Cancer Market Size 2024-2028

The bladder cancer market size is forecast to increase by USD 2.45 billion at a CAGR of 11.4% between 2023 and 2028.

- Bladder cancer is a significant health concern, with minimally invasive surgical procedures, such as robotic-assisted surgery and laparoscopic treatments, gaining popularity due to their benefits in reducing post-operative complications and recovery time.

- Additionally, the market is witnessing advancements in non-invasive diagnostics, including liquid biopsy, which offers early detection and recurrence monitoring for advanced-stage bladder cancer patients. New drug approvals are driving market growth, while concerns over product recalls remain a challenge for companies. This report provides a comprehensive analysis of market trends, growth drivers, and challenges in the market.

What will be the Size of the Market During the Forecast Period?

- Bladder cancer is a type of urinary tract cancer that affects the tissues lining the inside of the bladder. This malignancy encompasses various subtypes, including urothelial carcinoma, adenocarcinoma, and transitional cell carcinoma. In the United States, bladder cancer ranks among the top ten most common cancers, with an estimated 81,190 new cases and 17,240 deaths in 2021, according to the Cancer Observatory. Despite advancements in diagnostics and therapeutics, bladder cancer remains a significant challenge due to factors such as detection delays and ineffective biomarkers. The healthcare industry is dedicated to addressing these issues and improving patient outcomes through innovative approaches.

- Additionally, nanobots, a promising technology, have emerged as a potential solution for early detection and targeted treatment of bladder cancer. These tiny robots can navigate through the urinary system, identifying and targeting cancer cells without harming healthy cells. Intravesical treatment, a common approach for superficial bladder cancer, involves administering anti-cancer drugs directly into the bladder. Chemotherapy and immunotherapy are the primary therapeutic methods for invasive bladder cancer. Immunotherapy, specifically immune checkpoint inhibitors, has shown promising results in clinical trials, with increasing adoption in the healthcare sector. Diagnostic techniques play a crucial role in the early detection and successful treatment of bladder cancer.

- Moreover, cystoscopy, urine cytology, and biomarker tests are the primary methods for diagnosing bladder cancer. However, persistent bladder infections can complicate the diagnostic process, necessitating a thorough evaluation to distinguish between infection and cancer. Radiation therapy and immunotherapy are essential components of bladder cancer treatment. While radiation therapy destroys cancer cells using high-energy radiation, immunotherapy harnesses the power of the immune system to target and eliminate cancer cells. Despite these advancements, challenges remain in the market. Detection delays and ineffective biomarkers continue to impact patient outcomes. The healthcare industry must focus on improving diagnostic accuracy and developing more effective biomarkers to enhance early detection and improve treatment outcomes.

- In conclusion, the market is driven by the need for innovative diagnostics and therapeutics to address the challenges of detection delays and ineffective biomarkers. Technologies such as nanobots, intravesical treatment, and immunotherapy are leading the way in the development of advanced solutions for bladder cancer. The healthcare sector must continue to invest in research and development to improve patient outcomes and ultimately, conquer this formidable disease.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Disease Type

- Transitional cell carcinoma

- Others

- Drug Class

- Immunotherapy drugs

- Chemotherapy drugs

- Target therapy drugs

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Disease Type Insights

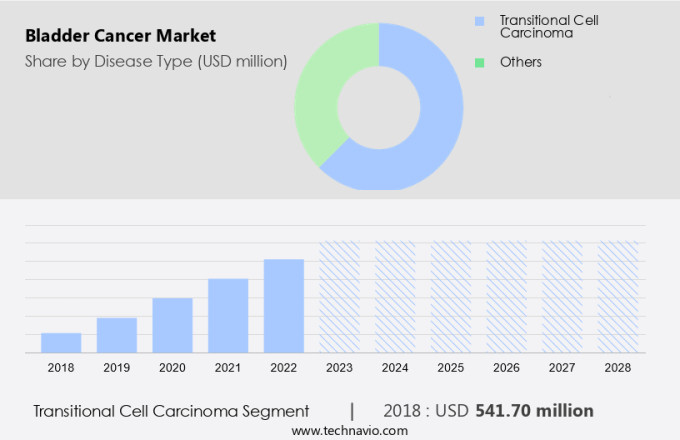

- The transitional cell carcinoma segment is estimated to witness significant growth during the forecast period.

Bladder cancer, specifically Transitional Cell Carcinoma (TCC), originates from the urothelial cells that line the interior of the bladder and other parts of the urinary tract, including the renal pelvis, ureters, and urethra. This type of cancer, also known as urothelial carcinoma, accounts for the majority of bladder cancer cases and is a significant focus in the global market for bladder cancer treatments. TCC can manifest at either the superficial or muscle-invasive stages, with the latter indicating a more aggressive disease progression. The primary risk factor for bladder cancer is smoking, which accounts for approximately half of all cases.

Other health risks include exposure to certain industrial chemicals, radiation therapy, and a family history of the disease. Early diagnosis is crucial for effective treatment, making diagnostic tools and procedures a vital aspect of the healthcare industry's response to bladder cancer. Various diagnostic methods are used to identify bladder cancer, including urine cytology, cystoscopy, and imaging techniques such as CT scans and MRI. The market is driven by the increasing prevalence of the disease, particularly TCC, and the growing demand for advanced diagnostic tools and effective treatments. The market is expected to grow steadily due to the rising awareness of the disease and the development of new therapeutic approaches. In the US, the National Cancer Institute estimates that over 81,000 Americans will be diagnosed with bladder cancer in 2021, making it essential for healthcare providers to stay informed about the latest diagnostic and treatment options to improve patient outcomes.

Get a glance at the market report of share of various segments Request Free Sample

The transitional cell carcinoma segment was valued at USD 541.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

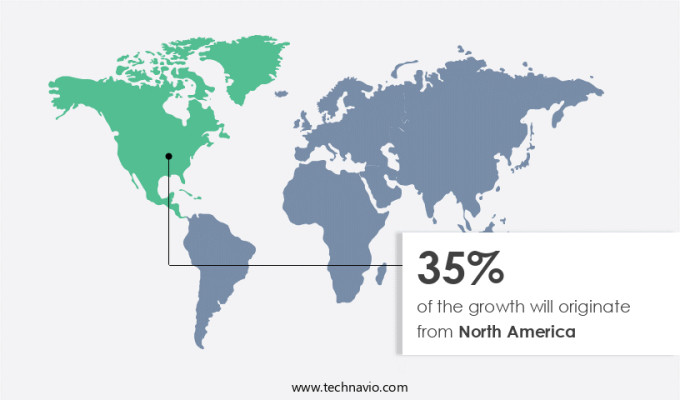

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is experiencing growth due to the high incidence rates and substantial research investments in cancer care centers across the region. In the United States, bladder cancer is the second most common urologic cancer among men, with approximately 22,000 new cases of non-muscle invasive bladder cancer diagnosed annually. Furthermore, there are around 60,000 recurrences each year among previously diagnosed patients.

In Canada, bladder cancer is the fifth most common cancer type, with approximately 12,300 new cases diagnosed annually, making it the ninth leading cause of cancer-related deaths in the country. The advanced research infrastructure and institutional support in North America significantly contribute to the region's capacity for clinical trials and the development of new treatment options, such as monoclonal antibodies and biosimilars. Diagnostic techniques, including urine cytology, play a crucial role in the early detection and treatment of bladder cancer. The market in North America is expected to grow due to these factors and the increasing demand for effective treatment options for persistent bladder infections.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Bladder Cancer Market?

The rising incidence of bladder cancer is the key driver of the market.

- The market is experiencing growth due to the increasing number of diagnosed cases. According to the International Agency for Research on Cancer (IARC), the global cancer burden reached approximately 19.9 million cases and 9.7 million deaths in 2022. Bladder cancer is the ninth most frequently diagnosed cancer worldwide, with an estimated 614,298 new cases diagnosed in 2022. With one in five people globally expected to develop cancer during their lifetime, the impact of an aging population and various socio-economic factors cannot be ignored. Mortality rates for bladder cancer are alarming, with one in nine men and one in twelve women succumbing to the disease. Early detection of bladder cancer is crucial for effective treatment, and advancements in biomarker tests are playing a significant role.

- In addition, immunotherapy, specifically immune checkpoint inhibitors, is increasingly being adopted as a treatment option. Clinical trials are ongoing to identify effective biomarkers for early detection and improved treatment outcomes. Radiation therapy remains a common treatment method, but its long-term effects necessitate ongoing research for alternative, less invasive options.

What are the market trends shaping the Bladder Cancer Market?

Approval of new drugs is the upcoming trend in the market.

- The market in the United States is experiencing notable expansion due to the authorization of novel drugs, expanding treatment alternatives, and enhancing patient results. On December 15, 2023, the US Food and Drug Administration (FDA) granted approval to the combination of enfortumab vedotin-ejfv (Padcev, Astellas Pharma) and pembrolizumab (Keytruda, Merck) for individuals with advanced urothelial cancer, who are not eligible for cisplatin-based chemotherapy.

- Moreover, this approval extends the application of this combination therapy, following the FDA's earlier accelerated approval in 2022. This combination of Padcev and Keytruda introduces a new therapeutic avenue for advanced bladder cancer patients, addressing an unmet need and offering a promising alternative to conventional chemotherapy. The healthcare industry in the US continues to prioritize access to innovative treatments, making this approval a significant development in the fight against bladder cancer.

What challenges does Bladder Cancer Market face during the growth?

Vendor concerns over product recalls is a key challenge affecting the market growth.

- The market faces challenges due to product recalls, as demonstrated by Zydus Pharmaceuticals (USA) Inc.'s recall of 7,248 bottles of Oxybutynin Chloride extended-release tablets in the US. This recall, reported on September 21, 2023, was due to manufacturing issues causing Failed Dissolution Specifications, according to the US Food and Drug Administration (FDA). These tablets, produced in India and distributed by Zydus Pharmaceuticals (USA) Inc., are utilized for managing overactive bladders and urinary conditions. Although classified as a Class I recall, indicating temporary or reversible health effects, it does not pose a significant risk of severe health complications. This incident underscores the importance of maintaining stringent quality control measures in the production of medical devices and pharmaceuticals within the market.

- However, in the realm of advanced-stage bladder cancer treatments, minimally invasive surgical procedures, such as robotic-assisted surgery and laparoscopic treatments, have gained significant traction. These techniques offer numerous benefits, including reduced recovery time, minimal scarring, and enhanced precision. Moreover, non-invasive diagnostics, including liquid biopsy, have emerged as essential tools for recurrence monitoring, allowing for early detection and intervention. These advancements are transforming the bladder cancer treatment landscape, providing hope for patients and healthcare professionals alike. The market encompasses a wide range of products and services, including minimally invasive surgical procedures, pharmaceuticals, and diagnostic tools. As the market continues to evolve, it is crucial for companies to prioritize quality control measures and adhere to regulatory guidelines to mitigate risks and maintain patient trust.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Adaptimmune Therapeutics plc - The company provides advanced treatment options for patients in the US diagnosed with bladder cancer, particularly those with inoperable or advanced solid tumors. One such treatment is ADP-A2M4CD8, a medication specifically designed to address the needs of these patients. This innovative solution aims to improve patient outcomes and contribute to the ongoing advancements in bladder cancer care.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adaptimmune Therapeutics plc

- Amneal Pharmaceuticals Inc.

- Astellas Pharma Inc.

- AstraZeneca Plc

- Bavarian Nordic AS

- Bristol Myers Squibb Co.

- Eli Lilly and Co.

- Endo International Plc

- Ferring BV

- Incyte Corp.

- Johnson and Johnson Inc.

- MEDYRA PHARMACEUTICAL

- Merck and Co. Inc.

- Merck KGaA

- Nanostics

- Pfizer Inc.

- UroGen Pharma Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Bladder cancer is a type of urothelial carcinoma that affects the urinary tract. The detection and treatment of bladder cancer are crucial for improving patient outcomes. Delayed detection of bladder cancer can lead to invasive and advanced-stage diseases, requiring more aggressive therapies. Advancements in therapeutics include intravesical treatment with anti-cancer drugs and nanobots. Chemotherapy, radiation therapy, immunotherapy, and surgical procedures like radical cystectomy are common treatments for bladder cancer. Risk factors for bladder cancer include smoking, persistent bladder infections, and exposure to certain chemicals. Early detection through diagnostic techniques such as urine lab tests, cystoscopy, biopsy, imaging tests, and biomarker tests is essential for effective treatment.

In summary, the healthcare industry is investing in research and development of new diagnostic techniques and treatments, including clinical trials of monoclonal antibodies, biosimilars, and immune checkpoint inhibitors. Minimally invasive surgical procedures like robotic-assisted surgery and laparoscopic treatments are also gaining popularity. Despite advancements, challenges remain, such as ineffective biomarkers for early detection and limited healthcare access for some populations. Charitable donations and collaborations between healthcare institutions and cancer observatories can help address these challenges and improve cancer care for all. Urinary tract cancer, including bladder cancer, affects thousands each year. Prostate cancer and adenocarcinoma are other types of cancer that can impact the urinary system. Cancer care centers and hospitals provide essential services for diagnosing and treating these diseases.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.4% |

|

Market growth 2024-2028 |

USD 2.45 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.8 |

|

Key countries |

US, Germany, Japan, UK, China, Canada, France, India, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch