Blow Molded Plastic Bottles Market Size 2024-2028

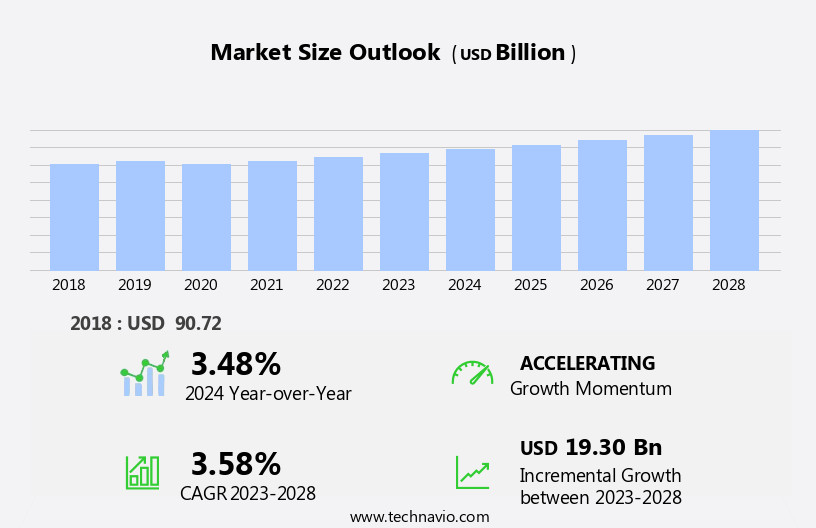

The blow molded plastic bottles market size is forecast to increase by USD 19.30 billion at a CAGR of 3.58% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. One of the primary drivers is the increasing number of mergers and acquisitions among market companies, leading to the consolidation of the industry. Another trend is the increased focus on producing lightweight bottles, which not only reduces production costs but also lowers transportation and disposal expenses. Additionally, there is a growing global demand for pouch packaging solutions, particularly In the food and beverage industry, which is expected to impact the market positively. These trends, along with others, are shaping the future of the market.

What will be the Size of the Blow Molded Plastic Bottles Market During the Forecast Period?

- The market encompasses the production and sale of bottles molded using blow molding technology. This market exhibits robust growth due to the versatility and cost-effectiveness of blow molding in comparison to traditional glass and metal containers. Blow molding technology is employed across various industries, including packaging for food and beverages, automotive and transportation, and industrial applications such as construction, where it is used for concrete forms, panels, and barricades. In the realm of consumer goods, the demand for blow molded plastic bottles is driven by the increasing popularity of electric vehicles and the need for lightweight, durable containers for batteries.

- Furthermore, the ongoing global health crisis has fueled demand for blow molded plastic bottles In the production of face masks, protective gowns, hand sanitizers, and other essentials. Polyethylene (PE), Polyethylene Terephthalate (PET), and Polypropylene (PP) are common polymers used in blow molding to manufacture bottles for various applications. The market trends include advancements in blow molding technology, such as injection blow and extrusion blow molding, which offer improved production efficiency and product quality. Additionally, the growing focus on sustainability and recycling initiatives is driving innovation In the use of biodegradable polymers for blow molded plastic bottles.

How is this Blow Molded Plastic Bottles Industry segmented and which is the largest segment?

The blow molded plastic bottles industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- PET

- PE

- Others

- End-user

- Food and beverage

- Household

- Personal care

- Others

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

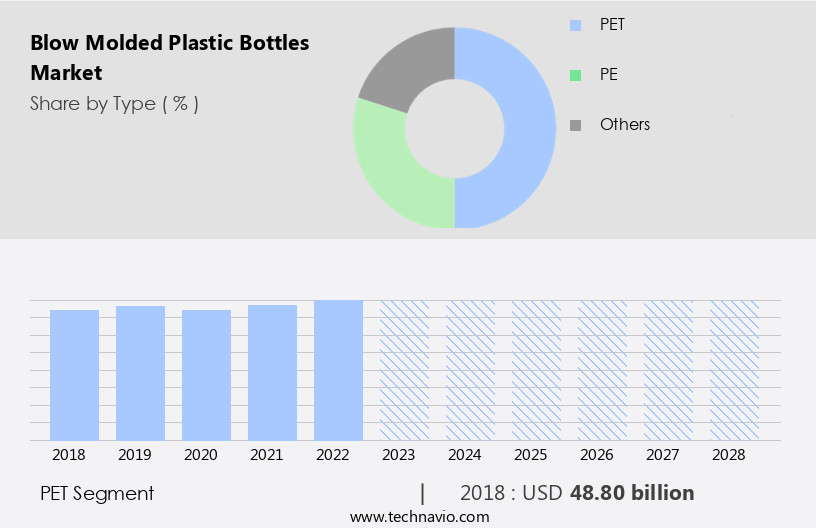

- The pet segment is estimated to witness significant growth during the forecast period.

PET bottles have become a preferred choice for packaging various products due to their versatility and durability. These bottles are extensively used In the packaging industry for beverages, personal care items, food products, pharmaceuticals, and household cleaners. The use of PET bottles offers several advantages, including tamper resistance and protection of the encased products from external factors throughout the supply chain. PET bottles are resilient and less prone to breakage, ensuring the safety and integrity of the contents during transportation and handling. PET bottles are widely adopted for packaging beverages such as water, carbonated soft drinks, juices, sports drinks, and ready-to-drink teas and coffees.

In addition, PET bottles are increasingly used In the medical sector for packaging face masks, protective gowns, and other medical supplies. The construction industry utilizes PET bottles for making concrete forms, panels, and traffic markers. Electric vehicles and injection-molded components also make use of PET bottles as raw materials. Molding technologies like Injection blow, Extrusion blow, and Rotational blow molding are used to manufacture PET bottles. Polyethylene (PE), Polypropylene (PP), Polyethylene terephthalate (PET), and other resins are used In the production of these bottles. The recycling of plastic waste is a significant trend In the industry, and PET bottles are a major contributor to this initiative.

Government bodies and industry verticals are promoting the use of recycled PET bottles in various applications, including packaging for food and beverages.

Get a glance at the Blow Molded Plastic Bottles Industry report of share of various segments Request Free Sample

The PET segment was valued at USD 48.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

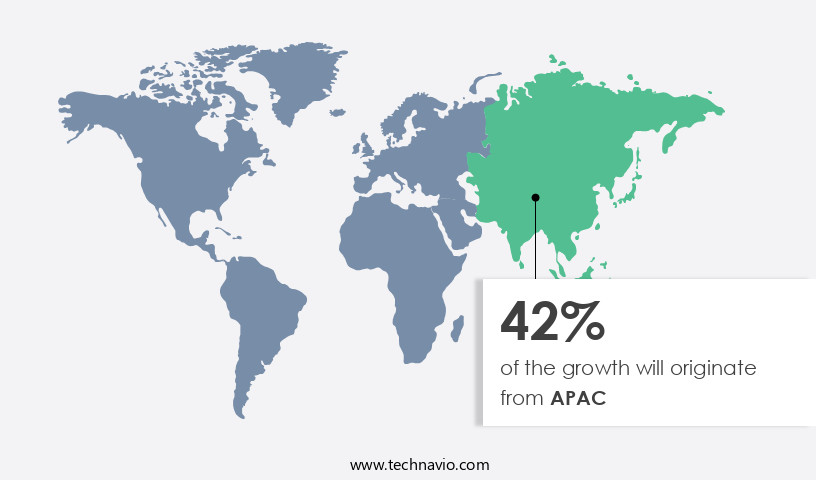

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region, comprising countries like China, India, Japan, South Korea, and Southeast Asian nations, is witnessing significant economic expansion. This growth is driving demand for packaging solutions, particularly blow molded plastic bottles, in various industries. Key factors fueling market growth include expanding industrial activities, the surge in e-commerce, rising consumer preferences for convenience, and increasing urbanization. The evolving lifestyle trends In the region have significantly impacted industries such as food and beverages, FMCG, and pharmaceuticals, all of which rely heavily on blow molded plastic bottles for packaging. With some of the world's fastest-growing urban populations and centers In the APAC region, demand for packaged consumer goods, beverages, personal care products, and household chemicals is expected to continue rising, making blow molded plastic bottles an essential component In the packaging industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Blow Molded Plastic Bottles Industry?

Increasing number of merger and acquisitions among market vendors is the key driver of the market.

- Blow molded plastic bottles are utilized extensively in various industries due to their versatility and durability. In the construction sector, they are used to create concrete forms, panels, and barricades. In the transportation industry, electric vehicles use blow molded plastic bottles for making components such as fuel tanks and battery casings. In the medical sector, these bottles are used to manufacture face masks, protective gowns, and packaging for hand sanitizers, PET bottles, soft drinks bottles, and drinking water bottles. The packaging applications of blow molded plastic bottles are vast, including household products, government bodies, and various industry verticals. The use of blow molding technology, such as injection blow, extrusion blow mold, rotational blow molding, stretch blow molding, custom molds, compound blow molding, and injection blow molding, enables the production of bottles with different shapes, sizes, materials, and functionalities.

- Polyethylene (PE), PEt, and Polypropylene are commonly used resins in blow molding. Acquisitions and mergers play a significant role In the market, allowing companies to expand their customer base, geographic reach, and market share. For instance, Greif, Inc.'s acquisition of Reliance Products, Ltd., in October 2023, enabled the company to offer a broader range of packaging solutions. Plastic waste and recycling are essential considerations In the market. Governments and industry bodies are implementing regulations to reduce plastic waste and promote recycling. The use of recycled polyethylene and polypropylene resin in blow molding is increasing, making the process more sustainable and cost-effective.

- In conclusion, the market is dynamic, with various applications across industries and continual advancements in technology. The use of different resins, acquisition strategies, and sustainability initiatives are key factors driving the market's growth.

What are the market trends shaping the Blow Molded Plastic Bottles Industry?

Increased focus on production of lightweight bottles is the upcoming market trend.

- Blow molded plastic bottles are engineered for lightweight and efficient production, with a focus on minimizing material usage while maintaining structural integrity. Advanced manufacturing techniques, such as injection blow molding, extrusion blow molding, and rotational blow molding, enable the creation of bottles with strategic ribbing, grooves, and indentations to enhance strength and rigidity without excess weight. This results in cost savings for manufacturers due to reduced resource consumption and transportation needs. Consumers benefit from the convenience of lighter bottles, which are easier to handle for on-the-go consumption of various products, including soft drinks, drinking water, hand sanitizers, and packaging bottles for household products and the medical sector.

- Government bodies and industries, such as electric vehicles and construction, also utilize blow molded plastic bottles for applications like concrete forms, panels, barricades, and traffic markers, further expanding the market's scope. The use of polymers like polyethylene (PE), polypropylene, polyethylene terephthalate (PET), and various resins contributes to the versatility of blow molded plastic bottles in various industry verticals. Recycling initiatives for plastic waste further support the market's growth, making it an essential component In the packaging industry.

What challenges does the Blow Molded Plastic Bottles Industry face during its growth?

Growing global demand for pouch packaging solutions is a key challenge affecting the industry growth.

- Blow molded plastic bottles have long been a staple in various industry verticals, including construction, transportation, and packaging applications. Concrete forms, panels, barricades, and traffic markers are common applications in construction, while electric vehicles and fuel tanks are prominent In the transportation sector. In the packaging industry, blow molded plastic bottles are widely used for packaging applications in sectors such as medical, household products, and beverages. Polyethylene (PE), Polypropylene, Polyethylene terephthalate (PET), and Polyethylene terephthalate (PET) are popular resins used in blow molding technology to produce bottles for various applications. With advancements in molding technology, including injection blow, extrusion blow mold, rotational blow molding, stretch blow molding, custom molds, compound blow molding, and injection blow molding, the production of blow molded plastic bottles has become more efficient and cost-effective.

- However, the increasing focus on sustainability and environmental concerns has led to a shift towards alternative packaging solutions, such as pouches. Pouches offer greater flexibility and convenience compared to traditional rigid containers like blow molded plastic bottles. They are lightweight, flexible, and collapsible, making them easier to store, transport, and dispose of. Moreover, pouches require less material compared to blow molded plastic bottles, generating fewer resources and waste during production and disposal. Government bodies and industry verticals are also promoting recycling and reducing plastic waste. This trend is expected to continue, further strengthening the need for sustainable packaging solutions.

- While blow molded plastic bottles continue to play a significant role in various industries, the increasing popularity of pouches and sustainability concerns may impact the demand for blow molded plastic bottles In the future.

Exclusive Customer Landscape

The blow molded plastic bottles market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the blow molded plastic bottles market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, blow molded plastic bottles market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ALPLA Werke Alwin Lehner GmbH and Co KG - Blow molded plastic bottles are a prominent category In the beverage and container market, encompassing various types such as water bottles, PET rectangular gallons, light weight water gallons, F style gallons, motor oil bottles with view strips, and square gallons. These bottles offer versatility, durability, and cost-effectiveness, making them a preferred choice for numerous applications. The production process involves blowing molten plastic into a mold, resulting in a uniform, seamless container. Blow molded plastic bottles cater to diverse industries, including food and beverage, automotive, and industrial sectors, among others. Their lightweight, shatter-resistant properties contribute to their widespread usage and popularity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALPLA Werke Alwin Lehner GmbH and Co KG

- Amcor plc

- Berry Global Inc.

- Blow Molded Products

- Comar LLC

- Gerresheimer AG

- Graham Packaging Co. LP

- Greiner Packaging International GmbH

- Hub Plastics

- Nampak Ltd.

- North American Plastics Ltd.

- O.Berk Co. LLC

- PAREKHPLAST India LTD.

- PCE Inc.

- Plastipak Holdings Inc.

- Precision Concepts International

- Silgan Holdings Inc.

- Streamline Plastics

- Universal Plastics Group Inc.

- Valencia Plastics Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Blow molded plastic bottles have gained significant traction in various industry verticals due to their versatility and cost-effectiveness. These bottles are manufactured using different techniques such as injection blow molding, rotational blow molding, and stretch blow molding, among others. The primary raw materials used In the production of blow molded plastic bottles include polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET). The demand for blow molded plastic bottles is driven by their extensive applications in various sectors. In the packaging industry, these bottles are widely used for packaging beverages such as soft drinks, drinking water, and hand sanitizers. They are also used for packaging household products and industrial chemicals.

In the medical sector, blow molded plastic bottles are used for producing face masks, protective gowns, and other medical equipment. The global market for blow molded plastic bottles is expected to grow at a steady pace due to several factors. One of the primary factors driving the growth of the market is the increasing demand for sustainable packaging solutions. Blow molded plastic bottles offer several advantages over traditional packaging materials such as glass and metal. They are lighter, more durable, and offer better protection to the contents. Moreover, they are recyclable, making them an eco-friendly alternative. Another factor contributing to the growth of the market is the increasing focus on reducing plastic waste.

Governments and regulatory bodies are imposing stringent regulations on the use of plastic, especially single-use plastic. Blow molded plastic bottles offer a solution to this problem as they can be reused and recycled, reducing the amount of plastic waste generated. The market is also driven by the increasing demand for electric vehicles (EVs). These vehicles require high-density polyethylene (HDPE) bottles for producing batteries. The demand for HDPE bottles is expected to increase significantly In the coming years as the adoption of EVs continues to grow. The market is highly competitive, with several players operating In the market. The market is characterized by a high degree of customization, with companies offering custom molds and designs to meet the specific requirements of their clients.

The market is also witnessing significant innovation, with companies investing in new technologies such as compound blow molding and injection blow molding to improve the production process and reduce costs. In conclusion, the market is expected to grow at a steady pace In the coming years due to their extensive applications in various industry verticals and their eco-friendly nature. The market is highly competitive, with several players offering customized solutions to meet the specific requirements of their clients. The market is also witnessing significant innovation, with companies investing in new technologies to improve the production process and reduce costs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.58% |

|

Market growth 2024-2028 |

USD 19.30 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.48 |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Blow Molded Plastic Bottles Market Research and Growth Report?

- CAGR of the Blow Molded Plastic Bottles industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the blow molded plastic bottles market growth of industry companies

We can help! Our analysts can customize this blow molded plastic bottles market research report to meet your requirements.