Cannabidiol (CBD) Market Size 2025-2029

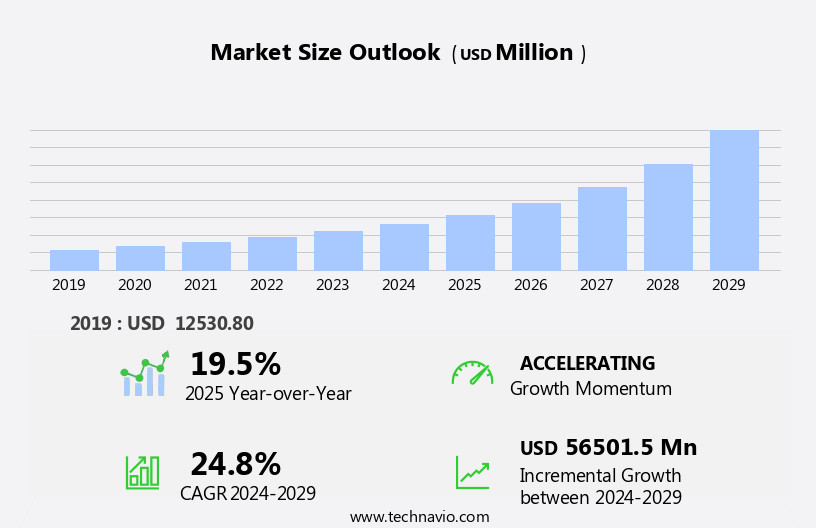

The cannabidiol (CBD) market size is forecast to increase by USD 56.5 billion, at a CAGR of 24.8% between 2024 and 2029.

- The CBD market is experiencing significant growth, driven primarily by the ongoing legalization and regulatory changes surrounding cannabidiol. This evolving regulatory landscape presents both opportunities and challenges for market participants. On the one hand, increasing legalization allows for broader market access, fostering growth in various end-use industries such as food and beverages, cosmetics, and pharmaceuticals. On the other hand, the high cost of CBD products poses a significant challenge for consumer adoption and market penetration. The e-commerce industry plays a crucial role in the CBD market's growth, enabling brands to reach a wider audience and offering consumers the convenience of purchasing products online.

- However, the high cost of CBD products, largely due to production and extraction expenses, may limit market expansion and create barriers for smaller players. To capitalize on market opportunities and navigate challenges effectively, companies must focus on optimizing production costs, exploring alternative extraction methods, and developing innovative, competitively priced products. By addressing these challenges and leveraging the growing demand for CBD, businesses can position themselves for success in this dynamic and rapidly evolving market.

What will be the Size of the Cannabidiol (CBD) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The CBD market continues to evolve at an unprecedented pace, with new developments and trends emerging constantly. One of the most significant areas of growth is product differentiation, as companies strive to distinguish themselves in a crowded marketplace. CBD for inflammation is a popular application, with many brands offering various forms of CBD, including capsules, gummies, and topicals. Cannabis-derived CBD and hemp-derived CBD are two distinct categories, each with its unique advantages and challenges. The legal framework surrounding CBD is also a dynamic factor, with regulations evolving to accommodate the growing industry. Bioavailability is another critical aspect, with brands investing in research to improve the efficacy of their products through advanced formulation and delivery methods.

Consumer education is essential as the market becomes more complex, with various CBD types, such as broad spectrum and full spectrum, and different extraction methods, such as CO2 and ethanol. Brand awareness and loyalty are also crucial, with companies focusing on sustainable practices, transparency, and competitive pricing strategies to attract and retain customers. CBD's applications extend beyond human health, with the pet market showing significant growth. Pricing strategies vary, with some brands adopting a direct-to-consumer model, while others rely on retail channels and wholesale distribution. Regulations continue to shape the industry, with a focus on ensuring safety and quality, particularly in the areas of labeling, clinical trials, and intellectual property.

The CBD market's continuous evolution reflects the ongoing research and innovation in this field. From CBD oil to CBD vape products, CBD for anxiety to CBD for athletes, the potential applications of CBD are vast and ever-expanding. As the industry matures, it is essential to stay informed about the latest trends, regulations, and consumer preferences to remain competitive and succeed in this dynamic market.

How is this Cannabidiol (CBD) Industry segmented?

The cannabidiol (CBD) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- Marijuana

- Hemp

- Distribution Channel

- Offline

- Online

- End-user

- Medical

- Personal use

- Wellness

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

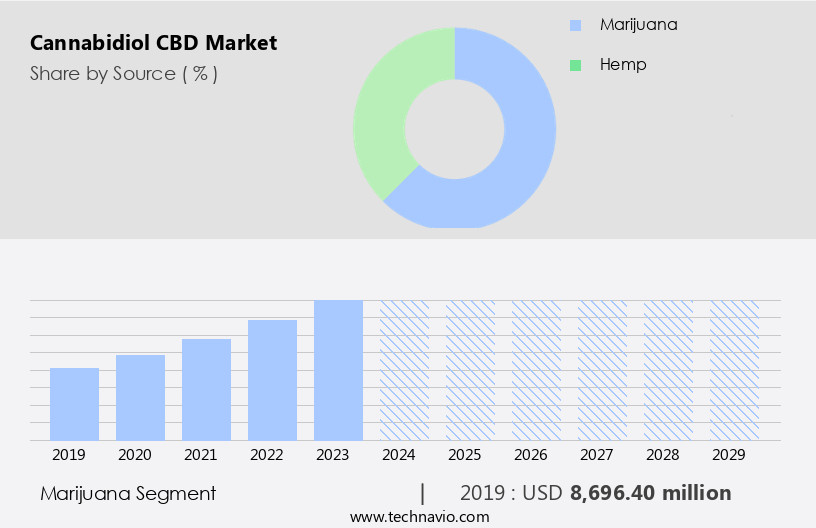

By Source Insights

The marijuana segment is estimated to witness significant growth during the forecast period.

CBD, a non-psychoactive compound derived from the cannabis plant, has gained significant attention in the health and wellness industry due to its potential therapeutic benefits. Different forms of CBD products cater to various consumer preferences, including capsules, oils, topicals, edibles, vape products, and tinctures. The market for CBD continues to grow rapidly, driven by increasing consumer awareness and acceptance, favorable legal frameworks, and expanding product innovation. CBD's efficacy in addressing various health conditions, such as anxiety and sleep disorders, has been supported by numerous clinical trials. The industry's commitment to sustainability, transparency, and adherence to regulations ensures the production of high-quality, safe CBD products.

Brands focus on building consumer loyalty through effective marketing strategies and clear product labeling. The CBD market encompasses both hemp-derived and cannabis-derived products, with the former being more widely available due to its lower THC content. Extraction methods, such as CO2 and ethanol, are used to isolate CBD from the plant material, ensuring optimal bioavailability and purity. The competition landscape is diverse, with numerous brands vying for market share, and intellectual property protections play a crucial role in differentiating offerings. CBD's versatility extends to various applications, including skincare, pet health, and athletic performance. Pricing strategies and consumer demographics continue to evolve as the market matures, with direct-to-consumer and retail channels offering various purchasing options.

As research on CBD's potential benefits continues to emerge, it is poised to become a significant player in the health and wellness industry.

The Marijuana segment was valued at USD 8.7 billion in 2019 and showed a gradual increase during the forecast period.

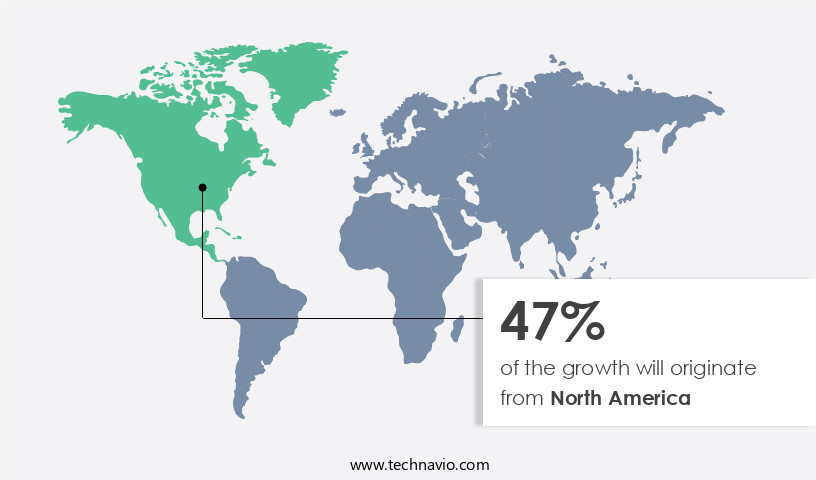

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the legalization of medical cannabis in the US and Canada is fueling the growth of the market. With Canada leading the way in full legalization, and several US states following suit, the region accounted for the largest share of the global CBD market in 2024. The market is moderately concentrated, with both regional and global players present. Key players include major cannabis companies based in the US and Canada. CBD products, such as capsules, oil, topicals, edibles, and vape products, are popular in North America due to their perceived health benefits. These include relief from anxiety, sleep disorders, inflammation, and pain.

CBD capsules offer convenience and consistent dosing, while CBD oil provides quick absorption and versatility. Topicals are effective for localized pain and skincare, and vape products offer fast relief. Brand awareness and industry standards are crucial in the CBD market. Companies invest in research and development to differentiate their products through superior bioavailability, efficacy, and sustainability. Clinical trials and consumer education are essential to validate CBD's safety and efficacy. Full-spectrum and broad-spectrum CBD products are gaining popularity due to their entourage effect, which enhances the therapeutic benefits of CBD. Hemp-derived CBD and cannabis-derived CBD have different regulatory frameworks.

Hemp-derived CBD is legal under the 2018 Farm Bill in the US, while cannabis-derived CBD is subject to stricter regulations due to its association with psychoactive THC. The CBD market is also subject to regulations regarding labeling, pricing, and distribution. Direct-to-consumer sales and retail channels are common, and wholesale distribution is also an essential part of the market. CBD is gaining popularity among athletes and pets due to its potential benefits for muscle recovery and joint health. CBD's versatility and potential health benefits have led to significant investment opportunities in the market. The competition landscape is dynamic, with new players entering the market and established players expanding their product offerings.

Patents and intellectual property are crucial in the CBD market, as companies seek to protect their unique formulations and extraction methods. The future of the CBD market is promising, with continued innovation and consumer education driving growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cannabidiol (CBD) Industry?

- The market's growth is primarily attributed to the legalization and regulatory changes surrounding cannabidiol (CBD). These adjustments have significantly impacted the industry, fostering increased demand and investment opportunities.

- The global CBD market is experiencing substantial growth due to the increasing legalization of cannabidiol in various countries and favorable regulatory environments. The Farm Bill, passed in 2018 in the US, legalized hemp cultivation, making it possible to produce and distribute CBD products nationwide. As a result, a diverse range of CBD offerings, including oils, capsules, edibles, and topicals, are now accessible to consumers. Safety and transparency are crucial factors driving the CBD market. Broad-spectrum CBD, which contains all cannabinoids except THC, is gaining popularity due to its enhanced therapeutic benefits and zero psychoactive effects. CBD isolate, which contains only CBD, is another preferred option for those seeking pure CBD.

- Marketing strategies focusing on consumer demographics, such as baby boomers and millennials, have proven effective. CBD vape products and online sales channels have also contributed to the market's growth. Brand loyalty is essential, and product labeling that clearly indicates CBD content, sourcing, and third-party lab testing results can help build trust with customers. CBD is increasingly used for various health conditions, including sleep disorders. As research continues to uncover CBD's potential benefits, the market is expected to expand further. Wholesale distribution is a crucial aspect of CBD business operations, ensuring products reach a broad customer base efficiently and cost-effectively.

What are the market trends shaping the Cannabidiol (CBD) Industry?

- The e-commerce industry is experiencing significant growth and represents an emerging market trend.

- The CBD market has experienced significant growth due to increasing consumer interest in hemp-derived CBD products. CBD edibles, such as gummies and chocolates, are popular choices for consumers seeking discreet and convenient ways to consume CBD. The dosage for CBD varies depending on individual needs and product potency. Direct-to-consumer sales and retail channels have emerged as significant distribution avenues for CBD products. The competitive landscape is dynamic, with numerous players vying for market share. Patents and intellectual property are essential in the CBD industry, with ongoing research and development focusing on new extraction methods. Ethical production and sustainability are becoming crucial factors in consumer decision-making.

- Full-spectrum CBD products, which contain all the cannabinoids and terpenes found in the hemp plant, are gaining popularity due to their potential entourage effect. Investment opportunities in the CBD industry continue to attract investors, driven by the market's potential for growth. Despite the competition, companies that prioritize quality, transparency, and innovation are well-positioned for success.

What challenges does the Cannabidiol (CBD) Industry face during its growth?

- The escalating costs of producing and marketing cannabidiol (CBD) products represent a significant challenge to the industry's growth trajectory.

- CBD, a non-psychoactive compound found in cannabis plants, has gained significant attention in the health and wellness industry due to its potential benefits for inflammation, pain relief, and various other health conditions. The market for CBD products, including CBD gummies and skincare formulations, is experiencing rapid innovation. However, the production and purification of cannabis-derived CBD involve complex processes and specialized equipment, contributing to higher prices. Intellectual property rights and regulations also impact the CBD market. As the industry grows, companies are investing in research and development to create new CBD formulations and improve purification techniques. Pricing strategies are a crucial consideration for CBD businesses, as fluctuations in the cost of raw materials and production can impact profitability.

- CBD is not only popular among humans but also among pets. The pet CBD market is expected to grow significantly in the coming years. Consumer education is essential to ensure that people understand the benefits and potential risks of CBD use. Regulations surrounding CBD production, labeling, and marketing are evolving, adding complexity to the market dynamics. Overall, the CBD industry is poised for continued growth, with innovation and consumer education key drivers.

Exclusive Customer Landscape

The cannabidiol (cbd) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cannabidiol (cbd) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cannabidiol (cbd) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aurora Cannabis Inc. - The company specializes in the production and distribution of a range of cannabidiol (CBD) products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aurora Cannabis Inc.

- Cannabis Science Inc.

- Cannoid LLC

- Canopy Growth Corp.

- Charlottes Web Holdings Inc.

- Cronos Group Inc.

- Elixinol

- Endoca BV

- Folium Biosciences

- HEMPMEDS MEDICAMENTOS DO BRASIL LTDA

- Isodiol International Inc.

- MediPharm Labs Inc.

- Medterra CBD

- NuLeaf Naturals LLC

- PharmaHemp d.o.o.

- Tikun Olam

- Tilray Brands Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cannabidiol (CBD) Market

- In February 2023, CV Sciences, a leading CBD company, announced the launch of their new product line, PlusCBD Gold Formula Capsules, which contains double the amount of CBD per serving compared to their original product (CV Sciences Press Release). This expansion aims to cater to consumers seeking higher potency CBD solutions.

- In July 2024, Curaleaf Holdings, a major cannabis operator, entered into a strategic partnership with GW Pharmaceuticals, a leading pharmaceutical cannabinoid company. This collaboration focused on co-developing and commercializing CBD-based therapeutic products, expanding Curaleaf's presence in the pharmaceutical sector (Curaleaf Holdings Press Release).

- In November 2024, Canopy Growth Corporation, a global cannabis company, raised USD300 million in a senior secured convertible debenture financing. The funds will be used to support the company's strategic initiatives, including CBD product development and international expansion (Canopy Growth Corporation SEC Filing).

- In March 2025, the Food and Drug Administration (FDA) approved the first-ever prescription CBD drug, Epidiolex, for the treatment of tuberous sclerosis complex, further legitimizing the use of CBD in the pharmaceutical industry (FDA Press Release). This approval opens the door for more CBD-based medications and could significantly boost market growth.

Research Analyst Overview

- The CBD market continues to evolve, with companies leveraging various strategies to gain a competitive advantage. Consumer trust is a crucial factor, leading some businesses to implement loyalty programs and email marketing campaigns. The cannabinoid profile, including CBD, Cannabinol (CBN), and Cannabigerol (CBG), plays a significant role in differentiating products. Brands focus on enhancing the customer experience through content marketing, while ensuring product potency and quality control through rigorous testing. Terpene content and shelf life are essential considerations for maintaining brand reputation.

- Data analytics and certification help businesses optimize their business model and reach their target audience effectively. CBD companies also explore influencer marketing and product packaging to expand their reach and differentiate themselves from competitors. THC's presence in some CBD products adds complexity to the market segmentation and storage requirements, necessitating careful consideration of the value proposition for various customer segments.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cannabidiol (CBD) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 24.8% |

|

Market growth 2025-2029 |

USD 56501.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

19.5 |

|

Key countries |

US, Canada, Germany, China, Mexico, UK, India, Japan, South Korea, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cannabidiol (CBD) Market Research and Growth Report?

- CAGR of the Cannabidiol (CBD) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cannabidiol (cbd) market growth of industry companies

We can help! Our analysts can customize this cannabidiol (cbd) market research report to meet your requirements.