Catheters Market Size 2024-2028

The catheters market size is forecast to increase by USD 18.13 billion, at a CAGR of 8.09% between 2023 and 2028.

- The market is driven by the increasing prevalence of chronic diseases, fueling the demand for diagnostic and therapeutic interventions. Minimally invasive procedures continue to gain traction, as they offer several advantages, including reduced recovery time, minimal scarring, and lower risk of infection. However, the market faces challenges, including the risk of complications, such as thrombosis, hemorrhage, and infection, which can lead to increased healthcare costs and patient morbidity. To mitigate these risks, companies must focus on developing advanced catheter technologies, such as biocompatible materials, improved designs, and enhanced coating technologies, to ensure patient safety and improve clinical outcomes.

- Additionally, regulatory compliance and stringent quality standards are crucial for market success. Companies must navigate these challenges while capitalizing on the growing demand for minimally invasive procedures and addressing the unmet needs of chronic disease patients.

What will be the Size of the Catheters Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The catheter market continues to evolve, driven by advancements in technology and increasing demand across various sectors. PTCA catheters, used for percutaneous transluminal coronary angioplasty, are a key segment, with ongoing research focusing on improving their efficacy and reducing complications. Peripheral venous catheters remain essential for fluid and medication administration, with a growing emphasis on reducing catheter-associated infections through the use of hydrogel coatings and improved sterilization methods. Pressure sensor catheters are gaining popularity in monitoring applications, while the development of biocompatible materials and innovative catheter designs is driving growth in the reusable catheter segment. The use of multi-lumen catheters for thrombosis prevention and temperature sensors in hemodialysis catheters is also on the rise.

Catheter insertion and removal techniques are continually being refined to minimize complications and improve patient outcomes. The manufacturing process for catheters is becoming more sophisticated, with an increasing focus on the use of radiopaque materials and the integration of flow sensors. The market dynamics of the catheter industry are continually unfolding, with new applications and technologies emerging in areas such as arterial catheters, urinary catheters, and angiography catheters. The ongoing quest for biocompatible materials and minimally invasive procedures is a significant trend, with companies investing in research and development to meet the evolving needs of healthcare providers and patients.

How is this Catheters Industry segmented?

The catheters industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Hospital stores

- Retail stores

- Others

- Product Type

- Cardiovascular catheters

- Specialty catheters

- Intravenous catheters

- Urinary catheters

- Neurovascular catheters

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

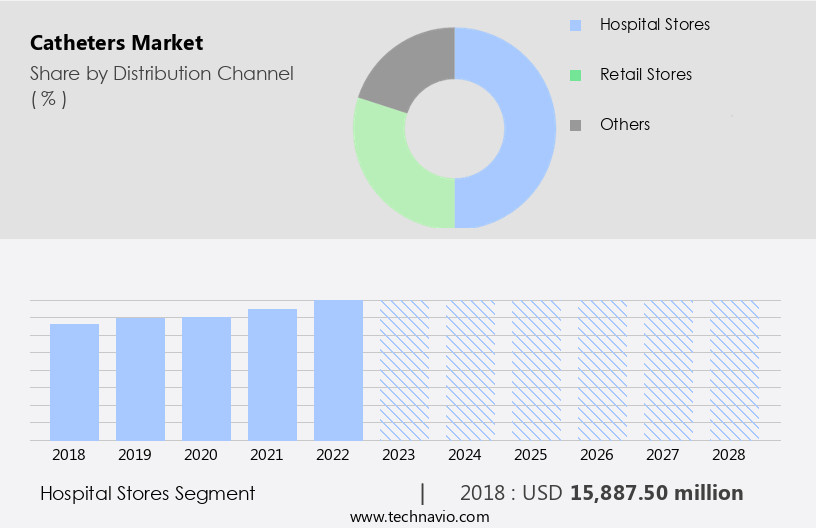

By Distribution Channel Insights

The hospital stores segment is estimated to witness significant growth during the forecast period.

The market encompasses a wide range of medical devices, including catheter guidewires, drug eluting catheters, balloon catheters, rigid catheters, catheter hubs, single-use catheters, flow sensor catheters, reusable catheters, PTCA catheters, peripheral venous catheters, pressure sensor catheters, and various other types. Hospital stores served as the largest distribution channel segment in 2023, managing the inventory levels of these diverse catheter types. These stores, also known as central supply departments, maintain an adequate supply by tracking usage patterns and reordering as needed. Biocompatible materials, such as hydrogel coatings, are essential in catheter manufacturing to minimize catheter-associated infections and ensure a smooth catheter insertion and removal process.

Catheters are utilized in various medical procedures, including urinary catheterization, hemodialysis, and angiography, among others. Multi-lumen catheters, sheath catheters, and arterial catheters are essential for critical care settings and surgeries. Thrombosis prevention measures, such as temperature sensors and radiopaque materials, are integrated into catheter designs to enhance patient safety. Catheter sterilization processes are crucial to maintain the hygiene and safety of reusable catheters. The catheter manufacturing process involves rigorous quality checks to ensure the biocompatibility, functionality, and durability of these essential medical devices.

The Hospital stores segment was valued at USD 15.89 billion in 2018 and showed a gradual increase during the forecast period.

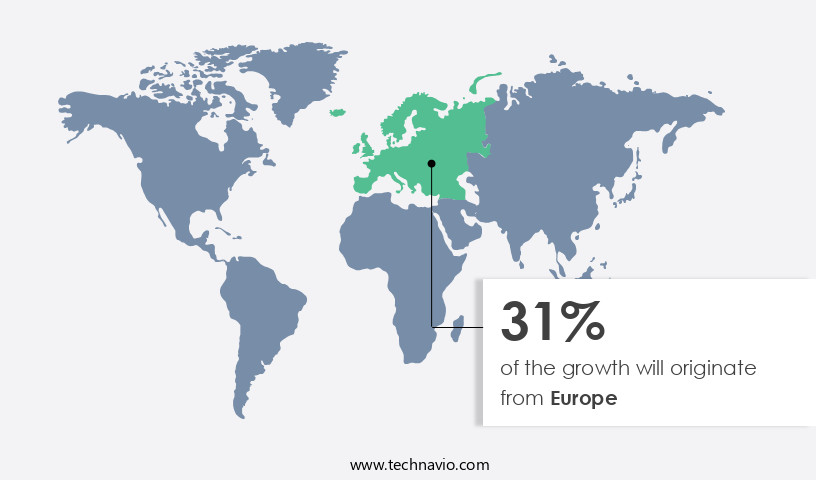

Regional Analysis

Europe is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, with North America leading the way in 2022. Factors driving this expansion include an aging population, rising prevalence of chronic diseases, technological innovations, and substantial healthcare expenditures. The US, with its advanced healthcare system, extensive medical device manufacturing capabilities, and large patient population, holds the largest share in the North American market. Major catheter manufacturers are based in the US, and the favorable reimbursement landscape further fuels market growth. North America is at the forefront of medical device technology advancements, including catheters. Various types of catheters, such as catheter guidewires, drug eluting catheters, balloon catheters, rigid catheters, catheter hubs, single-use catheters, flow sensor catheters, reusable catheters, PTCA catheters, peripheral venous catheters, pressure sensor catheters, and urinary catheters, among others, are in high demand.

Technological advancements include biocompatible materials, multi-lumen catheters, thrombosis prevention, radiopaque materials, temperature sensors, and sheath catheters. Catheter sterilization and catheter design are crucial aspects of the catheter manufacturing process. Catheter-associated infections remain a concern, leading to the development of hydrogel coatings and improved catheter removal and insertion techniques. Overall, the market is poised for continued growth, driven by these trends and advancements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of medical devices used for various diagnostic and therapeutic applications. With considerations like patient safety, comfort, and cost-effectiveness playing crucial roles, the market continues to evolve, focusing on advanced technologies and materials. Key areas involve the development of specialized catheters for specific conditions, such as neurocatheters for neurological procedures and urology catheters for urinary tract issues. Through methods such as coating technologies and biocompatible materials, manufacturers strive to minimize complications and improve patient outcomes. Moreover, interventional radiology catheters have gained significant traction due to their minimally invasive nature and high precision. These catheters enable radiologists to access hard-to-reach areas of the body, facilitating procedures like angiography and embolization. Innovations in catheter materials, such as silicone and polyurethane, offer enhanced flexibility and durability. Additionally, the integration of sensors and wireless connectivity in catheters allows for real-time monitoring and remote control, expanding their applications in various medical fields. Furthermore, the adoption of catheters in ambulatory settings and home healthcare is on the rise, enabling patients to receive treatment in a more convenient and cost-effective manner. This trend is expected to drive growth in the market, as healthcare systems increasingly focus on patient-centric care and reducing hospital readmissions. In summary, the market is characterized by continuous innovation and expansion, driven by advancements in materials, technologies, and applications. The focus on patient safety, comfort, and cost-effectiveness remains a priority, as catheters become increasingly integral to modern healthcare delivery.

What are the key market drivers leading to the rise in the adoption of Catheters Industry?

- The rising incidence of chronic diseases serves as the primary market driver.

- The global healthcare industry is witnessing a significant increase in demand for catheters due to the rising prevalence of chronic diseases and an aging population. Chronic conditions such as cardiovascular diseases, diabetes, urinary disorders, and kidney disease are on the rise, necessitating the use of catheters for diagnosis, treatment, and management. The elderly population, which is more susceptible to various health conditions, is growing, leading to a corresponding increase in demand for catheters. Healthcare providers and manufacturers are responding to this trend by introducing innovative and specialized catheter products, including drug eluting catheters, balloon catheters, rigid catheters, and flow sensor catheters, among others.

- These advanced catheters offer improved patient outcomes and enhanced functionality, making them essential tools in modern healthcare. Single-use and reusable catheters are also gaining popularity due to their cost-effectiveness and ease of use. Overall, the demand for catheters is expected to continue growing as the global population ages and the prevalence of chronic diseases increases.

What are the market trends shaping the Catheters Industry?

- Minimally invasive procedures are currently gaining popularity in the healthcare industry due to their numerous benefits, including reduced recovery time and minimal scarring. These innovative treatments are becoming the market trend as patients increasingly seek less invasive options for medical procedures.

- In the healthcare sector, minimally invasive procedures are gaining popularity due to their reduced recovery time and fewer complications compared to traditional surgeries. These procedures often utilize catheters, which are thin, flexible tubes used for diagnostic and therapeutic interventions. Catheters enable various medical procedures, such as angioplasty with PTCA catheters, peripheral venous access with standard venous catheters, and pressure monitoring with sensor catheters. As the preference for less invasive treatments increases, the demand for catheters is projected to surge. Catheters play a crucial role in procedures like angioplasty, stenting, ablation, and endovascular interventions. They facilitate the delivery of medication, drainage of fluids, removal of blockages, pressure measurement, and tissue sampling.

- The use of biocompatible materials and advanced coatings like hydrogel in catheters minimizes the risk of catheter-associated infections during insertion and removal. The growing emphasis on patient safety and comfort, coupled with the advantages of minimally invasive procedures, is expected to fuel the market growth for catheters.

What challenges does the Catheters Industry face during its growth?

- The growth of the industry is significantly impacted by the risk of complications, which presents a major challenge that necessitates careful consideration and management.

- Catheters, particularly indwelling types, pose risks of complications and adverse events, making healthcare providers consider alternative treatment methods. Catheter-associated infections are a significant concern, as they can introduce bacteria into the urinary tract or bloodstream, leading to urinary tract infections (UTIs) or bloodstream infections (BSIs). These infections can result in discomfort, extended hospital stays, increased healthcare costs, and potentially life-threatening complications. Catheter-related complications can include urinary stones, urethral strictures, or catheter fragment migration within the urinary tract. Multi-lumen catheters, such as sheath catheters and arterial catheters, are essential in various medical procedures.

- They come with features like thrombosis prevention through radiopaque materials and temperature sensors. Flexible catheters are also widely used due to their ease of insertion and maneuverability. Despite these advancements, the potential risks associated with catheter use remain a concern, driving the need for continuous research and innovation in catheter technology to minimize complications.

Exclusive Customer Landscape

The catheters market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the catheters market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, catheters market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Medtronic PLC - The company specializes in advanced catheter technology, featuring the FlexAbility ablation catheter and TactiCath contact force ablation catheter.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Medtronic PLC

- Boston Scientific Corp.

- Abbott Laboratories

- Becton Dickinson and Co.

- Terumo Corp.

- Edwards Lifesciences Corp.

- Cardinal Health Inc.

- Cook Group Inc.

- AngioDynamics Inc.

- CONMED Corp.

- Merit Medical Systems Inc.

- Teleflex Inc.

- Smiths Group PLC

- Olympus Corp.

- Stryker Corp.

- B. Braun SE

- Intersurgical Ltd.

- ConvaTec Group PLC

- Vygon SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Catheters Market

- In January 2024, Edwards Lifesciences Corporation announced the U.S. Food and Drug Administration (FDA) approval of their new Sapien 3 Ultra Transcatheter Heart Valve. This advanced device offers improved delivery and positioning capabilities, expanding Edwards' portfolio and addressing the growing demand for minimally invasive heart valve replacement solutions (Edwards Lifesciences Press Release, 2024).

- In March 2024, Medtronic plc and Abbott Laboratories entered into a definitive agreement to merge their diabetes businesses. This strategic partnership aimed to create a leading diabetes technology company, combining Medtronic's MiniMed insulin pumps and Abbott's FreeStyle Libre continuous glucose monitoring systems (Medtronic Press Release, 2024).

- In May 2024, Boston Scientific Corporation completed the acquisition of BTG plc, a global specialist healthcare company. This acquisition added BTG's interventional medicine portfolio, including its Interventional Oncology and Interventional Radiology businesses, to Boston Scientific's offerings, strengthening their presence in the global medical device market (Boston Scientific Press Release, 2024).

- In February 2025, Merit Medical Systems, Inc. received FDA clearance for its new Neuromodulation Catheter System. This innovative technology enables real-time monitoring and adjustment of spinal cord stimulation therapy, enhancing patient care and outcomes in the treatment of chronic pain conditions (Merit Medical Systems Press Release, 2025).

Research Analyst Overview

- The catheter market encompasses a diverse range of products, including those with lubricant coatings, hydrophilic coatings, silicone catheters, PTFE catheters, and polyurethane catheters. These devices face various challenges, such as catheter fragmentation, occlusion, and embolic protection. To mitigate these issues, manufacturers focus on material biocompatibility, blood compatibility, and catheter tip design. Angiographic guidance and catheter calibration are crucial for ensuring accurate catheter placement. Sterility assurance and catheter migration are also significant concerns, necessitating stringent manufacturing processes and quality control measures. Catheter ablation procedures require catheter efficacy and safety, while contrast media usage necessitates catheter durability and thrombogenicity testing.

- Catheter selection criteria, catheter sizing, and catheter imaging are essential considerations for healthcare providers. Embolic protection devices and heparin bonding are advanced technologies employed to enhance catheter performance and safety. Catheter durability and catheter safety remain key market drivers, as the industry continues to innovate and address the evolving needs of healthcare professionals and patients.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Catheters Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 18128.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, China, Germany, UK, India, Spain, Brazil, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Catheters Market Research and Growth Report?

- CAGR of the Catheters industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the catheters market growth of industry companies

We can help! Our analysts can customize this catheters market research report to meet your requirements.