Car Rack Market Size 2024-2028

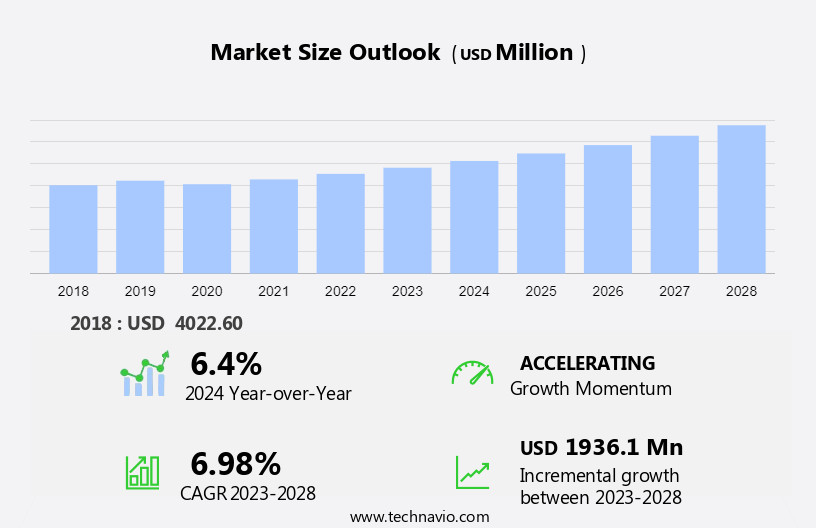

The car rack market size is forecast to increase by USD 1.94 billion at a CAGR of 6.98% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing demand for smaller cars is driving market growth, as these vehicles often come without built-in roof racks, creating a need for aftermarket solutions. Additionally, the growing popularity of outdoor activities, such as skiing and camping, is boosting the market, as participants seek convenient and efficient ways to transport their equipment. Materials like aluminum and steel ensure durability, while crossbars and gear mounts provide customizable solutions for various gear types. However, challenges remain, including the difficulties in installation and ensuring proper fit and safety. Properly addressing these challenges will be crucial for market success. The market analysis report provides a comprehensive examination of these trends and challenges, offering valuable insights for stakeholders looking to capitalize on the growth opportunities In the market.

What will be the Size of the Car Rack Market During the Forecast Period?

- The market caters to the growing demand for transporting outdoor adventure gear, such as bicycles, kayaks, skis, and other recreational equipment, during travel. With increasing restrictions on traveling and uncertainties in economies, there is a heightened emphasis on contingency plans for personal vehicles. Car racks have become essential for tourism activities, including mountain biking and ski trips. Lightweight and durable designs, adjustable fittings, and smart rack systems are popular trends, offering convenience and versatility. The market also prioritizes theft protection features, ensuring peace of mind for passengers. The coronavirus pandemic has accelerated the adoption of car racks, as travelers seek safe and flexible transportation options.

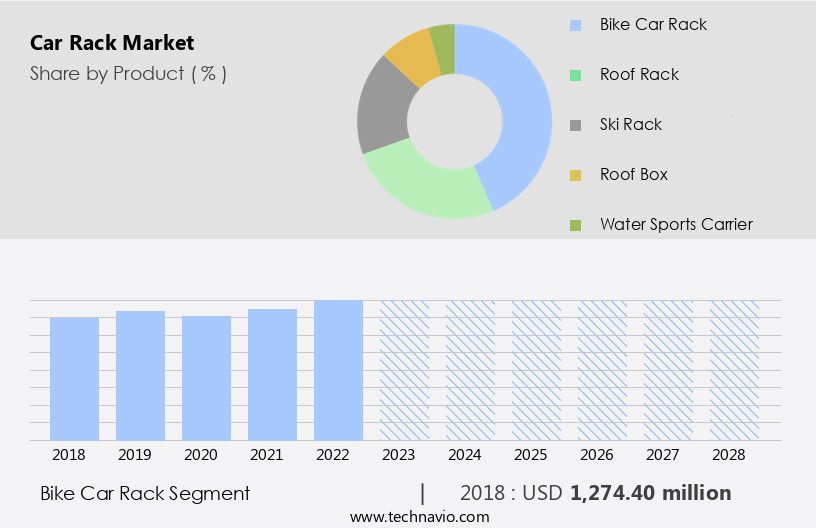

How is this Car Rack Industry segmented and which is the largest segment?

The car rack industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Bike car rack

- Roof rack

- Ski rack

- Roof box

- Water sports carrier

- Application

- Passenger vehicle

- Commercial vehicle

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Product Insights

- The bike car rack segment is estimated to witness significant growth during the forecast period.

The market In the US is experiencing growth due to the increasing popularity of outdoor recreational activities, particularly those involving biking, ski trips, and camping. The millennial generation's preference for adventure sports and eco-friendly mobility options, such as electric bikes and scooters, is driving demand for car racks to transport these items. However, business uncertainties and travel restrictions arising from the global economic situation and the COVID-19 pandemic have created contingency plans for consumers, leading to an increased focus on personal vehicles for leisure trips. Car racks for compact SUVs, roof racks, and towers are gaining popularity due to their versatility and convenience.

The market is also witnessing capacity expansions, joint ventures, and the introduction of new materials to enhance product durability and lightweight design. The roof rack segment, which includes carriers for bikes, kayaks, skis, and other gear, is a significant contributor to the market's growth. Consumers prioritize quality, pricing, and theft protection features when purchasing car racks, making adjustable fittings, smart racks, and online payment options essential. The market caters to various vehicle types, including recreational vehicles, motorhomes, lifestyle pickup trucks, and commercial car racks. The market's future growth is expected to be influenced by factors such as fuel efficiency, vehicle roof rails, and load bearing capacities.

Get a glance at the Car Rack Industry report of share of various segments Request Free Sample

The bike car rack segment was valued at USD 1.27 billion in 2018 and showed a gradual increase during the forecast period.

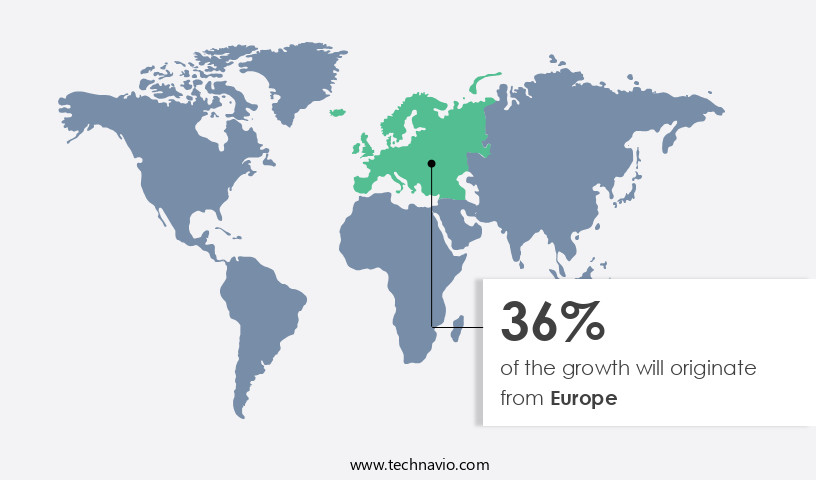

Regional Analysis

- Europe is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the region is anticipated to experience moderate growth due to economic uncertainties and decreasing discretionary spending on vehicle accessories. Outdoor recreational activities, such as mountain biking, ski trips, and camping, are popular among the millennial generation and tourists. However, the slowdown In these activities due to weather conditions and limited living spaces in urban areas may negatively impact the market. Contingency plans and business uncertainties may also influence consumers' decisions to invest in car racks. The market offers a range of options, including lightweight and durable racks with adjustable fittings, smart racks with theft protection features, and compact solutions for urban populations.

New materials, such as aluminum and steel, are used to ensure quality and affordability, while multifunctional racks cater to various vehicle types and leisure pursuits. The market includes roof racks for luggage, bicycles, and other gear, as well as towers, fitting pieces, crossbars, and gear mounts. Car racks are essential for leisure vehicles, such as motorhomes, campers, and off-road vehicles, as well as commercial applications, such as car rentals and taxi services. The market's future growth depends on factors such as fuel efficiency, load bearing capacities, and compatibility with vehicle roof rails. The market is expected to expand through capacity expansions, joint ventures, and innovation in eco-friendly mobility options, such as electric bikes and scooters.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Car Rack Industry?

Increasing demand for smaller cars is the key driver of the market.

- Car racks have gained significant popularity among US consumers, particularly those who engage in outdoor adventure activities such as mountain biking, ski trips, and camping. With traveling restrictions and business uncertainties caused by the tourism sector's downturn, car racks have become essential for millennials and families seeking contingency plans for leisure trips. These racks enable the transportation of gear, including bikes, kayaks, skis, and other equipment, on compact SUVs, lifestyle pickup trucks, motorhomes, and recreational vehicles. The roof rack segment, in particular, has seen rising popularity due to its versatility and compatibility with various vehicle types. Brands offer a range of roof racks, from lightweight and durable smart racks to adjustable fittings that cater to different roof rail types and vehicle capacities. The market's growth is driven by the increasing demand for eco-friendly mobility options, such as electric bikes and scooters, which can be easily transported using these racks. Despite the benefits, challenges persist, including pricing difficulties, rust and corrosion concerns, and product expenses. Consumers must consider the roof rack's capacity, compatibility, ease of use, and theft protection features when making a purchase.

- Further, online payment options, interest rates, and compatibility with various roof rails are also essential factors. Car rack manufacturers face raw material costs and inventory management challenges, necessitating capacity expansions and joint ventures to meet the growing demand. The market's future growth is influenced by the rising popularity of adventure sports, consumers' increasing focus on living standards, and the need for eco-friendly commuting options. Thus, car racks offer a convenient and versatile solution for consumers seeking to transport their gear for outdoor recreational activities. The market's growth is driven by various factors, including the increasing popularity of adventure sports, the need for eco-friendly commuting options, and the demand for compact, lightweight, and durable racks. Despite challenges, the future looks promising for this market as more consumers embrace the car rack lifestyle.

What are the market trends shaping the Car Rack Industry?

Increasing initiatives to enhance participation in skiing is the upcoming market trend.

- The market is experiencing significant growth due to increasing travel restrictions and the rising popularity of outdoor adventure activities among the millennial generation. Car racks are essential for transporting gear such as mountain bikes, kayaks, skis, and other equipment for leisure activities like camping, hiking, cycling, skiing, and snowboarding. With the increasing demand for eco-friendly mobility options, there is also a growing trend towards electric bikes, scooters, and other micro-mobility vehicles. Business uncertainties and contingency plans have led consumers to invest in high-quality, durable, and adjustable car racks that offer theft protection features and online payment options. Compact SUVs, lifestyle pickup trucks, motorhomes, and recreational vehicles are popular choices for those seeking versatility and vehicular capabilities for off-roading and camping trips. The roof rack segment, including crossbars, gear mounts, and fitting pieces, is a significant contributor to the market's growth. New materials, such as lightweight and rust-resistant alloys, are being used to improve product quality and reduce product expenses. Capacity expansions and joint ventures are common strategies among market players to meet the increasing demand for car racks.

- Moreover, the tourism sector, including car rental, taxi services, and commercial car racks, is a significant consumer base for the market. The market is also influenced by factors such as fuel efficiency, weight, and compatibility with vehicle roof rails, parallel loading, and aerodynamic design. The market dynamics are affected by various factors, including changing consumer preferences, product innovation, and economic conditions. The coronavirus pandemic has led to a demand for car racks as people seek alternative modes of transportation and outdoor recreational activities. However, high material costs and limited living spaces in urban populations pose challenges for the market's growth. Thus, the market is experiencing significant growth due to the increasing popularity of outdoor adventure activities, the rising trend of eco-friendly mobility options, and the changing consumer preferences towards versatile and durable car racks. The market is expected to continue its growth trajectory, driven by product innovation, capacity expansions, and joint ventures.

What challenges does the Car Rack Industry face during its growth?

Difficulties in installation is a key challenge affecting the industry growth.

- Car racks have gained significant popularity among consumers In the US market, particularly among the millennial generation, as they enable the transportation of outdoor recreational equipment for traveling restrictions due to the pandemic and personal leisure trips. The roof rack segment, including carriers, towers, fitting pieces, crossbars, and gear mounts, is a crucial part of the market, catering to various vehicle types such as compact SUVs, lifestyle pickup trucks, motorhomes, and recreational vehicles. Business uncertainties and contingency plans have led to increased demand for lightweight, durable, and adjustable fittings that can accommodate gear such as mountain bikes, kayaks, skis, and other sporting equipment. The companies are focusing on providing smart racks with theft protection features, online payment options, and interest-free financing to cater to consumers' needs. The market dynamics are influenced by factors such as the rising popularity of adventure sports, fuel efficiency, weight, and vehicle roof rails' load-bearing capacities.

- Further, companies are investing in capacity expansions, joint ventures, and new materials to meet the demand for multifunctional racks and eco-friendly mobility options like electric bikes and scooters. The market faces challenges such as pricing difficulties, rust and corrosion, and product expenses. However, the convenience and versatility of car racks make them a worthwhile investment for families and individuals seeking to enhance their leisure pursuits and outdoor adventures. The tourism sector, including car rental, taxi services, and campers, also benefits from the availability of reliable and efficient car racks. Thus, the market is a dynamic and evolving industry that caters to the growing demand for eco-friendly mobility options and the need for convenience and versatility in personal transportation. companies are focusing on innovation, ease of use, and reliability to meet the demands of consumers and the tourism sector.

Exclusive Customer Landscape

The car rack market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the car rack market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, car rack market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACPS Automotive GmbH

- Atera GmbH

- Car Mate Mfg Co Ltd

- Cequent

- CRUZBER SA

- Demar UK Ltd.

- Farad Pvt. Ltd.

- Front Runner GmbH

- JAC Products

- KAMEI GmbH and Co. KG

- Kuat Innovations LLC

- Malone Auto Racks

- Mont Blanc Group AB

- Perrycraft Inc.

- Rhino Rack Pty Ltd.

- Saris Cycling Group Inc.

- Thule Sweden AB

- TOWER POPULAR Ind Co. Ltd.

- Tradesman Roof Racks

- Yakima Products Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth as consumers seek convenient and versatile solutions for transporting various gear and equipment. This trend is driven by the rising popularity of outdoor recreational activities, such as camping, hiking, cycling, skiing, and snowboarding. These activities have gained increasing appeal among consumers, particularly the millennial generation, who prioritize leisure pursuits and eco-friendly mobility options. The market for car racks is diverse, catering to various vehicle types and consumer needs. Passenger cars, compact SUVs, and recreational vehicles, including motorhomes, campers, and off-road vehicles, all require specialized car racks for transporting gear. The market offers a range of options, from multifunctional racks that can accommodate multiple types of equipment to single-use racks designed for specific items such as bikes, kayaks, or skis. Manufacturers are continually innovating to meet consumer demands, with new materials and designs being introduced regularly. Lightweight and durable materials, such as aluminum and composite materials, are becoming increasingly popular due to their strength and fuel efficiency. Adjustable fittings and smart racks with theft protection features also add value for consumers. The market is influenced by various market dynamics. Consumer preferences for convenience and versatility, as well as the increasing popularity of outdoor recreational activities, are driving demand.

Additionally, urbanization and limited living spaces are leading to an increased reliance on private vehicles for transportation and storage. However, the market also faces challenges, including pricing difficulties and high material costs.

Manufacturers must balance the need for affordability with the requirement for high-quality, durable products. Furthermore, the market is subject to economic fluctuations and external factors, such as the coronavirus pandemic, which can impact demand and production. Despite these challenges, the future of the market looks promising. Consumers' desire for convenient and versatile transportation solutions, combined with the growing trend towards eco-friendly mobility options, is expected to drive continued growth. Additionally, advancements in technology and materials are likely to lead to new and innovative products that cater to evolving consumer needs. Thus, the market is a dynamic and growing industry that caters to consumers' increasing demand for convenient and versatile transportation solutions for their gear and equipment. Manufacturers must continually innovate to meet these demands while navigating challenges such as pricing difficulties and economic fluctuations. The future of the market looks bright, with continued growth expected as consumers prioritize outdoor recreational activities and eco-friendly mobility options.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.98% |

|

Market growth 2024-2028 |

USD 1.94 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Car Rack Market Research and Growth Report?

- CAGR of the Car Rack industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the car rack market growth of industry companies

We can help! Our analysts can customize this car rack market research report to meet your requirements.