Centrifugal Compressor Market Size 2025-2029

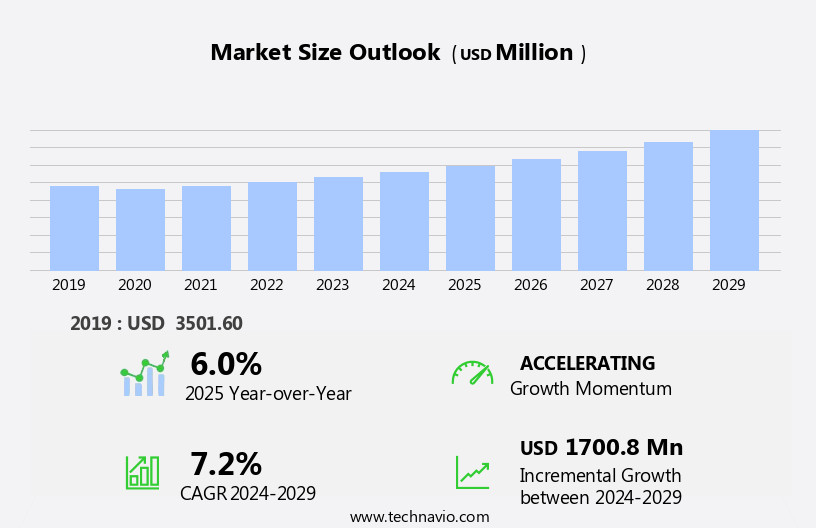

The centrifugal compressor market size is forecast to increase by USD 1.7 billion at a CAGR of 7.2% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by increasing investment in oil and gas exploration and production activities. The energy sector's expansion, particularly in regions like North America and the Middle East, fuels the demand for centrifugal compressors due to their efficiency and ability to handle large volumes of gas. Furthermore, the market is witnessing a in mergers and acquisitions, consolidating key players and strengthening their market presence. However, the market's growth potential is tempered by several challenges. Fluctuating prices of raw materials, such as steel and iron, impact the manufacturing costs of centrifugal compressors. The market is experiencing significant growth due to the increasing demand for electricity in various sectors, including renewable energy generation and oil and gas.

- Additionally, regulatory hurdles, including stringent emission norms, necessitate the adoption of energy-efficient technologies and increase the cost of production. Supply chain inconsistencies, particularly in the supply of specialized components, can disrupt production schedules and delay project timelines. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on cost optimization, regulatory compliance, and supply chain resilience.

What will be the Size of the Centrifugal Compressor Market during the forecast period?

- Centrifugal compressors play a pivotal role in various industries, driving processes in oil and gas production, power generation, and chemical manufacturing. The market for centrifugal compressors is dynamic, with ongoing advancements in technology shaping its landscape. Impeller blade geometry and compressor inlet design significantly influence compressor operation and efficiency. Compressor bearings and lubrication systems ensure reliable performance, while control prevents compressor stall and damage. Compressor casing and piping require robust designs to withstand the extreme pressures and temperatures. Reciprocating compressors and screw compressors each have their unique applications, with the former dominating smaller-scale applications and the latter preferred for larger installations. Centrifugal compressors are used in various applications that help reduce greenhouse gas emissions, such as natural gas production and renewable power generation.

- Compressor overhaul and replacement are essential for maintaining optimal compressor performance and extending their life cycle. Rotating equipment safety is paramount, with compressor safety systems and diagnostics crucial for identifying potential issues before they escalate. Compressor commissioning and optimization ensure efficient compressor installation and operation. Advanced compressor design software and simulation tools enable engineers to optimize compressor performance and minimize wear. Centrifugal compressor stages and axial flow compressors contribute to the overall efficiency improvement of the compressor system. Compressor efficiency, compressor shutdown, compressor outlet pressure, and compressor efficiency improvement are critical factors for operators seeking to maximize their assets' productivity and minimize downtime.

- Compressor repair and maintenance are ongoing processes, with regular inspections and preventive measures essential for maintaining compressor reliability and minimizing unscheduled downtime. Compressor efficiency, compressor wear, compressor monitoring, and compressor design all interconnect, forming a comprehensive approach to managing centrifugal compressor systems. These compressors are essential in compressing air to generate electricity in renewable power plants, as well as in the oil and gas sector, where they are used in both the upstream and midstream sectors

How is this Centrifugal Compressor Industry segmented?

The centrifugal compressor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Single-stage

- Multi-stage

- Variant

- Below 20 bars

- Between 20 and 200 bars

- Between 200 and 400 bars

- Above 400 bars

- End-user

- Oil and gas industry

- Power sector

- Petrochemical and chemical industries

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

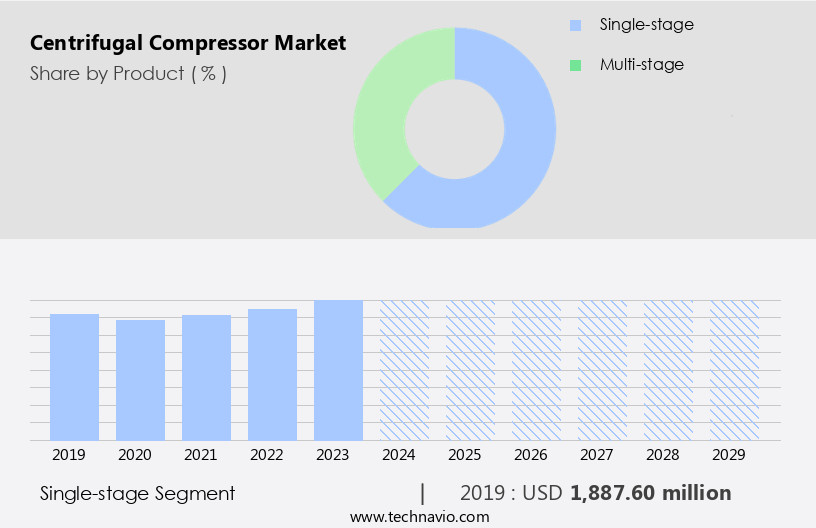

The single-stage segment is estimated to witness significant growth during the forecast period. Centrifugal compressors, a critical component in various industries, continue to gain traction due to their efficiency and versatility. These compressors, which come in single-stage and multistage configurations, are instrumental in compressing process gases, including air and natural gas, for applications ranging from power generation and HVAC systems to chemical processing and oil and gas production. Single-stage centrifugal compressors, which compress air in a single passage between the inlet and the discharge, are popular for their reliability and ease of transportation. The compression process involves drawing air into a cylinder, compressing it through a single stroke, and discharging it into a storage tank or directly to the process.

Advancements in centrifugal compressor technology have led to improvements in diffuser efficiency, oil-free compression, and throughput enhancement through the use of variable speed drives and impeller design. Predictive maintenance strategies, enabled by the Internet of Things and compressor control systems, have become increasingly important for optimizing operational efficiency and reducing energy consumption. Moreover, centrifugal compressors play a pivotal role in reducing greenhouse gas emissions and improving environmental compliance in various industries. The adoption of renewable energy sources and the integration of compressors into sustainable solutions have further boosted the market's growth. Centrifugal compressor services, including compressor upgrades, compressor selection, and compressor troubleshooting, are essential for maintaining optimal compressor performance and ensuring cost optimization.

The Single-stage segment was valued at USD 1.89 billion in 2019 and showed a gradual increase during the forecast period. As the market evolves, capacity expansion and pressure ratio enhancements continue to be key drivers for growth. In the petrochemical industry, centrifugal compressors are utilized in multistage compression processes for synthetic gas production and air separation. These compressors' low noise operation and emissions reduction capabilities make them a preferred choice for numerous applications. The market is experiencing significant growth due to the increasing demand for efficient and reliable compressors in various industries. The integration of advanced technologies, such as digital twins, predictive maintenance, and compressor control systems, is driving innovation and enhancing overall performance. The expansion of various sectors such as oil and gas, industrial gases, beverage manufacturing, food preparation and packaging, and chemical and petrochemical industries in the region will fuel the demand for centrifugal compressors.

Regional Analysis

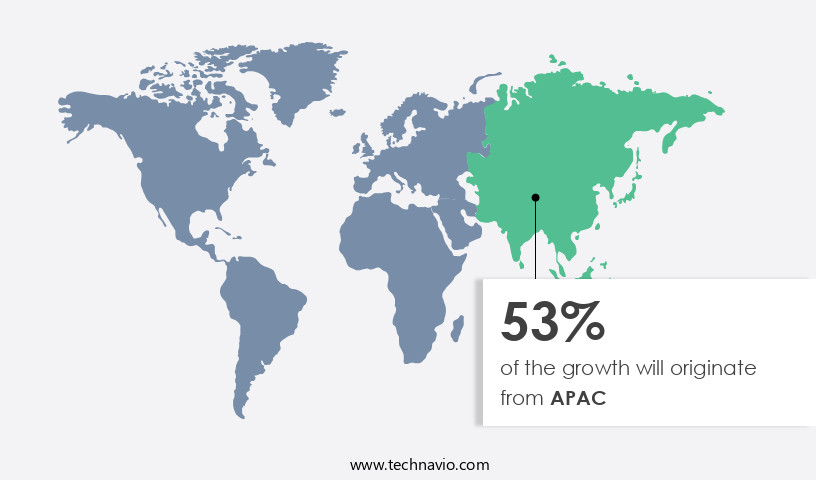

APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. StartFragment The Centrifugal Compressor Market is growing rapidly due to advancements in industrial applications and enhanced efficiency demands. Effective control ensures stable operations, preventing fluctuations. Comparisons with axial flow compressor, screw compressor, and reciprocating compressor highlight the benefits of centrifugal technology in durability and performance. Optimizing compressor life cycle through proper compressor lubrication and compressor seals improves reliability. Efficient compressor piping and compressor foundation play a vital role in system stability. Advanced compressor diagnostics enable predictive maintenance, reducing downtime. Timely compressor replacement ensures peak efficiency in evolving operational requirements.

The market in Asia Pacific (APAC) is experiencing steady growth, driven by the expanding oil and gas, industrial gases, beverage manufacturing, food preparation and packaging, and chemical and petrochemical sectors. Centrifugal compressors, particularly those with integrated gears, are in high demand due to their energy efficiency and ability to handle large flow rates. Japan, China, South Korea, and India are significant contributors to the market in APAC, with their large refineries and chemical imports. The oil and gas industry remains the primary market for centrifugal compressors in APAC, as natural gas and other process gases require compression for transportation and use.

The chemical and petrochemical industries also rely on centrifugal compressors for synthetic gas production and pressure ratio enhancement. The market is also witnessing trends such as predictive maintenance, oil-free compression, and the integration of digital twins and the Internet of Things for compressor troubleshooting and remote monitoring. Additionally, there is a growing focus on compressor upgrades for increased capacity, energy efficiency, and emissions reduction. Centrifugal compressor technology is also being adopted for power generation, air conditioning, and air separation applications, further expanding the market's scope. Compressor services, compressor control systems, and maintenance contracts are essential components of the market, ensuring optimal compressor performance and cost optimization.

The market's evolution is also influenced by the increasing demand for sustainable solutions and environmental compliance in various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Centrifugal Compressor market drivers leading to the rise in the adoption of Industry?

- The significant investment expansion in the oil and gas sector, specifically in exploration and production activities, serves as the primary market catalyst. Centrifugal compressors play a significant role in the oil and gas industry, with increasing investments in Exploration and Production (E&P) activities driving market growth. These compressors are essential for the upstream, midstream, and downstream processing of oil and gas, facilitating the extraction, refining, and transportation of hydrocarbons. The oil and gas industry's recovery from the sales downturn in 2020 is expected to boost demand for centrifugal compressors. Advancements in technology have led to innovations such as oil-free compression, digital twins, and predictive maintenance, enhancing compressor efficiency and reducing downtime. Oil-free compression eliminates the need for oil lubrication, ensuring cleaner process gases.

- Digital twins provide real-time monitoring and analysis, enabling proactive maintenance and extending compressor service intervals. HVAC systems and air compression also benefit from centrifugal compressor technology. Centrifugal compressors' rotational speed and diffuser efficiency are critical factors influencing their performance and energy consumption. Manufacturers and service providers offer technical support and customized solutions to optimize compressor performance and minimize operational costs. The market's growth is further fueled by the increasing adoption of advanced compressor technologies in various industries.

What are the Centrifugal Compressor market trends shaping the Industry?

- Merger and acquisition activity is on the rise, representing a significant market trend. This trend reflects the dynamic business landscape, where companies continually seek growth opportunities through strategic consolidation. The market is witnessing significant growth due to increasing demand in power generation and air conditioning applications. Compressor performance and maintenance contracts are crucial factors driving market expansion. Capacity expansion and greenhouse gas reduction are key trends, with renewable energy and natural gas sectors showing substantial growth. Throughput enhancement, impeller design, and variable speed drives are essential technologies advancing compressor efficiency and reliability. Manufacturers are focusing on mergers and acquisitions to expand their product offerings and strengthen market presence. For instance, Atlas Copco's acquisitions of Powered Compressors and Supplies (PCS) and MSS Nitrogen Ltd. Furthermore, the primary materials for manufacturing these compressors include steel, aluminum, and carbon steel.

- In 2025 enhanced its centrifugal compressor offerings and nitrogen generation solutions, respectively. These strategic moves enable manufacturers to provide comprehensive, reliable, and advanced technology-based parts and services to their customers.

How does Centrifugal Compressor market faces challenges face during its growth?

- The unstable pricing of raw materials poses a significant challenge to the industry's growth trajectory. The market is characterized by intense competition, leading some companies to lower their product prices to retain market share. The production of centrifugal compressors involves primary materials such as steel, aluminum, and carbon steel, whose costs fluctuate due to economic factors. This volatility influences the pricing of centrifugal compressors, with the average cost ranging from USD 0.5-0.9 million/MW for the 5-15 MW range and USD 0.8-1.5 million/MW for the 1-5 MW range. Centrifugal compressor technology continues to evolve, focusing on operational efficiency, energy efficiency, compressor sizing, emissions reduction, and process optimization.

- Advanced technologies like the Internet of Things (IoT) enable real-time compressor troubleshooting and vibration control, contributing to cost optimization and improved flow rate. Operating range expansion and air separation applications further enhance the market's growth potential.

Exclusive Customer Landscape

The centrifugal compressor market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the centrifugal compressor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, centrifugal compressor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atlas Copco AB - The company specializes in providing advanced centrifugal compressor solutions, including the GT, T, and RT series.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atlas Copco AB

- Baker Hughes Co.

- Ebara Corp.

- FS ELLIOTT Co. LLC

- Fusheng Precision Co. Ltd.

- General Electric Co.

- Hanbell Precise Machinery Co. Ltd.

- Hanwha Power Systems Co. Ltd.

- Hitachi Ltd.

- IHI Corp.

- Ingersoll Rand Inc.

- Kawasaki Heavy Industries Ltd.

- Kobe Steel Ltd.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd.

- Mitsui and Co. Ltd.

- Siemens Energy AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Centrifugal Compressor Market

- In February 2023, Gardner Denver Holdings, a leading industrial compressor manufacturer, announced the launch of its new line of centrifugal compressors, the BOGE COMPACT CUBE series. These compressors offer increased efficiency and reduced emissions, catering to the growing demand for sustainable industrial processes (Gardner Denver Press Release).

- In May 2024, Air Liquide, a global leader in gases, technologies, and services, entered into a strategic partnership with Siemens Energy to develop and manufacture large centrifugal compressors for air separation units. This collaboration aims to strengthen Air Liquide's position in the market and leverage Siemens Energy's expertise in compressor technology (Air Liquide Press Release).

- In August 2024, Howden, a global engineering group, acquired the compressor business of Atlas Copco for approximately â¬700 million. This acquisition significantly expanded Howden's compressor portfolio, enabling it to cater to a broader customer base and offer a more comprehensive range of centrifugal compressor solutions (Howden Press Release).

- In November 2025, the European Union approved the FuelEfficiency II project, which includes the development and deployment of large-scale centrifugal compressors for natural gas applications. This initiative aims to reduce greenhouse gas emissions and promote energy efficiency in Europe's industrial sector (European Commission Press Release).

Research Analyst Overview

The market continues to evolve, driven by the diverse demands of various sectors such as power generation and air conditioning. Centrifugal compressors play a crucial role in enhancing compressor performance, reducing greenhouse gas emissions, and increasing capacity in power generation and air conditioning applications. In the power sector, centrifugal compressors contribute to the efficient production of electricity by increasing pressure ratio and improving turbine efficiency. In the air conditioning industry, centrifugal compressors ensure optimal cooling by maintaining consistent flow rate and operational efficiency. The ongoing quest for energy efficiency and cost optimization has led to the adoption of variable speed drives and throughput enhancement technologies.

The chemical processing industry relies on centrifugal compressors for process optimization, pressure ratio enhancement, and emissions reduction. In the oil and gas sector, centrifugal compressors are essential for natural gas compression and oil-free compression applications. The integration of predictive maintenance and technical support, along with compressor services and maintenance contracts, ensures the longevity and reliability of centrifugal compressors. The market is also witnessing the emergence of renewable energy applications, such as air separation and synthetic gas production. Centrifugal compressor technology continues to advance, with innovations in impeller design, rotational speed control, and vibration control. The Internet of Things (IoT) and compressor troubleshooting systems enable remote monitoring and cost optimization.

The market dynamics of the centrifugal compressor industry are continuously unfolding, with new applications and technologies shaping the landscape. Centrifugal compressors are poised to play a significant role in the transition towards sustainable solutions and environmental compliance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Centrifugal Compressor Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2025-2029 |

USD 1.70 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

China, US, Canada, Japan, India, South Korea, Saudi Arabia, Germany, Australia, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Centrifugal Compressor Market Research and Growth Report?

- CAGR of the Centrifugal Compressor industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the centrifugal compressor market growth of industry companies

We can help! Our analysts can customize this centrifugal compressor market research report to meet your requirements.