Cat Litter Market Size 2025-2029

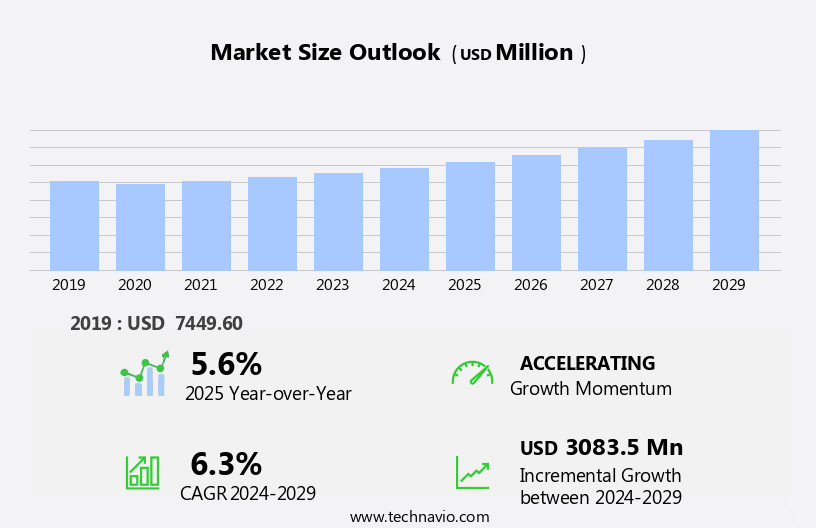

The cat litter market size is forecast to increase by USD 3.08 billion at a CAGR of 6.3% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing number of cat owners In the US and the trend toward premiumization in pet care services. As more Americans choose to bring cats into their homes, the demand for high-quality cat litter products has risen. Furthermore, pet owners are willing to invest in superior cat litter options that offer benefits such as odor control, easy clumping, and eco-friendliness. In addition, there is growing interest in how furniture and home decor can be designed to complement pet-related products, such as discreet litter box enclosures that blend with modern furniture styles. However, challenges remain in the adoption of cat litter products, including consumer preferences for natural and biodegradable options, as well as concerns over the potential health risks associated with certain types of litter. Overall, the market is expected to continue expanding, with manufacturers focusing on developing eco-friendly, cost-effective, and high-performing products to meet the evolving needs of cat owners.

What will be the Size of the Cat Litter Market During the Forecast Period?

- The market caters to the needs of pet owners seeking effective care solutions for their feline companions. This market encompasses a wide range of products, including odor-controlling clays, silica gel crystals, natural plant-based alternatives, and eco-friendly options made from wood, bamboo, sawdust, and other materials. The market's growth is driven by the increasing number of pet owners who prioritize their pets' health and hygiene. Anthropomorphism and the desire for easy cleanup, long-lasting freshness, and biodegradable or compostable options have fueled the demand for advanced cat litter solutions. The millennial and Generation Z demographics, who are more likely to consider themselves pet parents, are significant contributors to the market's growth.

- Smart litter systems that monitor and alert pet owners when it's time to change the litter are gaining popularity. Specialized pet shops and internet sales channels cater to the diverse needs of this market, offering a range of options to suit various budgets and preferences.

How is this Cat Litter Industry segmented and which is the largest segment?

The cat litter industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Clumping

- Conventional

- Distribution Channel

- Offline

- Online

- Raw Material

- Clay

- Silica

- Biodegradable materials

- Type

- Scented

- Unscented

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Product Insights

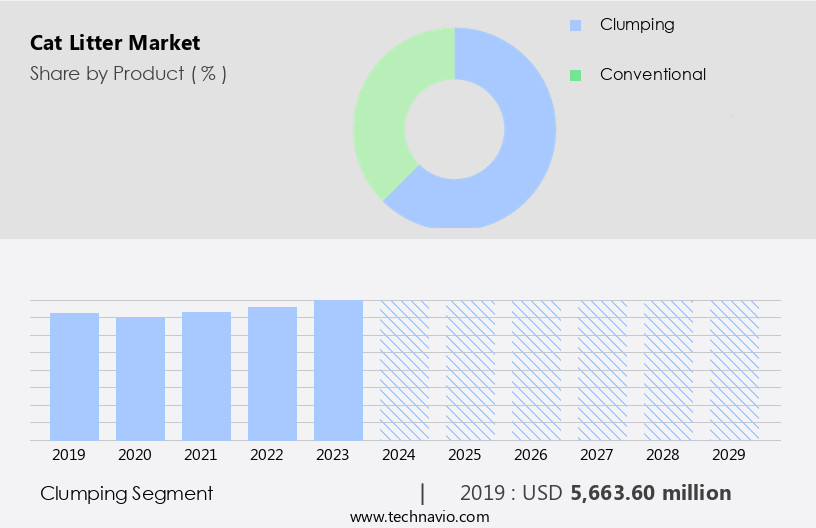

- The clumping segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing number of pet owners prioritizing care solutions for their feline companions. Clumping litter, made from materials like clay and silica, dominates the market due to its easy cleanup and long-lasting freshness. Innovations include smart litter systems, biodegradable and compostable options, and eco-friendly alternatives made from natural plant-based materials, corn, wheat, walnut shells, pine, diatomaceous earth, and thermoplastic polymer. Brands focus on consumer trust and brand loyalty, especially among the millennial generation and older adults. Sustainable cat litter, such as those made from wood, bamboo, sawdust, and recycled litter products, are gaining popularity.

Get a glance at the Cat Litter Industry report of share of various segments Request Free Sample

The Clumping segment was valued at USD 5.66 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

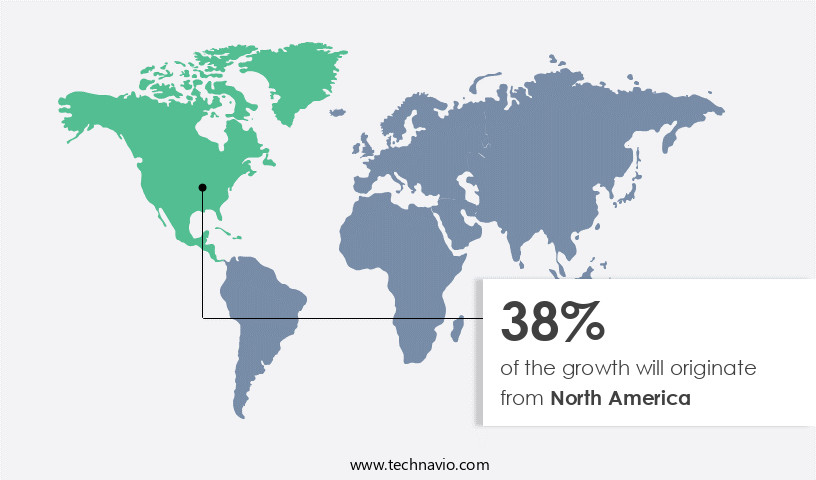

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is the largest segment globally, driven by the growth of the pet industry and increasing cat ownership. The region's market size is bolstered by the expanding cat food industry, cat insurance sector, and rising online sales of cat products. Smart cat care devices, technological advancements, and easy access to cat litter are additional growth factors. In North America, eco-friendly options, such as biodegradable and compostable cat litters, are gaining popularity among pet owners. Brands offer various solutions, including clumping clay, silica gel crystals, natural plant-based alternatives, and smart litter systems, catering to consumers' preferences for easy cleanup, long-lasting freshness, and odor control.

The market also includes cat litter deodorizers, jugs, mats, and cat litter boxes. Consumer trust and brand loyalty are essential, with millennials and older adults prioritizing natural materials and considering the environmental impact. Natural materials like corn, wheat, walnut shells, pine, and diatomaceous earth are used in eco-friendly cat litters. Brands offer recycled and reusable litter products made from thermoplastic polymer, bentonite, and plant fiber litters. The market's growth is further fueled by the increasing demand for sustainable and natural cat litter options, including wood, bamboo, sawdust, and unscented varieties. Online retailers and specialized pet shops contribute significantly to market sales, with social media networks and direct-to-consumer trends influencing consumer behavior.

Cat litter brands employ hashtag campaigns, social media influencers, and

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cat Litter Industry?

Increase in number of people owning cats is the key driver of the market.

- The market has experienced notable growth due to the rising number of pet cat owners and their increasing spending on premium pet care solutions. With cats being considered as cherished family members, pet owners seek innovative and specialized products to ensure their feline companions' comfort and wellbeing. According to the American Pet Products Association, approximately two-thirds of US households own cats, and spending on cats continues to increase, encompassing veterinary care, cat accessories, and cat food. In response to this trend, the market offers a wide range of products catering to various preferences and needs. These include odor-controlling clumping clay and silica gel crystals, eco-friendly options such as biodegradable and compostable alternatives, smart litter systems, and easy-to-clean long-lasting freshness solutions.

- Brands are focusing on consumer trust and brand loyalty by offering natural plant-based alternatives, natural cat litters, and health benefits. Moreover, the market caters to different demographics, such as millennial generation and older adults, with various price points and unscented options. Online retailers, specialized pet shops, and internet sales have become popular channels for purchasing cat litter. The market also offers sustainable cat litter options made from wood, bamboo, sawdust, and other natural materials. Branding, consumer trust, and sustainability are essential factors influencing the market. Social media networks and direct-to-consumer trends have become essential marketing tools for brands to reach potential customers and build brand loyalty.

- Cat litter deodorizers, cat litter jugs, cat litter mats, and cat litter box accessories are some of the additional products offered in the market. The market is driven by the growing number of cat owners, their increasing spending on pet care, and the demand for innovative, eco-friendly, and health-conscious products. Brands are focusing on consumer preferences, sustainability, and building trust to cater to the diverse needs of cat owners.

What are the market trends shaping the Cat Litter Industry?

Growing trend of premiumization in pet care services is the upcoming market trend.

- The market experiences continuous growth due to the increasing number of pet cat owners who view their animals as family members and prioritize their care. This trend, often referred to as pet humanization, drives the demand for premium cat litter solutions. Eco-friendly options, such as biodegradable and compostable cat litters, have gained popularity among environmentally-conscious consumers. Smart litter systems with easy cleanup and long-lasting freshness are also sought after for their convenience. Branding and consumer trust play significant roles in the market. Feline companions and their health are top priorities for cat owners, leading to brand loyalty and the preference for high-quality, sustainable, and eco-friendly cat litter products.

- The millennial generation and older adults are major consumers, with a preference for natural materials like corn, wheat, walnut shells, pine, and diatomaceous earth. Clumping clay and silica gel crystals are common choices, while recycled and reusable litter products made from thermoplastic polymer, bentonite, eco-friendly cat litters, plant fiber litters, and natural cat litters are gaining traction. Cat litter deodorizers, jugs, mats, and cat litter boxes are essential accessories for cat owners. The market caters to various consumer segments, including adult cats, medium price range, unscented, and specialized pet shops. Online retailers, hashtag campaigns, and social media influencers are essential marketing channels.

- The market also includes for dogs, clumping litter, silica, and specialized products. Health benefits, hygiene, and sustainability are essential considerations for cat owners, making it crucial for brands to offer eco-friendly, ethically sourced alternatives that cater to cat safety and the environmental impact.

What challenges does the Cat Litter Industry face during its growth?

Challenges related to product adoption is a key challenge affecting the industry growth.

- The market caters to the needs of pet owners, providing care solutions for their feline companions. Odor-controlling features and eco-friendly options are popular trends in this market. Clumping clay and silica gel crystals are common types, while natural plant-based alternatives, such as corn, wheat, walnut shells, pine, and diatomaceous earth, are gaining traction due to their sustainability and health benefits. Smart litter systems, easy cleanup, and long-lasting freshness are other desirable features. Eco-friendly types, made from plant fiber and natural materials, are increasingly preferred by consumers for their reduced environmental impact. Biodegradable and compostable options are also available.

- Brands focus on branding, consumer trust, and brand loyalty, especially among millennial and older adult cat owners. The market includes specialized pet shops, internet sales, and direct-to-consumer trends. Unscented, high-quality products are popular, and online retailers, deodorizers, jugs, mats, and boxes are common offerings. Social media networks and influencers are used for marketing. However, challenges exist, such as cats' resistance to change and the stress caused by forceful adoption of new litter types. Noise from automated self-cleaning litter boxes can also disturb cats and their owners. Despite these challenges, the market continues to grow, driven by the increasing number of single individuals and the anthropomorphism of pets.

- The focus on sustainable, eco-friendly, and ethically sourced alternatives is a significant market trend.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Healthy Pet L.P.: The company offers cat litter such as okocat original premium clumping wood cat litter and okocat super soft clumping wood cat litter.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cat Litter Co.

- Church and Dwight Co. Inc.

- Dr. Elseys

- Healthy Pet L.P.

- Intersand

- Kent Corp.

- Laviosa Chimica Mineraria SpA

- Mars Inc.

- Naturally Fresh Cat Litter

- Nestle SA

- Oil Dri Corp. of America

- Pettex Ltd.

- TABPS PETS PVT. Ltd.

- Targeted PetCare LLC

- The Clorox Co.

- TOLSA SA

- Weihai Pearl Silica Gel CO. Ltd.

- ZOLUX SAS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the needs of pet owners seeking effective care solutions for their feline companions. This market encompasses a wide range of offerings designed to address various requirements, including odor control, eco-friendliness, and easy cleanup. These options span from traditional clumping clay to innovative silica gel crystals, natural plant-based alternatives, and smart litter systems. The demand for long-lasting freshness and biodegradable or compostable choices has led to the emergence of various eco-friendly options. Branding plays a significant role in the market, with consumers placing trust and loyalty in preferred brands. Feline companions are cherished members of families, and their well-being is a priority for their owners.

As a result, these choices are often influenced by factors such as health benefits, environmental impact, and consumer trust. Social media networks have become essential platforms for reaching cat owners, with direct-to-consumer trends and websites playing a growing role in the market. These devices deodorizers, jugs, mats, and other accessories are increasingly available online, making it convenient for consumers to shop from the comfort of their homes. The millennial generation and older adults alike are drawn to natural materials, such as corn, wheat, walnut shells, pine, and diatomaceous earth, as eco-friendly alternatives to conventional type. Clumping litter made from silica and recycled products, as well as reusable litter products, have also gained popularity due to their sustainability.

The market offers a diverse range of choices, including unscented options catering to sensitive noses and specialized pet shops that focus on natural and eco-friendly products. The sawdust segment, while not as popular as clumping or conventional clay and silica options, still holds a presence in the market. The anthropomorphism of pets, particularly cats, has led to an increased focus on pet health and hygiene. As a result, these choices are increasingly influenced by factors such as sustainability, eco-friendliness, and ethically sourced alternatives. Cat safety is also a concern, with many consumers opting for high-quality products that minimize the risk of health issues for their feline friends.

These boxes, which are an essential component of cat care, are available in various sizes and designs to accommodate different cat breeds and owner preferences. The market also offers a wide range of box styles, from traditional designs to high-tech, self-cleaning models. The market is a dynamic and diverse industry that caters to the needs of pet owners seeking effective, eco-friendly, and sustainable solutions. Brands that prioritize consumer trust, brand loyalty, and innovation are well-positioned to succeed in this market, as consumers continue to prioritize the health and well-being of their feline companions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 3.08 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, Canada, UK, Germany, China, France, Italy, The Netherlands, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cat Litter Market Research and Growth Report?

- CAGR of the Cat Litter industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cat litter market growth of industry companies

We can help! Our analysts can customize this cat litter market research report to meet your requirements.