Cetanol Market Size 2024-2028

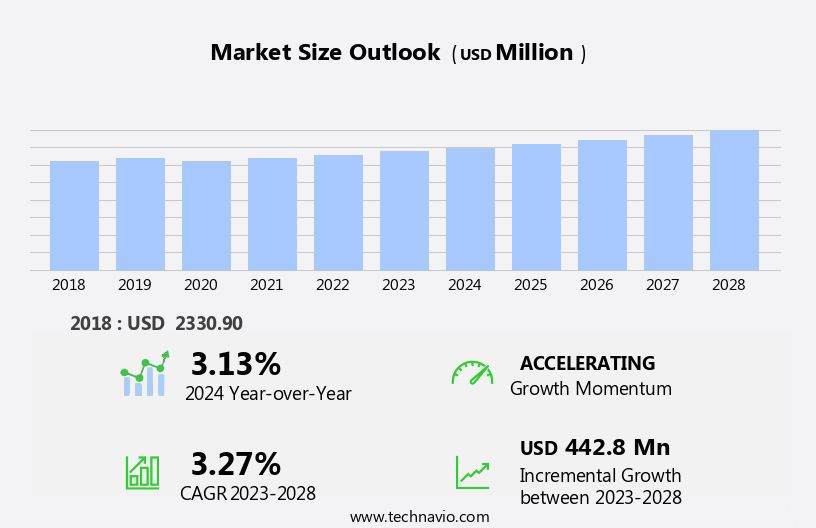

The cetanol market size is forecast to increase by USD 442.8 million at a CAGR of 3.27% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing use of this chemical in personal care and cosmetic products. This trend is being fueled by the in e-commerce sales in these sectors, as consumers continue to seek out high-quality, chemical-free options for their beauty needs. The consumer preference for natural and organic products is a key trend shaping the market, with many companies responding by incorporating cetanol into their formulations due to its natural origin and superior performance properties.

- However, the market is not without challenges, including regulatory compliance and price volatility of raw materials. Companies seeking to capitalize on this market opportunity must stay informed of regulatory requirements and maintain a strong supply chain to navigate these challenges effectively. Additionally, investing in research and development to create innovative, high-performance products that cater to the evolving consumer preferences will be crucial for long-term success in the market.

What will be the Size of the Cetanol Market during the forecast period?

- The market encompasses the production and distribution of Cetyl Alcohol and its derivatives, including Hexadecan-1-ol, Palmitic Acid, Palmityl Alcohol, N-Hexadecyl Alcohol, and Cetearyl Alcohol. These compounds are utilized extensively in various industries, primarily in the formulation of cosmetics and personal care products. Cetyl Alcohol serves multiple functions in these applications, acting as a co-emulsifier, surfactant, thickening agent, opacifier, and softener. It is commonly found in topical medicines, moisturizers, lotions, skincare products, cleansers, non-aqueous liquids, shampoos, and soaps. The market's growth is driven by the increasing demand for high-performance, eco-friendly, and allergy-friendly personal care products.

- Consumers are increasingly concerned about contact dermatitis and other skin sensitivities, leading to a preference for gentle, hypoallergenic formulations. Additionally, the market is influenced by advancements in technology, which enable the production of more efficient and cost-effective Cetanol derivatives. Ethylene Glycol and other raw materials, such as Palm Oil, are integral to the manufacturing process. The market is expected to continue growing, driven by the expanding personal care industry and the increasing demand for innovative, effective, and sustainable cosmetic solutions.

How is this Cetanol Industry segmented?

The cetanol industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Waxy

- Liquid

- Geography

- Europe

- France

- Germany

- UK

- North America

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Type Insights

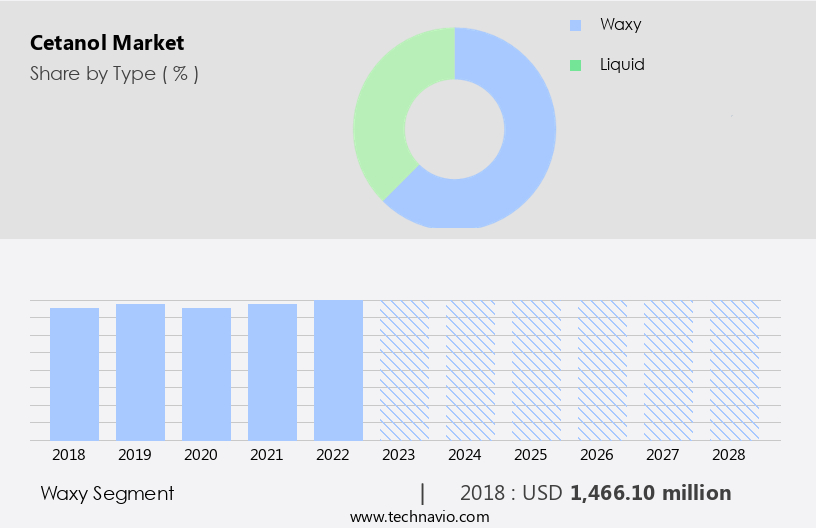

The waxy segment is estimated to witness significant growth during the forecast period.

Cetyl alcohol is a waxy solid obtained from coconut, palm, or vegetable oils through the process of saponification and reduction with metallic sodium and alcohol. This ingredient, which has a temperature higher than the human body, is widely used in various industries, including personal care, cosmetics, food and beverage, and pharmaceuticals. In personal care and cosmetics, cetyl alcohol functions as an emulsifier, foam stabilizer, viscosity control agent, coupling agent, thickening agent, conditioning agent, anti-oxidant, surfactant, emollient, opacifier, and softener. It is essential in the formulation of cleansers, lotions, emulsions, sun care products, skincare products, shampoos, and topical medicines.

Additionally, it is used as a carrying agent in the food industry and as an emulsifier, emulsification aid, and thickening agent in pharmaceuticals. Cetyl alcohol is also used as an anti-oxidant and stabilizer in non-aqueous liquids, making it suitable for use in anti-aging creams and other skin care products. The ingredient is certified for use in various industries, ensuring safety and quality.

Get a glance at the market report of share of various segments Request Free Sample

The Waxy segment was valued at USD 1466.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

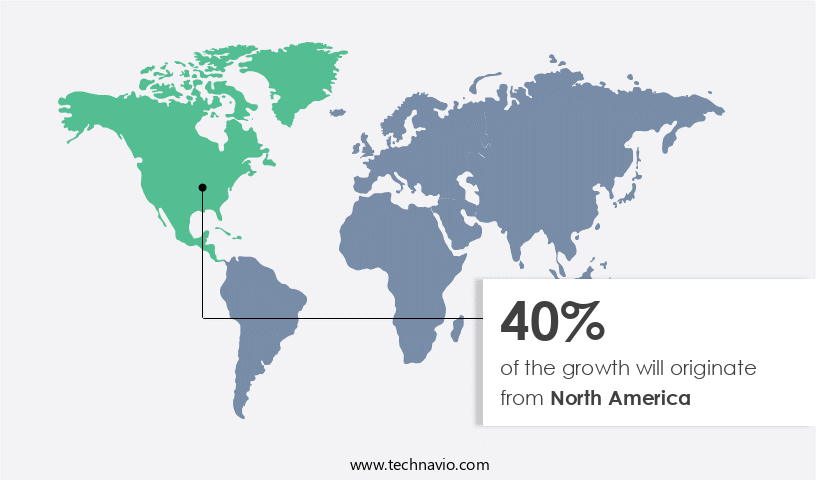

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Cetanol, a waxy solid derived from palm oil through saponification, plays a significant role in various industries, including Personal Care and the Food Industry. In the Personal Care sector, it functions as a carrying agent, opacifier, emulsifier, thickening agent, co-emulsifier, and emollient in the formulation of cosmetics. Cetanol is commonly used in the production of cleansers, skincare products, lotions, emulsions, sun care products, and shampoos. The European market holds the largest share in The market due to the high consumption of personal care and cosmetics in countries like Germany, the UK, and France.

Consumers in these regions prefer premium skincare products, such as firming and anti-aging lotions and creams, night-time formulations, and skin brighteners. Additionally, there is a growing demand for skincare and body care cosmetics designed for specific body parts, leading to increased demand for cetanol from the European cosmetics industry. In the Food Industry, cetanol is used as a stabilizer, emulsifier, and antioxidant in non-aqueous liquids, such as food supplements and food additives. Furthermore, it is used in the Pharmaceutical industry as a softener and thickening agent in topical medicines. Cetanol is available in various forms, including Cetearyl Alcohol, N Hexadecyl alcohol, 1 Hexadecanol, and Palmityl alcohol.

The market dynamics of cetanol are influenced by factors such as its versatile applications, increasing demand for personal care and cosmetics, and the regulatory requirements for its use in various industries. For instance, cetanol is certified for use in food, pharmaceuticals, and cosmetics, ensuring its safety and quality. However, it is essential to note that contact dermatitis can occur in some individuals due to the use of cetanol-based products. Therefore, it is crucial to follow the recommended usage guidelines and safety measures while handling and using cetanol-based products.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cetanol Industry?

- Growing use of cetanol in personal care and cosmetic products is the key driver of the market.

- Cetyl alcohol is a versatile ingredient widely used in various industries, particularly in personal care and cosmetics. Its functions as an emulsifier, emollient, opacifier, softener, and surfactant have expanded its applications in a multitude of products. In the personal care sector, it is commonly found in skin creams, lotions, sunscreen, shampoos, hair dyes, and face washes, among others. As an emulsifier, cetyl alcohol prevents the separation of oil and water in creams and lotions. As an emollient, it forms a protective layer on the skin, lubricates and softens it, and shields it from chapping and drying.

- In the role of a surfactant, it is utilized in cleansers and body washes to enhance their cleansing properties. These uses have significantly increased the demand for cetyl alcohol in the personal care industry.

What are the market trends shaping the Cetanol Industry?

- Growth in e-commerce sales of personal care and cosmetic products is the upcoming market trend.

- E-commerce has emerged as a preferred shopping destination for consumers due to its convenience and cost advantages, particularly in the sale of personal care products. With busy schedules, people find it more convenient to shop online rather than visiting physical stores. The reduction in overhead costs for companies when selling products through e-retailing websites results in lower prices for customers. This trend has led many international and national companies to sell personal care products online, thereby expanding their reach and enhancing their brand presence.

- The shift towards e-commerce is a significant market dynamic that continues to influence the personal care industry.

What challenges does the Cetanol Industry face during its growth?

- Consumer demand for chemical-free personal care and cosmetic products is a key challenge affecting the industry growth.

- The personal care industry is experiencing a shift in consumer preferences towards natural and organic products. Consumers are increasingly conscious of the ingredients in their cosmetics and personal care items, favoring those with natural components over synthetic alternatives. This trend has led many cosmetics manufacturers to replace synthetic chemicals with natural ingredients, including those like cetanol, which have raised health and environmental concerns. The market may face negative growth during the forecast period due to this increasing consumer awareness. Cetanol, along with other chemicals such as sulfates, parabens, phthalates, synthetic colors, triclosan, and others, have been identified as potentially harmful ingredients in conventional personal care products.

- As consumers become more informed about the potential risks associated with these chemicals, they are likely to avoid products containing them, negatively impacting the market for these ingredients. In , the personal care industry is undergoing a significant transformation as consumers become more educated about the ingredients in their products and their potential health and environmental impacts. This shift towards natural and organic alternatives is likely to negatively impact the growth of the market during the forecast period.

Exclusive Customer Landscape

The cetanol market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cetanol market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cetanol market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BASF SE - The company supplies high-purity cetyl alcohol, also known as cetanol, a naturally derived ingredient used extensively in various industries, including cosmetics and pharmaceuticals, for its emollient, thickening, and solubilizing properties. Cetyl alcohol is a long-chain fatty alcohol, derived from renewable sources, providing a sustainable solution for businesses seeking to reduce their carbon footprint. This versatile ingredient enhances product performance and consumer experience, making it an essential component in numerous personal care and industrial applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Bo International

- BRENNTAG SE

- Central Drug House Pvt. Ltd.

- Emery Oleochemicals Group

- Godrej Industries Ltd.

- Kao Corp.

- KLK Oleo

- Kokyu Alcohol Kogyo Co. Ltd.

- Musim Mas Group

- Naturallythinking

- Niram Chemicals

- Pandian Surfactants Pvt. Ltd.

- Surfachem Group Ltd

- Suriachem Sdn. Bhd.

- The Herbarie at Stoney Hill Farm Inc.

- The Procter and Gamble Co.

- Timur OleoChemicals Malaysia Sdn. Bhd.

- VVF Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of applications in various industries, primarily in the personal care sector. This market involves the production and utilization of Cetanol, a versatile chemical compound, which plays a crucial role in the formulation of various products. Cetanol is a colorless, odorless liquid, derived from the distillation of palm oil. It is a key ingredient in the production of personal care products such as cleansers, skincare, and lotions. In these applications, Cetanol functions as a carrying agent, opacifier, emulsifier, emollient, and thickening agent. In the personal care industry, Cetanol is widely used in the formulation of cosmetics.

It is an essential component in the production of various skincare products, including moisturizers and anti-aging creams. In these applications, Cetanol's ability to enhance the penetration of active ingredients into the epidermis layer makes it an indispensable ingredient. The food industry also utilizes Cetanol as a food additive. It is used as a solvent and stabilizer in various food products. In the non-aqueous liquids sector, Cetanol is used as a solvent for various active ingredients, including sun care products. Cetanol's properties make it an ideal ingredient in various industrial applications. For instance, it is used as a softener in the textile industry and as a thickening agent in the pharmaceutical industry.

In the production of topical medicines, Cetanol acts as a co-emulsifier, enhancing the stability and effectiveness of the formulation. The demand for Cetanol is driven by various factors, including its versatility, effectiveness, and safety. The millennial group, with its increasing focus on personal care and wellness, is a significant consumer base for Cetanol-based products. The regulatory landscape also plays a crucial role in the market dynamics, with various certifications and regulatory requirements influencing the production and utilization of Cetanol. The production of Cetanol involves various processes, including saponification and mechanical agitation. The use of stainless steel equipment is common in the production process due to its resistance to corrosion.

Ethylene glycol, palmitic acid, and palmityl alcohol are some of the raw materials used in the production of Cetanol. In the personal care industry, Cetanol is used in various applications, including cleansers, lotions, shampoos, and soaps. It is also used as an emulsifier in sun care products and as an emollient in moisturizers. In the food industry, Cetanol is used as a solvent and stabilizer in various food products. The market for Cetanol is expected to grow due to various factors, including the increasing demand for personal care products, the growing awareness of health and wellness, and the regulatory requirements for the use of natural ingredients in various industries.

The market is also expected to be influenced by various trends, including the increasing demand for organic and natural products and the growing popularity of vegan and cruelty-free products. In , the market is a dynamic and growing market, with various applications in various industries. Its versatility, effectiveness, and safety make it an indispensable ingredient in various applications, from personal care to food and pharmaceuticals. The market is expected to grow due to various factors, including the increasing demand for personal care products, the growing awareness of health and wellness, and the regulatory requirements for the use of natural ingredients.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 442.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

US, Germany, China, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cetanol Market Research and Growth Report?

- CAGR of the Cetanol industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cetanol market growth of industry companies

We can help! Our analysts can customize this cetanol market research report to meet your requirements.