Face Wash Market Size 2024-2028

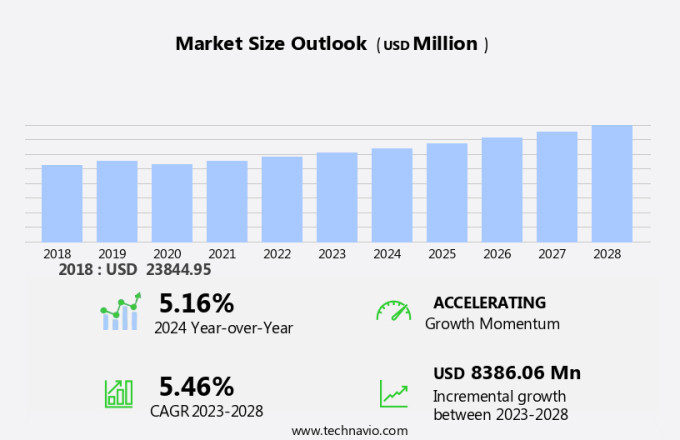

The face wash market size is forecast to increase by USD 8.39 billion at a CAGR of 5.46% between 2023 and 2028.

- The market in North America is experiencing significant growth due to increasing per capita income and changing consumer preferences. One trend influencing market growth is the rising demand for organic face washes as consumers become more health-conscious. However, the market also faces challenges such as the easy availability of counterfeit products, which can negatively impact brand reputation and consumer trust. As income levels rise and consumers prioritize self-care, the market for face washes is expected to continue expanding. Organic options catering to this demand will likely see particular success, as long as manufacturers can effectively address the issue of counterfeit products.

What will be the Size of the Market During the Forecast Period?

- The market is a significant segment of the personal care industry, driven by the growing awareness of the importance of maintaining a hygienic lifestyle and the desire for healthy, radiant skin. With the increasing prevalence of excess oil, dirt, pollution, and unwanted skin cells, the demand for face wash products has surged in recent years. The market for face wash caters to various skin types and concerns, including those affected by acne, signs of aging, and sun damage. Organic face wash options have gained popularity due to their natural ingredients and the growing trend towards organic and sustainable products.

- The organic harvest of botanical ingredients, such as chamomile, aloe vera, and green tea, is a key factor driving the growth of the organic face wash segment. The rise of online retailing has made it easier for consumers to access a wide range of face wash products from the comfort of their homes. This trend is particularly prominent in rapidly urbanizing areas, where consumers lead busy lifestyles and prefer the convenience of shopping online. Despite the numerous benefits of face wash, there are concerns regarding the use of harsh surfactants and potential irritants, such as rashes and burns

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Women

- Men

- Kids

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

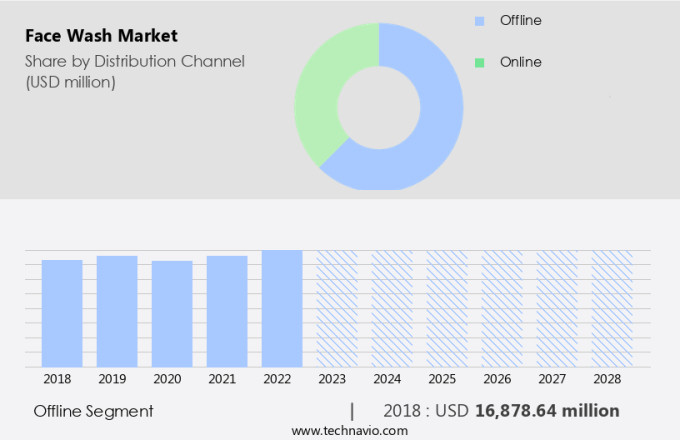

- The offline segment is estimated to witness significant growth during the forecast period.

Face wash is a crucial component of personal care routines, available in various forms such as Gel, Cream, Powder, Foam, catering to different skin types including Dry, Oily, Normal, and Sensitive. The market for face wash is substantial, with significant revenue generated through both online retailing platforms and traditional retail stores. E-commerce sales are on the rise due to the convenience and accessibility it offers. However, retail stores continue to dominate the market, accounting for a substantial share. Specialty stores, in particular, are a significant revenue generator in the market. The increasing popularity of these stores, which specialize in beauty and personal care products, is driving market growth.

Moreover, the rise in the number of hypermarkets, supermarkets, convenience stores, and warehouse clubs of major retailers is contributing to the sales growth of these retail formats and significantly impacting the market. While shopping for face wash, consumers consider factors such as skin type, price, brand reputation, and product effectiveness. It's essential to protect your skin from environmental factors like UV rays and sunlight. Using the right face wash can help maintain healthy skin.

However, it's important to avoid harsh soaps that can cause rashes or burns. Always read the label before use and consult a dermatologist if you have sensitive skin. In conclusion, the market is a thriving industry, with various forms and retail formats catering to diverse consumer preferences. Specialty stores, hypermarkets, supermarkets, convenience stores, and warehouse clubs are the major revenue contributors to this market. Consumers prioritize factors such as skin type, price, brand reputation, and product effectiveness when purchasing face wash.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 16.87 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

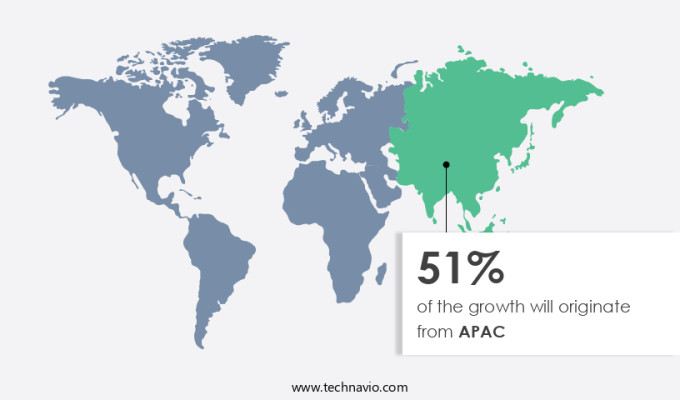

- APAC is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The facial cleanser market in Asia Pacific (APAC) holds a significant share in the global market due to the increasing population and rising disposable income in countries like China and India. Urbanization is leading to a surge in demand for skincare products, including face wash, among both male and female consumers in the region. The market's growth is further fueled by various factors, such as celebrity endorsements and an extensive range of product offerings. In response to consumer preferences for natural and gentle ingredients, many skincare brands are incorporating natural ingredients like tea tree oil, aloe vera, and essential oils into their face wash formulations.

Hyaluronic acid and Niacinamide are also popular ingredients that provide additional benefits, such as hydration and skin brightening. To reduce plastic waste, some companies are introducing refillable cleansers, making their products more eco-friendly. Gel cleansers are also gaining popularity due to their ability to effectively cleanse the skin without stripping it of essential oils. However, synthetic ingredients and harsh chemicals in some facial cleansers can cause skin irritation, redness, and allergic reactions. To address these concerns, many consumers are opting for natural and gentle alternatives. Leading brands like Neutrogena continue to innovate and design skincare products that cater to various skin types and concerns.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Face Wash Market?

Increasing per capita income and changing purchase behavior is the key driver of the market.

- The market is witnessing significant growth due to the increasing awareness of a hygienic lifestyle and the desire for clear, healthy-looking skin. Factors such as excess oil, dirt, pollution, and unwanted skin cells contribute to the need for regular face washing. Organic face washes, free of harsh chemicals like sulphate and sodium lauryl sulfate, are gaining popularity due to their benefits for various skin types, including acne-prone, sensitive, and normal skin. Vitamin E and other advanced ingredients, such as hyaluronic acid and niacinamide, are increasingly being used in facial cleansers to address signs of aging, inflammation, and irritation. The rise of e-commerce stores and retail outlets has made it easier for consumers to access these skincare products, including face wash, in large quantities or small sachets.

- In addition, the increasing prevalence of facial skin disorders, such as acne and allergic contact dermatitis, has led to a growing demand for anti-acne and anti-allergic products. The aging population is also driving demand for products that address wrinkles and other signs of aging. Facial appearance is a significant concern for individuals in both male and female demographics, leading to the growth of the male grooming segment. Skincare products, including face wash, are essential for maintaining healthy, glowing skin in various climates and environments, such as humid conditions or indoor heating. Natural ingredients, such as tea tree oil, aloe vera, and essential oils, are increasingly being used in face washes to provide added benefits and reduce skin irritation and rashes caused by synthetic ingredients. Such factors will increase the market growth druing the forecast period.

What are the market trends shaping the Face Wash Market?

Growing preference for organic face washes is the upcoming trend in the market.

- The market in the US is witnessing significant growth due to the rising trend of adopting a hygienic lifestyle and the increasing awareness about the harmful effects of excess oil, dirt, pollution, and unwanted skin cells on facial skin. Consumers are increasingly seeking organic face washes as an alternative to traditional soaps and cleansers, as these products offer advanced ingredients such as vitamin E, hyaluronic acid, and niacinamide that help nourish and protect the skin from signs of aging, acne, and other facial skin disorders. Organic face washes are made using natural ingredients like tea tree oil, aloe vera, and essential oils, which are free from harsh chemicals such as sulfate, sodium lauryl sulfate, and cocamidopropyl betaine.

- These natural ingredients help soothe inflammation, irritation, and redness caused by allergic contact dermatitis and other skin irritations. Manufacturers are focusing on designing skincare products that cater to different skin types, including dry, oily, normal, sensitive, and male grooming segments. They are also offering refillable cleansers and various forms of face washes, such as gel, cream, powder, and foam, to cater to the preferences and needs of consumers in different climates and regions. The increasing prevalence of facial skin disorders such as acne, pimples, and enlarged pores, along with the aging population and their hydration needs, are driving the demand for oil-control products and anti-acne face washes. Such factors will increase the market trends during the forecast period.

What challenges does Face Wash Market face during the growth?

The easy availability of counterfeit products is a key challenge affecting the market growth.

- The market is a significant segment of the personal care industry, catering to consumers seeking to maintain a hygienic lifestyle and address skin concerns such as excess oil, dirt, pollution, and unwanted skin cells. The market offers various types of face washes, including gel, cream, powder, and foam, catering to different skin types, including dry, oily, normal, sensitive, and anti-acne. The use of advanced ingredients like hyaluronic acid, niacinamide, and vitamin E, as well as natural ingredients like tea tree oil, aloe vera, and essential oils, adds value to the market. However, the market faces challenges from counterfeit products, which are increasingly available through e-commerce stores and retail outlets.

- These fake products, sometimes contaminated with harsh chemicals, can cause skin irritation, redness, and allergic reactions. Consumers, particularly in APAC and Middle Eastern countries, are often misled by packaging and product names that mimic established brands. The production of counterfeit face washes is driven by low production costs, which can undermine the sales and reputation of legitimate companies. Consumers are advised to be vigilant and ensure they purchase products from reputable sources to maintain healthy and nourished skin.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alchemee LLC

- Amway Corp.

- Beiersdorf AG

- Bloomtown Ltd.

- Christian Dior SE

- Emami Ltd.

- Helios Lifestyle Pvt Ltd.

- Himalaya Global Holdings Ltd.

- Honasa Consumer Pvt. Ltd.

- Johnson and Johnson

- Kao Corp.

- Khadi Natural

- LOreal SA

- Mountain Valley Springs India Pvt. Ltd.

- NAOS

- Natura and Co Holding SA

- Oriflame Cosmetics S.A.

- Shiseido Co. Ltd.

- The Body Shop International Ltd.

- The Estee Lauder Companies

- The Honest Co. Inc.

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing awareness of hygienic lifestyles and the desire for healthy, radiant skin. Factors such as excess oil, dirt, pollution, and unwanted skin cells contribute to the need for regular face washing. Excess oil and dirt can lead to various skin problems, including acne and facial skin disorders. Acne, an acne skin condition, affects individuals of all ages and genders. Organic face wash, infused with herbs and medicinal plants, has gained popularity due to its ability to address these issues while catering to consumers' growing preference for organic products. The aging population is another significant factor driving the demand for face wash. With the increasing signs of aging, such as wrinkles and fine lines, people are looking for skincare products that can help maintain healthy, youthful-looking skin. Skin type is a crucial consideration when it comes to face wash. Different skin types, including oily, dry, normal, sensitive, and combination, require specific formulations. For instance, anti-acne and oil-control products cater to those with oily skin, while hydrating and nourishing cleansers are ideal for dry skin. The rise of e-commerce stores and online retailing has made it easier for consumers to access a wide range of face wash options.

However, the convenience of retail stores remains a popular choice for those who prefer a more tactile shopping experience. UV rays and sunlight are common environmental factors that can damage the skin. Face wash infused with advanced ingredients like vitamin E, hyaluronic acid, and niacinamide can help protect the skin from these harmful elements. Facial appearance plays a significant role in personal care and beauty. Skincare products, including face wash, are essential components of daily routines, often used in conjunction with makeup and other cleansers. Dead skin cells and pollutants can accumulate on the skin, leading to a dull complexion. Regular use of a facial cleanser can help remove these impurities, revealing a clearer, more vibrant complexion. Sodium lauryl sulfate and cocamidopropyl betaine are common surfactants used in face wash. While effective at removing impurities, they can also cause skin irritation, redness, and allergic reactions in some individuals. Natural ingredients, such as tea tree oil, aloe vera, and essential oils, offer gentler alternatives. The facial cleanser market is evolving, with new product designs and packaging options. Refillable cleansers are gaining popularity due to their eco-friendly nature and reduced plastic waste. Gel and cream cleansers offer lightweight, clear textures that cater to consumers in humid climates.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.46% |

|

Market growth 2024-2028 |

USD 8.38 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.16 |

|

Key countries |

US, China, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch