BMXBikes Market Size 2025-2029

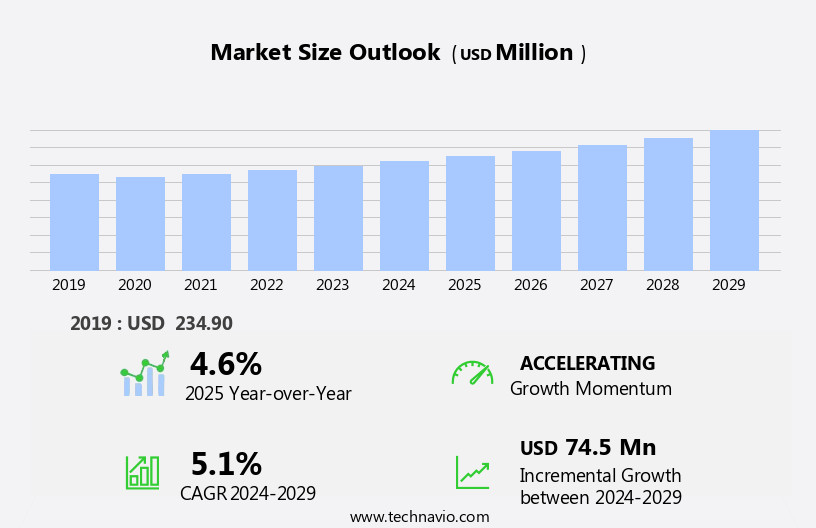

The BMXbikes market size is forecast to increase by USD 74.5 million, at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing number of BMXsports events that foster competition and promote the sport on a global scale. This trend is further bolstered by the rising prominence of online sales channels through e-commerce sites, which provide consumers with greater accessibility and convenience. Another key trend shaping the market is the growing popularity of e-bikes, which cater to a wider demographic and offer an alternative to traditional BMXbikes for those seeking a more accessible and versatile riding experience. However, the market also faces challenges, including the intensifying competition and the need for continuous innovation to meet evolving consumer preferences.

- Additionally, regulatory frameworks and safety concerns pose significant obstacles, requiring manufacturers to invest in research and development to ensure compliance and maintain consumer trust. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay abreast of these trends and be agile in their approach, leveraging technology and partnerships to differentiate themselves and meet the evolving needs of consumers.

What will be the Size of the BMXBikes Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The BMXbike market continues to evolve, with dynamic trends shaping its various sectors. BMXclubs foster a vibrant community of riders, encouraging the growth of vert BMXand freestyle disciplines. The application of safety gear, such as knee and elbow pads, is paramount in these high-risk activities. BMXparks and 24-inch wheels cater to the needs of freestyle riders, while rim brakes remain popular for their affordability and ease of maintenance. Bike parts distributors play a crucial role in supplying the market with an extensive range of components, enabling bike tuning and customization. The integration of disc brakes and suspension forks enhances the performance and safety of racing bikes and cruiser bikes alike.

The ongoing advancements in bike design, including the use of materials like carbon fiber, contribute to the continuous evolution of BMXbikes. Bike retailers and manufacturers collaborate to offer a diverse range of products, from racing bikes to street BMXand flatland bikes. Online bike sales and bike repair services expand the market's accessibility, while bike maintenance and tuning remain essential for optimizing performance. The interconnected nature of these entities underscores the BMXbike market's continuous dynamism, as riders and businesses adapt to emerging trends and evolving patterns.

How is this BMXBikes Industry segmented?

The BMXbikes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Sports

- Fitness

- Others

- Type

- 16 Inch BMXbikes

- 18 Inch BMXbikes

- 20 Inch BMXbikes

- Others

- Distribution Channel

- Online Retail

- Specialty Stores

- Direct Sales

- End-User

- Recreational

- Professional

- Material Type

- Steel

- Aluminum

- Carbon Fiber

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- The Netherlands

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

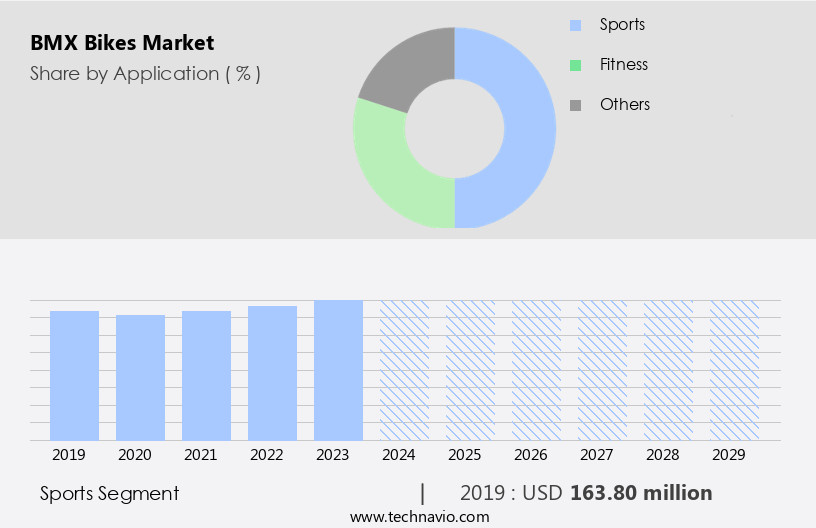

By Application Insights

The sports segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant activity, with the sports segment leading the charge due to the high demand for BMXbikes in various events such as BMXRacing, Vert BMXriding, and BMXFreestyle. Major sports events like the UCI Cycling World Championship contribute to the segment's dominance. In the US alone, USA BMXorganizes numerous events annually in North America, including the USA BMXState Qualifier, Gold Cup Qualifier, and Tanglewood BMXSummer Camp. BMXriders' preference for customization and modification drives the market for BMXparts, including hydraulic brakes, 20-inch wheels, and bike tuning services.

Online bike sales have also gained traction, providing convenience to consumers. Bike retailers and manufacturers cater to this demand, offering a range of BMXbikes, from racing bikes to cruiser bikes. Carbon fiber and other lightweight materials are increasingly used in bike design for improved performance and agility. Protective gear, such as knee pads and elbow pads, is essential for rider safety during freestyle and vert BMX. BMXclubs and parks foster a community of enthusiasts, promoting the sport and driving demand for BMXbikes and accessories. BMXcompetitions continue to evolve, with innovations in bike design, such as suspension forks and disc brakes, enhancing riders' experience.

Rim brakes and rigid forks remain popular choices for some riders due to their cost-effectiveness and simplicity. Mountain bikes and road bikes also cater to those who enjoy BMX-style riding on diverse terrains. Bike repair and maintenance services are essential for ensuring the longevity and optimal performance of BMXbikes. Bike parts distributors play a crucial role in supplying the necessary components for bike customization and repair. Overall, the market is characterized by a vibrant community of riders, a diverse range of products, and a strong focus on innovation and safety.

The Sports segment was valued at USD 163.80 million in 2019 and showed a gradual increase during the forecast period.

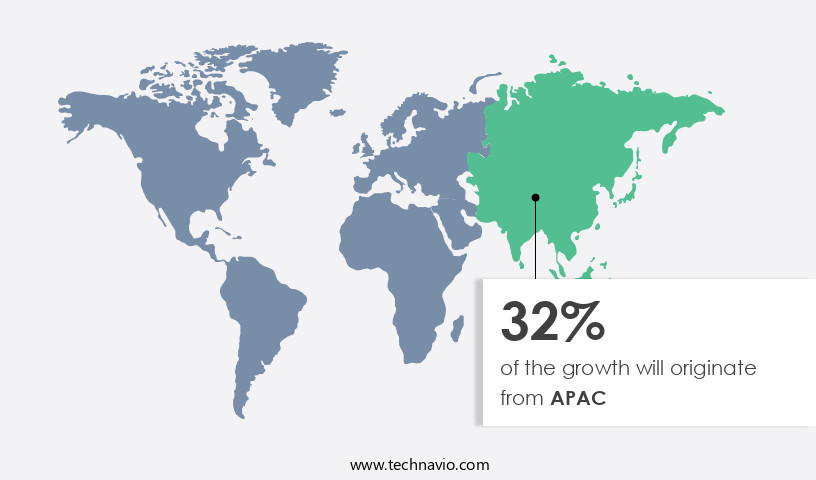

Regional Analysis

APAC is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the US and Canada are significant markets for BMXbikes due to the popularity of motocross cycling, which involves racing on off-road tracks using BMXbikes. The American Bicycle Association (ABA), also recognized as USA BMX, serves as the sole governing body for BMXsports events in the region, including the US and Canada, and some neighboring countries. This organization's presence fosters increased participation in BMXbike racing, thereby driving market expansion. BMXbike retailers cater to the demand for various BMXbikes, such as racing and cruiser models, as well as parts, including hydraulic brakes, 20-inch wheels, and suspension forks.

Online sales and bike modification are also popular trends, with riders customizing their bikes using protective gear, carbon fiber frames, and flatland BMXtechniques. Additionally, bike manufacturing companies produce BMXbikes with innovative designs, such as disc brakes and bottom brackets, to cater to the evolving needs of BMXriders. Bike repair and maintenance services are essential for maintaining the functionality and performance of BMXbikes, further fueling market growth. BMXclubs and parks provide opportunities for riders to practice and compete in various BMXfreestyle and vert disciplines, using safety gear and accessories like knee and elbow pads.

Overall, the North American market is thriving due to the sport's widespread appeal, the presence of a governing body, and the continuous innovation in bike design and technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a thriving industry that caters to the needs of enthusiasts seeking adrenaline-pumped, off-road cycling experiences. BMXbikes, with their robust frames and knobby tires, are designed for extreme maneuvers and stunts. Riders often customize their bikes with aftermarket parts, including handlebars, pedals, and brakes, to enhance performance and personalize their ride. BMXbikes are popular among both professionals and amateurs, with many participating in competitive events and freestyle sessions at skate parks. The market offers a wide range of BMXbikes, from entry-level models for beginners to high-performance bikes for experienced riders. Accessories, such as protective gear, helmets, and maintenance tools, are also essential components of the market. Overall, the market continues to grow, fueled by the passion and dedication of its diverse community of riders.

What are the key market drivers leading to the rise in the adoption of BMXBikes Industry?

- The surge in the number of BMXsports events serves as the primary catalyst for market growth.

- BMXbiking is a popular extreme sport that involves racing bicycles on a purpose-built track with jumps and banked turns. The BMXbiking market is driven by various factors, including the increasing popularity of BMXsports events and the growing demand for customized bikes. These sports events, which include amateur and professional races, are governed by international and national associations, such as the Union Cycliste Internationale (UCI) and the American Bicycle Association (ABA). Amateur races cater to both men and women, with competitions held at national, regional, and local levels. The BMXbiking market is witnessing significant growth due to the increasing participation in these sports events.

- For instance, the 2024 UCI BMXRacing World Championships attracted over 3,500 riders from more than 45 nations. Additionally, the trend towards bike customization and innovative bike designs, such as those made with carbon fiber, is fueling market growth. Safety is a major concern in BMXbiking, leading to the increasing demand for protective gear, including knee pads and helmets. The market is also witnessing advancements in bike components, such as bottom brackets, which offer improved durability and performance. Flatland BMX, a freestyle discipline, is gaining popularity due to its immersive and harmonious nature.

- Racing bikes and cruiser bikes cater to different riding styles and preferences, further expanding the market's scope. Overall, the BMXbiking market is expected to continue its growth trajectory, driven by the increasing popularity of BMXsports events, the demand for customized bikes, and the need for protective gear.

What are the market trends shaping the BMXBikes Industry?

- The increasing prevalence of online sales represents a significant market trend. This shift towards e-commerce is mandatory for businesses seeking to remain competitive in today's digital economy.

- BMXbikes have gained significant traction in the specialty bicycle market, with a growing number of enthusiasts joining BMXclubs and participating in vert BMXand BMXfreestyle events. As the demand for these bikes continues to rise, bike parts distributors play a crucial role in supplying essential components, including 24-inch wheels, rim brakes, and suspension forks. Despite the popularity of BMXbikes, safety remains a top priority for riders. Consequently, safety gear such as helmets, pads, and gloves are essential accessories. With the increasing focus on safety, there has been a shift towards advanced bike tuning techniques and the adoption of disc brakes for improved stopping power.

- Traditional brick-and-mortar stores have been the primary distribution channels for BMXbikes. However, the limitations of physical retail spaces have led retailers to explore online platforms as an alternative. Customers are now attracted to online buying platforms due to features such as extensive customer reviews, simple return policies, door-to-door delivery, and customer-informed fit guidelines using videos. These advantages have enabled retailers to offer a more immersive and harmonious shopping experience, catering to the evolving needs of BMXenthusiasts.

What challenges does the BMXBikes Industry face during its growth?

- The surging popularity of e-bikes poses a significant challenge to the industry's growth trajectory.

- The market is experiencing significant competition from e-bikes and other road bicycles. The global trend towards adopting bicycles, driven by government initiatives to reduce reliance on conventional cars, is contributing to this growth. E-bikes, a type of advanced BMXbike, offer a battery-assisted pedaling experience, enabling riders to navigate uphill terrain and rough terrains effortlessly. These bikes provide adjustable speed control, making them an attractive option for riders. Additionally, advancements in battery technology, including long-lasting batteries and fast charging options, are fueling the adoption of e-bikes.

- BMXaccessories, such as elbow pads and bike repair tools, continue to be essential for riders, complementing the use of BMXbikes for freestyle and competition purposes. Despite the competition, the market remains vibrant, with ongoing innovation in bike maintenance and design.

Exclusive Customer Landscape

The BMXbikes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the BMXbikes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, BMXbikes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alta Cycling Group - The company specializes in BMXbikes, distributing innovative models under brands like Haibike and Redline, enhancing online visibility through cutting-edge research and analysis.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alta Cycling Group

- CHASE Bicycles

- CULT

- Cycling Sports Group LLC

- deepAutum GmbH and Co. KG

- Dynacraft BSC Inc.

- Eastern Bikes

- Elite BMXCo.

- Fitbikeco.

- FLYBIKES S.L.

- Haro Bikes

- Hyper Bicycles Inc.

- Kink BMX

- Royalbaby Cycle Beijing Co. Ltd.

- Stolen Brand

- Stomp Distribution Ltd.

- Subrosa

- Tall Order BMX

- United Bike Co.

- WeThePeople Bike Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in BMXBikes Market

- In January 2024, GT Bicycles, a leading BMXbike manufacturer, announced the launch of its new line of carbon fiber BMXbikes, the Performer Carbon, at the annual BMXindustry trade show in Anaheim, California (GT Bicycles Press Release). This innovation marked a significant shift towards lighter and more durable BMXbikes, appealing to high-performance riders and enthusiasts.

- In March 2024, Haro Bikes, another major player in the BMXmarket, entered into a strategic partnership with a leading sports retailer, Dick's Sporting Goods, to expand its distribution network and reach a broader customer base (Dick's Sporting Goods Press Release). This collaboration allowed Haro Bikes to increase its market presence and cater to a more diverse demographic.

- In April 2025, SE Bikes, a prominent BMXbrand, secured a USD 5 million Series A funding round led by a venture capital firm, SJF Institute, to accelerate its product development and expand its global footprint (SE Bikes Press Release). The investment would enable SE Bikes to invest in advanced technologies and expand its production capacity, positioning the company for future growth.

- In May 2025, the European Union passed new regulations on the safety standards for BMXbikes, requiring mandatory certification for all BMXbikes sold within the EU market (European Parliament Press Release). The new regulations aimed to ensure the highest safety standards for BMXriders and increase consumer confidence in the market.

Research Analyst Overview

- The BMXbike market exhibits dynamic trends, with consumer preferences shifting towards bikes offering superior ride quality. Tire pressure and crank length are critical factors influencing ride quality, while repair costs and retail pricing remain key concerns for consumers. Parts availability, tire width, and wheel size are essential considerations for ensuring optimal bike performance. Bike geometry, including standover height, seat tube angle, bottom bracket height, chain stay length, and head tube angle, significantly impact the overall riding experience. Quality control and maintenance costs are crucial elements in the production process, affecting both the supply chain and distribution network.

- Manufacturers employ various marketing strategies to cater to their target market, focusing on materials science and innovation to create high-performance bikes. Brake leverage and gear ratios are essential features that influence bike functionality, with bike geometry and tire width playing a significant role in handling and stability. Maintaining production capacity and ensuring parts availability are essential for meeting consumer demand and maintaining a competitive edge in the market. The sales channels, including online and offline retailers, continue to evolve, requiring bike manufacturers to adapt their distribution strategies accordingly.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled BMXBikes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 74.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

US, China, Germany, Japan, UK, India, Canada, Brazil, UAE, Australia, Saudi Arabia, France, South Korea, Mexico, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this BMXBikes Market Research and Growth Report?

- CAGR of the BMXBikes industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the BMXbikes market growth of industry companies

We can help! Our analysts can customize this BMXbikes market research report to meet your requirements.