Boom Truck Market Size 2024-2028

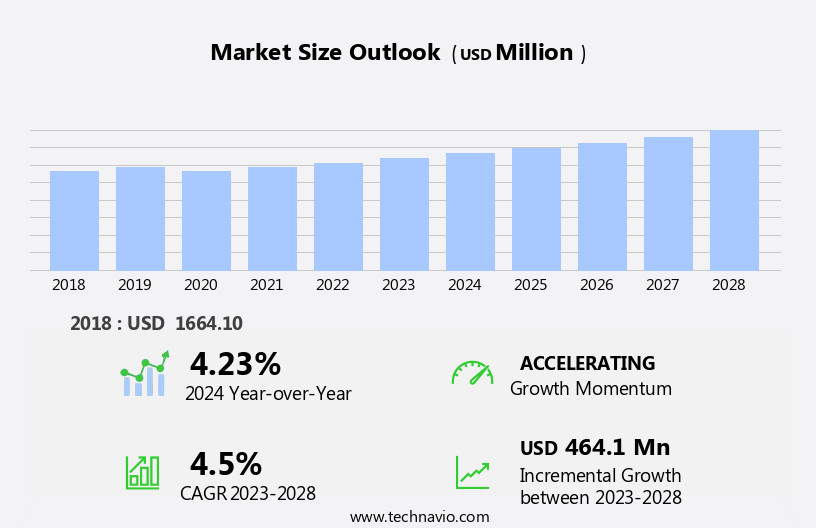

The boom truck market size is forecast to increase by USD 464.1 million at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the expansion of end-user industries, particularly in urban areas. Urbanization has led to an increased demand for construction and infrastructure projects, thereby fueling the need for versatile and efficient lifting solutions. A notable trend in the market is the development of autonomous boom trucks, which promises to enhance productivity and safety. However, regulatory hurdles and the lack of standardized certification processes for autonomous vehicles may hinder adoption. Furthermore, the increasing availability of second-hand boom trucks and counterfeit boom trucks in the market poses a challenge for original equipment manufacturers (OEMs) seeking to maintain market share and ensure product quality.

- To capitalize on the growth opportunities and navigate these challenges effectively, companies must focus on innovation, regulatory compliance, and strengthening their supply chain to deliver high-quality, authentic products.

What will be the Size of the Boom Truck Market during the forecast period?

- The market exhibits dynamic trends, with performance optimization playing a pivotal role. Advanced counterweight systems and drive train technologies enhance lifting capabilities and travel speed, respectively. Future trends include safety protocols, such as fault detection sensors and safety sensors, which improve work site planning and project management. Chassis design, hydraulic cylinders, and suspension system upgrades extend service life and ensure optimal performance. Boom stabilization and work platform size adjustments cater to various worksite requirements.

- Lowering speed and platform access are essential considerations for efficient and safe operations. Industry best practices emphasize regular maintenance intervals, data-driven insights, and load moment indicator monitoring. Ground clearance, operating costs, electrical system, tire size, and boom control system upgrades further optimize boom truck usage.

How is this Boom Truck Industry segmented?

The boom truck industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Construction

- Telecom

- Transportation and logistics

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

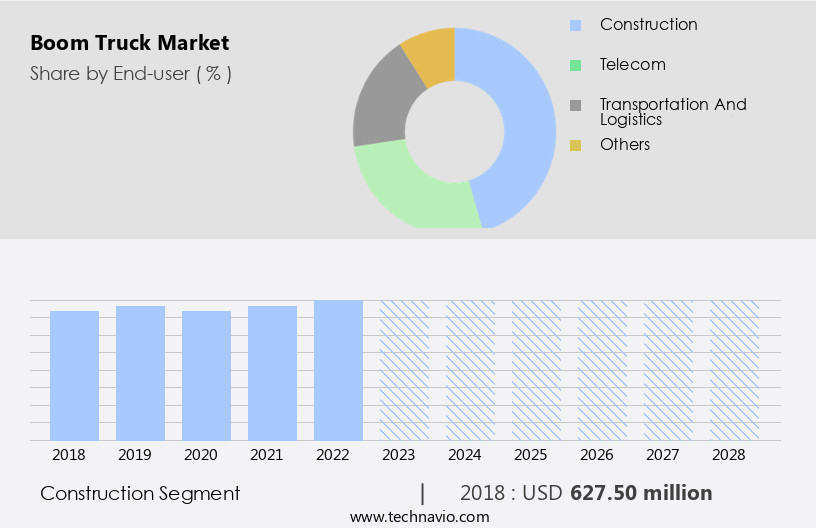

The construction segment is estimated to witness significant growth during the forecast period.

The market in the construction industry is experiencing notable growth due to the increasing adoption of these vehicles by contractors and the surge in infrastructure investments worldwide. Industrialization and urbanization trends fuel the demand for construction activities and infrastructure development, leading to a significant increase in the demand for boom trucks. Infrastructure projects in regions such as India, China, and the Middle East have driven a large portion of the demand for boom trucks in infrastructural applications. Innovation trends in the market include advanced materials, data analytics, and lightweight construction, which enhance operator comfort, operational efficiency, and heavy lifting capabilities.

Safety regulations are a critical consideration, with safety features such as stability control, outrigger systems, and operator controls ensuring worksite safety. Boom trucks are also used in power line maintenance, tree trimming, and wind energy applications, requiring off-road capabilities and reach heights. Compliance with safety standards and environmental regulations is essential, with hydraulic systems and hybrid technology contributing to fuel efficiency and sustainability initiatives. The market also offers a range of telescopic and articulating booms, as well as aerial work platforms and utility work applications. Remote control, operator training, and load capacity are essential considerations for operators, with telematics systems and parts and accessories available for service and repair.

Construction projects require various maintenance requirements, and the market offers a range of boom trucks to meet these needs. Boom length, lifting capacity, and return on investment are crucial factors in the decision-making process. The market is also witnessing the emergence of autonomous operation and compact design trends, offering productivity gains and user experience enhancements. Emission standards and sustainability initiatives continue to shape the market's evolution.

The Construction segment was valued at USD 627.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

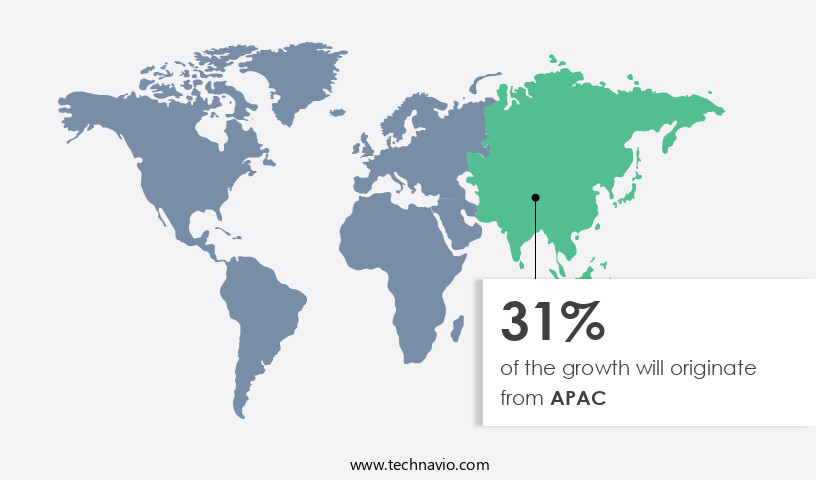

APAC is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing notable growth, driven by the construction and industrial sectors. The construction industry holds a substantial market share, with specifications such as lifting capacity, reach, payload, and hauling capacity being key considerations. Innovations in products and technology have fueled demand from the utilities sector, particularly for applications like power line maintenance and wind energy development in countries like China, India, Korea, Indonesia, Thailand, and Japan. Boom trucks are increasingly utilized for setting up wind turbines in these nations. Safety regulations, operator comfort, operational efficiency, and heavy lifting capabilities are essential features in the evolving market.

Advanced materials, data analytics, and lightweight construction are trending innovations, while safety features, outrigger systems, and fuel efficiency are prioritized for worksite safety. Sustainability initiatives and environmental regulations also influence market dynamics. The hydraulic system, hybrid technology, parts and accessories, telematics systems, and operator training are crucial components of the market. The market's growth is further boosted by infrastructure development, remote monitoring, and autonomous operation capabilities. The compact design and telescopic boom are essential for maneuvering in tight spaces and handling various construction projects. Maintenance requirements, stability control, lifting capacity, return on investment, and emission standards are critical factors influencing market trends.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Boom Truck market drivers leading to the rise in the adoption of Industry?

- Urbanization's impact on end-user industries is the primary market growth driver. This trend is influenced by the continuous expansion of cities and the subsequent increase in demand for goods and services within these urban areas.

- Boom trucks, recognized for their compact design and versatile functionality, are increasingly sought after in various industries, including manufacturing, transportation and logistics, and utilities. The global trend of urbanization, particularly in developing countries, is driving the demand for boom trucks due to the expansion of end-user industries. By 2030, it is projected that megacities, defined as urban areas with over 10 million inhabitants, will significantly increase, especially in countries like China, India, and South Africa. In 2020, approximately 56% of the global population resided in urban areas (The World Bank Group). Boom trucks cater to the needs of these industries with their extended reach, enabling efficient industrial maintenance and worksite safety.

- Safety features, such as outrigger systems, operator controls, and a well-defined working envelope, ensure optimal performance and safety. Fuel efficiency and sustainability initiatives, including the integration of hydraulic systems and hybrid technology, further enhance the appeal of boom trucks. Environmental regulations continue to shape the market, driving manufacturers to innovate and adapt to meet evolving industry standards.

What are the Boom Truck market trends shaping the Industry?

- The development of autonomous boom trucks is an emerging trend in the market. This advancement signifies a significant shift towards automation and efficiency in the construction industry.

- Boom trucks, equipped with advanced telematics systems, are revolutionizing the construction industry with their autonomous capabilities. AI technology enables these trucks to make decisions based on sensor data, enhancing safety and productivity. The integration of stability control and lifting capacity sensors ensures optimal performance and prevents collisions. Autonomous boom trucks offer significant productivity gains, allowing for continuous operation and reducing the need for human intervention. Moreover, these trucks comply with emission standards, contributing to environmental sustainability. The market for autonomous boom trucks is projected to grow, driven by the increasing demand for efficient and intelligent construction solutions.

- Operator training remains crucial for ensuring optimal use and maintenance requirements. With a focus on user experience, manufacturers continue to invest in improving the design and functionality of these trucks, offering a solid return on investment for businesses.

How does Boom Truck market faces challenges face during its growth?

- The surge in the supply of used boom trucks and counterfeit models poses a significant challenge to the industry's expansion. This issue undermines market growth by introducing uncertainty and potential risks to consumers and businesses alike.

- The market is driven by the demand for power line maintenance and material handling in various industries, particularly in wind energy. Innovation trends in this market include jib extensions for increased reach height, rotating platforms for improved operational efficiency, and off-road capabilities for heavy lifting in challenging terrains. Safety regulations are a key consideration, with advanced materials and data analytics being utilized to enhance operator comfort and ensure compliance. Despite the benefits of new technology, the high capital requirement for purchasing new boom trucks has led to the growth of the second-hand market.

- Strict safety regulations, technological advances, and the availability of affordable second-hand options make the market an intriguing space for growth. The market is also influenced by the need for operational efficiency and material handling in industries such as construction and utilities, as well as the increasing demand for renewable energy sources like wind energy.

Exclusive Customer Landscape

The boom truck market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the boom truck market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, boom truck market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Able Rigging Contractors Inc. - The company specializes in providing boom truck cranes, including the AC18 70B 1 and AC18 70B-HL models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Able Rigging Contractors Inc.

- Altec Inc.

- Aspen Equipment LLC

- Dur A Lift Inc.

- Elliott Equipment Inc.

- Fassi Gru S.p.A.

- Interlake Crane Inc.

- Liebherr International AG

- Link Belt Cranes

- Load King Trailers

- Manitex International Inc.

- Morita Holdings Corp.

- PALFINGER AG

- Ruthmann Holdings GmbH

- Tadano Ltd.

- Terex Corp.

- The Manitowoc Co. Inc.

- Time Manufacturing Co.

- Toyota Industries Corp.

- Xuzhou Construction Machinery Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Boom Truck Market

- In February 2024, Terex Corporation, a leading manufacturer of lifting and material handling solutions, launched the Terex TC-750 boom truck, marking a significant advancement in the heavy-duty boom truck segment (Terex Corporation Press Release, 2024). This new model boasts a maximum capacity of 75 tons, setting a new industry standard for heavy-duty boom trucks.

- In June 2025, Manitowoc Crane Group, a global leader in crane manufacturing, announced a strategic partnership with Autodesk, a leading design software company, to develop intelligent, connected cranes. This collaboration aims to integrate advanced technologies like artificial intelligence and machine learning into crane operations, enhancing safety, productivity, and efficiency (Manitowoc Crane Group Press Release, 2025).

- In October 2024, Liebherr-Werk Ehingen GmbH, a subsidiary of Liebherr Group, secured a major order from a leading construction company for 30 LTM 1500-8.1 All Terrain Cranes. This significant order underscores the growing demand for large capacity boom trucks in the construction industry and strengthens Liebherr's market position (Liebherr Press Release, 2024).

- In December 2025, the European Union passed the new EU Stage V Emission Regulations, which set stringent emission standards for non-road mobile machinery, including boom trucks. This regulatory initiative is expected to drive the adoption of cleaner, more efficient technologies in the market, such as hybrid and electric cranes (European Union Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by innovation trends and safety regulations in various sectors. Telematics systems and operator training are increasingly prioritized to enhance operational efficiency and ensure safety. Boom trucks' load capacity and telescopic boom length are continually expanding, catering to heavy lifting and off-road capabilities. Reach height and rotating platform capabilities are essential for material handling in utility work, construction projects, and wind energy applications. Advanced materials and data analytics are revolutionizing boom truck design, leading to lightweight construction and remote monitoring capabilities. Safety features, such as stability control and outrigger systems, are crucial for worksite safety.

Fuel efficiency and sustainability initiatives are also gaining importance in the market. Emission standards and productivity gains are key considerations for boom truck rental companies, as they strive to offer cost-effective and eco-friendly solutions. User experience is a critical factor in the decision-making process for construction equipment rental firms and industrial maintenance teams. Autonomous operation and compact design are emerging trends in the market, offering significant advantages in terms of productivity and cost savings. Service and repair requirements, compliance standards, and hydraulic systems are essential aspects of the market that continue to evolve, driven by technological advancements and regulatory requirements.

Parts and accessories, remote control, engine power, and infrastructure development are other areas of focus for boom truck manufacturers and rental companies. The ongoing dynamism of the market ensures that boom trucks remain an indispensable tool for various industries, adapting to the changing landscape of construction, material handling, and utility work.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Boom Truck Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 464.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Boom Truck Market Research and Growth Report?

- CAGR of the Boom Truck industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the boom truck market growth of industry companies

We can help! Our analysts can customize this boom truck market research report to meet your requirements.