Cytology Market Size 2024-2028

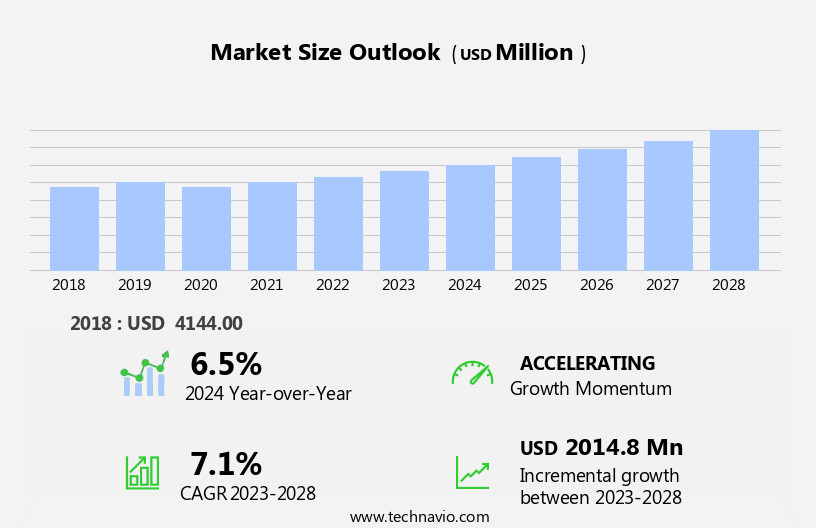

The cytology market size is forecast to increase by USD 2.01 billion at a CAGR of 7.1% between 2023 and 2028.

-

The global cytology market is growing steadily, driven by rising awareness of cervical cancer screening and the shift toward liquid-based cytology, which improves diagnostic accuracy. This report offers actionable insights through detailed market size data, growth forecasts, and analysis of key segments like gynecological cytology, which leads due to its critical role in early detection. It highlights a key trend in co-testing with HPV for more thorough results, while addressing a challenge from subjectivity in analysis, which can affect consistency. With data on regional trends, vendor strategies, and technological shifts, this report equips businesses to enhance diagnostic offerings, refine strategies, and stay competitive in a changing global landscape by tackling precision and innovation.

What will be the Cytology Market Size During the Forecast Period?

- Cytology, a branch of pathology, plays a pivotal role in the diagnosis of various diseases, particularly those related to abnormalities in bodily tissues, fluids, and cells. This non-invasive diagnostic technique has revolutionized the medical field with its ability to provide accurate and timely results. The process begins with the collection of a tissue sample or fluid, which is then examined under a microscope by a trained pathologist. Cytology encompasses various subspecialties, including exfoliative cytology and intervention cytology. Exfoliative cytology involves the collection of cells shed from the body's mucous membranes or epithelial surfaces.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Research laboratories and academic institutions

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Spain

- Asia

- Japan

- India

- China

- South America

- Chile

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

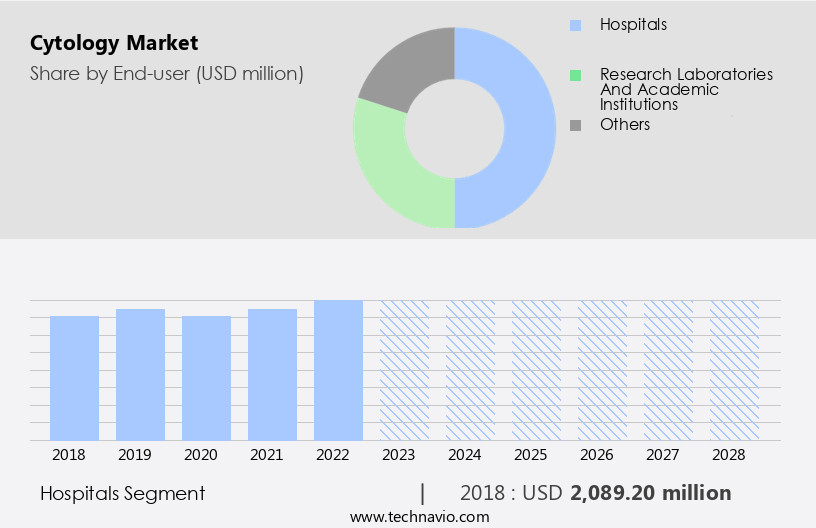

The hospitals segment is estimated to witness significant growth during the forecast period.Cytopathology, a crucial branch of medical science, focuses on the examination of cells and bodily fluids to identify abnormalities and diagnose various diseases. In 2023, the hospitals segment dominated the market due to the high volume of patient traffic and the advanced diagnostic facilities they offer. Hospitals and clinics, as the oldest type of healthcare institutions, cater to a vast patient population daily. Equipped with sophisticated infrastructure and integrated operating rooms, they provide the most comprehensive diagnostic services, including cytopathology. With advanced laboratories and a large number of beds, these hospitals offer the most technologically advanced services and treatment options. A typical large multispecialty hospital houses over 500 beds and employs a team of skilled pathologists to analyze cell samples using microscopes for accurate diagnosis.

Get a glance at the market report of share of various segments Request Free Sample

The hospitals segment was valued at USD 2.09 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

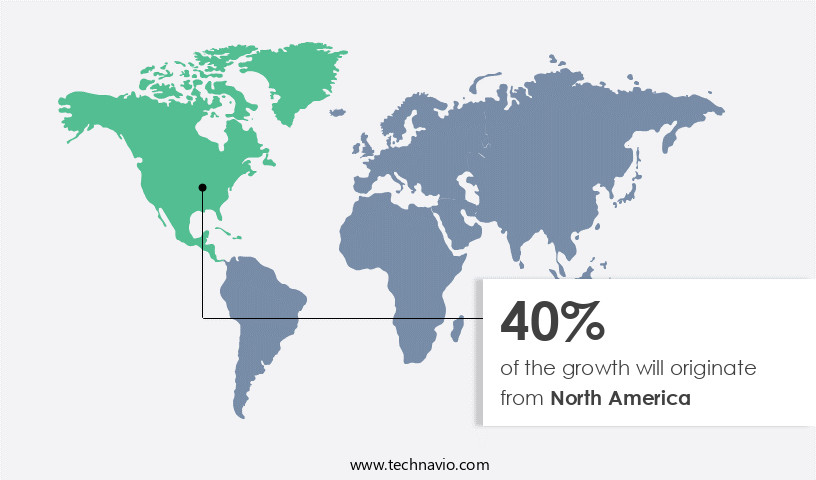

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth, with North America leading the way. Major contributors to this market include countries like the US and Canada. These companies are investing heavily in research and development and constructing new manufacturing facilities. For instance, Thermo Fisher Scientific allocated approximately USD 1,406 million for research and development in 2021, focusing on innovation and productivity. These investments will broaden the scope of research and foster the creation of advanced products, propelling the market forward.

In the field of cytology, various types of samples are analyzed, including those from the gastrointestinal tract, obtained through endoscopy, skin, mucous membranes, respiratory tracts, and urinary systems. Interventions like Pap smears and fine-needle aspiration (FNA) are commonly used to collect these samples. The increasing prevalence of various diseases and conditions, such as cervical cancer, gastrointestinal diseases, and skin disorders, is driving the demand for cytology tests. As a result, the market is expected to grow steadily during the forecast period.

Market Dynamics

The adequacy of the test remains a challenge, as inadequate samples can lead to false negatives and the need for repeat tests. Pathologists play a crucial role in the cytopathology process, carefully examining tissue samples under a microscope to identify any abnormalities. Despite these challenges, the market is expected to continue growing as the importance of accurate and early diagnosis becomes increasingly recognized.A common example of this technique is the Pap smear, which is used to screen for cervical cancer. This procedure is essential in the early detection and prevention of cervical cancer. Intervention cytology, on the other hand, involves the use of fine-needle aspiration (FNA) to obtain tissue samples directly from the body. This technique is widely used in the diagnosis of various cancers, including breast, thyroid, lymph node, and others. FNA is a minimally invasive procedure that provides valuable diagnostic information with minimal risk and discomfort to the patient. Cytology is also used extensively in the diagnosis of various diseases affecting different systems of the body.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Cytology Market?

- Growing cervical cancer screening awareness is the key driver of the market.A Global Perspective Cervical cancer is a significant health concern in both developing and developed countries, with an estimated 604,127 diagnoses worldwide in 2020. The primary causes of cervical cancer are human papillomavirus (HPV) infections. To detect these cancerous cells, medical science relies on cytology, a diagnostic technique that examines cells for abnormalities. Two common cytology tests used for cervical cancer screening are the liquid-based cytology test and the pap smear test. The increasing incidence of cervical cancer cases is driving the demand for cytology testing.

- Governments and non-governmental organizations (NGOs) are taking initiatives to increase awareness of cervical cancer screening and access to testing, which is expected to boost the volume of cytology tests performed. Cytology is a crucial component of cell biology, pathology, and microbiology in clinical medicine. It plays a vital role in identifying and diagnosing various types of cervical lesions, including cysts and nodules. By providing accurate and timely diagnoses, cytology helps improve patient outcomes and reduce healthcare costs associated with advanced-stage cancers.

What are the market trends shaping the Cytology Market?

- The growing popularity of co-testing is the upcoming trend in the market.Cytology and HPV-Associated Lesions Cytology, a branch of science dealing with the study of cells, plays a pivotal role in the early detection and diagnosis of various cancers, including those of the oral cavity and respiratory tract. In the context of oral health, oral cytology is an essential tool for identifying precancerous and cancerous lesions in the oral cavity. Human papillomaviruses (HPV) are the primary cause of many oral cancers and premalignant lesions. The success story of cervical cancer screening using the Pap test as a screening tool is well-documented.

- This non-invasive, cost-effective, and rapid method has significantly reduced morbidity and mortality rates. Similarly, HPV+Pap testing (co-testing) is gaining popularity due to its enhanced sensitivity in detecting high-grade dysplasia. The increasing prevalence of HPV-associated cancers is a significant concern. According to the Centers for Disease Control and Prevention (CDC), approximately 46,143 HPV-associated cancers were diagnosed in the US between 2014 and 2018. Of these, about 25,719 were identified as women, and 20,424 were among men. This trend is likely to drive the market for oral cytology and HPV testing. In the respiratory tract, sputum cytology is a valuable diagnostic tool for detecting respiratory conditions, including lung cancer.

What challenges does Cytology Market face during its growth?

- Factors affecting the adequacy of tests is a key challenge affecting market growth.Cytology, a branch of medical science, plays a crucial role in the detection of various diseases, including cervical cancer and precancerous conditions, by examining abnormal cells from bodily fluids and secretions. This non-invasive, cost-effective, and relatively quick diagnostic method involves collecting specimens from the cervix or vaginal canal and analyzing them for any cellular abnormalities. However, the adequacy of cytology results can be compromised due to several factors. Air-drying artifacts, caused by leaving slides unstained for extended periods, can give a false impression of cell enlargement.

- The presence of blood elements in the specimen can also lead to misinterpretations in the final test results. Moreover, chronic and acute inflammation can obscure diagnostic cellular details, making it challenging to identify abnormalities. Another significant challenge in cytology is the poor collection technique during sample collection. Using inappropriate slides or containers can result in inadequate cytology results. These factors can negatively impact the market growth, emphasizing the importance of addressing these challenges to improve the overall accuracy and reliability of cytological examinations.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Agilent Technologies Inc.

- Arbor Vita Corp.

- Becton Dickinson and Co.

- Bio Optica Milano Spa

- CellPath Ltd.

- Danaher Corp.

- Diapath S.p.A.

- F. Hoffmann La Roche Ltd.

- HiMedia Laboratories Pvt. Ltd.

- Hologic Inc.

- Merck KGaA

- Perkin Elmer Inc.

- Poly Scientific R and D Corp.

- Polysciences Inc.

- Promega Corp.

- Southwest Precision Instruments LLC

- Sysmex Corp.

- Thermo Fisher Scientific Inc.

- Trivitron Healthcare

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cytology, a branch of cell biology, plays a pivotal role in the diagnosis of various diseases by examining cells obtained from bodily tissues, fluids, and secretions. Pathologists use a microscope to identify abnormalities in cells, which can indicate cancer or precancerous conditions. Exfoliative cytology and intervention cytology are two primary methods used in cytology. In exfoliative cytology, cells are obtained by brushing or scraping the mucous membranes or skin. A pap smear is a well-known example of this method, used for cervical cancer screening. Intervention cytology, on the other hand, involves collecting tissue samples through fine-needle aspiration (FNA) or endoscopy.

The cytology market is driven by advancements in sample accuracy, staining quality, and cell preservation, ensuring improved imaging clarity and processing speed. Enhanced diagnostic precision, error reduction, and slide durability contribute to more reliable results. Reagent purity, data reliability, and cost efficiency optimize laboratory operations, while safety protocols, automation level, and result consistency improve workflow efficiency. Storage stability, contamination control, and user training enhance specimen integrity. With increasing scalability potential, analysis depth, and specimen handling innovations, cytology continues to evolve as a vital tool for accurate disease detection and research.

Furthermore, cytology is widely used for diagnosing diseases in various parts of the body, including the gastrointestinal tract, respiratory system, urinary system, and reproductive organs. Cytology plays a crucial role in the early detection of diseases such as breast cancer, thyroid, cervical cancer, and oral cancers. Cytology is an essential diagnostic technique in clinical medicine, contributing significantly to the fields of pathology, microbiology, and clinical science. It helps in the identification of abnormal cells and diseased cells in various bodily fluids, such as urinary samples, respiratory samples, and discharge samples. Cytology plays a vital role in the detection and diagnosis of various abnormalities, including cysts, nodules, and premalignant lesions.

| Cytology Market scope | |

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market Growth 2024-2028 |

USD 2.01 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.5 |

|

Key countries |

US, Canada, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth trends and changes in consumer behavior

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch