Buy Now Pay Later Market Size 2025-2029

The buy now pay later market size is forecast to increase by USD 90.29 billion, at a CAGR of 37.7% between 2024 and 2029.

- The Buy Now Pay Later (BNPL) market is experiencing significant growth, driven by the increasing adoption of online payment methods and the affordability and convenience these services offer. Consumers are increasingly drawn to BNPL solutions as they enable impulse purchases without the immediate financial burden, fostering a shift from traditional credit cards and cash transactions. This trend is particularly prominent among younger demographics, who are more likely to shop online and value flexibility in payment options. However, the BNPL market faces challenges that require careful navigation.

- Additionally, the lack of standardization across providers and platforms may create confusion for consumers, necessitating clear communication and transparency from companies. Addressing these challenges will be crucial for BNPL providers seeking to build trust and establish long-term relationships with customers. Payment processing and fraud prevention are essential components, ensuring secure transactions through system architecture, data encryption, and risk assessment models. Companies that successfully navigate these obstacles will be well-positioned to capitalize on the market's potential and meet the evolving needs of consumers in the digital economy. Regulatory scrutiny is intensifying, with concerns around consumer protection and potential risks associated with excessive borrowing and debt accumulation.

What will be the Size of the Buy Now Pay Later Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its applications across various sectors. Point-of-sale financing and deferred payment plans are increasingly popular, integrating seamlessly with software development and e-commerce platforms. Credit utilization and user experience (UX) are crucial factors, with business intelligence and predictive modeling optimizing conversion rates. KYC/AML compliance and customer onboarding streamline operations, while financial education and debt management tools foster customer loyalty. Currency exchange, international payments, and late fees are common considerations, with interest rates and repayment schedules influencing consumer behavior.

Fraud detection systems and technical support address potential risks, while loan origination and targeted advertising leverage data analytics and consumer segmentation. API integration, merchant services, and performance monitoring enable efficient operations, with promotional offers and debt collection tools enhancing customer engagement. Cross-border transactions and retail partnerships expand market reach, while marketing automation and spending habits analysis inform strategic decision-making. The financial technology (fintech) landscape is characterized by continuous innovation, with ongoing activities unfolding in areas such as churn rate reduction, risk management, and transaction fees optimization. System architecture, dispute resolution, and loan origination remain key focus areas, ensuring a robust and adaptive market response.

How is this Buy Now Pay Later Industry segmented?

The buy now pay later industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Business Segment

- Large enterprise

- Small and medium enterprise

- Channel

- Online

- POS

- End-user

- Retail and e-commerce

- Fashion and garment

- Consumer electronics

- Healthcare

- Travel and tourism

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Business Segment Insights

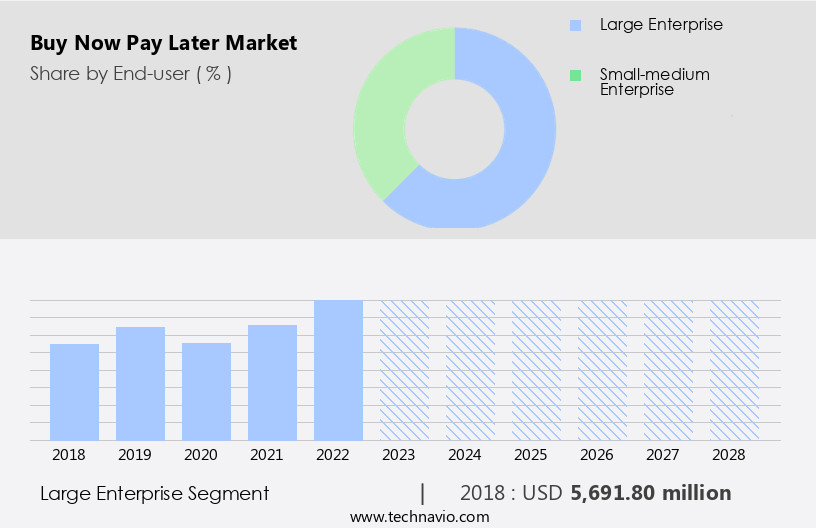

The Large enterprise segment is estimated to witness significant growth during the forecast period. The Buy Now Pay Later (BNPL) market experienced significant growth in 2024, with large enterprises leading the adoption of this payment solution. BNPL solutions, which include point-of-sale financing and deferred payment plans, have become increasingly popular among large businesses due to their ability to enhance customer experience and boost sales. By offering installment payment options, BNPL enables consumers to make high-value purchases more affordably and manage their spending more effectively. Credit scoring algorithms and predictive modeling are integral components of BNPL, ensuring a streamlined customer onboarding process and effective risk assessment. Fraud prevention and security protocols are also crucial, safeguarding both merchants and consumers from potential fraudulent activities.

Performance monitoring and technical support are essential for maintaining a seamless user experience, while debt management tools and integration partners facilitate efficient loan origination and repayment scheduling. International payments and e-commerce platforms are key areas of focus for BNPL providers, allowing businesses to expand their reach and cater to a global customer base. Alternative lending through BNPL caters to consumers who lack access to traditional credit or prefer not to use credit cards. Late fees and interest rates are competitive, making BNPL an attractive alternative for consumers seeking greater financial control. Fraud detection systems and KYC/AML compliance are essential for maintaining a secure and compliant environment.

Customer segmentation and targeted advertising enable merchants to tailor their offerings and marketing strategies to specific customer demographics. Business intelligence and data analytics provide valuable insights into consumer behavior and spending habits, enabling merchants to optimize their strategies and improve overall performance. BNPL solutions also offer various features such as dispute resolution, loan origination, and loyalty programs, enhancing the overall shopping experience and fostering customer loyalty. Merchant services and retail partnerships are essential for facilitating cross-border transactions and expanding the reach of BNPL offerings. The integration of payment gateways, API integration, and system architecture ensures seamless integration with various e-commerce platforms and financial systems.

The market is witnessing a rise in adoption, with large enterprises leading the charge. BNPL solutions offer a flexible and affordable payment method for consumers, enabling them to manage their expenses effectively while boosting sales for businesses. The integration of various components, including credit scoring algorithms, fraud prevention, security protocols, and performance monitoring, ensures a seamless and secure user experience. The market's continued growth is driven by the evolving needs of consumers and businesses, as well as advancements in financial technology and data analytics.

The Large enterprise segment was valued at USD 6.64 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

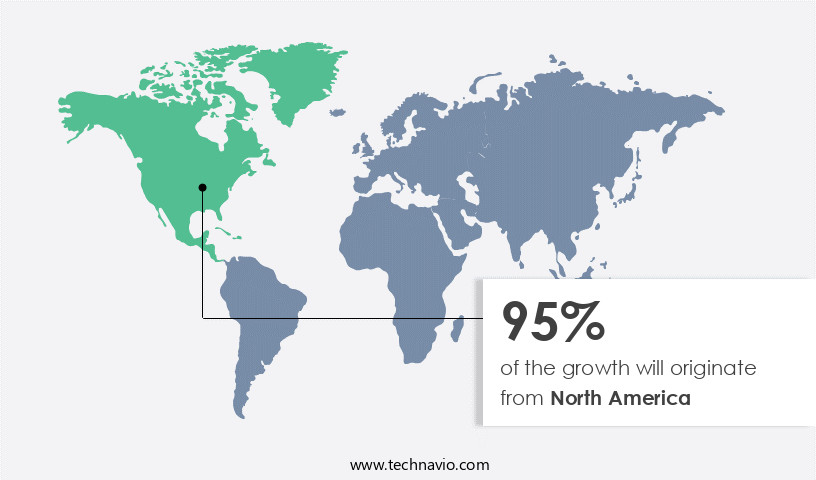

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America experienced significant growth in 2024, with this region holding the largest share due to its consumer-oriented culture and widespread use of digital transactions. The number of internet users in North America continues to increase, driving the expansion of online payment methods such as debit and credit cards, digital wallets, and buy now, pay later services. Consumers are attracted to the benefits of these payment options, including cashbacks, discounts, and flexible repayment schedules. E-commerce platforms have been a primary driver of buy now, pay later adoption in North America. These platforms offer seamless integration with BNPL services, providing a convenient and user-friendly shopping experience. The convenience and benefits of digital payments, including lower transaction costs, quicker fund transfers, and enhanced payment security, are making them increasingly appealing to a broader audience.

Payment processing, fraud prevention, and security protocols are essential components of these services, ensuring a safe and efficient transaction process. Credit scoring algorithms and customer segmentation enable lenders to assess risk and offer personalized payment plans to consumers. Alternative lending options have gained popularity, particularly among younger demographics and those with limited credit history. Predictive modeling and data analytics help lenders make informed decisions and manage risk. Transaction fees, performance monitoring, and technical support are essential for ensuring the smooth operation of buy now, pay later services. Promotional offers and debt collection tools help lenders attract and retain customers.

Debt management tools and integration partners enable seamless integration with various e-commerce platforms and payment gateways. Business intelligence, user experience, and financial education are critical factors in the success of buy now, pay later services. Credit utilization, currency exchange, and customer support are essential components of these services, ensuring a positive customer experience. Risk assessment models, KYC/AML compliance, and dispute resolution systems help mitigate risk and maintain regulatory compliance. Loan origination, targeted advertising, and financial technology are key trends in the buy now, pay later market. Shopping cart abandonment and marketing automation help lenders engage customers and increase conversions.

Consumer behavior and spending habits continue to shape the market, with a focus on providing flexible and convenient payment options.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Buy Now Pay Later Industry?

- The significant rise in the use of online payment methods serves as the primary catalyst for market growth. The market is experiencing significant growth due to the increasing adoption of digital payment methods, such as mobile payments, debit cards, and credit cards. This trend is particularly noticeable in developing regions where high-speed internet and smartphone usage are on the rise. Performance monitoring and promotional offers are essential elements of buy now pay later services, ensuring timely repayment and customer satisfaction. Debt collection and fraud detection systems are also critical components, ensuring the security and reliability of transactions.

- E-commerce platforms and international payments are major integration partners, expanding the market's reach and accessibility. Interest rates and repayment schedules vary among providers, making it essential for businesses to carefully consider their debt management tools and customer segmentation strategies. Technical support and debt collection services are also crucial for managing customer relationships and mitigating potential risks. Payment gateways and debt management tools are essential for seamless integration with existing systems, ensuring a smooth user experience. As the market continues to evolve, it is essential for businesses to stay informed about the latest trends and developments, including advances in fraud detection systems, technical support, and debt management tools.

What are the market trends shaping the Buy Now Pay Later Industry?

- Payment services that are both affordable and convenient are currently in high demand among consumers. This trend reflects the increasing importance of accessibility and affordability in financial transactions. The Buy Now Pay Later (BNPL) market expansion is driven by several factors, including the provision of affordable and convenient payment solutions, quick credit card fund transfers at checkout, and enhanced payment security. Advanced payment solutions, such as QR-code technology and UPI-based payment methods, facilitate seamless transactions and add convenience for users. BNPL services prioritize customer experience (UX) by enabling purchases without the need for swiping debit cards, thereby increasing personal information security.

- Dispute resolution mechanisms are in place to address any potential issues, while loan origination processes are streamlined to offer quick and efficient services. Data encryption ensures the security of sensitive financial information, and currency exchange capabilities cater to global customers. Customer support is a priority, with dedicated teams available to address any inquiries or concerns. By partnering with reputable integration partners and staying up-to-date on market dynamics, businesses can effectively leverage the benefits of buy now pay later services to enhance their customer offerings and drive growth. To ensure business intelligence and mitigate risks, BNPL platforms employ risk assessment models, KYC/AML compliance, and customer onboarding processes. System architecture is another critical aspect, with API integration enabling seamless communication between various systems.

What challenges does the Buy Now Pay Later Industry face during its growth?

- The increasing popularity of Buy Now Pay Later (BNPL) solutions, while driving sales growth, poses a significant challenge by encouraging impulsive spending and potentially leading to unsustainable debt for some consumers. Buy Now, Pay Later (BNPL) services have gained significant traction in the market due to their convenience and flexibility. These services allow consumers to purchase items without making an immediate payment, instead opting for deferred payments. However, this convenience comes with potential risks, particularly in relation to consumer spending habits. The ease of access to deferred payments can encourage impulse buying, potentially leading consumers to exceed their financial capacity and accumulate debt. As BNPL providers continue to expand their reach, it is crucial for them to address these financial risks. Stricter regulations and comprehensive consumer education are essential to mitigate potential harm.

- Financial technology (FinTech) companies offering BNPL services must prioritize data analytics and marketing automation to target advertising effectively and reduce shopping cart abandonment. Data warehousing and data analytics are also vital for tracking consumer behavior and identifying trends, enabling providers to offer personalized solutions and improve default rates. Retail partnerships and cross-border transactions are key areas of growth for BNPL services. Merchant services and loyalty programs can help increase market penetration and customer retention. However, it is essential to maintain a balance between convenience and financial responsibility, ensuring that consumers are fully informed about the implications of using BNPL services and are able to make informed decisions about their spending.

Exclusive Customer Landscape

The buy now pay later market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the buy now pay later market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, buy now pay later market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Affirm Holdings Inc. - The company specializes in Buy Now, Pay Later services and offers a flexible payment solution, Affirm, allowing consumers to split their purchases into convenient installment payments.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Affirm Holdings Inc.

- Afterpay US Services LLC

- Amazon.com Inc.

- APaylater Financials Pte. Ltd.

- Flipkart Internet Pvt. Ltd.

- Grab Holdings Ltd.

- Hoolah Holdings Pte Ltd.

- Klarna Bank AB

- Laybuy Holdings Ltd.

- Mastercard Inc.

- Monzo Bank Ltd.

- One97 Communications Ltd.

- Pace Now Enterprise Sdn Bhd

- PayPal Holdings Inc.

- Perpay Inc.

- Rely Pte Ltd

- Revolut Ltd.

- Social Money Ltd.

- Visa Inc.

- Zip Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Buy Now Pay Later Market

- In January 2024, PayPal announced the global expansion of its Pay in 4 service, allowing customers in the US, UK, and select European countries to split their purchases into four equal installments with no interest or fees (PayPal Press Release, 2024).

- In March 2024, Afterpay and Square formed a strategic partnership, enabling Square sellers in the US, Canada, and the UK to offer Afterpay as a payment option to their customers (Square Press Release, 2024).

- In April 2025, Klarna raised a USD 650 million funding round, bringing its valuation to USD 45.6 billion, making it the highest-valued private fintech company in Europe (Bloomberg, 2025).

- In May 2025, Affirm secured a significant regulatory approval in the UK, allowing it to operate as a lender and offer its point-of-sale financing solutions to a broader range of merchants and consumers (Affirm Press Release, 2025).

Research Analyst Overview

The buy now pay later (BNPL) market is experiencing significant evolution, driven by various factors. Private equity firms are increasingly investing in this sector, recognizing its potential for growth. Brand awareness is a crucial factor, with companies leveraging big data analytics and artificial intelligence (AI) to personalize marketing campaigns. Pricing strategies are undergoing shifts, with some players adopting dynamic pricing based on economic indicators and consumer behavior. Microservices architecture and cloud computing enable scalability and flexibility, while geopolitical factors and compliance regulations pose challenges for global expansion. Interest rate changes impact consumer spending and borrowing patterns, influencing market penetration.

Competitive differentiation is achieved through innovative features like biometric authentication, embedded finance, and digital wallets. Sales channels are expanding beyond traditional e-commerce, with distribution networks embracing open banking and agile development. Machine learning (ML) and AI are used for risk assessment and customer retention. Venture capital and financing are essential for growth, with investors seeking to capitalize on the value proposition of BNPL. Market trends include the integration of BNPL into various sales channels and the increasing use of blockchain technology for security and transparency. Overall, the BNPL market is dynamic and complex, requiring businesses to stay informed and adapt to changing market conditions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Buy Now Pay Later Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 37.7% |

|

Market growth 2025-2029 |

USD 90.29 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

35.3 |

|

Key countries |

US, China, Canada, Germany, UK, Brazil, India, France, Japan, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Buy Now Pay Later Market Research and Growth Report?

- CAGR of the Buy Now Pay Later industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the buy now pay later market growth of industry companies

We can help! Our analysts can customize this buy now pay later market research report to meet your requirements.