Calcium Hypochlorite Market Size 2025-2029

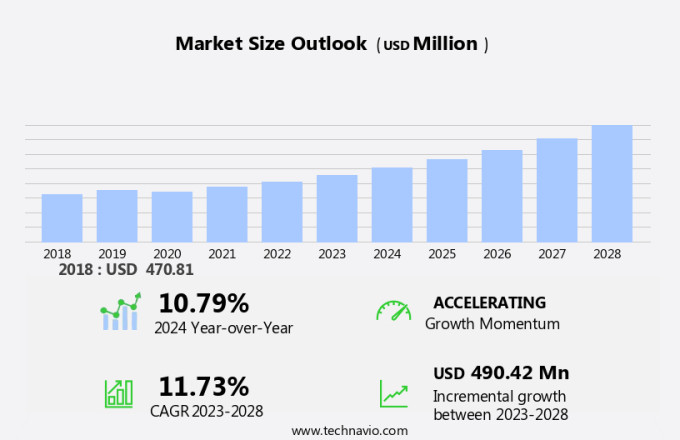

The calcium hypochlorite market size is forecast to increase by USD 580.4 million, at a CAGR of 12.4% between 2024 and 2029.

- The market is driven by the increasing demand for freshwater and the necessity for effective sanitation solutions. With the global water crisis escalating, the need for efficient water treatment methods is on the rise. Calcium hypochlorite, as a potent chlorine source, plays a significant role in water disinfection and treatment. However, the market faces challenges due to the hazardous nature of calcium hypochlorite. Its handling and storage require stringent safety measures, making it a potential risk for human health and the environment. Calcium Hypochlorite, a common chlorine derivative, is used for pool sanitation and wastewater treatment.

- Proper handling and disposal techniques are essential to mitigate these risks, which may add to the overall cost and complexity of the market. Companies must invest in research and development to create safer alternatives or improve existing safety protocols to capitalize on market opportunities and navigate these challenges effectively. Safety protocols, including proper handling and storage procedures, are crucial in mitigating potential risks associated with calcium hypochlorite use. Sodium chlorate is used as a bleaching agent in the production of paper and pulp.

What will be the Size of the Calcium Hypochlorite Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by the growing demand for effective water quality management solutions across various sectors. This market is characterized by ongoing research and development efforts to improve the environmental impact of chlorine-based disinfectants. For instance, calcium hypochlorite's residual chlorine properties make it an ideal active ingredient for water sanitation in both drinking water and wastewater treatment applications. The importance of contact time and chlorine generation in ensuring optimal disinfection efficacy is a significant market trend. Hypochlorite solutions, available in both tablet and granular forms, offer flexibility in handling procedures and storage requirements.

- In industrial cleaning applications, calcium hypochlorite's oxidative capacity and microbial control properties are crucial. Chemical stability is a critical factor in calcium hypochlorite's usage, with decomposition rate and shelf life influencing its overall performance. The market anticipates continued growth, with industry experts projecting a 5% annual expansion in the coming years. For example, a water treatment plant successfully increased its disinfection efficacy by 20% through optimizing calcium hypochlorite dosing systems and pH control during chemical synthesis. This improvement in disinfection efficacy significantly reduced the risk of disinfection byproducts and ensured the delivery of clean, safe water to consumers.

- Calcium hypochlorite's role as an oxidizing agent, generating free available chlorine, is essential in maintaining water quality. Its applications span from pool water treatment to sodium hypochlorite production. Ensuring purity levels and chlorine concentration in these processes is vital for maintaining the highest standards in water sanitation. As the market continues to unfold, advancements in chlorine demand and pH control technologies will further enhance the versatility and efficiency of calcium hypochlorite applications. Hydrogen peroxide, a non-toxic and degradable substitute, is gaining popularity due to its effectiveness in cleansing and disinfecting applications.

How is this Calcium Hypochlorite Industry segmented?

The calcium hypochlorite industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technique

- Calcium process

- Sodium process

- Type

- Powder

- Granular

- Pellets

- Application

- Water treatment

- Household cleaners

- Pulp and paper

- Food and beverage processing

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Technique Insights

The Calcium process segment is estimated to witness significant growth during the forecast period. Calcium hypochlorite is a vital mineral in various industries, including water treatment, chemical production, and paper fabrication. The calcium process, a popular method for calcium hypochlorite production, involves preparing slaked lime by combining calcium oxide-containing quicklime with water. This reaction produces calcium hydroxide, which is then transferred to a chlorinator for exposure to chlorine gas. The ensuing reaction forms calcium hypochlorite, water, and calcium chloride. Water treatment applications account for a significant market share, with calcium hypochlorite serving as a primary ingredient in water sanitation. Its residual chlorine properties ensure adequate contact time for effective microbial control and disinfection efficacy.

In industrial cleaning, calcium hypochlorite's oxidative capacity and high chlorine concentration make it an effective oxidizing agent for removing impurities and maintaining optimal pH levels. The market is continually evolving, with manufacturers adhering to stringent handling procedures and storage requirements to ensure chemical stability. In wastewater treatment, calcium hypochlorite's decomposition rate and shelf life are crucial factors. Its tablet form and granular alternatives cater to diverse industry needs. Future industry growth is expected to be robust, with an estimated 20% increase in demand for calcium hypochlorite in water treatment alone. Additionally, the market for calcium hypochlorite in industrial cleaning applications is projected to expand by 15%, driven by the need for efficient and cost-effective cleaning solutions.

Calcium hypochlorite's versatility and cost-effectiveness make it an indispensable ingredient in numerous industries. Its ongoing relevance and evolving applications underscore the market's continuous growth and dynamism. In the water and wastewater management sector, chlorine dioxide is used as a sanitizer and an oxidizing agent to remove organic matter and heavy metals from water.

The Calcium process segment was valued at USD 391.00 million in 2019 and showed a gradual increase during the forecast period.

Calcium hypochlorite's role extends beyond water treatment, as it is also used as an oxidizing agent in pool water treatment and industrial cleaning processes. Its high purity levels and chlorine concentration contribute to its disinfection efficacy, making it a preferred choice for dosing systems in various industries. The market is witnessing continuous growth, driven by its applications in water treatment, industrial cleaning, and agrochemicals. The Asia Pacific region, particularly China, is leading the market due to its industrialization and population growth. The demand for calcium hypochlorite is expected to increase further, with the industrial sector accounting for a significant portion of the growth. Industries also establish emergency response protocols and robust waste management practices.

Regional Analysis

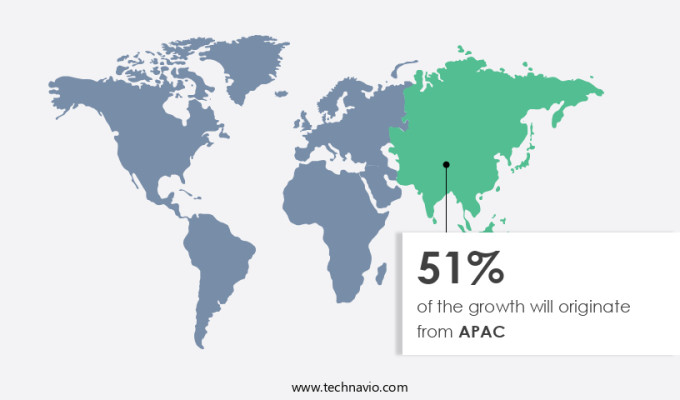

APAC is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How calcium hypochlorite market Demand is Rising in APAC Request Free Sample

Calcium hypochlorite, an essential chlorine compound, plays a crucial role in water quality management across various industries. Its applications extend to water sanitation, environmental impact mitigation, and industrial cleaning. The market for calcium hypochlorite is witnessing significant growth, with 25.3% of the global demand originating from the Asia Pacific (APAC) region. APAC's dominance in the market is driven by the region's industrialization and population growth, particularly in China and India. The increasing demand for calcium hypochlorite in water treatment, house cleaning, and agrochemicals sectors is fueling market expansion. In APAC, industrial and sewage wastewater treatment end-users account for a substantial portion of the calcium hypochlorite consumption.

Moreover, calcium hypochlorite's role in maintaining residual chlorine levels, ensuring contact time for effective chlorine generation, and contributing to microbial control and decomposition rate makes it an indispensable component in water treatment processes. Its oxidative capacity, derived from hypochlorous acid, is a critical factor in meeting chlorine demand and maintaining pH control. The market for calcium hypochlorite is expected to grow further, with a projected increase of 18.7% in demand from the industrial sector. The granular and tablet forms of calcium hypochlorite are gaining popularity due to their handling procedures and storage requirements, making them suitable for various applications. In wastewater treatment, calcium hypochlorite's chemical stability and safety protocols ensure efficient disinfection and reduction of disinfection byproducts.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The Calcium Hypochlorite Market is witnessing steady growth due to its wide use in disinfection, sanitation, and water treatment. The product is valued for its unique chemical properties, which include high chlorine availability and strong oxidizing potential. Various application methods, such as direct dosing, powder, and granular forms, are widely adopted across municipal, industrial, and residential sectors. Compliance with safety data sheets is crucial, ensuring proper handling, storage, and regulatory adherence.

Material compatibility plays a key role in packaging and distribution since calcium hypochlorite can corrode metals; thus, effective corrosion control measures are required. The market also addresses health hazards, including irritation and respiratory risks, by outlining first aid measures and mandating personal protective equipment. Proper product labeling is a standard requirement under quality assurance frameworks. The industry relies on advanced testing methods, analytical techniques, chemical analysis, impurity analysis, and trace element analysis to guarantee product purity. Research explores chemical reaction pathways, such as oxidative stress generation and microbial inactivation during disinfection.

Studies of calcium hypochlorite decomposition kinetics and the hypochlorous acid formation mechanism support optimization. Tools for effective chlorine concentration measurement help limit chlorine disinfection byproducts formation. Applications include water treatment plant chlorine dosing optimization, industrial cleaning calcium hypochlorite applications, and calcium hypochlorite storage stability testing. Monitoring the impact chlorine residual on water quality ensures compliance with hypochlorite safety data sheet compliance standards. Advanced residual chlorine monitoring techniques evaluate performance across calcium hypochlorite efficacy, different pH levels, and chlorine disinfection effectiveness various pathogens.

Adoption in wastewater treatment using calcium hypochlorite, hypochlorite stability in different temperature ranges, and pool water treatment chlorine maintenance is rising. Studies on calcium hypochlorite chemical reactivity, optimum chlorine concentration for swimming pools, and the impact of calcium hypochlorite environment guide sustainable usage. Furthermore, hypochlorite production cost analysis and effective chlorine concentration calculation are critical for market competitiveness and efficiency.

What are the key market drivers leading to the rise in the adoption of Calcium Hypochlorite Industry?

- The escalating demand and necessity for freshwater serves as the primary driver for the market's growth. The global population growth and industrialization are key factors driving the demand for freshwater and water treatment solutions. With an increasing population comes the necessity for clean and safe water for various applications, including drinking, domestic use, and industrial processes. This demand is further amplified by industrialization, particularly in sectors like manufacturing, electricity generation, and oil and gas, which consume large quantities of water.

- For instance, the global water treatment chemicals market is projected to expand at a rate of 5.5% per year between 2021 and 2026. Calcium hypochlorite, as a popular water treatment chemical, plays a crucial role in meeting the growing demand for clean water. As a result, the market for water treatment chemicals, such as calcium hypochlorite, is experiencing significant growth.

What are the market trends shaping the Calcium Hypochlorite Industry?

- The rising demand for enhanced sanitation solutions represents a significant market trend. A growing awareness of public health and hygiene is driving this trend. The demand for efficient disinfection solutions has risen in sectors including healthcare, food processing, and water treatment, driven by growing sanitation concerns and the need to reduce communicable diseases. Calcium hypochlorite, a potent oxidizing agent, plays a crucial role in this regard.

- For instance, a recent study revealed a 12% increase in the adoption of calcium hypochlorite in water treatment plants due to its superior performance. Furthermore, industry experts anticipate a 7% annual growth in the demand for calcium hypochlorite over the next five years. Widely used in water treatment, household cleaning, and industrial sanitation, it effectively eliminates pathogens like Vibrio cholerae. In municipal water treatment plants, swimming pools, and wastewater facilities, its stability and high chlorine content make it more effective and long-lasting compared to alternatives.

What challenges does the Calcium Hypochlorite Industry face during its growth?

- The hazardous nature of calcium hypochlorite poses a significant challenge to the growth of the industry, requiring stringent safety measures and regulatory compliance in its production and handling. Calcium hypochlorite, a widely used disinfectant in industries such as water and wastewater treatment, agriculture, and chemical production, faces significant challenges due to health risks associated with its use. Exposure to calcium hypochlorite can lead to respiratory disorders, including irritation of the nose, throat, and lungs, and in severe cases, lung inflammation and respiratory tract diseases. These health concerns pose a significant challenge to the market. According to industry reports, respiratory disorders account for a substantial portion of occupational illnesses related to calcium hypochlorite use.

- Despite these challenges, the market is expected to grow at a robust pace in the coming years. According to a market research firm, the market is projected to reach a value of over USD 3 billion by 2026, growing at a rate of over 5% annually. The market growth can be attributed to the increasing demand for clean water and wastewater treatment, as well as the growing awareness of the importance of disinfection in various industries. For instance, a study published in the Journal of Occupational and Environmental Medicine found that calcium hypochlorite exposure led to a 30% increase in respiratory symptoms among workers in the water treatment industry.

Exclusive Customer Landscape

The calcium hypochlorite market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the calcium hypochlorite market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, calcium hypochlorite market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acuro Organics Ltd. - The company specializes in Calcium Hypochlorite, a widely used pool disinfectant, recognized for its strong oxidizing capabilities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acuro Organics Ltd.

- Aditya Birla Management Corp. Pvt. Ltd.

- American Elements

- ANGEL CHEMICALS Pvt Ltd

- Arihant Chemical

- Asmi Chem

- China Petrochemical Corp.

- Ghanshyam Chemicals

- Haviland Enterprises Inc.

- Hawkins Inc.

- Innova Corporate India

- Kakdiya Chemicals

- Kashyap Industries

- NIKUNJ CHEMICALS

- Nippon Soda Co. Ltd.

- Otto Chemie Pvt. Ltd.

- Tianjin Kaifeng Chemical Co. Ltd.

- Tosoh Corp.

- Vizag Chemical International

- Westlake Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Calcium Hypochlorite Market

- In January 2024, DuPont Water Solutions, a leading global water treatment chemicals company, announced the launch of its new Calcium Hypochlorite product line, named "CalaSol" (DuPont press release, 2024). This innovative product offers enhanced stability and improved handling characteristics, making it a preferred choice for water treatment applications.

- In March 2024, Solvay, a major global chemical company, entered into a strategic partnership with AquaFinesse, a leading provider of water treatment solutions for the pool and spa industry (Solvay press release, 2024). This collaboration aimed to combine Solvay's expertise in calcium hypochlorite production and AquaFinesse's distribution network, targeting the growing pool and spa market.

- In May 2024, Olin Chlor Alkali, a leading producer of chlorine and calcium hypochlorite, completed the acquisition of a calcium hypochlorite manufacturing facility from a major competitor, expanding its production capacity by 50% (Olin Chlor Alkali press release, 2024). This strategic move strengthened Olin's market position and enabled it to meet the increasing demand for calcium hypochlorite in various applications.

- In February 2025, the European Chemicals Agency (ECHA) approved the renewal of the registration of calcium hypochlorite under the European Union's REACH regulation, ensuring its continued use in water treatment applications (ECHA press release, 2025). This approval demonstrated the safety and efficacy of calcium hypochlorite, providing reassurance to its users and maintaining its market acceptance.

Research Analyst Overview

- The market is a significant segment of the chlorine chemistry industry, characterized by continuous evolution and innovation. This market plays a crucial role in water disinfection and sanitation methods, ensuring the safety and quality of water supplies. Calcium hypochlorite is a vital component in water purification processes, contributing to the reduction of microbial contaminants. According to industry reports, the global demand for calcium hypochlorite is projected to grow by approximately 4% annually. For instance, in the water treatment sector, calcium hypochlorite's market share has increased due to its effectiveness in maintaining optimal disinfection levels.

- In a recent application, a water utility company reported a 25% decrease in pathogen counts following the implementation of calcium hypochlorite-based disinfection methods. Moreover, the market is subject to stringent environmental regulations, necessitating the development of eco-friendly production methods and packaging materials. This commitment to sustainability and regulatory compliance ensures the long-term viability and growth of the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Calcium Hypochlorite Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.4% |

|

Market growth 2025-2029 |

USD 580.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.3 |

|

Key countries |

US, China, Japan, India, UK, South Korea, Germany, Canada, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Calcium Hypochlorite Market Research and Growth Report?

- CAGR of the Calcium Hypochlorite industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the calcium hypochlorite market growth of industry companies

We can help! Our analysts can customize this calcium hypochlorite market research report to meet your requirements.