Bus Seating Systems Market Size 2025-2029

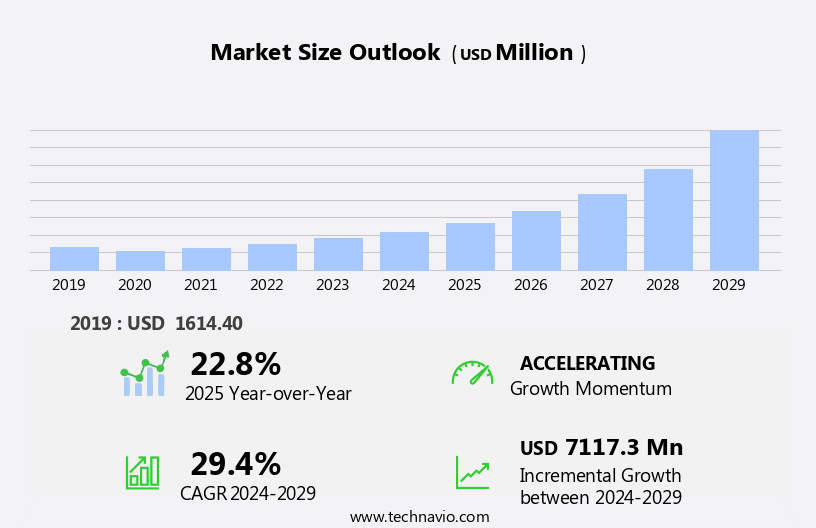

The bus seating systems market size is forecast to increase by USD 7.12 billion at a CAGR of 29.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing investments in bus transportation infrastructure by governments worldwide. This trend is particularly evident in the US, where public transport is a key component of urban mobility. Another key factor fueling market expansion is the rising demand for smart seating solutions. These systems offer advanced features such as adjustable backrests, reclining seats, and integrated entertainment systems, enhancing the passenger experience. Additionally, there is a growing focus on reducing the weight of bus seats while increasing safety features, which is driving innovation in the market.

- Moreover, the growth of the standard seats segment in the market is anticipated due to the rising adoption of public transportation and cost-effective fares compared to air travel. Companies in the bus seating systems industry are responding to these trends by developing lightweight, yet powerful seating solutions that meet the evolving needs of bus operators and passengers. As the market continues to evolve, players must stay abreast of these trends and adapt their offerings to capitalize on opportunities and navigate challenges effectively.

What will be the Size of the Bus Seating Systems Market during the forecast period?

- The market encompasses the production and supply of seats for various types of buses, catering to the evolving needs of public transportation in metropolitan cities and beyond. This market is driven by several factors, including the increasing demand for public transport due to rising population growth and the subsequent need for efficient and comfortable seating solutions. Strict government regulation, particularly in relation to child seats and safety systems, plays a significant role in market dynamics. Moreover, the shift towards eco-friendly transportation and the adoption of electric buses have led to a growing focus on eco-friendly bus seat materials, such as those made from recycled or plant-based materials.

- Lightweight materials and adjustable backrests with lumbar support are becoming increasingly popular for enhancing passenger comfort. Seat design innovations, including passive and active air cushions, climate control, and ergonomic seats, are also gaining traction. Government-led programs and transportation infrastructure investments are further fueling market growth, with a particular emphasis on retrofitting legacy buses with modern seating systems. The market is expected to continue expanding, with seat belts, adjustable backrests, and climate control becoming standard features for bus interiors. The market is a dynamic and innovative industry, continually adapting to the changing needs of passengers and the transportation sector as a whole.

How is this Bus Seating Systems Industry segmented?

The bus seating systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Standard seats

- Recliner seats

- Vehicle Type

- Transit buses

- Coach buses

- School buses

- Transfer buses

- Material

- Leather

- Fabric

- Vinyl

- Composite materials

- End-user

- OEMs

- Aftermarket

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Russia

- UK

- South America

- North America

- US

- Middle East and Africa

- APAC

By Type Insights

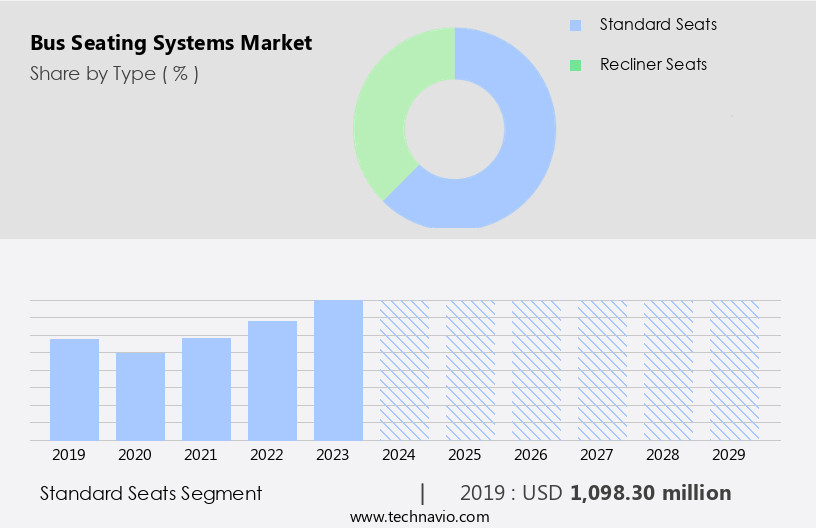

The standard seats segment is estimated to witness significant growth during the forecast period. The market encompasses standard seats, which are typically 40-45 cm wide and offer significant reclination. These bench-style seats include sleeper seats, commonly found in buses with extended commute routes, providing passengers with a comfortable sleeping arrangement. The growing preference for public transportation and its cost-effectiveness compared to air travel are expected to boost the demand for standard seats in The market. Advanced technologies, such as electric bus platforms, seat heat, and eco-friendly raw materials, are increasingly integrated into bus seats. Additionally, the adoption of electric buses, including EV buses and hybrid buses, is expanding last-mile connectivity in metropolitan cities, further fueling market growth.

Government-led programs promoting eco-friendly transportation and reducing carbon emissions are also contributing factors. The market comprises various seat types, including regular passenger seats, recliner seats, folding seats, bus driver seats, and integrated child seats for transit buses, coach buses, and school buses. Air seat cushions with passive and active air cushions are also gaining popularity. The VMR industry report highlights the impact of rising population and rapid urbanization on the demand for advanced bus seats.

Get a glance at the market report of share of various segments Request Free Sample

The Standard seats segment was valued at USD 1.1 billion in 2019 and showed a gradual increase during the forecast period.

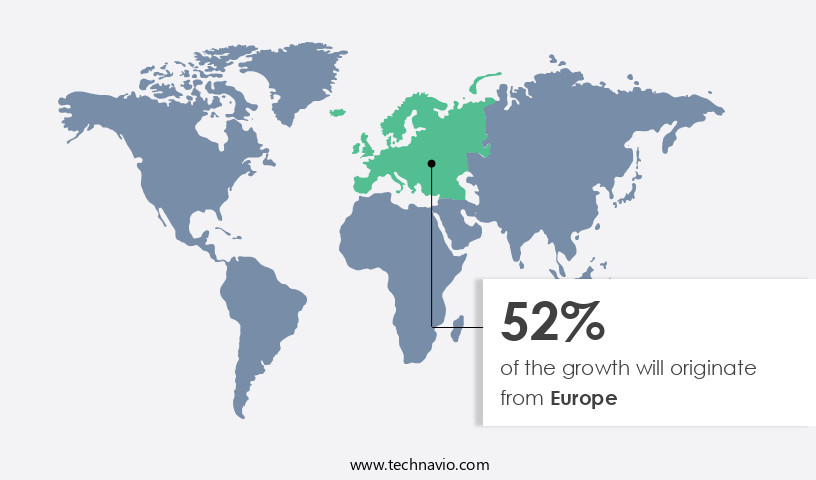

Regional Analysis

Europe is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Buses are the preferred mode of public transportation in Asia-Pacific (APAC), serving billions of commuters daily. The region's population growth and urbanization have led to a significant increase in bus demand, particularly in developing countries like India and China. This trend is further fueled by government initiatives to improve last-mile connectivity and link rural areas to metropolitan cities. In response to environmental concerns and stricter emission regulations, many countries are incorporating electric buses into their public transport fleets. The electric bus market's expansion, in turn, boosts the market, as these vehicles require advanced, eco-friendly seats. Electric vehicles, including electric buses, are becoming increasingly popular due to their reduced carbon emissions and improved road safety.

Seating systems in electric buses often feature advanced technologies like seat heat, passive and active air cushions, and eco-friendly raw materials. The component segment, which includes seat types like regular passenger seats, recliner seats, folding seats, and bus driver seats, is expected to grow significantly due to the increasing demand for advanced bus seats. Integrated child seats are also gaining popularity to enhance safety, particularly in school buses and transit buses. In summary, the market in APAC is thriving due to the region's population growth, urbanization, and government initiatives, as well as the increasing adoption of electric buses and the demand for advanced, eco-friendly seats.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Bus Seating Systems Industry?

- High investments in bus transportation by governments is the key driver of the market. Bus seating systems play a crucial role in enhancing the comfort and capacity of buses, making them an essential component of public transportation systems. For instance, Bus Rapid Transit Systems (BRTS) in countries like India have gained popularity due to their ability to reduce congestion and pollution in urban areas. In September 2024, the Union Ministry proposed the development of BRTS on expressways across India, featuring air-conditioned buses and amenities. Notable BRTS systems in India include Ahmedabad, Surat, Pune, and Bhopal, which serve over 1.75 million passengers daily.

- These systems have significantly improved urban quality of life by reducing traffic congestion and promoting sustainable transportation. Bus seating systems contribute to this success by offering comfortable and efficient seating arrangements, enabling bus operators to accommodate more passengers and provide a better travel experience.

What are the market trends shaping the Bus Seating Systems Industry?

- Increasing demand for smart seating is the upcoming market trend. The market is experiencing significant growth due to the increasing focus on comfort and safety in public transportation. With travel restrictions easing and the rise of electric vehicles, the demand for advanced bus seats is increasing. These seats offer features such as lumbar support, footstools, headrests, massage functions, seat heat, and ventilation. Both electric bus platforms and hybrid buses are integrating these eco-friendly seats to reduce carbon emissions and retrofit legacy buses. The component segment, including frame, upholstery, and seat type, is witnessing substantial growth. The VMR industry report suggests that the rising population and rapid urbanization in metropolitan cities are driving the demand for last mile connectivity through public transport.

- Additionally, government-led programs and the integration of child seats are further boosting the market. Despite the benefits, road accidents remain a concern, with an estimated 4 million drivers in interstate commerce In the US spending long hours on the road, leading to potential fatalities. To address this, eco-friendly raw materials and advanced technologies, such as passive and active air cushions, are being used to enhance safety and comfort.

What challenges does the Bus Seating Systems Industry face during its growth?

- Reducing weight of seat while increasing safety features is a key challenge affecting the industry growth. Bus seating systems continue to prioritize comfort and safety features for consumers, posing a significant challenge for Original Equipment Manufacturers (OEMs) and suppliers. With increasing demand for functional and safety features in buses, it is crucial to hit a balance between convenience and efficiency.

- The European Union and North American fuel emission regulations have intensified the pressure on OEMs to minimize fuel consumption, enhance vehicle mileage, and innovate efficient designs. The Corporate Average Fuel Economy (CAFE) standards set the bar at 54.5 mpg by 2025, compelling OEMs to explore weight reduction measures to meet emission requirements. The quest for lightweight yet strong seating systems is a critical focus area in the industry.

Exclusive Customer Landscape

The bus seating systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bus seating systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bus seating systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adient Plc - The company offers bus seating systems and solutions that are designed with the superior standards, making professional seating the affordable, high-quality choice for commercial fleets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adient Plc

- AUNDE Group SE

- BASF SE

- Brusa Koltuk

- Commercial Vehicle Group Inc.

- Exmark

- Faurecia SE

- FP Seating Systems Pvt. Ltd.

- Franz Kiel GmbH

- Freedman Seating Co.

- Lazzerini Srl

- Leadcom Seating Inc.

- Lear Corp.

- Magna International Inc.

- MG Seating Systems Pvt. Ltd.

- Minda Industries Ltd.

- Ningbo Jifeng Auto Parts Co. Ltd.

- Pinnacle Industries Ltd.

- TACHI S Co. Ltd.

- Tata Motors Ltd.

- Toyota Motor Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products designed to enhance the comfort and safety of passengers in various types of public transportation vehicles. These systems cater to the unique requirements of metropolitan cities and their rapidly expanding populations, driven by urbanization and the increasing demand for eco-friendly and advanced transportation solutions. One significant trend in the market is the integration of eco-friendly features. Manufacturers are focusing on reducing carbon emissions by utilizing raw materials with a lower environmental impact. Additionally, some seats offer seat heat and ventilation systems to ensure passenger comfort in various climate conditions.

The integration of electric vehicles and electric bus platforms into the transportation industry has led to the development of eco-friendly bus seats. Another essential aspect of bus seating systems is ensuring passenger comfort and safety. Seats come in various types, including regular passenger seats, recliner seats, folding seats, and integrated child seats. Advanced technologies such as passive and active air cushions are being employed to provide optimal comfort and support for long-distance travel. Lumbar support is another essential feature that has gained popularity in recent years. This feature helps alleviate back pain and discomfort, making bus travel more enjoyable for passengers. Seat heating is another desirable feature, particularly in colder climates, ensuring a comfortable riding experience. The market is not limited to transit buses alone.

Each seat type caters to specific bus types, such as transit buses, coach buses, and school buses. Coach buses and school buses also incorporate advanced seating systems to cater to their unique passenger demographics. Bus driver seats are specifically designed to provide optimal comfort and support for long hours of driving, ensuring driver focus and safety. The component segment of the market includes various parts such as seat frames, upholstery, and mechanical components. These components are subject to rigorous testing and certification to ensure they meet the highest safety standards. Government-led programs and initiatives are also driving the growth of the market. These programs prioritize the provision of safe and comfortable transportation solutions for the public, particularly in densely populated areas.

The VMR industry report highlights the increasing demand for advanced bus seats that cater to the evolving needs of passengers. This trend is being fueled by the rising population and the need for last-mile connectivity in metropolitan cities. The market is a dynamic and evolving industry that caters to the unique requirements of various types of public transportation vehicles. The focus on eco-friendly features, passenger comfort and safety, and advanced technologies is driving innovation and growth in this sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 29.4% |

|

Market growth 2025-2029 |

USD 7.11 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.8 |

|

Key countries |

China, India, Japan, South Korea, Russia, Australia, France, UK, Germany, and US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bus Seating Systems Market Research and Growth Report?

- CAGR of the Bus Seating Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, South America, North America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bus seating systems market growth and forecasting

We can help! Our analysts can customize this bus seating systems market research report to meet your requirements.