Bleach Market Size 2025-2029

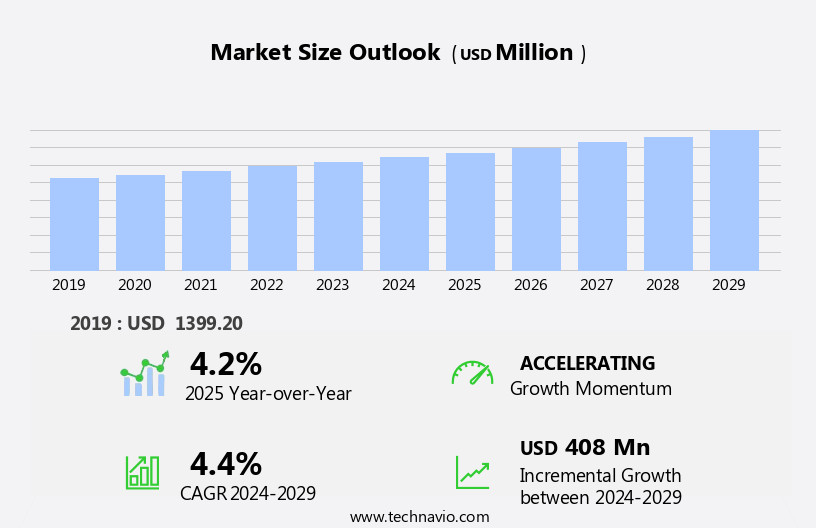

The bleach market size is forecast to increase by USD 408 million, at a CAGR of 4.4% between 2024 and 2029.

- The market is driven by the increasing demand for bleaches in water treatment applications and the rising preference for bleaches as surface disinfectants. The water treatment industry's growth is fueled by the global focus on ensuring clean water supplies for various sectors, including agriculture, industry, and domestic use. Simultaneously, the demand for bleaches as surface disinfectants is on the rise due to the growing awareness of health and hygiene, particularly in the wake of the ongoing pandemic. However, the market faces challenges in the form of biodegradation and biohazard risks associated with the use of bleaches.

- The environmental concerns surrounding the disposal of bleach residues and the potential health hazards posed by the use of certain types of bleaches necessitate the development of eco-friendly and safer alternatives. Companies in the market must invest in research and development to create sustainable and effective bleach solutions while addressing these challenges to maintain their market position and capitalize on the growing demand.

What will be the Size of the Bleach Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its various segments. Powder bleach and liquid bleach, including chlorine bleach and oxygen bleach, remain popular choices for disinfection and stain removal across numerous sectors. Bleach safety and toxicity are ongoing concerns, driving innovation in manufacturing processes and distribution channels. Bleach concentration and handling techniques have evolved to address sustainability concerns and improve efficiency. Bleach degradation and expiration are critical factors influencing market trends, with new technologies and regulations aimed at extending product life and reducing odor. Bleach effectiveness and consumer behavior shape retail sales, with all-purpose bleach and color-safe bleach catering to diverse consumer needs.

Bleach pricing and competition are key drivers in the wholesale market, with innovation in bleach tablets, pre-treatment, and concentrate offerings. Bleach's future outlook is influenced by its environmental impact and regulations, with a focus on reducing residue and improving sustainability. Bleach standards and regulations continue to evolve, shaping the market landscape and driving innovation in packaging, application, and additives. The market's continuous unfolding is marked by ongoing research and development, with new applications and trends emerging in the disinfectant and stain removal industries. The market's evolving patterns reflect the industry's commitment to meeting consumer needs while addressing safety, environmental, and regulatory concerns.

How is this Bleach Industry segmented?

The bleach industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Water treatment

- Industrial bleach

- Dentistry

- Household cleaning

- Grade Type

- Food grade

- Industrial grade

- Type

- Reduced

- Oxidized

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

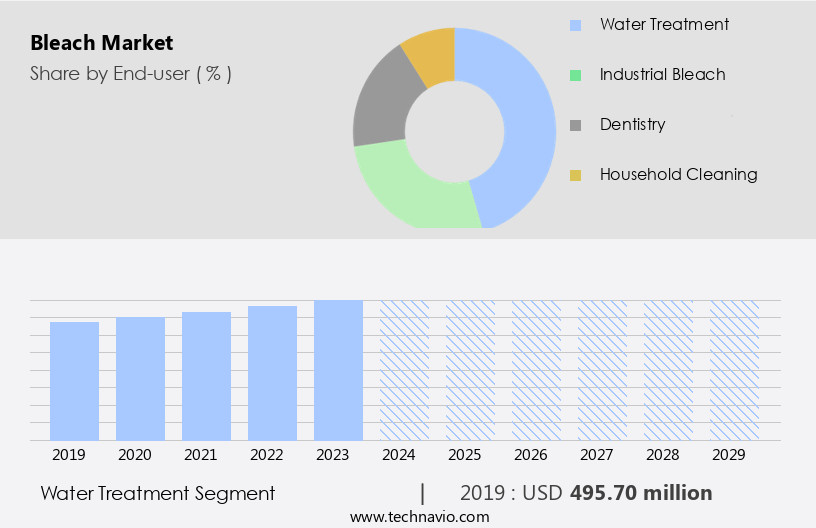

By End-user Insights

The water treatment segment is estimated to witness significant growth during the forecast period.

Bleach is a versatile disinfectant and bleaching agent widely used in various industries and households. Chlorine bleach, primarily sodium hypochlorite, dominates the market due to its high efficacy in disinfection and bleaching. However, oxygen bleach, such as hydrogen peroxide and sodium percarbonate, is gaining popularity due to its eco-friendliness and ability to tackle tough stains. Bleach is used extensively in water treatment to eliminate contaminants and ensure safe drinking water. The water treatment segment is experiencing moderate growth due to the increasing global population and the resulting demand for clean water. Moreover, emerging markets, including China, India, Brazil, and Indonesia, are driving market expansion as they develop their industrial and municipal water treatment networks.

Bleach is also a crucial component in the manufacturing sector, particularly in textiles and pulp and paper industries, for pre-treatment and post-treatment processes. In the retail sector, bleach is available in various forms, such as liquid, powder, tablets, and concentrates, catering to diverse consumer preferences and usage patterns. Bleach safety and sustainability are essential considerations in the market. Manufacturers are focusing on developing low-toxicity and eco-friendly bleach alternatives, such as oxygen bleach and natural bleaches like lemon juice and hydrogen peroxide. Additionally, regulations and standards, such as the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA), govern the production, handling, and disposal of bleach to ensure safety and minimize environmental impact.

Bleach competition is fierce, with numerous players, including major chemical companies, local manufacturers, and e-commerce platforms. Innovations in bleach technology, such as bleach dispensers and additives, are enhancing the user experience and expanding market opportunities. In conclusion, the market is dynamic and diverse, with applications ranging from water treatment to household use. Its future outlook is promising, driven by population growth, industrialization, and the ongoing quest for eco-friendly and sustainable alternatives.

The Water treatment segment was valued at USD 495.70 million in 2019 and showed a gradual increase during the forecast period.

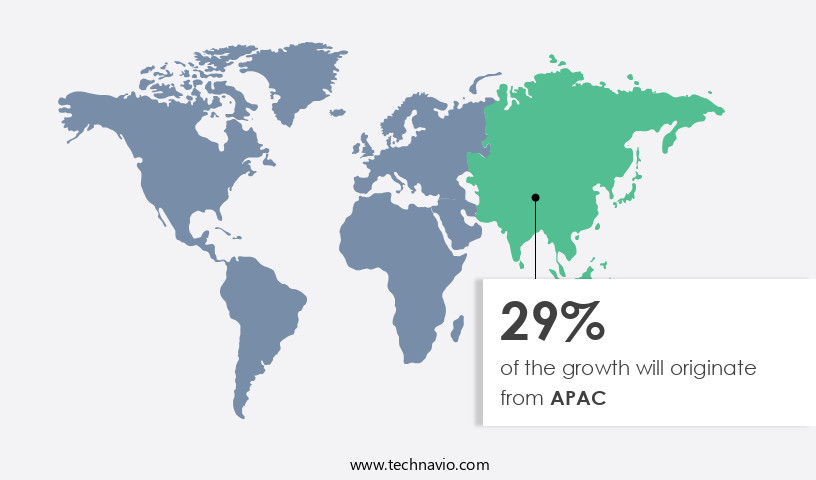

Regional Analysis

APAC is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region. Bleach is widely used in various industries, including water treatment and household cleaning, making APAC the fastest-growing market. China and India are key contributors in this region due to their extensive demand from end-user industries. In water treatment, bleach, specifically chlorine bleach and sodium hypochlorite, plays a crucial role. The food industry also relies on bleach for sanitation and disinfection. Moreover, the increasing number of commercial establishments like hotels, resorts, and offices in APAC is driving the demand for surface disinfectants, which are often bleach-based.

Bleach's versatility extends to stain removal, laundry, and disinfection in various sectors. The market's future outlook is promising, with ongoing innovation in bleach technology, such as bleach tablets and concentrated bleach, offering convenience and efficiency. Safety concerns, such as toxicity and handling, are addressed through regulations and standards. Sustainability is a growing trend, with oxygen bleach and eco-friendly additives gaining popularity. Consumer behavior influences pricing and competition, with all-purpose bleach and color-safe bleach catering to diverse needs. Despite these advancements, challenges remain, including bleach degradation, residue, and expiration. The market's dynamics are shaped by these factors, ensuring a continually evolving landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Bleach Industry?

- The significant increase in demand for bleaches, primarily used for water treatment applications, serves as the primary market driver.

- The scarcity of freshwater in certain countries poses a significant challenge for industries and households, particularly in regions like Australia, Libya, South Africa, and Qatar. In Australia, for instance, surface water in reservoirs serves as the primary municipal water supply, making it susceptible to droughts. In 2023, the country faced below-normal inflow conditions, worsening the water scarcity issue. To address this challenge, the demand for water recycling through chemical treatments, such as bleaches, has surged. This trend is evident in various industries, including oil and gas, power production, mining, and chemicals, which have significantly increased their wastewater consumption. The efficient use of bleaches, like chlorine bleach and oxygen bleach, in water treatment helps maintain water quality and extend its availability.

- This trend is expected to continue due to the growing emphasis on water conservation and the increasing demand for sustainable industrial practices. The future outlook of bleach retail, including both disinfectant bleach and liquid bleach, remains promising as industries and households seek effective and eco-friendly solutions for water treatment and management. However, it is essential to consider the potential bleach degradation and odor issues and invest in advanced bleach dispensers to ensure optimal performance and user experience.

What are the market trends shaping the Bleach Industry?

- The increasing demand for bleaches in the production of surface disinfectants represents a significant market trend. This trend underscores the growing importance of effective sanitization solutions in various industries, particularly in the context of ongoing health concerns.

- The global market for powder bleach is witnessing notable growth due to the escalating demand for effective disinfectants. This trend is fueled by the heightened emphasis on hygiene and sanitation, particularly in response to the COVID-19 pandemic. Bleach, recognized for its potent disinfectant properties, is increasingly used in both residential and commercial cleaning routines. The expansion of the market is further propelled by the increasing prevalence of infectious diseases and the stringent regulations enforced by health authorities to ensure public safety.

- In sectors such as healthcare facilities, food processing industries, and public spaces, the adoption of bleach-based disinfectants is a significant contributor to this growth. Bleach safety is of paramount importance, and manufacturers adhere to established standards to ensure proper handling, concentration, and distribution. The market's dynamics are influenced by various factors, including consumer preferences, technological advancements, and regulatory requirements.

What challenges does the Bleach Industry face during its growth?

- The convergence of biodegradation and biohazard risks poses a significant challenge to the industry's growth trajectory. This complex issue requires careful management to mitigate potential hazards while promoting sustainable processes.

- Bleach, a common household disinfectant, is an essential consumer good that effectively eliminates bacteria and viruses from surfaces. However, its production involves the use of chemicals such as sodium hypochlorite and calcium hypochlorite, which have environmental implications. These chemicals are not fully biodegradable and can negatively impact soil fertility and plant growth when released into the environment. Furthermore, the disposal of hypochlorite in water sources contributes to the formation of dioxins, polluting waterways and posing risks to marine life and human health. To mitigate these concerns, manufacturers and consumers must prioritize bleach sustainability. This includes proper usage patterns, such as using the recommended dosage and avoiding overuse.

- Proper storage is also crucial to prevent bleach from expiring and losing its effectiveness. Regulations governing the production and disposal of bleach aim to minimize its environmental impact. Innovations in bleach technology, such as pre-treatment tablets and more efficient production methods, are also being explored to reduce the use of harsh chemicals and improve sustainability. By adhering to these practices, manufacturers can produce effective bleach products while minimizing their environmental footprint.

Exclusive Customer Landscape

The bleach market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bleach market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bleach market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aditya Birla Management Corp. Pvt. Ltd. - The company specializes in providing advanced bleaching solutions through its innovative product offerings, including RENSA and RENSA HS bleach.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aditya Birla Management Corp. Pvt. Ltd.

- Arkema

- Ashland Inc.

- BASF SE

- Clariant International Ltd.

- Ecolab Inc.

- EnviroChem International Pty Ltd.

- Evonik Industries AG

- Gujarat Alkalies and Chemicals Ltd.

- Hawkins Inc.

- Hill Brothers Chemical Co.

- Kemira Oyj

- Mitsubishi Gas Chemical Co. Inc.

- Nouryon Chemicals Holding B.V.

- Solvay SA

- Sree Rayalaseema Hi Strength Hypo Ltd.

- Stearns Packaging Corp.

- Swastik Chemicals

- The Clorox Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bleach Market

- In February 2024, Clorox, a leading bleach manufacturer, introduced Sustainable Care, a new line of bleach products with plant-derived ingredients, signifying a shift towards eco-friendly cleaning solutions (Clorox Press Release, 2024).

- In May 2024, P&G, the world's largest consumer goods company, partnered with the National Institutes of Health (NIH) to research and develop advanced bleach technologies for enhanced disinfection capabilities (P&G and NIH Press Release, 2024).

- In August 2024, Ecolab, a global water, hygiene, and energy technology company, acquired the bleach business of Reckitt Benckiser, expanding its presence in the industrial and institutional market (Ecolab Press Release, 2024).

- In December 2024, the European Union's Chemicals Agency (ECHA) approved the use of sodium hypochlorite, the primary ingredient in bleach, as an effective disinfectant against SARS-CoV-2, the virus causing COVID-19, paving the way for increased demand in the sector (ECHA Press Release, 2024).

Research Analyst Overview

- The market encompasses various segments, including bleach detergents and hydrogen peroxide, with bleach formulations incorporating enhancers, activators, and surfactants. Bleach recycling and sustainability practices are gaining momentum, as manufacturers explore ways to reduce waste and improve biodegradability. Hydrogen peroxide and sodium dichloroisocyanurate are commonly used as bleach stabilizers, ensuring product longevity and chemical compatibility. Bleach biocides and enzymes play crucial roles in maintaining product effectiveness and quality control. Certification and industry associations contribute to market transparency and consumer trust. Hypochlorous acid, a key component of bleach, undergoes rigorous testing to ensure safety and efficacy. Bleach labeling regulations are essential for clear communication about product usage and disposal instructions.

- Innovations in bleach technology include the development of new activators and formulations, expanding the market's applications and appeal to eco-conscious consumers. Bleach shelf life is influenced by various factors, including storage conditions and compatibility with other substances. Ensuring proper handling and disposal is crucial to minimize environmental impact. Bleach manufacturers prioritize research and development to address these challenges and meet evolving consumer demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bleach Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2025-2029 |

USD 408 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Canada, India, UK, Japan, Brazil, South Korea, France, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bleach Market Research and Growth Report?

- CAGR of the Bleach industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bleach market growth of industry companies

We can help! Our analysts can customize this bleach market research report to meet your requirements.