Construction Equipment Market Size 2025-2029

The construction equipment market size is valued to increase USD 34 billion, at a CAGR of 4.3% from 2024 to 2029. Rising number of new construction equipment launches will drive the construction equipment market.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By Product - Owned equipment segment was valued at USD 81.60 billion in 2023

- By Application - Residential segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 43.03 billion

- Market Future Opportunities: USD 34.00 billion

- CAGR from 2024 to 2029 : 4.3%

Market Summary

- The market encompasses a dynamic and ever-evolving landscape of core technologies and applications, service types, and product categories. With the rise of advanced technologies such as automation, IoT, and AI, construction equipment is becoming increasingly sophisticated, enhancing productivity and efficiency. The adoption of electric construction equipment is on the rise, driven by growing environmental concerns and the need for sustainable solutions. However, high initial costs and maintenance expenses remain significant challenges. According to recent reports, electric construction equipment is expected to account for over 15% of the market share by 2027.

- Despite these challenges, the market continues to unfold with new opportunities, including the increasing demand for rental services and the growing popularity of modular construction. Regions such as Asia Pacific and Europe are witnessing significant growth, driven by increasing infrastructure development and urbanization.

What will be the Size of the Construction Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Construction Equipment Market Segmented?

The construction equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Owned equipment

- Rented equipment

- Leased equipment

- Application

- Residential

- Infrastructure

- Commercial

- Type

- Earthmoving equipment

- Material handling equipment

- Road construction equipment

- Concrete equipment

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The owned equipment segment is estimated to witness significant growth during the forecast period.

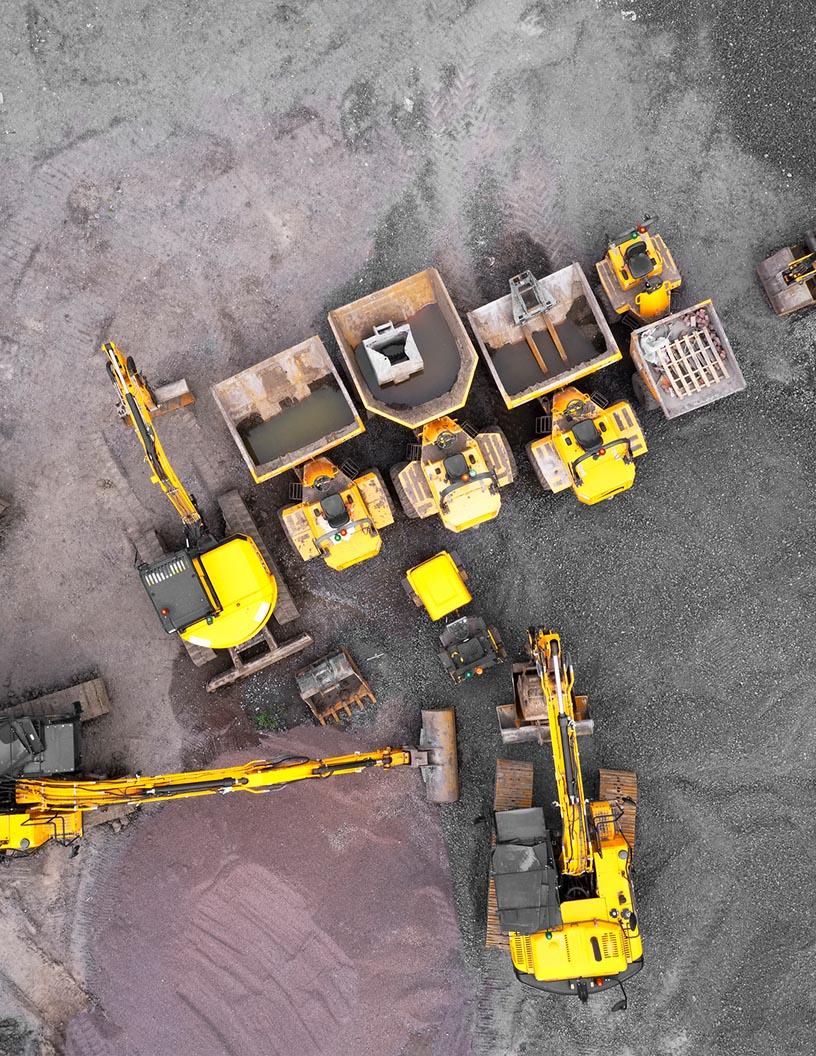

The market encompasses a vast array of machinery and vehicles, with the owned equipment segment being a significant contributor. This segment includes excavators, loaders, skid steers, and other small machinery, as well as trucks, trailers, and specialized construction vehicles. Owned equipment is typically purchased outright by construction companies, contractors, or end-users, leading to extensive usage and maintenance. Key components of owned construction equipment include material handling systems, heavy-duty engines, power transmission, construction software, hydraulic systems, telematics integration, digital dashboards, ground pressure control, and off-road mobility.

The Owned equipment segment was valued at USD 81.60 billion in 2019 and showed a gradual increase during the forecast period.

Emphasis on operator safety, noise reduction, remote diagnostics, and load capacity is increasing, with advancements in engine performance, machine durability, GPS integration, automation features, structural integrity, data acquisition, vibration dampening, component lifespan, precision control, wear resistance, thermal management, maintenance scheduling, electrification systems, and excavator technology.

Crane mechanisms and safety protocols are also essential, with control algorithms optimizing lifting capacity and fuel efficiency while sensor networks ensure continuous performance monitoring.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Construction Equipment Market Demand is Rising in APAC Request Free Sample

The market in Asia-Pacific (APAC) is experiencing significant growth, driven by expanding construction activities in emerging countries like India, Afghanistan, and Bangladesh. This region is expected to maintain a steady growth trajectory during the forecast period, fueling the demand for new infrastructure projects to accommodate the increasing urban population. Simultaneously, emerging economies are witnessing substantial growth in both commercial and residential construction sectors. For instance, the M6 Motorway Expansion project in Southern Sydney, New South Wales, Australia, is one such initiative.

Commencing in Q4 2023, this 23km motorway expansion is projected for completion in Q4 2025. The market's growth is a testament to the region's burgeoning infrastructure development.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is characterized by continuous innovation and advancements in technology, with a focus on enhancing efficiency, safety, and sustainability. One significant trend is the integration of advanced technologies into excavator hydraulic systems, crane load moment indicators, and bulldozer blade wear resistance analysis. Telematics plays a pivotal role in optimizing construction site operations, with more than 70% of new projects adopting telematics solutions to improve efficiency. Another critical development is the implementation of advanced driver-assistance systems for heavy equipment, including paver automation system calibration procedures and predictive maintenance algorithms for construction machinery. Sensor network data integration for remote equipment monitoring and machine learning applications in construction equipment maintenance are also gaining traction, enabling proactive maintenance and reducing downtime.

Emission standards have significantly impacted heavy equipment design, leading to the adoption of heavy-duty engine designs for improved operational efficiency and digital dashboard interfaces for enhanced equipment operation. Remote operation capabilities and operator training programs for enhanced safety protocols are also essential components of the evolving construction equipment landscape. Advanced control algorithms for precision equipment operation and wear resistance materials used in construction equipment components further contribute to the market's growth. Vibration dampening techniques in construction equipment design are another area of focus, as manufacturers strive to improve overall equipment performance and reduce maintenance costs. In the competitive market, a minority of players account for a significantly larger share due to their ability to offer advanced technologies and innovative solutions.

Companies are also investing in construction software integration for improved project management and hydraulic system component lifecycle management to maintain a competitive edge.

What are the key market drivers leading to the rise in the adoption of Construction Equipment Industry?

- The increasing number of new construction equipment launches serves as the primary catalyst for market growth.

- The construction industry is undergoing a transformation due to the escalating number of new equipment launches. This trend is fueled by technological innovations, shifting customer preferences, and the imperative for more efficient and eco-friendly construction methods. The introduction of these new offerings is significantly altering the construction landscape, delivering superior performance, productivity, safety, and environmental advantages. A crucial factor contributing to the surge in new equipment launches is the increasing demand for versatile and adaptable machinery tailored to specific project needs.

- With construction projects growing in intricacy and diversity, manufacturers are responding by releasing an expanded array of equipment options, equipped with advanced features and capabilities.

What are the market trends shaping the Construction Equipment Industry?

- The adoption of electric construction equipment is increasingly prevalent in the current market. This trend signifies a shift towards more sustainable and eco-friendly solutions in the construction industry.

- The market is experiencing a significant shift towards electric equipment, fueled by heightened environmental consciousness, stringent emissions regulations, and the advantages electric technology brings to construction operations. Electric construction equipment offers numerous benefits, including lower operating costs, reduced carbon emissions, quieter operation, and enhanced efficiency. One of the primary reasons for this trend is the increasing importance of sustainability and environmental responsibility within the construction sector. Electric equipment produces substantially fewer emissions compared to diesel-powered alternatives, enabling construction companies to lessen their carbon footprint and adhere to stringent environmental regulations.

- Furthermore, electric equipment's quieter operation contributes to improved working conditions on construction sites and increased community acceptance. As the construction industry continues to evolve, electric construction equipment is poised to play a pivotal role in enhancing operational efficiency and environmental performance.

What challenges does the Construction Equipment Industry face during its growth?

- The high initial cost and ongoing maintenance expenses of construction equipment pose a significant challenge to the growth of the industry.

- The market faces continuous challenges due to the substantial initial costs and ongoing maintenance expenses. These factors significantly influence purchasing decisions and budgeting for construction companies, particularly small- and mid-sized businesses. The high acquisition cost of new construction equipment necessitates a considerable upfront investment, potentially straining financial resources. Consequently, some companies may opt for older or less efficient equipment to minimize initial expenses, which could compromise performance, productivity, and safety. Moreover, the high operational costs of maintaining construction equipment further add to the financial burden for companies.

- Regular maintenance, repairs, and replacement of parts can accumulate substantial costs over time. Despite these challenges, the market remains dynamic, with ongoing advancements and innovations in technology driving improvements in efficiency, productivity, and safety. Companies that invest in modern, well-maintained equipment can reap significant benefits, including increased productivity, reduced downtime, and improved safety standards.

Exclusive Technavio Analysis on Customer Landscape

The construction equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the construction equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Construction Equipment Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, construction equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - This company specializes in providing construction equipment solutions, including articulated trucks and asphalt pavers, catering to diverse industry needs with a commitment to innovation and quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Action Construction Equipment Ltd.

- Caterpillar Inc.

- CNH Industrial NV

- Deere and Co.

- Doosan Corp.

- Escorts Ltd.

- Guangxi Liugong Machinery Co. Ltd.

- HD Hyundai Construction Equipment Co. Ltd.

- Hitachi Construction Machinery Co. Ltd.

- J C Bamford Excavators Ltd.

- Kobe Steel Ltd.

- Komatsu Ltd.

- Liebherr International AG

- Manitou BF SA

- Sany Group

- Sumitomo Heavy Industries Ltd.

- Terex Corp.

- Xuzhou Construction Machinery Group Co. Ltd.

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Construction Equipment Market

- In January 2024, Caterpillar Inc., a leading construction equipment manufacturer, announced the launch of its new electric backhoe loader, the 936 Electric, marking a significant stride in the electrification of heavy construction equipment (Cat.Com).

- In March 2024, Volvo Construction Equipment and Gehl Company, a part of the Volvo Group, entered into a strategic partnership to expand their distribution network in the United States, enhancing their market presence and customer reach (Volvo Construction Equipment Press Release).

- In April 2025, Komatsu Limited, a major player in the construction equipment industry, completed the acquisition of MOBILEX Robotics, a leading developer of autonomous construction equipment, for approximately USD 300 million. This acquisition aimed to bolster Komatsu's autonomous technology capabilities and expand its product offerings (Komatsu Limited Press Release).

- In May 2025, the European Union approved the European Green Deal, which includes a significant investment in the construction sector to promote the use of green technologies and reduce carbon emissions. This initiative is expected to drive the demand for eco-friendly construction equipment and create new opportunities for market players (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Construction Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 34 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.1 |

|

Key countries |

China, US, India, UK, Japan, Canada, Germany, France, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving market, material handling solutions continue to adapt and innovate, integrating advanced technologies to meet stringent emission standards. Ground pressure is a critical consideration for heavy-duty engines, with manufacturers focusing on optimizing power transmission to improve machine durability and fuel efficiency. Construction software and hydraulic systems are increasingly integrated with telematics, digital dashboards, and GPS to enhance off-road mobility and operator safety. Noise reduction and remote diagnostics are essential features, allowing for more efficient maintenance scheduling and improved component lifespan. Load capacity and engine performance are key performance indicators, with continuous advancements in vibration dampening, thermal management, and precision control contributing to increased lifting capacity and structural integrity.

- Heavy-duty engines are undergoing electrification, with excavator technology and crane mechanisms adopting automation features and safety protocols. Control algorithms are becoming more sophisticated, enabling better lifting capacity and fuel efficiency. Sensor networks are a crucial aspect of these advancements, providing real-time data acquisition and enabling remote monitoring and maintenance. In the realm of hydraulic systems, wear resistance and machine durability are essential considerations. Telematics integration, digital dashboards, and GPS are transforming the way construction equipment is operated and maintained. Automation features, such as remote diagnostics and maintenance scheduling, are becoming increasingly common, improving overall machine performance and reducing downtime.

- As emission standards continue to evolve, construction equipment manufacturers are focusing on thermal management, precision control, and wear resistance to meet the demands of the market. The integration of telematics, digital dashboards, and GPS is revolutionizing the industry, enabling more efficient and effective construction projects. With a focus on safety, durability, and performance, the market is poised for continued growth and innovation.

What are the Key Data Covered in this Construction Equipment Market Research and Growth Report?

-

What is the expected growth of the Construction Equipment Market between 2025 and 2029?

-

USD 34 billion, at a CAGR of 4.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Owned equipment, Rented equipment, and Leased equipment), Application (Residential, Infrastructure, and Commercial), Type (Earthmoving equipment, Material handling equipment, Road construction equipment, Concrete equipment, and Others), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising number of new construction equipment launches, High initial cost and maintenance of construction equipment

-

-

Who are the major players in the Construction Equipment Market?

-

AB Volvo, Action Construction Equipment Ltd., Caterpillar Inc., CNH Industrial NV, Deere and Co., Doosan Corp., Escorts Ltd., Guangxi Liugong Machinery Co. Ltd., HD Hyundai Construction Equipment Co. Ltd., Hitachi Construction Machinery Co. Ltd., J C Bamford Excavators Ltd., Kobe Steel Ltd., Komatsu Ltd., Liebherr International AG, Manitou BF SA, Sany Group, Sumitomo Heavy Industries Ltd., Terex Corp., Xuzhou Construction Machinery Group Co. Ltd., and Zoomlion Heavy Industry Science and Technology Co. Ltd.

-

Market Research Insights

- The market encompasses a diverse range of technologies and components, including electric motors, engine diagnostics, hydraulic pumps, and control valves. This sector continually evolves, with advancements in material science, diesel technology, and machine vision driving innovation. For instance, component reliability has improved significantly, reducing equipment downtime and increasing production output. However, the environmental impact of construction equipment remains a key concern. One notable trend is the integration of system components, such as predictive maintenance and equipment monitoring, which enable remote operation and real-time performance optimization. This not only enhances operational efficiency but also contributes to cost-benefit analysis and safety regulations compliance.

- For example, GPS tracking and fuel consumption monitoring help contractors minimize expenses and ensure efficient project scheduling. Despite these advancements, challenges persist. Design optimization and supply chain management remain crucial areas for improvement, as does operator training and adherence to manufacturing processes.

We can help! Our analysts can customize this construction equipment market research report to meet your requirements.