Calcium-Zinc Stabilizer Market Size 2024-2028

The calcium-zinc stabilizer market size is forecast to increase by USD 562.1 million at a CAGR of 5.6% between 2023 and 2028.

- The market is experiencing significant growth due to the rapid industrialization and urbanization In the Asia-Pacific region. With expanding manufacturing and production units, there is a growing demand for calcium-zinc stabilizers to address complexities related to these stabilizers in various industries. The use of calcium-zinc stabilizers is essential to prevent the degradation of PVC products, ensuring their longevity and durability. The market for calcium-zinc stabilizers is expected to continue growing due to the increasing demand for plastics and the need for sustainable and non-toxic alternatives to lead-based stabilizers. Calcium-Zinc Stabilizers are widely used in applications such as PVC pipes and tubing, wires and cables, and profiles and tubes.

What will be the Size of the Calcium-Zinc Stabilizer Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for non-toxic alternatives to traditional lead-based stabilizers in various industries. Lightweight materials, such as polyvinyl chloride (PVC), used extensively in consumer goods and construction, require effective thermal stability and weather resistance solutions.

- Moreover, calcium-zinc stabilizers, available in powder, liquid, and paste forms, offer superior heat resistance, light resistance, and weathering protection. These environmentally friendly stabilizers have gained popularity in applications ranging from PVC in electric vehicles to bioplastics, as they provide comparable performance to toxic stabilizers without the associated health and environmental risks. The market is expected to continue expanding as the need for sustainable and safe alternatives to lead-based products increases.

How is this Calcium-Zinc Stabilizer Industry segmented and which is the largest segment?

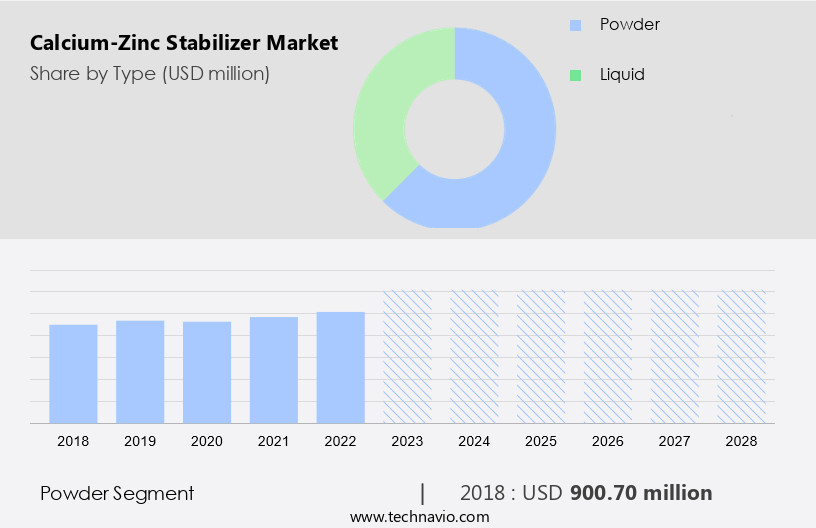

The calcium-zinc stabilizer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Powder

- Liquid

- Application

- Building and construction

- Automotive

- Packaging

- Health care

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Type Insights

- The powder segment is estimated to witness significant growth during the forecast period.

Calcium-zinc (Ca-Zn) stabilizers, available in powder form, are essential additives In the polyvinyl chloride (PVC) industry. These stabilizers offer numerous benefits, including improved processing efficiency, enhanced heat resistance, and long-term stability for PVC products. Key market participants, such as Baerlocher GmbH and Valtris Specialty Chemicals, provide powdered Ca-Zn stabilizers specifically designed for applications in construction, cables, and pipes. The powdered formulation's advantages lie in its ability to ensure product durability and reliable performance under harsh conditions. This makes it an ideal choice for industries that demand high-performance PVC materials. By using Ca-Zn stabilizers, manufacturers can produce PVC products with superior stability and resistance to degradation, ultimately leading to increased customer satisfaction and brand loyalty.

Get a glance at the Calcium-Zinc Stabilizer Industry report of share of various segments Request Free Sample

The powder segment was valued at USD 900.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific region is experiencing significant growth In the market due to increasing infrastructure development and urbanization. China, as a major player In the region, is driving this trend through initiatives like the West Development Strategy and 'Go West Campaign.' These efforts have led to an increase in demand for durable, non-toxic materials in construction, particularly in areas with challenging environmental conditions. Calcium-zinc stabilizers, which enhance the thermal stability and weather resistance of PVC products, are well-positioned to meet this need. The Chinese government's commitment to investing billions in infrastructure projects underscores the importance of using safe, efficient, and long-lasting materials, making calcium-zinc stabilizers an attractive solution for the construction industry In the region.

Market Dynamics

Our calcium-zinc stabilizer market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Calcium-Zinc Stabilizer Industry?

Rapid industrialization and urbanization in Asia-Pacific is the key driver of the market.

- The market is experiencing significant growth In the Asia-Pacific (APAC) region, particularly in East Asia, due to the region's rapid industrialization and urbanization. With economies In the region projected to expand at a rate of 4.8% in 2024, there is a rising demand for PVC-based products across various industries, including construction, infrastructure, and automotive. This growth is particularly notable in countries such as Indonesia, Malaysia, the Philippines, Vietnam, and Thailand, where domestic consumption is increasing. To meet the demand for durable and sustainable PVC products, there is a growing need for high-performance stabilizers. Calcium-Zinc Stabilizers, which offer thermal stability, weather resistance, and lightweight properties, are gaining popularity as a non-toxic alternative to lead-based stabilizers.

- Moreover, these stabilizers are also environmentally friendly and are available in both solid form (powder) and liquid form. In the electrical and electronics industry, these stabilizers are used in wires and cables for electric vehicles. The demand for calcium-zinc stabilizers is expected to continue to grow as there is a shift towards alternative stabilizers that offer superior performance and are less harmful to health and the environment compared to toxic lead-based products. Calcium-Zinc Stabilizers offer several advantages over traditional stabilizers.

What are the market trends shaping the Calcium-Zinc Stabilizer Industry?

Expanding manufacturing and production units is the upcoming market trend.

- The market is experiencing a significant expansion as companies respond to the increasing demand for eco-friendly and high-performance additives in various industries, particularly in PVC and polymers. For instance, Baerlocher India, a leading player, announced the opening of a new production facility in Dewas, Madhya Pradesh, in January 2024. This state-of-the-art facility, which prioritizes sustainability, incorporates advanced features such as solar power generation, biomass fuel utilization, and a focus on renewable energy and water efficiency. This move reflects the industry's growing focus on minimizing environmental impact and enhancing energy efficiency. Calcium-Zinc stabilizers are essential additives for enhancing the thermal stability, weather resistance, and heat resistance of PVC products, including pipes and tubing, profiles and tubes, wires and cables, and consumer goods.

- In addition, these stabilizers are available in various forms, including solid form, liquid form, and paste form, catering to diverse application requirements. Moreover, the shift toward electric vehicles and the growing popularity of bioplastics have created new opportunities for calcium-zinc stabilizers In the electrical and electronics sector and the consumer goods industry, respectively. Alternative stabilizers, such as calcium-zinc stabilizers, are gaining traction as non-toxic alternatives to lead-based stabilizers, which have been phased out due to their toxicity and environmental concerns. Therefore, the market is poised for growth, driven by the increasing demand for sustainable and high-performance additives in various industries, including construction, electrical and electronics, and consumer goods.

What challenges does the Calcium-Zinc Stabilizer Industry face during its growth?

Complexities issues related to Ca-Zn stabilizers is a key challenge affecting the industry growth.

- The market faces compatibility challenges due to the interaction of these stabilizers with other additives and materials. Calcium-zinc stabilizers provide exceptional performance in various applications, but their formulations may not always be compatible with specific resins or additives, leading to processing difficulties. Incompatible stabilizer solutions can result in uneven dispersion or reduced stability, negatively impacting product quality and consistency. To address these challenges, manufacturers must carefully evaluate their application needs when selecting stabilizers. Collaborating with experienced suppliers who can customize stabilizer solutions and ensure compatibility with other formulation components is crucial for optimal performance in industries such as PVC applications in Construction, Electrical and Electronics, and Electric Vehicles.

- Furthermore, non-toxic Calcium-Zinc Stabilizers, available in both solid and liquid forms, offer a safer alternative to lead-based stabilizers, making them an environmentally friendly choice for Bioplastics and other consumer goods. These stabilizers provide thermal stability, heat resistance, light resistance, and weathering properties, making them essential for Pipes and Tubing, Wires and Cables, Profiles and tubes, and other applications.

Exclusive Customer Landscape

The calcium-zinc stabilizer market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the calcium-zinc stabilizer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, calcium-zinc stabilizer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADEKA Corp

- Akdeniz Chemson

- ALA Polystabs PVT Ltd

- Baerlocher GmbH

- Clariant International Ltd

- Faith Industries Ltd.

- Galata Chemicals LLC

- Jiangsu Pangrui New Materials Co Ltd

- MLA Group of Industries

- Nimbasia Stabilizers

- Patcham FZC

- Pau Tai Industrial Corp.

- Reagens Spa

- Shandong Novista Chemicals Co. Ltd.

- Shandong Ruifeng Chemical Co Ltd

- Shital Industries Pvt Ltd.

- Songwon Industrial Co. Ltd.

- Suryadevara Polytech Pvt Ltd.

- Valtris Specialty Chemicals

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Calcium-zinc stabilizers have gained significant attention in various industries due to their ability to enhance the thermal stability and weather resistance of plastics. These stabilizers, which can be available in both solid and liquid forms, play a crucial role in improving the performance and longevity of products in diverse applications. The demand for calcium-zinc stabilizers is driven by the increasing use of plastics in construction, electrical and electronics, consumer goods, and automotive industries. In construction, calcium-zinc stabilizers are used to produce PVC profiles and tubes, which offer excellent durability and resistance to weathering. In the electrical and electronics sector, these stabilizers are employed in wires and cables to ensure heat resistance and prevent degradation.

In addition, calcium-zinc stabilizers are also gaining popularity as a non-toxic alternative to lead-based stabilizers. The growing concerns regarding the health and environmental hazards associated with lead-based products have led to the development of environmentally friendly stabilizers. Calcium-zinc stabilizers, being non-toxic, offer a safer and more sustainable solution for various applications. The lightweight nature of calcium-zinc stabilizers is another factor contributing to their widespread adoption. In the automotive industry, these stabilizers are used in electric vehicles to produce lightweight components, which help reduce the overall weight of the vehicle and improve its fuel efficiency. Moreover, calcium-zinc stabilizers offer excellent thermal stability, making them suitable for use in applications that require high temperatures.

For instance, In the production of bioplastics, calcium-zinc stabilizers are used to enhance the heat resistance of the material, enabling it to withstand high processing temperatures. Calcium-zinc stabilizers are also used in PVC applications, including pipes and tubing, to improve their resistance to weathering and ensure long-lasting performance. In the consumer electronics sector, calcium-zinc paste stabilizers are used to provide additional protection against thermal degradation in wires and cables. The market for calcium-zinc stabilizers is expected to grow at a steady pace due to the increasing demand for plastics in various industries and the growing preference for non-toxic alternatives to lead-based stabilizers.

Additionally, the development of new applications, such as in electric vehicles, is expected to provide new opportunities for calcium-zinc stabilizer manufacturers. Therefore, calcium-zinc stabilizers play a vital role in enhancing the performance and longevity of plastics in various applications. Their non-toxic nature, lightweight properties, and excellent thermal stability make them a popular choice for industries such as construction, electrical and electronics, consumer goods, and automotive.

|

Calcium-Zinc Stabilizer Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2024-2028 |

USD 562.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.1 |

|

Key countries |

China, US, Germany, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Calcium-Zinc Stabilizer Market Research and Growth Report?

- CAGR of the Calcium-Zinc Stabilizer industry during the forecast period

- Detailed information on factors that will drive the Calcium-Zinc Stabilizer growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the calcium-zinc stabilizer market growth of industry companies

We can help! Our analysts can customize this calcium-zinc stabilizer market research report to meet your requirements.