Bone-Anchored Hearing Aids Market Size 2024-2028

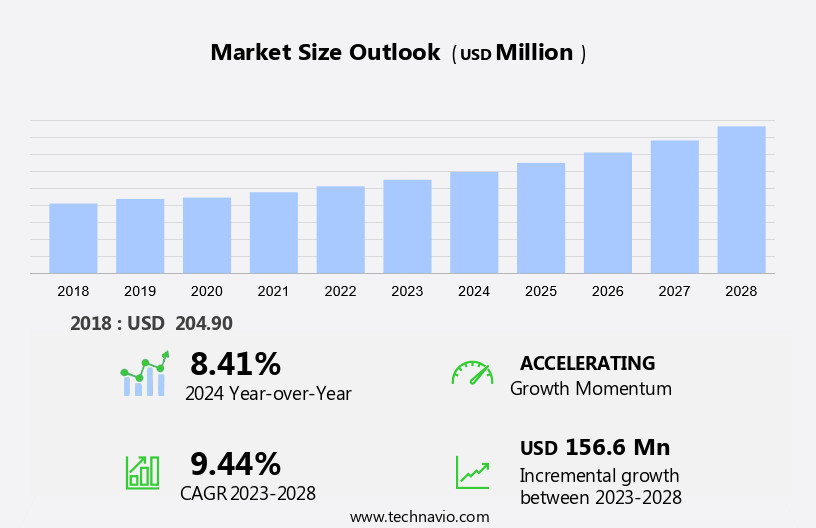

The bone-anchored hearing aids market size is forecast to increase by USD 156.6 million at a CAGR of 9.44% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing prevalence of hearing loss, particularly In the aging population. This trend is driven by the rising awareness of hearing health and the availability of advanced technologies. Technological advancements in bone-anchored hearing aids, such as improved implant designs and wireless connectivity, are enhancing user experience and convenience. Pediatric applications are also gaining traction due to customized hearing devices and aesthetic considerations. However, the high cost associated with these devices remains a major challenge for the market, limiting their accessibility to a larger population. Despite this, the market is expected to continue growing due to the unmet demand for effective hearing solutions and ongoing technological innovations.

What will be the Size of the Bone-Anchored Hearing Aids Market During the Forecast Period?

- The market encompasses surgical implantable devices that utilize a titanium screw anchored into the mastoid bone, connecting an abutment to the inner ear via the bone conduction mechanism. These hearing solutions cater to the hearing-impaired population, offering an alternative to standard hearing aids for those with conductive hearing loss or single-sided deafness. The market is driven by the increasing prevalence of chronic ear conditions such as acoustic neuroma, cholesteatoma, and chronic ear infections. However, concerns over skin irritation, aural discharge, and procedure numbers limit the market saturation.

- Moreover, leading competitors in this space continually innovate to address these challenges, offering advanced technology and improved surgical techniques. The market represents a significant treatment option for individuals with unique hearing needs, providing improved sound quality and enhanced speech recognition.

How is this Bone-Anchored Hearing Aids Industry segmented and which is the largest segment?

The bone-anchored hearing aids industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Sensorineural hearing loss

- Conductive hearing loss

- Others

- End-user

- Adults

- Pediatrics

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- Japan

- Rest of World (ROW)

- North America

By Type Insights

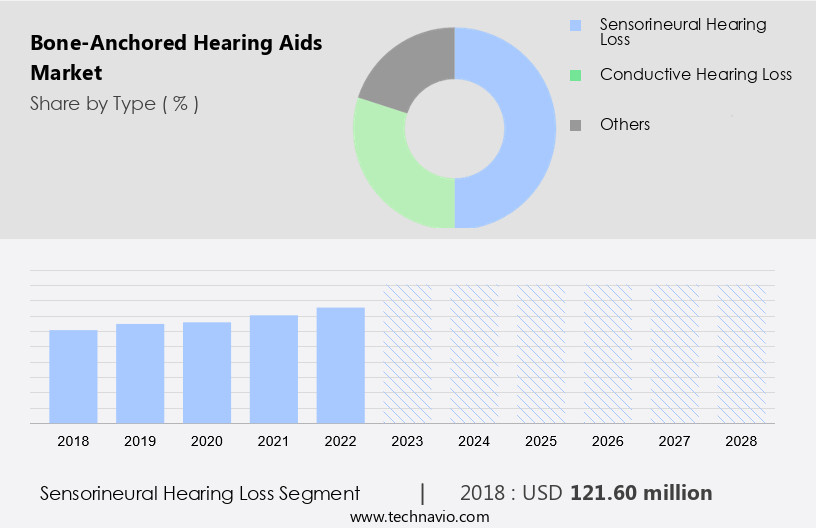

- The sensorineural hearing loss segment is estimated to witness significant growth during the forecast period.

Bone-anchored hearing aids (BAHA) offer a viable treatment solution for individuals with sensorineural hearing loss, a condition characterized by damage or dysfunction In the inner ear or auditory nerve pathways. BAHA bypass damaged parts of the ear by transmitting sound directly to the inner ear through bone conduction. This mechanism is facilitated by surgically implanting a titanium screw into the mastoid bone behind the ear, to which an abutment and a hearing aid are attached. BAHA effectively sends sound signals directly to the cochlea, bypassing the damaged inner ear structures. BAHA is suitable for various hearing loss types, including conductive, mixed, single-sided deafness, and sensorineural hearing loss.

Get a glance at the report of share of various segments Request Free Sample

The sensorineural hearing loss segment was valued at USD 121.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is projected to expand due to several factors. These include the rising prevalence of hearing loss caused by ear infections, genetic disorders such as Trisomy 21, and an increasing geriatric population. Additionally, product launches and reimbursement strategies are driving market growth. Age-related hearing loss, also known as presbycusis, can progress into a conductive hearing disorder, for which aids are an effective solution. Surgical implantable devices, such as titanium screws and abutments, are integral components of bone-anchored hearing aids. The inner ear, mastoid bone, subcutaneous tissues, and skin impedance are critical aspects of the bone conduction mechanism.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption?

Increasing prevalence of hearing loss is the key driver of the market.

- The market encompasses surgical implantable devices designed to bypass conductive hearing loss by transmitting sound vibrations through the skull bone. These devices consist of a titanium screw implanted into the mastoid bone, an abutment connecting the screw to an external component, and a hearing aid attached to the external component. BAHA is an effective treatment option for various types of hearing loss, including sensorineural, conductive, mixed, single-sided deafness, and cochlear implant candidates with intact inner ear function. The pediatric population, including neonates, also benefits from BAHA, with soft band BAHA being a popular choice for young children.

- However, challenges such as skin impedance, subcutaneous tissues irritation, aural discharge, and chronic infections may pose safety concerns. Reimbursement coverage and investment pockets vary, making project management crucial for market success. Robotic platforms and advanced raw materials, such as titanium alloy and ceramics composites, contribute to the evolution of BAHA technology. BAHA is a viable alternative for adults with chronic ear infections, acoustic neuroma, and cholesteatoma, offering improved safety and efficacy compared to standard hearing aids. Despite the benefits, potential side effects, including osseointegration complications and chronic infection, necessitate careful consideration.

What are the market trends shaping the Bone-Anchored Hearing Aids Industry?

Technological advancements in bone-anchored hearing aids is the upcoming market trend.

- It is a type of surgical implantable device, utilize a titanium screw implanted into the mastoid bone to transmit sound vibrations directly to the inner ear. BAHA systems consist of an abutment, which connects the titanium screw to an external hearing aid, and the inner ear receives sound through the bone conduction mechanism. BAHA is an effective treatment option for individuals with conductive hearing loss, sensorineural hearing loss, mixed hearing loss, single sided deafness, and chronic ear infections such as acoustic neuroma and cholesteatoma. Despite their benefits, BAHA implantation surgery carries risks, including skin irritation, aural discharge, and chronic infection.

- Furthermore, to mitigate these risks, companies are developing advanced bone-anchored aids with improved safety and efficacy, such as soft band BAHA for pediatrics and neonates, and robotic platforms for precise implantation. The market for bone-anchored aids is driven by the hearing-impaired population's growing need for alternative treatment options to standard hearing aids. Raw materials like titanium alloy and ceramics composites are crucial for the production of bone-anchored hearing aids. The market's investment pockets are expanding due to the increasing demand for bone-anchored hearing aids, with companies focusing on project management and quality control to ensure the safety and efficacy of their products.

What challenges does the Bone-Anchored Hearing Aids Industry face during its growth?

High cost associated with bone-anchored hearing aids is a key challenge affecting the industry growth.

- It is a type of surgical implantable device, utilize a titanium screw implanted into the mastoid bone, connecting an abutment and an inner ear transducer. BAHA is an alternative treatment option for the hearing-impaired population, particularly those with conductive hearing loss, sensorineural hearing loss, mixed hearing loss, single sided deafness, chronic ear infections, acoustic neuroma, or cholesteatoma. This high cost can pose a significant financial burden on patients. After surgery, patients may experience side effects such as skin irritation, aural discharge, and osseointegration complications.

- In addition, the pediatric population, including neonates, may require soft band BAHA systems. Reimbursement coverage varies, and project management, including raw material costs for titanium alloy and ceramics composites, adds to the overall investment pockets. BAHA technology uses the bone conduction mechanism and is an alternative to standard hearing aids and cochlear implants. Dental devices and aesthetic aids are also available. Safety and efficacy are crucial considerations, with ongoing research focusing on improving the technology and reducing side effects.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bone-anchored hearing aids market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baby Hearing.org

- Best Hearing solutions

- BHM Tech Produktionsgesellschaft mbH

- Cochlear Ltd.

- Demant AS

- Ear associates

- GN Store Nord AS

- Healthy Hearing

- Hearing Tracker, Inc.

- MED EL Elektromedizinische Gerate GmbH

- Medtronic Plc

- Micropoint Bioscience Inc.

- Natus Medical Inc.

- Oticon Medical AS

- Phonak ltd.

- Sonova AG

- Starkey Laboratories Inc.

- The Johns Hopkins Health System Corp.

- WS Audiology AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Bone-anchored hearing aids (BAHA) represent a surgical implantable device designed to provide hearing restoration for individuals with conductive hearing loss, single-sided deafness, and mixed hearing loss. The BAHA system utilizes a titanium screw implanted into the mastoid bone, an abutment connected to the screw, and an external hearing aid component. The inner ear, responsible for hearing, transmits sound waves through the cochlea. In cases of conductive hearing loss, the outer or middle ear fails to transmit sound effectively to the inner ear. BAHA bypasses this issue by directly stimulating the inner ear through the bone conduction mechanism. The BAHA system's components undergo a series of processes before being implanted.

Furthermore, the titanium screw, a raw material commonly used in surgical implantable devices, is implanted into the mastoid bone. Subsequently, an abutment is connected to the screw, and the external hearing aid component is attached to the abutment. The osseointegration process plays a crucial role In the BAHA system's success. This process involves the integration of the titanium screw into the skull, allowing for a strong and stable connection between the implant and the skull. This connection enables the transmission of sound vibrations from the external hearing aid to the inner ear. The BAHA system's safety and efficacy have been extensively researched and documented.

However, like any surgical procedure, there are potential side effects. These may include skin irritation, aural discharge, and chronic infection. Proper post-surgical care is essential to minimize these risks. The pediatric population, including neonates, can also benefit from BAHA treatment. However, the surgical implantation process may require specialized project management and consideration of reimbursement coverage. BAHA systems are an alternative treatment option for the hearing-impaired population, particularly for those with conductive hearing loss, single-sided deafness, and mixed hearing loss. BAHA systems offer several advantages over standard hearing aids, including improved speech recognition in noisy environments and enhanced sound quality.

In addition, the market for bone-anchored hearing aids is continually evolving, with advancements in technology leading to the development of aesthetic hearing aids and the integration of robotic platforms. These advancements aim to improve the BAHA system's functionality and user experience while minimizing the potential for side effects. The raw materials used In the production of BAHA components, such as titanium alloy and ceramics composites, continue to be refined to enhance the system's durability and biocompatibility. BAHA systems offer a viable treatment option for individuals with conductive hearing loss, single-sided deafness, and mixed hearing loss. The ongoing research and development in this field aim to improve the system's safety, efficacy, and user experience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.44% |

|

Market growth 2024-2028 |

USD 156.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.41 |

|

Key countries |

US, Germany, Japan, Canada, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bone-Anchored Hearing Aids Market Research and Growth Report?

- CAGR of the Bone-Anchored Hearing Aids industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bone-anchored hearing aids market growth of industry companies

We can help! Our analysts can customize this bone-anchored hearing aids market research report to meet your requirements.