Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market Size 2026-2030

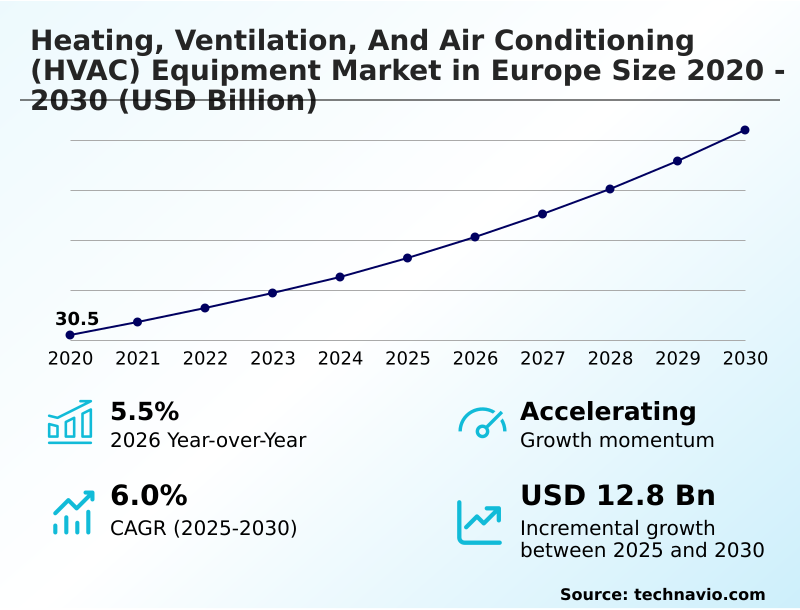

The europe heating, ventilation, and air conditioning (hvac) equipment market size is valued to increase by USD 12.8 billion, at a CAGR of 6% from 2025 to 2030. Expansion of district energy networks and industrial waste heat recovery will drive the europe heating, ventilation, and air conditioning (hvac) equipment market.

Major Market Trends & Insights

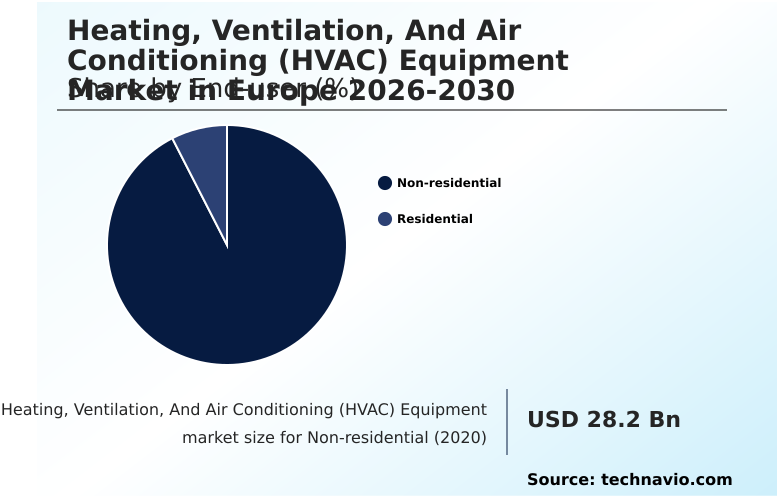

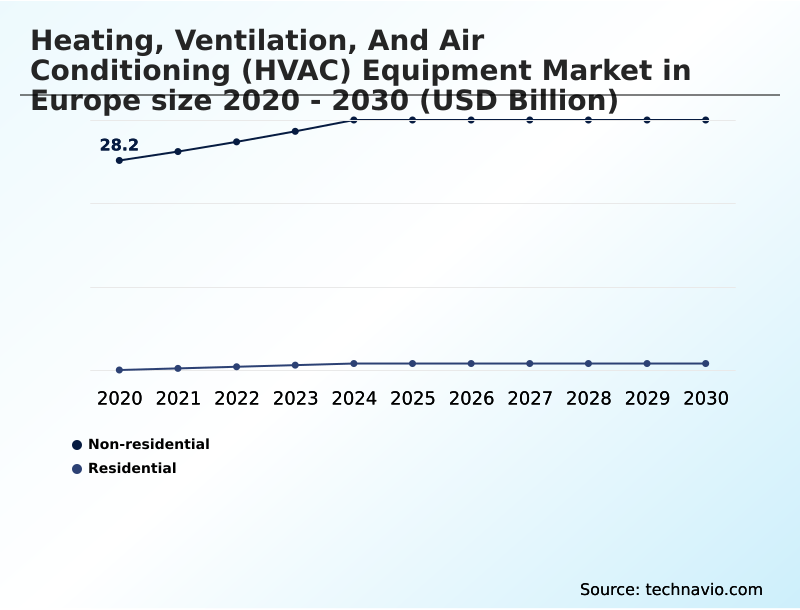

- By End-user - Non-residential segment was valued at USD 33.2 billion in 2024

- By Product - Air conditioning equipment segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 20.5 billion

- Market Future Opportunities: USD 12.8 billion

- CAGR from 2025 to 2030 : 6%

Market Summary

- The heating, ventilation, and air conditioning (hvac) equipment market in Europe is undergoing a significant transformation, driven by a convergence of regulatory pressures and technological advancements. A primary catalyst is the continent-wide push for decarbonization, compelling a shift from traditional fossil fuel systems to electrified solutions like air-to-water heat pumps and integrated building automation systems.

- This transition is reinforced by regulations such as the F-Gas Regulation and the Ecodesign Directive, which mandate higher efficiency and the use of natural refrigerants. For instance, a commercial real estate firm managing a portfolio of aging office buildings must now navigate complex capital expenditure planning.

- The firm must balance the high upfront cost of retrofitting with variable refrigerant flow systems against the long-term operational savings and the risk of non-compliance. This scenario highlights the market's core dynamic: balancing economic viability with the urgent need for sustainable infrastructure.

- Innovations in smart connectivity features and demand-controlled ventilation are creating new opportunities for energy optimization, while a persistent skilled labor shortage remains a critical barrier to widespread implementation, impacting project timelines and costs.

What will be the Size of the Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market Segmented?

The europe heating, ventilation, and air conditioning (hvac) equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- End-user

- Non-residential

- Residential

- Product

- Air conditioning equipment

- Heating equipment

- Ventilation equipment

- Technology

- Traditional HVAC

- Smart HVAC

- Sustainable HVAC

- Geography

- Europe

- Germany

- UK

- France

- Europe

By End-user Insights

The non-residential segment is estimated to witness significant growth during the forecast period.

The non-residential segment is shaped by stringent regulations mandating progress toward net-zero building targets. Compliance with the ecodesign directive drives the adoption of advanced building automation systems and high-performance chillers.

Organizations are increasingly focused on thermal comfort optimization and comprehensive indoor air quality monitoring, leading to investment in sophisticated air handling units with high-efficiency particulate air filtration.

Building management software is crucial for managing these integrated systems, including reversible heat pumps that provide both heating and cooling.

This focus on efficiency and health is a response to regulatory compliance management, with some facilities achieving a 15% reduction in energy waste through automated controls, establishing a new benchmark for operational excellence in commercial and industrial structures.

The Non-residential segment was valued at USD 33.2 billion in 2024 and showed a gradual increase during the forecast period.

Market Dynamics

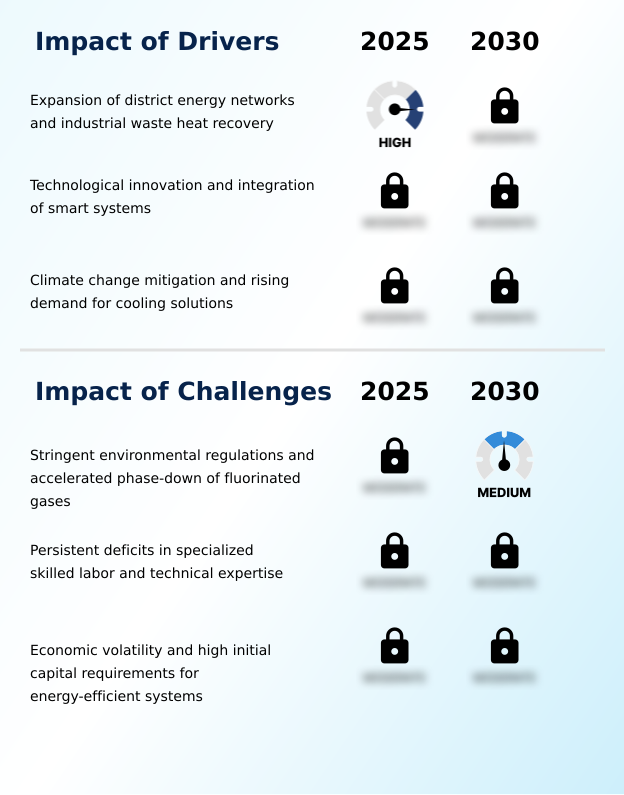

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- Strategic decision-making in the market is increasingly complex, shaped by the direct impact of f-gas regulation on hvac design and the growing emphasis on circular economy principles in hvac manufacturing. Businesses are actively conducting cost-benefit analysis of high-efficiency compressors to justify investments.

- The benefits of geothermal heat pumps in commercial buildings are well-documented, yet significant challenges in retrofitting older buildings with heat pumps persist. This has spurred interest in evaluating equipment-as-a-service models for hvac as a way to mitigate high initial costs.

- The core of the transition lies in understanding the role of natural refrigerants in sustainable hvac and improving energy security with hybrid heat pump technology. Achieving net-zero building targets with smart hvac is a primary objective, requiring the integration of smart hvac systems for energy consumption optimization.

- Success hinges on integrating heat pumps with existing district heating networks and leveraging predictive maintenance for variable refrigerant flow systems. Widespread adoption of demand-controlled ventilation for improved indoor air quality is seen as essential. However, the industry must first find ways of addressing skilled labor shortages in hvac installation, as backlogs in some regions have grown over 25% year-over-year.

- Optimizing thermal comfort in non-residential buildings through digital twin technology for hvac system management offers a path forward. Financial incentives for residential heat pump adoption and leveraging waste heat recovery from industrial processes are key enablers in the broader decarbonization pathways for the european heating sector, supported by life cycle assessment of sustainable cooling solutions.

What are the key market drivers leading to the rise in the adoption of Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Industry?

- The strategic expansion of district energy networks, combined with the recovery of industrial waste heat, serves as a key driver propelling market growth.

- The integration of digital technologies is a primary market driver, with smart connectivity features now standard in over 60% of new installations.

- This facilitates advanced demand side management and enables predictive maintenance strategies that can reduce equipment downtime by up to 25%. Smart thermostats and interconnected building automation systems leverage real-time data for optimization, enhancing smart grid integration.

- Simultaneously, the expansion of district heating networks, fueled by investments in waste heat recovery systems and industrial heat pumps, is creating large-scale demand.

- The need for robust cooling is also escalating due to the urban heat island effect, as cooling degree days have increased by 15%, pushing the adoption of high-efficiency compressors and advanced heat exchangers to ensure thermal comfort.

What are the market trends shaping the Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Industry?

- A paradigm shift toward natural and low-global warming potential refrigerants is an emerging market trend, significantly influencing product development and regulatory compliance strategies across the industry.

- The market is undergoing a significant transformation as circular economy principles become central to manufacturing and operations. This trend is compelling a shift toward modular HVAC solutions designed for easier end-of-life management and material recovery, supported by digital material passports for supply chain optimization.

- The adoption of equipment-as-a-service models is growing, incentivized by financial directives that reward sustainable practices and reduce the upfront investment burden for end-users by over 30% in some pilot programs. Furthermore, the strategic electrification of heating is accelerating the deployment of air-to-water heat pumps and innovative dual-fuel heat pumps.

- This move away from fossil fuels, a key part of the REPowerEU plan, is not only reducing the industry's carbon footprint but also reshaping long-term product development cycles.

What challenges does the Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Industry face during its growth?

- Stringent environmental regulations, particularly the accelerated phase-down of fluorinated gases, present a key challenge that impacts the industry's growth trajectory.

- Navigating the complex regulatory landscape, particularly the stringent F-Gas Regulation, poses a significant challenge, requiring substantial R&D investments to transition from traditional systems to those using eco-friendly alternatives. This shift impacts everything from variable refrigerant flow systems to multi-split systems and rooftop units.

- A critical bottleneck is the acute skilled labor shortage mitigation, with some nations reporting a deficit of tens of thousands of certified installers, leading to installation backlogs growing by over 25% annually. This scarcity hinders the decarbonization of the heating sector.

- Furthermore, high initial capital expenditure planning for energy-efficient equipment like geothermal heat pumps or modern condensing gas boiler systems remains a barrier, as high borrowing costs can dampen new construction and renovation projects, directly impacting demand.

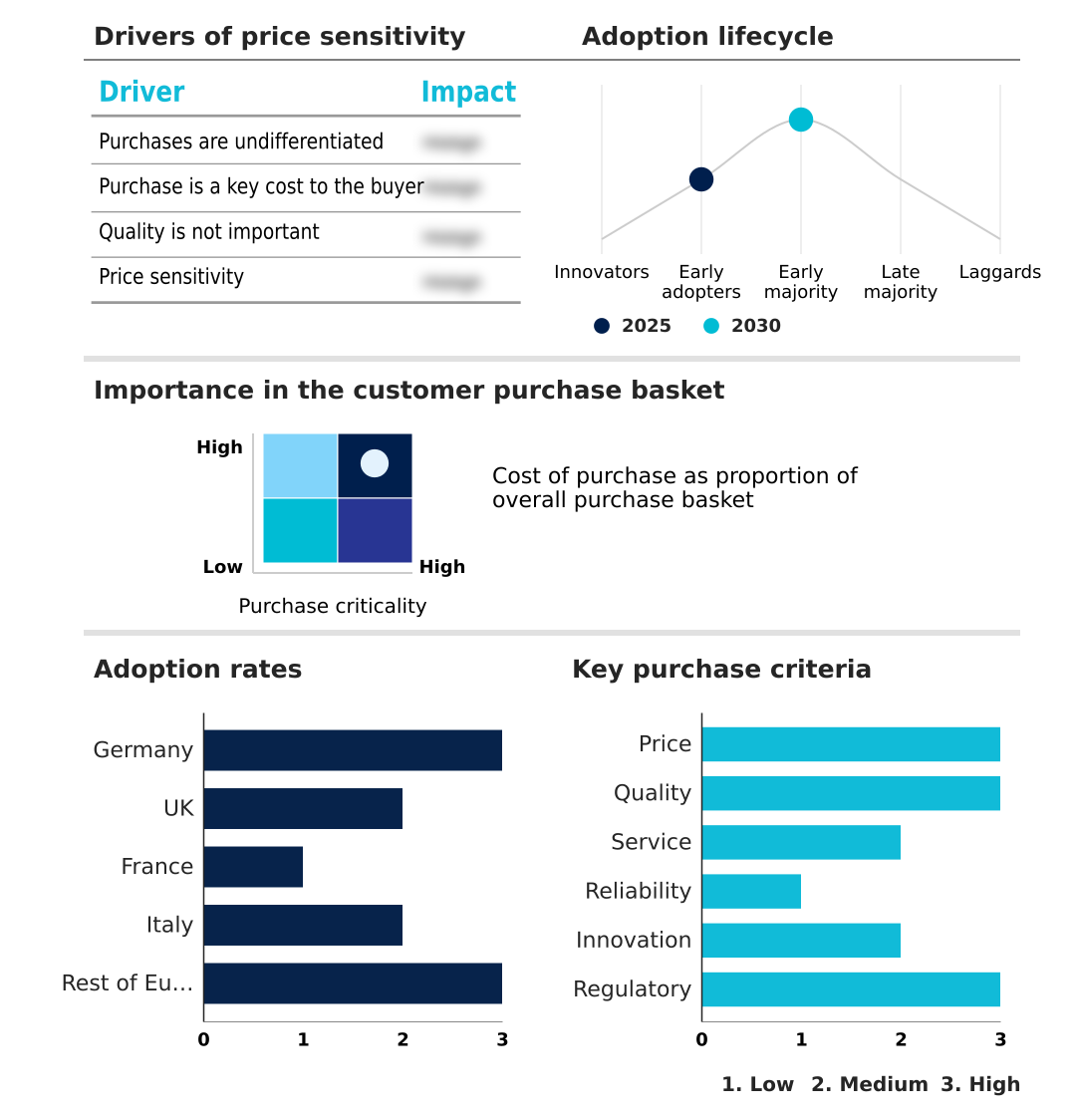

Exclusive Technavio Analysis on Customer Landscape

The europe heating, ventilation, and air conditioning (hvac) equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the europe heating, ventilation, and air conditioning (hvac) equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, europe heating, ventilation, and air conditioning (hvac) equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Carrier Global Corp. - The market features a range of key offerings, including advanced heating, ventilation, and air conditioning equipment such as chillers, air handling units, and intelligent thermostats.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Carrier Global Corp.

- Daikin Industries Ltd.

- Danfoss AS

- Haier Smart Home Co. Ltd.

- Honeywell International Inc.

- LG Electronics Inc.

- Mitsubishi Electric Corp.

- NIBE Industrier AB

- OSTBERG GROUP AB

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Swegon Group AB

- Systemair AB

- Trane Technologies Plc

- Vaillant Group

- WOLF GmbH

- Zehnder Group AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Europe heating, ventilation, and air conditioning (hvac) equipment market

- In February 2025, the European Investment Bank launched a dedicated credit facility to finance the modernization of fifth-generation district heating grids throughout Central Europe, focusing on integrating large-scale heat pumps and recovering industrial waste heat.

- In April 2025, the European Commission implemented a revised quota system for hydrofluorocarbons, significantly reducing the allowable volume of high global warming potential refrigerants for sale, thereby accelerating the transition to eco-friendly alternatives.

- In May 2025, the European Investment Bank finalized a new sustainable finance directive that incentivizes commercial property developers to adopt equipment-as-a-service models for HVAC systems, promoting circular economy principles.

- In October 2025, the French Ministry of Ecological Transition announced an updated policy that increases subsidies for installing geothermal heat pumps in public buildings as part of a national strategy to decarbonize public infrastructure.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 212 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 6% |

| Market growth 2026-2030 | USD 12.8 billion |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 5.5% |

| Key countries | Germany, UK, France, Italy and Rest of Europe |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is defined by a mandatory technological evolution toward sustainability, driven by the F-Gas Regulation and the Ecodesign Directive. This shift necessitates significant boardroom focus on capital investment for compliant systems, including air-to-water heat pumps, geothermal heat pumps, and equipment utilizing natural refrigerants or low global warming potential refrigerants.

- The integration of building automation systems, smart thermostats, and advanced heat exchangers is no longer optional but essential for efficiency. Over 60% of new installations now feature smart connectivity features, enabling advanced demand-controlled ventilation and energy recovery ventilation.

- Manufacturers are re-engineering entire product lines, from condensing gas boilers and chillers to multi-split systems and rooftop units, incorporating high-efficiency compressors and hydronic balancing systems. The focus extends to circular economy principles and digital material passports to manage equipment lifecycles.

- Solutions like dual-fuel heat pumps, reversible heat pumps, and high-temperature heat pumps, combined with seasonal thermal energy storage, thermal buffers, and smart water tanks, are becoming crucial. This transition impacts everything from industrial heat pumps and air handling units to the adoption of high-efficiency particulate air filtration and equipment-as-a-service models for district heating networks.

What are the Key Data Covered in this Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market Research and Growth Report?

-

What is the expected growth of the Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market between 2026 and 2030?

-

USD 12.8 billion, at a CAGR of 6%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Non-residential, and Residential), Product (Air conditioning equipment, Heating equipment, and Ventilation equipment), Technology (Traditional HVAC, Smart HVAC, and Sustainable HVAC) and Geography (Europe)

-

-

Which regions are analyzed in the report?

-

Europe

-

-

What are the key growth drivers and market challenges?

-

Expansion of district energy networks and industrial waste heat recovery, Stringent environmental regulations and accelerated phase-down of fluorinated gases

-

-

Who are the major players in the Europe Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market?

-

Carrier Global Corp., Daikin Industries Ltd., Danfoss AS, Haier Smart Home Co. Ltd., Honeywell International Inc., LG Electronics Inc., Mitsubishi Electric Corp., NIBE Industrier AB, OSTBERG GROUP AB, Panasonic Holdings Corp., Robert Bosch GmbH, Samsung Electronics Co. Ltd., Swegon Group AB, Systemair AB, Trane Technologies Plc, Vaillant Group, WOLF GmbH and Zehnder Group AG

-

Market Research Insights

- Market dynamics are increasingly shaped by strategic initiatives aimed at energy security enhancement and widespread carbon footprint reduction. The focus on the decarbonization of the heating sector, supported by policies favoring renewable energy integration, is accelerating the adoption of advanced climate control technologies.

- Smart grid integration is becoming a critical component, with over 60% of new commercial installations now including smart connectivity for demand side management. This allows for optimized performance and aligns with predictive maintenance strategies to reduce downtime.

- Concurrently, the urban heat island effect is intensifying the need for sustainable cooling solutions, as cooling degree days have risen by 15% in the last decade, compelling a shift in capital expenditure planning toward more resilient and efficient systems.

We can help! Our analysts can customize this europe heating, ventilation, and air conditioning (hvac) equipment market research report to meet your requirements.