Calcium Hydroxide Market Size 2024-2028

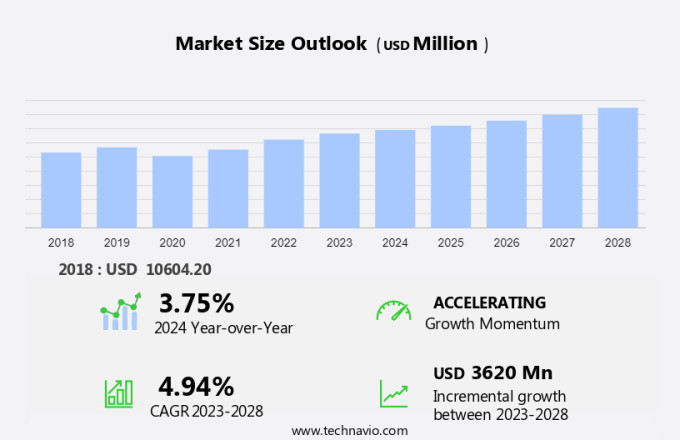

The calcium hydroxide market size is forecast to increase by USD 3.62 billion at a CAGR of 4.94% between 2024 and 2028. The market is experiencing significant growth due to the increasing demand for construction and infrastructure development. This trend is particularly prominent in emerging economies where urbanization and infrastructure expansion are priority areas for governments and private entities. Additionally, the modernization of lime production plants in Europe is driving the market, as these facilities adopt more efficient and environmentally friendly production methods. However, the market faces challenges related to environmental hazards associated with limestone mining, including water pollution and carbon emissions. Producers must address these concerns through sustainable mining practices and the implementation of advanced technologies to minimize the environmental impact of their operations.

Overall, the market is expected to witness steady growth in the coming years, driven by construction industry demand and the adoption of eco-friendly production methods.

Calcium hydroxide, also known as slaked lime or hydrated lime, is a critical ingredient in various industries, including water treatment, manufacturing, and construction. Caustic lime, another form of calcium hydroxide, is widely used as a flocculant in drinking water and wastewater recycling treatment to remove impurities and improve water quality. In the manufacturing sector, calcium hydroxide serves as a PH adjustment agent, a flux in the production of calcium oxide, and a slagging agent in the steel industry. In the water treatment industry, calcium hydroxide plays a significant role in precipitative softening and PH adjustment. It is used to remove contaminants from water and maintain desirable water quality.

In addition, calcium hydroxide is used in the production of calcium hypochlorite, a common disinfectant. Calcium hydroxide also finds applications in various industries, such as agriculture, where it is used as a soil structure improver and in the production of pesticides, fungicides, and herbicides. In the leather tanning industry, it is used as a PH adjustment agent, while in paper production, it is used as a filler and a sizing agent. Calcium hydroxide is available in both food grade and technical grade, making it suitable for various applications. The Mexican government has also announced infrastructure tenders to improve water treatment facilities, which is expected to boost the demand for calcium hydroxide in the region.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Grade Type

- Pharma grade

- Food grade

- Technical grade

- End-user

- Environmental water treatment

- Chemical

- Agriculture

- Zinc

- Others

- Geography

- APAC

- China

- India

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Grade Type Insights

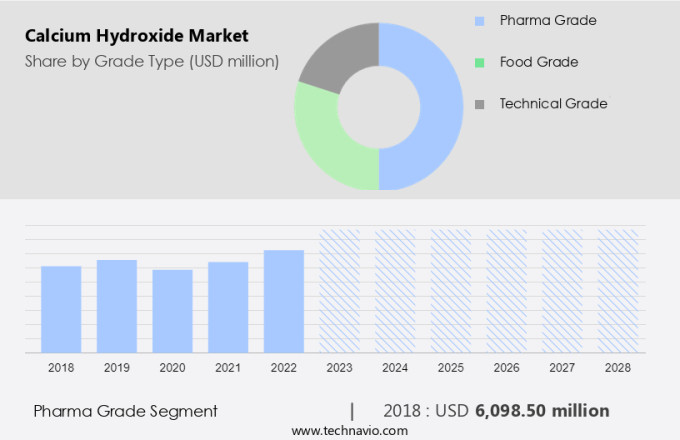

The pharma grade segment is estimated to witness significant growth during the forecast period. Calcium hydroxide, also known as slaked lime or hydrated lime, is a crucial component in various industries, including water treatment and steel manufacturing. Caustic lime, or calcium hydroxide in its caustic form, is utilized for pH adjustment and precipitative softening in water treatment plants. In the water treatment sector, calcium hydroxide serves as a flocculant in both industrial and municipal effluent treatment, enhancing water quality by removing contaminants. The Mexican government, through infrastructure tenders and the federal budget, invests in water treatment capacity expansion to meet drinking water regulations.

Get a glance at the market share of various segments Request Free Sample

The pharma grade segment was valued at USD 6.10 billion in 2018 and showed a gradual increase during the forecast period. In power generation, calcium hydroxide is employed as a flux and slagging agent in steel manufacturing and metallurgical uses. Additionally, it plays a significant role in flue gas treatment, neutralizing acidic gases and reducing emissions. The handling of calcium hydroxide sludges is a critical consideration in industrial processes, requiring research and development in efficient and sustainable methods. Renewable energy sources, such as wind and solar, are increasingly integrated into power generation, further emphasizing the importance of water treatment and calcium hydroxide's role in maintaining water quality for these energy sources.

Regional Insights

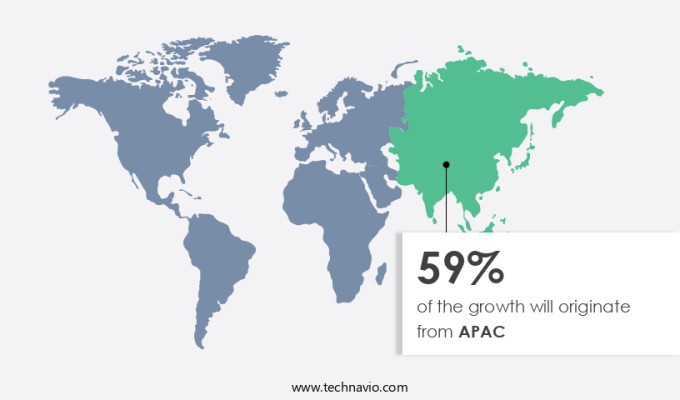

APAC is estimated to contribute 59% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Calcium hydroxide, also known as slaked lime or hydrated lime, is a critical ingredient in various industries, including water treatment and steel manufacturing. Caustic lime, or calcium oxide, is another form of calcium hydroxide, widely used for pH adjustment and precipitative softening. In the water treatment sector, calcium hydroxide serves as a flocculant for contaminant removal in both industrial and municipal effluent, ensuring water quality compliance with drinking water regulations. The Mexican government has prioritized infrastructure tenders and the federal budget for water treatment plants, focusing on renewable energy sources for power generation and flue gas treatment. The water treatment capacity expansion necessitates handling of sludges, leading to research and development in alkaline-based technologies for improved efficiency and manpower reduction.

Calcium hydroxide also finds applications in hygiene, as an active ingredient in calcium hypochlorite, and as a flux and slagging agent in steel manufacturing.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Calcium Hydroxide Market Driver

Increase in demand for construction and infrastructure development is the key driver of the market. Calcium hydroxide, a white powdered chemical compound, plays a significant role in various industries, including bauxite processing, environmental remediation applications, and construction. In construction, it is used as a concrete curing agent, soil conditioner, and in the manufacturing process of high calcium limestone and ground calcium oxide. Its applications extend to asphalt manufacturing, alkali chemical manufacturing, and refractories. Domestic consumption of calcium hydroxide is driven by its use in commercial sale for construction applications, such as concrete curing, soil stabilization, and improving soil acidity and structure. Additionally, calcium hydroxide is used in environmental uses, including the removal of heavy metal contamination.

In industry, it is utilized in the manufacturing process of pesticides, fungicides, herbicides, leather tanning, paper production, and as a food grade, technical grade, and pharmaceutical grade additive. The rise in infrastructure development in regions like the Middle East and Africa, due to population growth and mega-events, such as the FIFA World Cup 2022 and Dubai Expo 2022, is expected to further increase the demand for calcium hydroxide.

Calcium Hydroxide Market Trends

Modernization of lime production plants in Europe is the upcoming trend in the market. The market in Europe is experiencing significant transformation due to the region's commitment to a low-carbon economy by 2050. As a carbon- and energy-intensive sector, the lime industry is anticipated to play a substantial role in achieving Europe's environmental, energy, and climate targets. The modernization of lime processing plants is underway, with a focus on improving engine efficiency and implementing alternative fuel sources to minimize carbon emissions. Calcium Hydroxide, also known as slaked lime or limewater, is a white powdered chemical compound with various applications. In bauxite processing, it is used as a flotation agent. In environmental remediation applications, it aids in heavy metal contamination removal.

Construction applications include soil stabilization, concrete curing, and asphalt manufacturing. Alkali chemical manufacturing, refractories, and commercial sale also utilize Calcium Hydroxide. Domestic consumption of Calcium Hydroxide is prevalent in environmental uses such as soil conditioning, neutralizing soil acidity, and improving soil structure. It is also employed as a pesticide, fungicide, and herbicide in agriculture. In industries like leather tanning, paper production, food grade, technical grade, and pharmaceutical grade Calcium Hydroxide is an essential ingredient. Ground Calcium Oxide, a coarse particle form of Calcium Hydroxide, is used in air separation processes. In summary, the market in Europe is undergoing a shift towards sustainable production methods to align with the region's environmental goals.

Its versatile applications span across various industries, including construction, manufacturing processes, and environmental remediation.

Calcium Hydroxide Market Challenge

Environmental hazards of limestone mining is a key challenge affecting the market growth. Calcium hydroxide, a white powdery chemical compound, is primarily derived from high calcium limestone or obtained as a byproduct in the manufacturing process of other chemicals such as lime and alkali. Its applications span various industries, including construction, where it serves as a concrete curing agent and soil conditioner to improve soil structure, acidity, and stability. In bauxite processing, calcium hydroxide is used to neutralize the acidity of the bauxite residue during the refining process. Environmental uses include heavy metal contamination remediation and water treatment. Additionally, calcium hydroxide is employed in asphalt manufacturing, alkali chemical manufacturing, sugar refining, and commercial sale for miscellaneous uses such as refractories, pesticides, fungicides, herbicides, leather tanning, paper production, and food and pharmaceutical grades.

Ground calcium oxide, coarse particles of calcium hydroxide, is used in air separation for the production of oxygen.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Anmol Chemicals Group - The company offers calcium hydroxide such as hydrated lime, and slaked lime.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Boral Ltd.

- Calcinor SA

- Cales de Pachs SA

- CAO Industries Sdn Bhd

- Carmeuse Coordination Center SA

- GFS Chemicals Inc.

- Graymont Ltd

- Hydrite Chemical Co.

- Innova Corporate India

- Jost Chemical Co.

- Lhoist SA

- Minerals Technologies Inc.

- Mississippi Lime Co.

- Niki Chemical Industries

- Nordkalk Corp.

- Sigma Minerals Ltd.

- Singleton Birch Ltd.

- Tara Minerals and Chemicals Pvt. Ltd.

- United States Lime and Minerals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Calcium hydroxide, also known as caustic lime, slaked lime, or hydrated lime, is a crucial component in various industries, including water treatment and steel manufacturing. In the water treatment sector, calcium hydroxide is used as a flocculant to improve water quality by removing contaminants from drinking water and wastewater. In the municipalities and industrial effluent sectors, calcium hydroxide plays a significant role in ph adjustment and precipitative softening processes. The Mexican government's infrastructure tenders and federal budget have boosted the market in recent years, with a focus on water treatment plants and renewable energy sources. Calcium hydroxide is used in flue gas treatment for power generation and as a flux and slagging agent in steel manufacturing.

However, the market faces challenges such as manpower shortage and the handling of sludges generated during the production process. Research and development in alkaline-based technologies, such as FGD technology, are ongoing to address these challenges and improve the overall efficiency of calcium hydroxide production and usage. Calcium oxide, a precursor to calcium hydroxide, is also used in various applications, including ph adjustment and the manufacturing of calcium hypochlorite. Impurities in calcium hydroxide can affect its quality and usage, making purity a critical factor in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.94% |

|

Market growth 2024-2028 |

USD 3.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.75 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 59% |

|

Key countries |

China, US, India, Germany, and Indonesia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Anmol Chemicals Group, Boral Ltd., Calcinor SA, Cales de Pachs SA, CAO Industries Sdn Bhd, Carmeuse Coordination Center SA, GFS Chemicals Inc., Graymont Ltd, Hydrite Chemical Co., Innova Corporate India, Jost Chemical Co., Lhoist SA, Minerals Technologies Inc., Mississippi Lime Co., Niki Chemical Industries, Nordkalk Corp., Sigma Minerals Ltd., Singleton Birch Ltd., Tara Minerals and Chemicals Pvt. Ltd., and United States Lime and Minerals Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch