Chainsaw Market Size 2025-2029

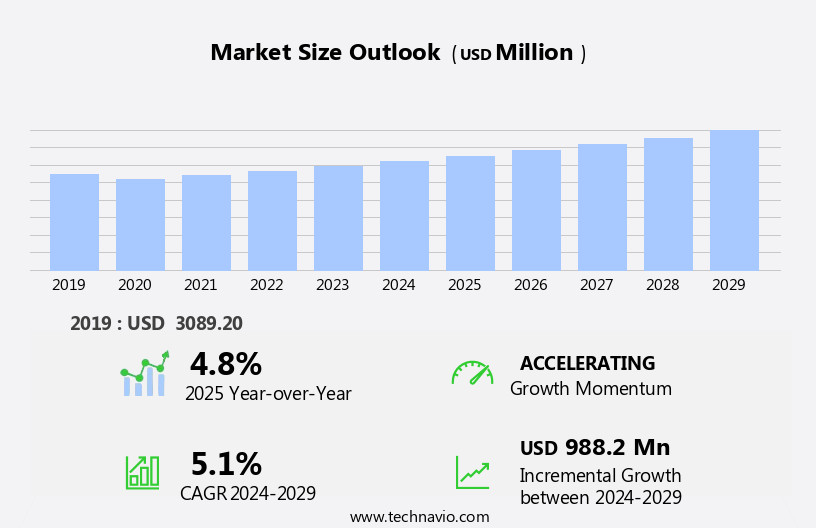

The chainsaw market size is forecast to increase by USD 988.2 million, at a CAGR of 5.1% between 2024 and 2029. The market is driven by the surging construction and infrastructure development sector, fueling the demand for efficient and powerful cutting tools.

Major Market Trends & Insights

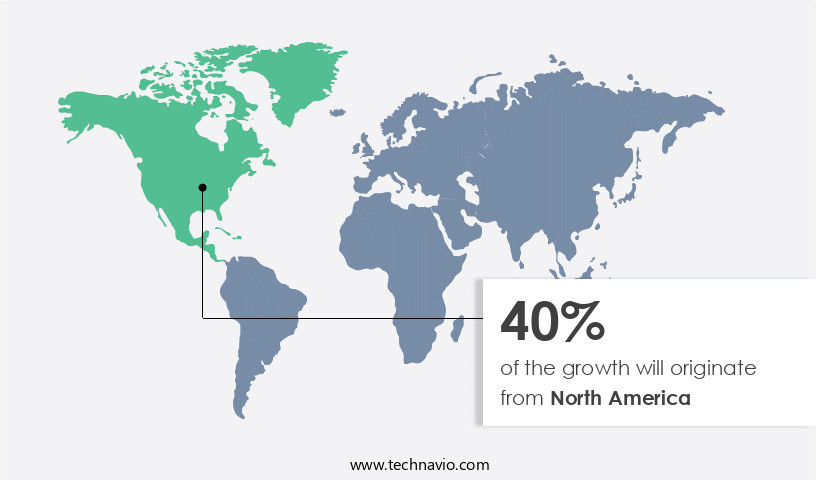

- North America dominated the market and contributed 40% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

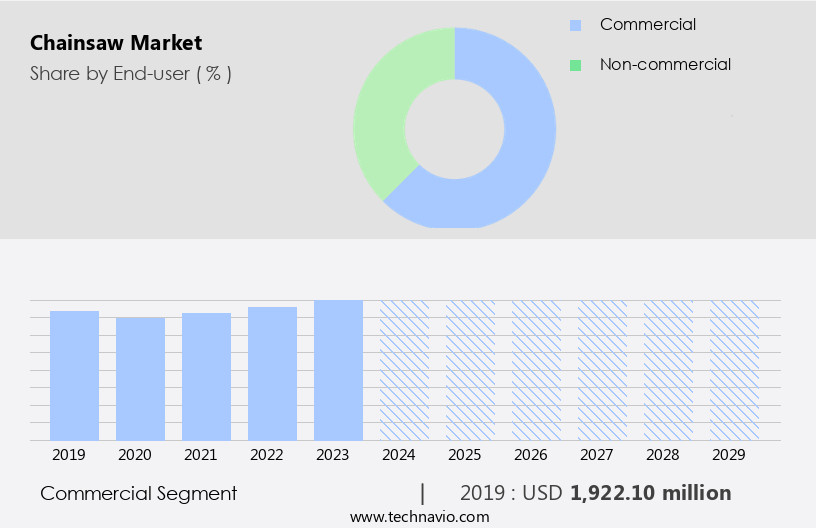

- Based on the End-user, the commercial segment led the market and was valued at USD 2.08 billion of the global revenue in 2023.

- Based on the Product, the gas-powered segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 45.38 Million

- Future Opportunities: USD 988.2 million

- CAGR (2024-2029): 5.1%

- North America: Largest market in 2023

Simultaneously, the growing number of DIY enthusiasts seeking to maintain their landscapes and gardens has expanded the consumer base for chainsaws. However, this market faces significant challenges. Safety concerns and the risks associated with chainsaws, such as accidents and injuries, necessitate stringent regulations and safety measures. Additionally, the increasing popularity of alternative landscaping methods, like robotic Lawn Mowers and electric trimmers, poses a threat to the traditional market. Companies must prioritize innovation, focusing on safety features, improved efficiency, and environmental sustainability to maintain their competitive edge. Effective marketing strategies targeting both professional and DIY consumers, as well as collaboration with construction and infrastructure industries, can further bolster market growth.

What will be the Size of the Chainsaw Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Key components, such as safety features, fuel tank capacity, electric start systems, and recoil starters, have become standard in both professional and consumer models. In tree care applications, chainsaws with automatic oilers, hearing and eye protection, and chain brakes are essential for safe and efficient operation. Safety switches and noise levels are critical considerations in the market, with electric chainsaws gaining popularity due to their reduced noise levels and improved safety features. Engine displacement and power output vary significantly between two-stroke and four-stroke engines, with the latter offering increased fuel efficiency and reduced emissions.

Fuel tank size, cutting speed, and power-to-weight ratio are crucial factors for professional use, while battery-powered chainsaws cater to the consumer market with their ease of use and minimal maintenance requirements. Air filters, vibration levels, and spark plugs are essential components that impact engine performance and longevity. Market dynamics continue to unfold, with ongoing research and development focusing on improving safety features, fuel efficiency, and power output. The evolving patterns in the market reflect the industry's commitment to meeting the diverse needs of its customers, from timber harvesting to consumer use.

How is this Chainsaw Industry segmented?

The chainsaw industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial

- Non-commercial

- Product

- Gas-powered

- Electric-powered

- Distribution Channel

- Online Retail

- Specialty Stores

- Home Improvement Stores

- Direct Sales

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The commercial segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 2.08 billion in 2023. It continued to the largest segment at a CAGR of 4.49%.

Chainsaws are essential tools for various industries and individual use, with commercial applications primarily in logging, carpentry, landscaping, gardening, construction, and wildfire fighting. Each profession demands specific chainsaw models based on their unique requirements. In commercial logging, heavy-duty gas-powered chainsaws are preferred due to their power, stability, and longer bar lengths for cutting large logs. These chainsaws are typically used for timber harvesting and provide increased efficiency in the process. The growing demand for landscaping and gardening activities in residential, commercial, and public spaces has led to a surge in the use of chainsaws for tree care. Electric and battery-powered chainsaws are popular choices for this application due to their lower noise levels and ease of use.

Safety features, such as automatic oilers, hearing protection, and eye protection, are essential for all chainsaw users, ensuring their well-being while operating these powerful machines. The increasing focus on safety and efficiency has led to advancements in chainsaw technology. Four-stroke engines offer improved fuel efficiency and reduced emissions, while two-stroke engines cater to the needs of professional users who require more power. Innovations like chain brakes, ignition systems, and safety switches enhance the overall user experience and contribute to evolving the market. The power output and engine displacement of chainsaws vary depending on their intended use. Consumers and professionals alike seek chainsaws with optimal power-to-weight ratios, cutting length, and vibration levels to maximize productivity while minimizing fatigue.

Fuel efficiency, chain pitch, and air filter are crucial factors in the selection process for both professional and consumer chainsaws. In conclusion, the market is dynamic and diverse, catering to various industries and applications. The integration of advanced technologies and safety features has led to the development of innovative chainsaw models that meet the unique demands of professionals and consumers alike.

The Commercial segment was valued at USD 1922.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing growth due to the expanding construction, forestry, and landscaping industries. In particular, the forestry sector's significant demand for chainsaws arises from tree cutting, log processing, and forest management tasks. Construction projects utilize chainsaws for lumber cutting, wood shaping, and demolition work. The market expansion is reflected in companies introducing new products to cater to this demand. Safety remains a priority in the chainsaw industry, with the use of safety features such as automatic oilers, hearing and eye protection, chain brakes, and safety switches becoming standard. Two types of engines power chainsaws: two-stroke and four-stroke.

Four-stroke engines are more fuel-efficient and have lower emissions, while two-stroke engines offer more power and are lighter. Battery-powered electric chainsaws are gaining popularity for their quieter operation, ease of use, and reduced fuel consumption. Cutting speed, engine displacement, and power output are essential factors influencing the choice of chainsaw for various applications. Vibration levels and fuel efficiency are also crucial considerations. Professionals and consumers alike rely on chainsaws for tree care, with cutting length, chain pitch, and power-to-weight ratio being essential factors. Safety and ease of starting mechanisms, such as electric start and recoil starter, are essential features for both groups.

The air filter and fuel filter ensure optimal performance and engine longevity. In conclusion, the North American market is thriving due to the growing demand from the construction, forestry, and landscaping industries. Companies are responding by introducing new products to meet this demand while prioritizing safety and efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive market, various brands cater to diverse consumer needs with innovative designs and advanced features. Gas-powered chainsaws, known for their raw power and versatility, dominate the scene. Electric chainsaws, more eco-friendly and quieter, are gaining popularity for their low maintenance and environmental appeal. Portable and lightweight models, ideal for homeowners and landscaping professionals, are in high demand. Chainsaw accessories, such as sharpening tools, protective gear, and oil, are essential for optimal performance and safety. The market also offers cordless and battery-operated chainsaws, providing the convenience of cordless use without sacrificing power. With continuous technological advancements, the market continues to evolve, catering to the diverse requirements of consumers in agriculture, forestry, and landscaping industries.

What are the key market drivers leading to the rise in the adoption of Chainsaw Industry?

- Construction and infrastructure development, marked by a steady rise, serve as the primary catalyst for market growth.

- Chainsaws are essential tools in the construction and infrastructure development sectors due to their ability to efficiently handle various cutting tasks. In timber harvesting and construction projects, chainsaws are utilized for cutting lumber, beams, and other wooden materials. They are also indispensable for shaping and trimming wood for structural elements. In construction projects involving concrete, chainsaws with diamond-tipped chains are employed to create openings, expansion joints, or remove damaged sections. Moreover, chainsaws play a crucial role in demolition work by cutting through wooden support structures, dismantling wooden components, and clearing debris.

- Safety features such as automatic oilers, hearing protection, and eye protection are essential for chainsaw operation. The ignition system and chain brake are integral components ensuring chain saw safety. The cutting speed of chainsaws enhances productivity, making them a valuable asset in the construction industry.

What are the market trends shaping the Chainsaw Industry?

- The number of DIY enthusiasts is on the rise, representing a significant market trend. This growing demographic is characterized by their self-sufficient and resourceful mindset, seeking to create and customize their own projects.

- The market has experienced growth due to the increasing number of DIY enthusiasts and homeowners seeking efficient tools for tree care and firewood preparation. Chainsaws are essential for cutting and pruning trees and bushes during home improvement projects, particularly during warmer months. For homeowners, chainsaws offer a more effective solution for processing large logs into manageable firewood pieces during the winter season. Advanced technology has led to the production of affordable and user-friendly chainsaw models, catering to various user needs.

- Safety features, such as safety switches and noise reduction mechanisms, ensure safe operation. Fuel tank capacity and engine displacement vary among models, while electric start and recoil starter options provide ease of use. Electric chainsaws are also gaining popularity for their environmental friendliness and reduced maintenance requirements.

What challenges does the Chainsaw Industry face during its growth?

- The growth of the chainsaw industry is significantly impacted by the inherent risks associated with their operation.

- Chainsaws are essential tools for various professional applications, offering high power output and the ability to cut through various materials efficiently. However, their operation involves inherent risks, such as the potential for severe injuries from the high-speed chain or fire hazards due to fuel mishandling. Regular maintenance is crucial to mitigate these risks, ensuring the chainsaw's components, including the spark plug, guide bar, primer bulb, and air filter, remain in optimal condition.

- Vibration levels, a common issue with chainsaws, can also impact user comfort and productivity. Modern chainsaws often utilize four-stroke engines or battery power for improved efficiency and reduced emissions. Ensuring proper usage and regular maintenance can help minimize risks and maximize the benefits of this versatile tool.

Exclusive Customer Landscape

The chainsaw market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chainsaw market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, chainsaw market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alfred Karcher SE and Co KG. - This company specializes in innovative battery-powered chainsaws, including the CNS 36 35 and CNS 18 30 models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfred Karcher SE and Co KG.

- AL KO SE

- ANDREAS STIHL AG and Co. KG

- Briggs and Stratton LLC

- Einhell Germany AG

- Husqvarna AB

- Jiangsu SUMEC Group Co. Ltd.

- Koki Holdings Co. Ltd.

- Lowes Co. Inc.

- Makita Corp.

- Oregon Tool Inc.

- Robert Bosch GmbH

- Stanley Black and Decker Inc.

- STIGA S.p.A.

- Talon Tough Tools

- Techtronic Industries Co. Ltd.

- The Toro Co.

- YAMABIKO CORP.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Chainsaw Market

- In January 2024, Husqvarna, a leading chainsaw manufacturer, introduced the 572 X-Cut, a new high-performance chainsaw with improved fuel efficiency and reduced emissions, according to Husqvarna's press release.

- In March 2024, Stihl and Bosch, two major players in the market, announced a strategic partnership to develop electric chainsaws, as reported by Reuters.

- In April 2025, Echo Inc. completed a USD 50 million funding round led by Honda, expanding their product line and strengthening their position in the market, as per the company's SEC filing.

- In May 2025, the European Union passed new regulations on emissions from chainsaws, requiring all new models to meet stricter emission standards, as stated in the EU Commission's press release.

Research Analyst Overview

- The market encompasses various applications, from branch trimming and tree felling to wood sculpture and ice sculpting. Crosscut saws and hand saws are alternatives for specific tasks, while chainsaws offer efficiency and power. Vibration dampening and noise reduction technology enhance user comfort and safety. Exhaust emission concerns are driving advancements in fuel injection systems and chain lubricants to reduce carbon footprint. Depth gauges ensure precise cuts in tree felling and chainsaw milling. Spare parts availability and safety training are crucial for effective maintenance and schedule adherence.

- Anti-vibration systems and chain saw sharpeners contribute to extended tool life and improved performance. Wood chips generated from sawmill operations can be repurposed as biomass fuel. Market trends include the integration of advanced technology to improve functionality and sustainability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Chainsaw Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 988.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Chainsaw Market Research and Growth Report?

- CAGR of the Chainsaw industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the chainsaw market growth of industry companies

We can help! Our analysts can customize this chainsaw market research report to meet your requirements.