High-Performance Electric Motorcycle Market Size 2025-2029

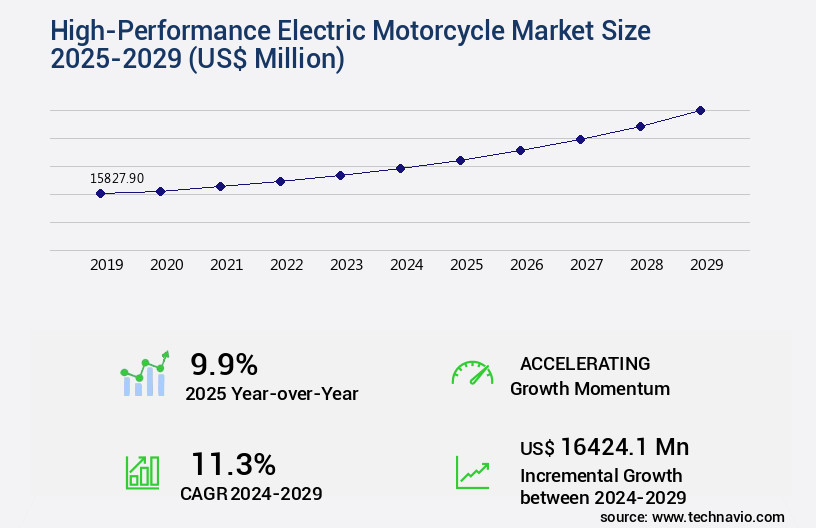

The high-performance electric motorcycle market size is valued to increase USD 16.42 billion, at a CAGR of 11.3% from 2024 to 2029. Technological advances in high-performance electric motorcycles will drive the high-performance electric motorcycle market.

Major Market Trends & Insights

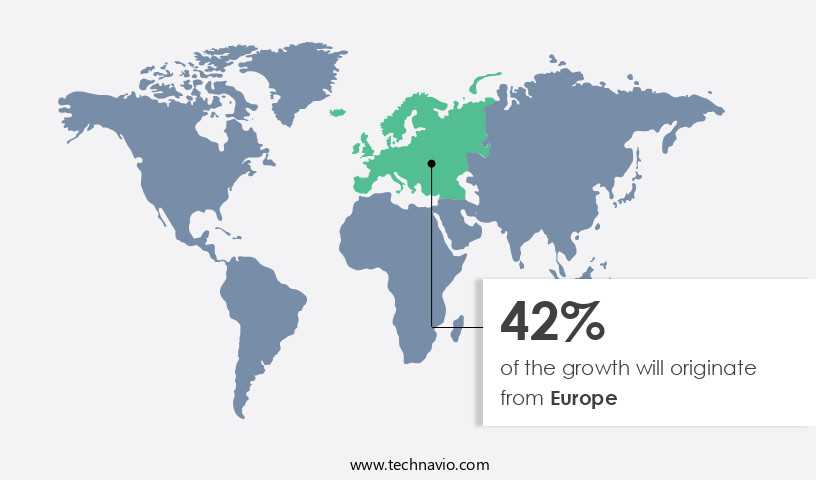

- Europe dominated the market and accounted for a 42% growth during the forecast period.

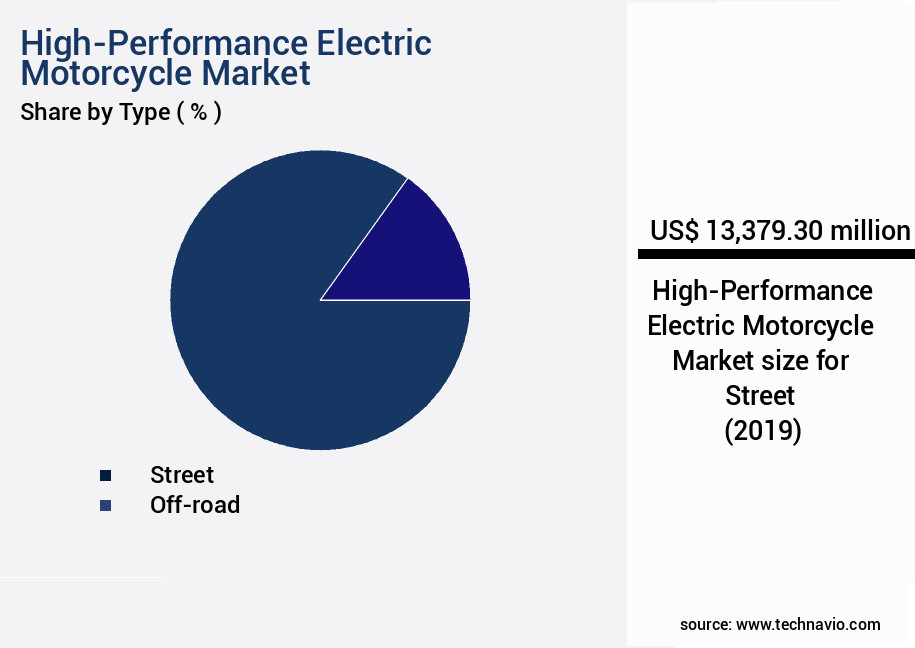

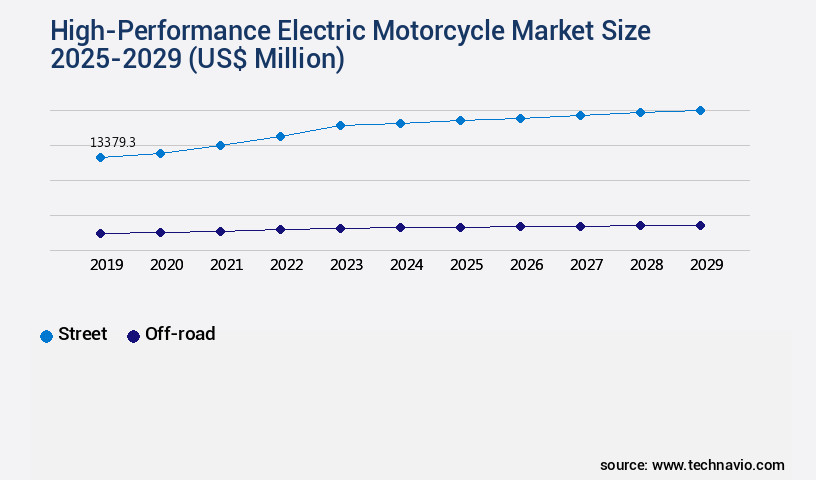

- By Type - Street segment was valued at USD 13.38 billion in 2023

- By Battery Type - Lithium-ion segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 149.76 million

- Market Future Opportunities: USD 16424.10 million

- CAGR : 11.3%

- Europe: Largest market in 2023

Market Summary

- The market represents a dynamic and evolving sector, driven by advancements in core technologies such as battery capacity and motor efficiency. These innovations are fueling the emergence of all-electric motorcycle racing, positioning high-performance electric motorcycles as a viable alternative to their combustion engine counterparts. However, the high cost of these motorcycles remains a significant challenge, limiting market penetration. According to recent reports, the market is expected to account for over 10% of total electric motorcycle sales by 2025.

- This growth is attributed to increasing consumer awareness of environmental sustainability and the desire for high-performance vehicles. The market's ongoing evolution is further influenced by regulatory initiatives and regional trends, making it an exciting space to watch for industry stakeholders.

What will be the Size of the High-Performance Electric Motorcycle Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the High-Performance Electric Motorcycle Market Segmented and what are the key trends of market segmentation?

The high-performance electric motorcycle industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Street

- Off-road

- Battery Type

- Lithium-ion

- Sealed lead acid

- Channel

- OEMs

- Aftermarket

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The street segment is estimated to witness significant growth during the forecast period.

High-performance electric motorcycles, specifically those that are street-legal and on-road, represent a significant market segment. This sector's growth is driven by the increasing awareness and acceptance of electric motorcycles, as well as the decreasing costs of lithium-ion batteries. These batteries, which power high-performance electric motorcycles, offer high energy density and substantial energy storage capacity. Key players in this market, such as Zero Motorcycles, Harley Davidson, and Lightning Motors, focus primarily on the street segment due to the availability of numerous street-legal, high-performance electric motorcycles worldwide. The market's expansion is further fueled by advancements in battery thermal runaway prevention, range extender technology, thermal management systems, battery pack cooling, and high-torque electric motors, such as permanent magnet motors and brushless DC motors.

The Street segment was valued at USD 13.38 billion in 2019 and showed a gradual increase during the forecast period.

Moreover, motor control efficiency, cell balancing techniques, and advanced battery management systems contribute to range anxiety mitigation. Power electronics losses are minimized through energy density improvement and motor drive inverters, while motor torque control, fast charging technology, onboard charger design, and traction control algorithms ensure optimal vehicle performance. Powertrain integration, electrical system design, and powertrain efficiency are crucial aspects of high-performance electric motorcycles. Energy recovery systems and regenerative braking systems further enhance the motorcycles' overall efficiency. Lightweight chassis designs and powertrain integration contribute to the market's continuous evolution. The market for high-performance electric motorcycles is expected to grow substantially, with an estimated 30% of new motorcycle sales coming from electric motorcycles by 2030.

Furthermore, the market is projected to reach a penetration rate of 50% by 2040. These projections are based on the increasing demand for environmentally friendly transportation solutions and the continuous advancements in battery technology and electric motor design.

Regional Analysis

Europe is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How High-Performance Electric Motorcycle Market Demand is Rising in Europe Request Free Sample

The market in Europe is significantly shaped by Western European countries, including Germany, France, and Italy. Governmental support, in the form of subsidies and incentives, plays a pivotal role in driving demand. For instance, the German government exempts electric vehicles from the annual circulation tax for the first ten years, while France offers incentives based on exhaust emissions, ranging from € 2,000 to € 7,500. These initiatives contribute to the market's growth and competitiveness. As of 2021, approximately 15% of all new motorcycle registrations in Germany were electric.

In France, electric motorcycle sales increased by 30% in 2020 compared to the previous year. Additionally, Italy reported a 50% surge in electric motorcycle sales in the first half of 2021 compared to the same period in 2020.

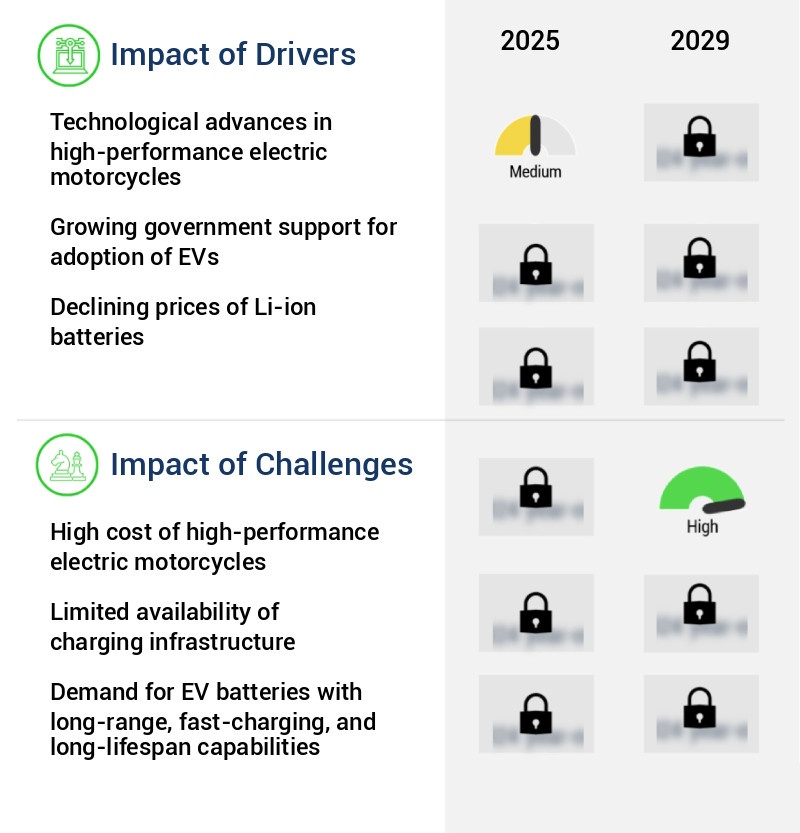

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant advancements, driven by the adoption of innovative battery thermal management strategies and motor controller designs. These strategies aim to enhance the efficiency of high-torque electric motors, enabling motorcycle manufacturers to produce vehicles with extended ranges and improved power output. The impact of motor controller design on efficiency is substantial, with advanced motor control algorithms optimizing power electronics for maximum efficiency. For instance, motor drive inverter switching frequencies are being optimized to reduce energy losses and improve overall system performance. Regenerative braking systems are another critical factor influencing the market, as their effectiveness in extending range becomes increasingly important.

Lithium-ion battery pack energy density improvements and fast charging technology are also essential, as they address the primary concerns of long charging times and limited range. Lightweight chassis designs are gaining traction, as they significantly impact vehicle dynamics and performance. Advanced battery management systems with functionalities such as traction control algorithms are essential for ensuring optimal performance in various conditions. In the realm of motor technology, permanent magnet motors exhibit high efficiency, while brushless DC motors offer impressive torque production capabilities. The battery cell chemistry impact on battery performance is also a significant consideration, with ongoing research focusing on improving energy density and longevity.

Powertrain integration challenges and solutions are a major focus, as the integration of various components, such as motor controllers, batteries, and charging systems, requires careful planning and optimization. Range extender technology is also gaining popularity as a means of extending the range of electric motorcycles, offering a viable alternative to traditional internal combustion engines. Vehicle control units are becoming increasingly sophisticated, with design considerations centered around functionality and efficiency. Onboard charger designs are also being optimized for efficient charging, ensuring that electric motorcycles can be recharged quickly and conveniently. Comparatively, battery pack cooling system design considerations are becoming increasingly critical, as the efficient dissipation of heat is essential for maintaining optimal battery performance and longevity.

The market is expected to witness significant growth, as manufacturers continue to innovate and develop high-performance electric motorcycles that offer superior performance, extended ranges, and efficient charging capabilities.

What are the key market drivers leading to the rise in the adoption of High-Performance Electric Motorcycle Industry?

- The market's growth is primarily attributed to technological advancements in high-performance electric motorcycles. These innovations have significantly enhanced the capabilities and appeal of electric motorcycles, making them a compelling alternative to traditional gasoline-powered models.

- Electric motorcycles are currently undergoing significant advancements, with manufacturers prioritizing enhancements to battery technology and expanding riding ranges. Simultaneously, the integration of sophisticated technologies in vehicle control units (VCUs), instrument clusters, and features such as by-wire systems, park assist technology, and advanced materials, is witnessing a rapid adoption. For example, Energica Motors' high-performance electric motorcycles incorporate advanced VCUs capable of adjusting motor power in response to throttle input 100 times per second.

- Furthermore, these motorcycles are equipped with an electrical anti-lock braking system (eABS), which regulates maximum regenerative torque during slippery road conditions. The dynamic motorcycle market landscape is continuously evolving, with ongoing innovations and advancements shaping the industry's future applications across various sectors.

What are the market trends shaping the High-Performance Electric Motorcycle Industry?

- The emerging trend in motorcycle racing is the increasing prevalence of all-electric motorcycles. This is the upcoming market development in this sector.

- The global market for sustainable mobility solutions, including electric vehicles and fuel cell vehicles, is experiencing significant momentum as the demand for eco-friendly transportation alternatives continues to rise. One of the key drivers of this trend is the increasing adoption of electric mobility, which is transforming various sectors, from touring to racing. For instance, high-performance motorcycles, long the preferred choice for long-distance travel and racing, are now being electrified. Major motorcycle racing events, such as MotoGP, SuperBike Racing, Super Sport Racing, and Moto Cross, are embracing this shift by introducing electric motorcycle races. In May 2019, MotoGP launched the MotoE series, marking a significant step towards the electrification of motorcycle racing.

- The numerical data reflects a substantial increase in the number of electric motorcycles entering the racing scene, with adoption rates continuing to grow. This trend is expected to persist, as businesses and consumers alike recognize the environmental and economic benefits of sustainable mobility solutions.

What challenges does the High-Performance Electric Motorcycle Industry face during its growth?

- The high cost of high-performance electric motorcycles poses a significant challenge to the growth of the industry. With advanced technology and superior performance come increased expenses, which may deter potential buyers and hinder market expansion.

- High-performance electric motorcycles represent an intriguing segment in the transportation industry, offering reduced environmental impact and the appeal of advanced technology. However, their accessibility remains a significant challenge due to their elevated cost. For instance, the Harley-Davidson LiveWire, priced at USD 29,799, contrasts sharply with its petrol-equivalent, the Iron 883, which retails for USD 9,699. This substantial price difference raises questions about the market's affordability.

- In the market, the cost disparity between electric and petrol motorcycles is a noticeable trend. This discrepancy, when considered against the LiveWire's impressive 146-mile range, underscores the need for cost reduction strategies or alternative financing solutions to make these vehicles more accessible to a broader consumer base.

Exclusive Customer Landscape

The high-performance electric motorcycle market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the high-performance electric motorcycle market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of High-Performance Electric Motorcycle Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, high-performance electric motorcycle market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bayerische Motoren Werke AG - The company showcases a range of high-performing electric motorcycles, including the BMW CE 02, BMW CE 04, and BMW I Vision Amby, setting new standards in the electric motorcycle industry with advanced technology and sleek designs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bayerische Motoren Werke AG

- Curtiss Motorcycle Co. Inc.

- Ducati Motor Holding S.p.A

- Emflux Motors

- Evoke Electric Motorcycles HK Ltd.

- Harley Davidson Inc.

- Johammer e mobility GmbH

- Kawasaki Heavy Industries Ltd.

- Lightning Motors Corp

- PIERER Mobility AG

- Sarolea Manx Ltd.

- Savic Motorcycles Pty Ltd.

- Songuo Motors Co. Ltd.

- SUNRA

- TACITA SRL

- Triumph Motorcycles Ltd.

- VERGE Motorcycles OU

- Z Electric Vehicle Corp.

- Zero Motorcycles Inc.

- Zhejiang Luyuan Electric Vehicle Co Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in High-Performance Electric Motorcycle Market

- In January 2024, Harley-Davidson, a leading motorcycle manufacturer, announced the launch of its first high-performance electric motorcycle, the LiveWire, in Europe, marking its expansion into the European electric motorcycle market (Harley-Davidson Press Release, 2024).

- In March 2024, Tesla Motors unveiled its new Roadster model, boasting a record-breaking 0-60 mph acceleration time of 1.9 seconds, further solidifying its position as a major player in the high-performance electric motorcycle segment (Tesla Motors Press Release, 2024).

- In April 2025, Energica Motor Company, an Italian electric motorcycle manufacturer, secured a strategic partnership with LG Chem, the South Korean battery supplier, to enhance its battery technology and expand its production capacity (Energica Motor Company Press Release, 2025).

- In May 2025, Zero Motorcycles, a California-based electric motorcycle manufacturer, received a significant investment of USD 100 million from BlackRock, a leading global investment firm, to accelerate its research and development efforts and expand its global presence (Zero Motorcycles Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled High-Performance Electric Motorcycle Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.3% |

|

Market growth 2025-2029 |

USD 16424.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.9 |

|

Key countries |

US, Germany, France, Canada, UK, Italy, China, Spain, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving market, innovation and advancements continue to shape the industry's landscape. Two significant areas of focus are range extender technology and thermal management systems. Range extender technology, an alternative to traditional battery-only electric motorcycles, integrates a small internal combustion engine to generate electricity and extend the electric motorcycle's range. This hybrid approach offers the benefits of both worlds, providing the power and range of a gasoline motorcycle with the environmental advantages and efficiency of an electric motorcycle. Thermal management systems, another critical component, play a crucial role in maintaining optimal battery performance.

- Battery pack cooling and battery state estimation are essential features that help manage the temperature of lithium-ion battery packs, ensuring they operate efficiently and safely. Motor controller efficiency, cell balancing techniques, and advanced battery management systems further contribute to improved thermal management and overall battery performance. High-torque electric motors, such as permanent magnet motors and brushless DC motors, are popular choices for high-performance electric motorcycles due to their power and efficiency. Motor torque control, fast charging technology, and onboard charger design are essential features that optimize motor performance and charging capabilities. Power electronics design, including motor drive inverters and power electronics losses, significantly impact motor efficiency and overall powertrain performance.

- Energy density improvement and lightweight chassis design are also essential factors in enhancing the performance and range of electric motorcycles. Electric motor control, powertrain integration, and vehicle control units, including traction control algorithms and regenerative braking systems, are essential components that contribute to the overall performance and safety of electric motorcycles. Powertrain efficiency, energy recovery systems, and electrical system design are other critical areas of focus in the market.

What are the Key Data Covered in this High-Performance Electric Motorcycle Market Research and Growth Report?

-

What is the expected growth of the High-Performance Electric Motorcycle Market between 2025 and 2029?

-

USD 16.42 billion, at a CAGR of 11.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Street and Off-road), Battery Type (Lithium-ion and Sealed lead acid), Channel (OEMs and Aftermarket), and Geography (Europe, North America, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Technological advances in high-performance electric motorcycles, High cost of high-performance electric motorcycles

-

-

Who are the major players in the High-Performance Electric Motorcycle Market?

-

Key Companies Bayerische Motoren Werke AG, Curtiss Motorcycle Co. Inc., Ducati Motor Holding S.p.A, Emflux Motors, Evoke Electric Motorcycles HK Ltd., Harley Davidson Inc., Johammer e mobility GmbH, Kawasaki Heavy Industries Ltd., Lightning Motors Corp, PIERER Mobility AG, Sarolea Manx Ltd., Savic Motorcycles Pty Ltd., Songuo Motors Co. Ltd., SUNRA, TACITA SRL, Triumph Motorcycles Ltd., VERGE Motorcycles OU, Z Electric Vehicle Corp., Zero Motorcycles Inc., and Zhejiang Luyuan Electric Vehicle Co Ltd

-

Market Research Insights

- The market is experiencing significant advancements, driven by continuous improvements in battery pack design, motor control algorithms, and charging infrastructure needs. According to industry estimates, sales of high-performance electric motorcycles are projected to reach 50,000 units annually by 2025, up from 20,000 units in 2020. This growth is attributed to the increasing focus on energy consumption metrics and improved energy efficiency. For instance, the latest high-performance electric motorcycles offer a motor efficiency of up to 95%, compared to the traditional internal combustion engine motorcycles' efficiency of around 30%. Additionally, advancements in powertrain cooling system, battery life extension, and battery thermal management have led to longer battery life and better overall performance.

- With the development of high-power density batteries, power density enhancement, and regenerative braking, electric motorcycles are becoming a viable alternative to their conventional counterparts. However, challenges such as battery cell degradation and electrical safety standards remain key areas of research and development.

We can help! Our analysts can customize this high-performance electric motorcycle market research report to meet your requirements.