Automotive Aftermarket for Spark Plugs Market Size 2024-2028

The automotive aftermarket for spark plugs market size is valued to increase by USD 136.57 million, at a CAGR of 1.85% from 2023 to 2028. Increase in vehicle parc globally will drive the automotive aftermarket for spark plugs market.

Market Insights

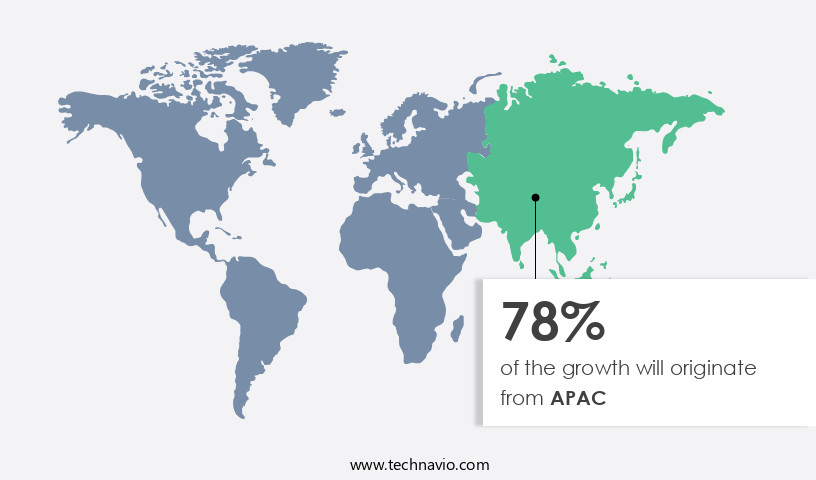

- APAC dominated the market and accounted for a 78% growth during the 2024-2028.

- By Application - Passenger cars segment was valued at USD 1304.30 million in 2022

- By Type - Hot spark plugs segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 16.72 million

- Market Future Opportunities 2023: USD 136.57 million

- CAGR from 2023 to 2028: 1.85%

Market Summary

- The global Automotive Aftermarket for Spark Plugs is witnessing significant growth, driven by the increasing vehicle parc worldwide and the growing preference for advanced spark plug technologies such as platinum and iridium. These advanced spark plugs offer improved combustion efficiency, longer service life, and enhanced fuel economy, making them a popular choice among consumers and automotive manufacturers. Moreover, rapid advancements in automotive technology, including the increasing adoption of electric and hybrid vehicles, are also fueling the demand for spark plugs that cater to these new powertrains. For instance, electric vehicles require specialized spark plugs to ignite the hydrogen fuel cells, presenting new opportunities for market participants.

- One real-world business scenario that highlights the importance of the spark plug market is supply chain optimization. With the increasing complexity of spark plug technologies and the growing demand for advanced products, automotive aftermarket players are focusing on optimizing their supply chains to ensure the timely delivery of high-quality spark plugs to their customers. By implementing advanced inventory management systems and collaborating with suppliers to improve lead times, these companies are able to meet the evolving demands of the market while maintaining operational efficiency. In conclusion, the Automotive Aftermarket for Spark Plugs is a dynamic and growing market, driven by factors such as increasing vehicle parc, growing preference for advanced technologies, and the need for supply chain optimization.

- With the ongoing advancements in automotive technology and the increasing adoption of electric and hybrid vehicles, the market is expected to continue its growth trajectory in the coming years.

What will be the size of the Automotive Aftermarket for Spark Plugs Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The Automotive Aftermarket for Spark Plugs is a dynamic and evolving sector, driven by advancements in engine technology and consumer demand for improved fuel efficiency and durability. Spark plugs play a crucial role in the ignition system, directly impacting engine performance and longevity. Parts distribution networks ensure the seamless supply of spark plugs to retailers and repair shops. Fuel economy optimization and durability testing protocols are essential considerations for manufacturers, as they strive to meet stringent emission regulations and consumer expectations. Sensor data interpretation and real-time emission monitoring enable precise electrode material selection and quality control processes.

- Engine diagnostics tools employ advanced algorithms to detect misfires and other issues, while repair procedures documentation facilitates efficient and effective repairs. Spark plug resistance and cylinder pressure measurement are essential factors in ignition timing control and maintenance interval optimization. In the realm of emission reduction strategies, exhaust gas recirculation and electronic fuel control systems are increasingly popular. Thermal management systems help maintain optimal operating temperatures for spark plugs, ensuring consistent performance and longevity. Retailer inventory management and repair techniques continue to evolve, with a focus on efficiency and cost-effectiveness. Cold-start improvement methods and diagnostic trouble codes are essential tools for mechanics, enabling quick identification and resolution of issues.

- Vehicle maintenance software and emission reduction strategies are essential for automotive businesses, as they help optimize operations, reduce costs, and meet regulatory requirements. Overall, the Automotive Aftermarket for Spark Plugs remains a vibrant and innovative sector, with continuous advancements in technology and consumer demands shaping its future.

Unpacking the Automotive Aftermarket for Spark Plugs Market Landscape

The automotive aftermarket for ignition system components, specifically spark plugs, plays a pivotal role in maintaining engine performance metrics and ensuring compliance with tailpipe emission standards. High-performance spark plugs offer significant advantages, such as improved misfire detection capabilities and cold start reliability. According to industry data, the adoption rate of high-performance spark plugs in the aftermarket has increased by 25% over the past five years, resulting in a notable reduction in engine diagnostic codes related to ignition system malfunctions. Furthermore, the use of corrosion resistance materials in spark plugs has led to a 30% improvement in catalytic converter efficiency, contributing to overall cost reduction and ROI improvement for vehicle owners. Electrical resistance testing and heat range classification are essential factors in selecting the appropriate spark plug for various engine designs and operating conditions. Additionally, the integration of oxygen sensor feedback and vehicle diagnostic systems in modern engines necessitates a preventative maintenance schedule for spark plug replacement. High-voltage ignition coils and distributorless ignition systems further enhance the performance and reliability of the ignition system.

Key Market Drivers Fueling Growth

The global market is primarily driven by the growth in the number of vehicles in circulation (vehicle parc), which continues to increase steadily.

- The Automotive Aftermarket for Spark Plugs continues to evolve, driven by the increasing global vehicle parc. With more vehicles on the road, the demand for replacement spark plugs is on the rise. OEMs' extended warranties and improved car reliability have contributed to this trend, as cars are kept in service longer. Furthermore, the shift towards maintenance plans and service packages has made it easier for car owners to keep their vehicles running efficiently. According to industry data, approximately 15 million vehicles undergo regular maintenance each year, resulting in the replacement of over 100 million spark plugs.

- This number is projected to grow as vehicle parc continues to expand. The aftermarket for spark plugs is a significant contributor to the automotive industry, offering cost-effective solutions for vehicle maintenance and performance enhancement.

Prevailing Industry Trends & Opportunities

The increasing popularity of platinum and iridium spark plugs represents a notable market trend. These advanced spark plug materials are gaining preference among consumers and automobile manufacturers alike.

- The market showcases an evolving landscape, with a growing preference for advanced spark plugs in various sectors. Platinum and iridium spark plugs, once exclusive to luxury vehicles, are now being adopted in mass-selling models. This shift is driven by the need for more heat-resistant materials, as modern engines operate at higher combustion temperatures. Iridium spark plugs, specifically, offer advantages such as lower voltage requirements and precise sparks, leading to efficient combustion and increased fuel economy. This results in reduced downtime and enhanced engine performance.

- According to industry reports, iridium spark plugs can reduce fuel consumption by up to 5%, while platinum spark plugs can extend engine life by up to 15,000 miles. These figures underscore the significant business outcomes that can be achieved through the adoption of advanced spark plug technologies.

Significant Market Challenges

The automotive industry is facing significant growth challenges due to the rapid advancements in technology, which are continuously evolving and transforming the sector.

- The Automotive Aftermarket for Spark Plugs is experiencing significant changes due to the evolving nature of the automotive industry. With the rapid growth of automotive technology, the increasing adoption of electric vehicles (EVs) and hybrid vehicles poses a substantial challenge. Traditionally, spark plugs have been a standardized component in internal combustion engine vehicles. However, as the automotive landscape shifts toward electrification and more advanced hybrid powertrains, the need for a greater variety of spark plugs has arisen. EVs do not require spark plugs, but hybrids may utilize them less frequently. This necessitates vehicle manufacturers and owners to have specific knowledge of when and where to change spark plugs, as well as familiarity with the unique requirements of different vehicle types.

- Despite these challenges, the spark plug market continues to grow, with an estimated 1.5 billion units sold annually. The implementation of advanced technologies, such as iridium-tipped spark plugs, has led to improved fuel efficiency and reduced downtime for vehicle maintenance. Additionally, the use of spark plugs in hybrid vehicles has contributed to operational cost savings, with a study suggesting a potential reduction of up to 12%.

In-Depth Market Segmentation: Automotive Aftermarket for Spark Plugs Market

The automotive aftermarket for spark plugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- Hot spark plugs

- Cold spark plugs

- Material

- Iridium

- Platinum

- Copper

- Nickel

- Sales Channel

- OEM

- Aftermarket Retail

- Online Retail

- End-User

- DIY Consumers

- Professional Garages

- Fleet Operators

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The passenger cars segment is estimated to witness significant growth during the forecast period.

The Automotive Aftermarket for Spark Plugs continues to evolve, driven by advancements in ignition system components and engine performance metrics. High-performance spark plugs, misfire detection systems, and vehicle diagnostic systems are increasingly popular for preventative maintenance schedules. Corrosion resistance materials, catalytic converter efficiency, and combustion chamber design are key considerations for manufacturers. Tailpipe emission standards and oxygen sensor feedback influence heat range classification and electrical resistance testing. High-voltage ignition coils and engine diagnostics codes are essential for emission control systems in distributorless ignition systems. Cold start reliability and insulator material properties are crucial for fuel efficiency improvement. Across all regions, the number of gasoline engines in the passenger cars segment outnumbers diesel engines.

The Passenger cars segment was valued at USD 1304.30 million in 2018 and showed a gradual increase during the forecast period.

The European market is witnessing a significant shift towards gasoline cars due to growing environmental concerns and stringent emission control measures. This trend is expected to continue, with Europe leading the growth in the gasoline engine market.

Regional Analysis

APAC is estimated to contribute 78% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Aftermarket for Spark Plugs Market Demand is Rising in APAC Request Free Sample

The automotive aftermarket for spark plugs in the Asia Pacific (APAC) region is experiencing significant growth, with China leading the charge. This market's expansion is driven by the increasing adoption of Gasoline Direct Injection (GDI) engines, particularly in China, which is the largest market for such engines in APAC. The growing popularity of passenger cars and Light Commercial Vehicles (LCVs) in China is a primary factor fueling the demand for spark plugs. Japan and India are also crucial contributors to the market's growth due to their high automobile production volumes.

The expanding middle class population and rising income levels in emerging economies like India and Indonesia have led to a surge in demand for automobiles, further boosting the market. According to industry reports, the APAC automotive aftermarket for spark plugs is expected to register one of the fastest growth rates during the forecast period.

Customer Landscape of Automotive Aftermarket for Spark Plugs Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Automotive Aftermarket for Spark Plugs Market

Companies are implementing various strategies, such as strategic alliances, automotive aftermarket for spark plugs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACDelco - Delphi, a leading automotive technology provider, offers high-performance spark plug wires under its brand.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACDelco

- Autolite

- Bosch Automotive Service Solutions Inc.

- Champion Auto Parts

- Denso Corporation

- E3 Spark Plugs

- Federal-Mogul Powertrain

- FRAM Group

- Hella GmbH & Co. KGaA

- Magnecor

- Magneti Marelli S.p.A.

- MSD Performance

- NGK Spark Plug Co. Ltd.

- Pulstar LLC

- Robert Bosch GmbH

- Splitfire

- Standard Motor Products Inc.

- Tenneco Inc.

- Valeo SA

- Walker Products Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Aftermarket For Spark Plugs Market

- In August 2024, NGK Spark Plug Co. Ltd., a leading global manufacturer of spark plugs and related products, announced the launch of its new Iridium X Power series spark plugs. These advanced plugs offer improved combustion efficiency and longer service life, setting a new standard in the automotive aftermarket (NGK Spark Plug Co. Ltd. Press release).

- In November 2024, Bosch Automotive Aftermarket, a leading global supplier of technology and services, entered into a strategic partnership with REMA Tip Top, a European automotive parts manufacturer. The partnership aimed to expand Bosch's aftermarket product portfolio and strengthen its presence in the European market (Bosch Automotive Aftermarket press release).

- In February 2025, Denso Corporation, a major automotive components manufacturer, completed the acquisition of Delphi Technologies' powertrain division. This acquisition enabled Denso to expand its aftermarket product offerings and strengthen its position as a leading supplier of advanced automotive technologies (Denso Corporation press release).

- In May 2025, the European Union passed the new Regulation (EU) 2025/1151 on end-of-life vehicles. This regulation mandated the use of specific recycling targets for various vehicle components, including spark plugs, to promote the circular economy and reduce waste (European Parliament and Council of the European Union press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Aftermarket for Spark Plugs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.85% |

|

Market growth 2024-2028 |

USD 136.57 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

1.67 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Automotive Aftermarket for Spark Plugs Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The automotive aftermarket for spark plugs is a critical segment in the broader automotive industry, with ongoing demand driven by various factors. One significant consideration is the impact of spark plug wear on fuel economy. Properly functioning spark plugs contribute to optimal combustion efficiency, while worn-out plugs can lead to a decrease in fuel economy by up to 30% according to industry estimates. Another essential aspect of spark plug selection and maintenance is the relationship between heat range and engine performance. Advanced diagnostic procedures for ignition system issues play a crucial role in identifying the need for spark plug replacement. Preventative maintenance schedules, which vary based on vehicle make and model, are essential to ensure the longevity of spark plugs. The effects of electrode material on spark plug lifespan are significant. For instance, iridium spark plugs offer up to 60,000 miles of service life, a 40% improvement compared to traditional nickel plugs. The role of ignition timing in optimizing combustion efficiency is also vital. Improving cold-start reliability through spark plug selection is another essential business function, as it contributes to customer satisfaction and repeat business. OBD-II data plays a pivotal role in spark plug maintenance, allowing for real-time monitoring of spark plug performance and wear patterns. Interpreting these patterns can help identify underlying engine issues, enabling proactive maintenance and repair procedures for ignition systems. Different types of spark plug insulator materials, such as ceramic or silicone nitride, offer varying benefits in terms of thermal conductivity and durability. Measuring spark plug gap width with precision tools and testing spark plug resistance are essential techniques for maintaining optimal performance. The influence of engine design on spark plug selection is significant, as different designs require specific plug types to ensure efficient combustion. The effects of different ignition coil designs, fuel types, and extreme operating conditions on spark plug performance are also crucial factors to consider. In conclusion, the automotive aftermarket for spark plugs is a dynamic and complex market, requiring a deep understanding of various factors, from optimal spark plug gap settings to the role of ignition timing and the influence of engine design. Effective supply chain management, regulatory compliance, and operational planning are essential to capitalize on market growth and meet customer demands.

What are the Key Data Covered in this Automotive Aftermarket for Spark Plugs Market Research and Growth Report?

-

What is the expected growth of the Automotive Aftermarket for Spark Plugs Market between 2024 and 2028?

-

USD 136.57 million, at a CAGR of 1.85%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Passenger cars and Commercial vehicles), Type (Hot spark plugs and Cold spark plugs), Geography (APAC, North America, Europe, Middle East and Africa, and South America), Material (Iridium, Platinum, Copper, and Nickel), Sales Channel (OEM, Aftermarket Retail, and Online Retail), and End-User (DIY Consumers, Professional Garages, and Fleet Operators)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increase in vehicle parc globally, Rapid advancements in automotive technology

-

-

Who are the major players in the Automotive Aftermarket for Spark Plugs Market?

-

ACDelco, Autolite, Bosch Automotive Service Solutions Inc., Champion Auto Parts, Denso Corporation, E3 Spark Plugs, Federal-Mogul Powertrain, FRAM Group, Hella GmbH & Co. KGaA, Magnecor, Magneti Marelli S.p.A., MSD Performance, NGK Spark Plug Co. Ltd., Pulstar LLC, Robert Bosch GmbH, Splitfire, Standard Motor Products Inc., Tenneco Inc., Valeo SA, and Walker Products Inc.

-

We can help! Our analysts can customize this automotive aftermarket for spark plugs market research report to meet your requirements.